Managing C-PACE Financing with Built

For commercial real estate developers and operators, commercial property-assessed clean energy (C-PACE) provides an additional source of capital to fund CRE construction or renovation without adding equity or debt into the capital stack. Managing C-PACE funding requires specialized controls to administer this additional source of capital. Built’s flexible construction and renovation loan administration platform powers C-PACE financing by allocating eligible funds to the specific energy-efficient project uses while managing the complexities in the draw and development process.

What is PACE?

According to the Office of Energy Efficiency & Renewable Energy, PACE financing is a funding source for energy efficiency property upgrades, disaster resiliency improvements, water conservation measures, or renewable energy installations for commercial, industrial, or residential properties. For commercial projects specifically, C-PACE can be used in both new and existing builds to overcome challenges that have previously impeded the adoption of energy efficiency for construction projects. C-PACE programs are available in 37 states and Washington, D.C., funding more than $2 billion in projects nationally. And, because C-PACE offers long-term repayment options, projects may achieve positive cash flow sooner and enable developers to complete larger, and more energy-efficient, projects.

How can Built help my team manage C-PACE funds?

Built’s CRE construction loan administration (CLA) platform has the ability to monitor complex capital sources and set up the eligible uses of those sources as they relate to the construction or renovation budget. The Eligible Use of Funds feature within Built’s CLA platform allows your team to indicate the funding sources for specific budget line items. So, when it comes to C-PACE, line items like LEED Certification, solar panels, or even energy-efficient light bulbs, can be funded according to the predetermined source. Built will also allow your team to dictate the timing of funding for different sources by setting allocations per the draw schedule.

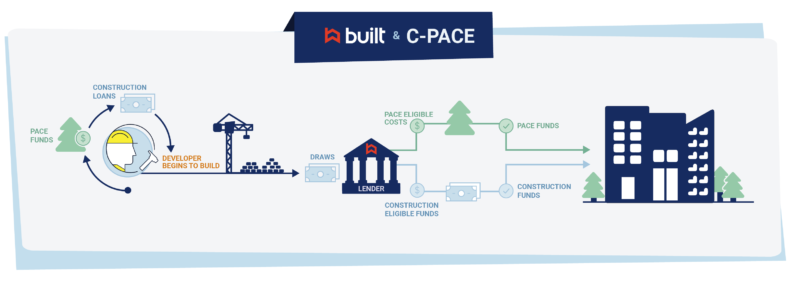

What does the workflow look like with Built?

For a project including C-PACE financing, Built ensures that funds are allocated appropriately. When a draw request for a C-PACE eligible expense comes through, Built automatically matches those expenses to the C-PACE funds, ensuring that the lender remains compliant with the predetermined funding rules associated with that project. By placing funding rules around the draw process, the lender’s team can rest assured that all funding sources will be utilized appropriately—enabling them to administer complex commercial construction loans with confidence.

Why should owners or developers seek C-PACE financing?

C-PACE financing enables building owners or developers to cover project development costs separate from their construction loans by covering 100% upfront financing on clean energy-related costs. And, energy-efficient building upgrades can increase property value and marketability.

Owners and developers can research local C-PACE programs to determine eligibility—and lenders who are leveraging Built can use the platform to ensure that the financing procured will be allocated to the proper uses. Whether a project requires C-PACE financing, SBA, or any other nuanced capital source, Built can set the structure for funding so you can rest assured sources are correctly allocating to the proper uses. For more information on Built’s solutions for complex CRE projects, visit getbuilt.com/commercial.

–

Sam Greene is a Solutions Engineer at Built Technologies. Prior to joining the Built team, Sam worked at one of the nation’s largest banks with a focus on managing syndicated and highly complex financial facilities, including large balance commercial construction. Built Technologies is the leading provider of construction finance technology in North America.

Related Posts

Built Names Chris DeVito as Vice President of Product