Keep projects moving.

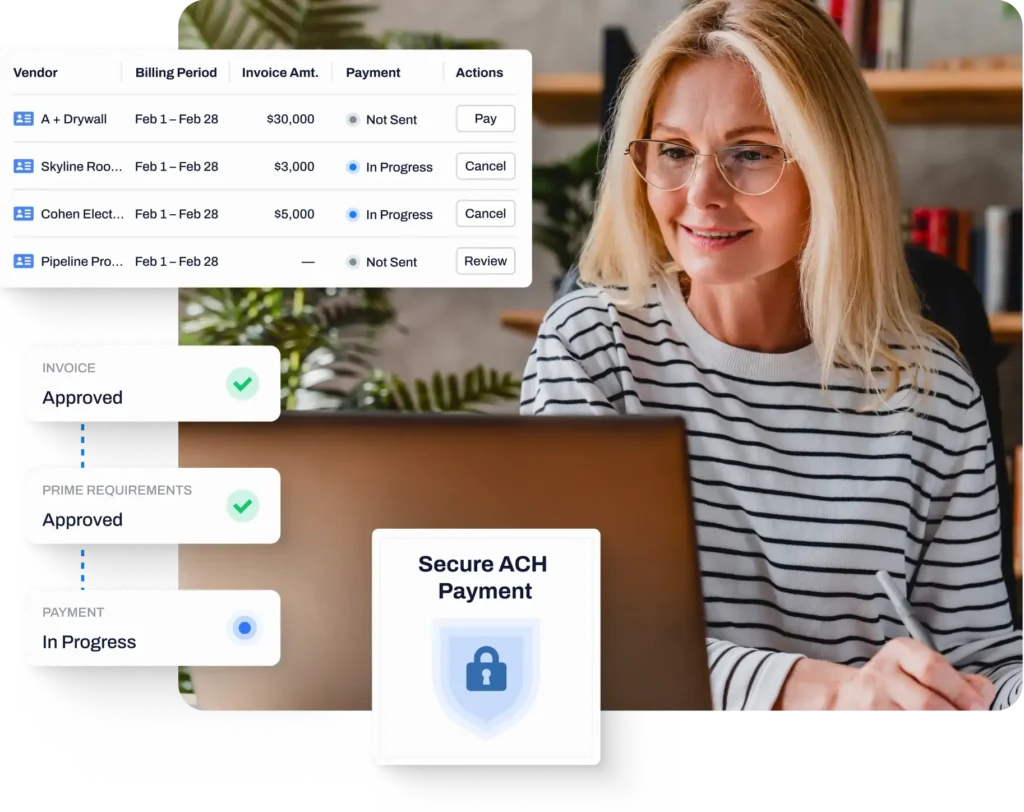

Pay your trade partners quickly and securely with Built.

Streamline your construction billing process.

Manage payments in one easy-to-use platform.

Never miss a payment.

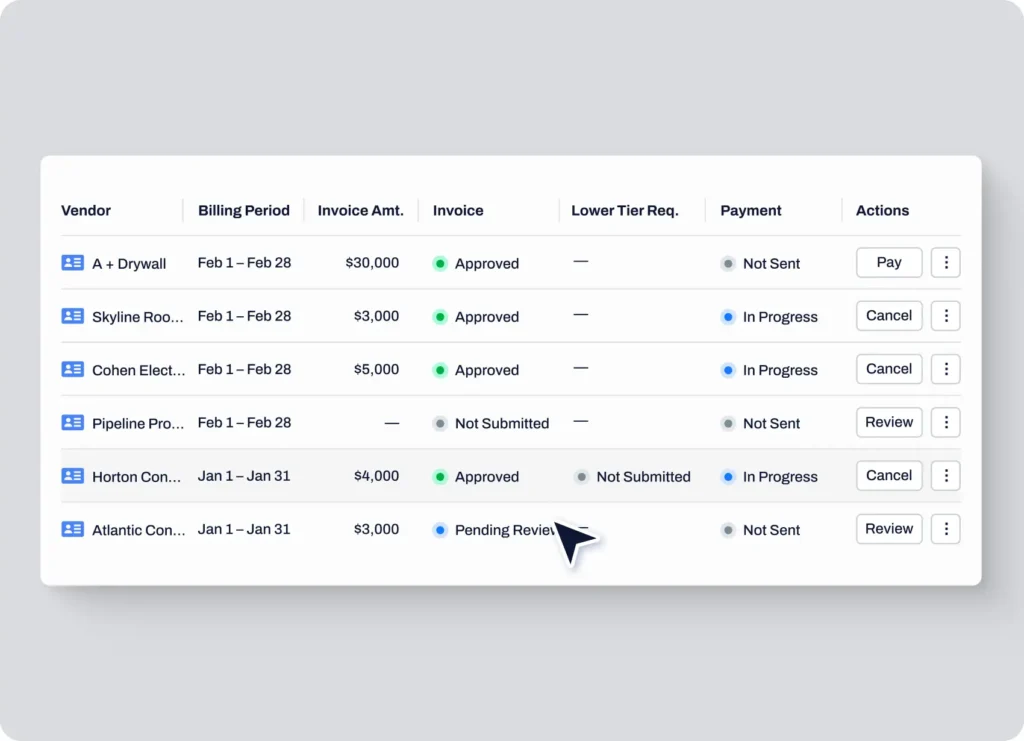

Pay multiple invoices across projects at the same time. With timely delivery of funds, you’ll build trust and boost vendor productivity.

Gain complete payment visibility.

Manage funds for each project, track payment status, and confirm that every payment has the necessary compliance documents on file – all in one place. And, easily share payment status and details with your trade partners, so everyone is on the same page.

Boost adoption.

Make it easy for subcontractors to connect and manage their bank accounts. A seamless and secure onboarding process takes work off your plate and ensures subs get paid faster.

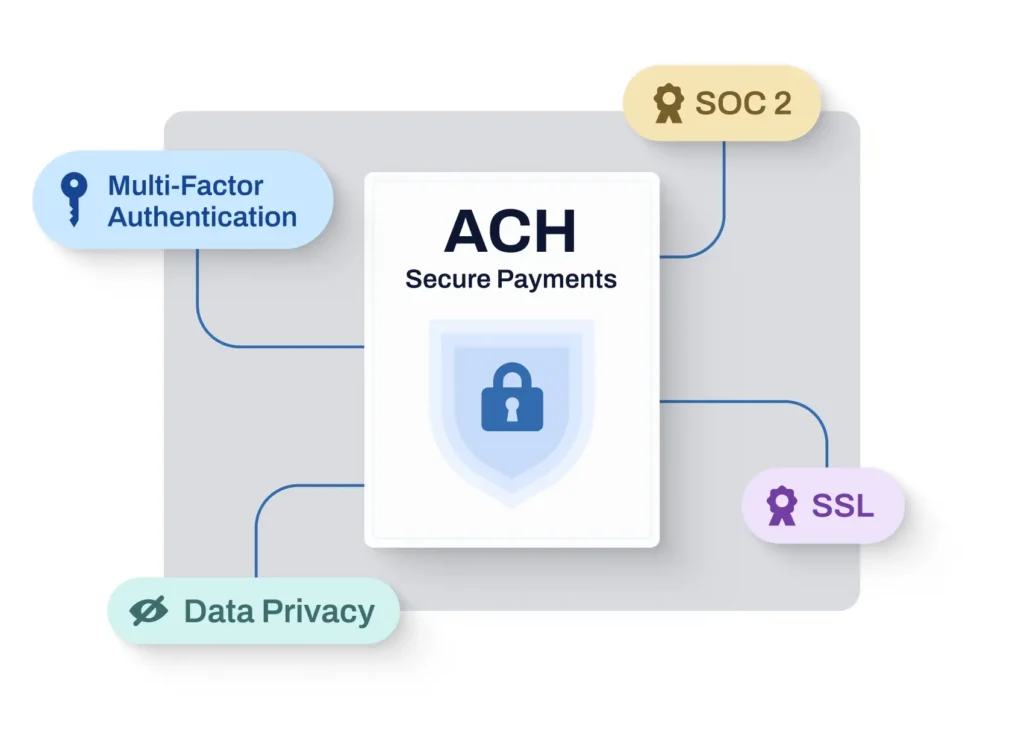

Increase security.

Complete high-volume payments securely with Built’s integrated ACH solution. Built follows strict SSL, SOC 2, and Data Privacy regulations, so you never have to worry about the safety of your money.

Get the tools you need to manage your payments.

ACH Payments

Securely manage high-volume payments with Built’s integrated ACH solution.

Payment Tracking

Keep an eye on every step of the transaction, from scheduled to paid.

Lien Waiver for Payment Exchange

Quickly ensure that every payment has a signed lien waiver on file.

Approval Workflows

Reduce errors and enforce financial controls with rigorous checks and balances.

Bulk Transactions

Handle high-volume transactions and process multiple payments at the same time.

Unique Project Accounts

Keep project finances distinct and organized for better fund management.

Take a quick tour

Learn how your team can improve lien waiver and compliance management.

Frequently asked questions

What are ACH payments?

ACH stands for Automated Clearing House, a centralized US financial network that allows banks and credit unions to send and receive electronic payments. The ACH Network securely handled 31.5 billion payments valued at $80.1 trillion in 2023 (source). It is trusted for a wide array of use cases, including payroll and utility payments.

Is ACH secure?

The ACH network is federally regulated, and is currently overseen by the National Automated Clearing House Association (NACHA). NACHA helps enforce a strict set of controls and procedures for all parties paying with ACH. Based on a study conducted by the Federal Reserve, ACH payments have the lowest fraud rates (source).

How does Built protect against fraud?

- All users must create accounts and login to send or accept money, providing more visibility and control into payments.

- To protect against common phishing attacks, payees must set up their bank account information directly by logging into the platform.

- Built’s payments partner is a registered PayFac, supported by a SOC 2, and is PCI certified. They perform business and identity verification for anyone sending money on the platform, and identify red flags for fraud and suspicious activity.

- Built maintains an anti-money laundering policy, partnering with a third-party to verify businesses and monitor transactions in a manner compliant with AML requirements.

- For more information on security, please read https://getbuilt.com/security/

How can I further protect my account?

Built is designed with your security in mind.

- Permissions: You can restrict payments capabilities to certain user accounts, minimizing the risk that a fraudulent actor can misappropriate funds

- Approvals: You can set up approval workflows, ensuring no single person can move money unchecked.

- Multi-Factor Authentication (MFA): You can enable MFA on your account for an extra layer of security.

Have additional questions?

Security and compliance are at the forefront of everything we do at Built. Our teams are continually developing and maintaining programs to secure your trusted information while meeting regulatory and contractual commitments. For more information, please refer to the following white papers: