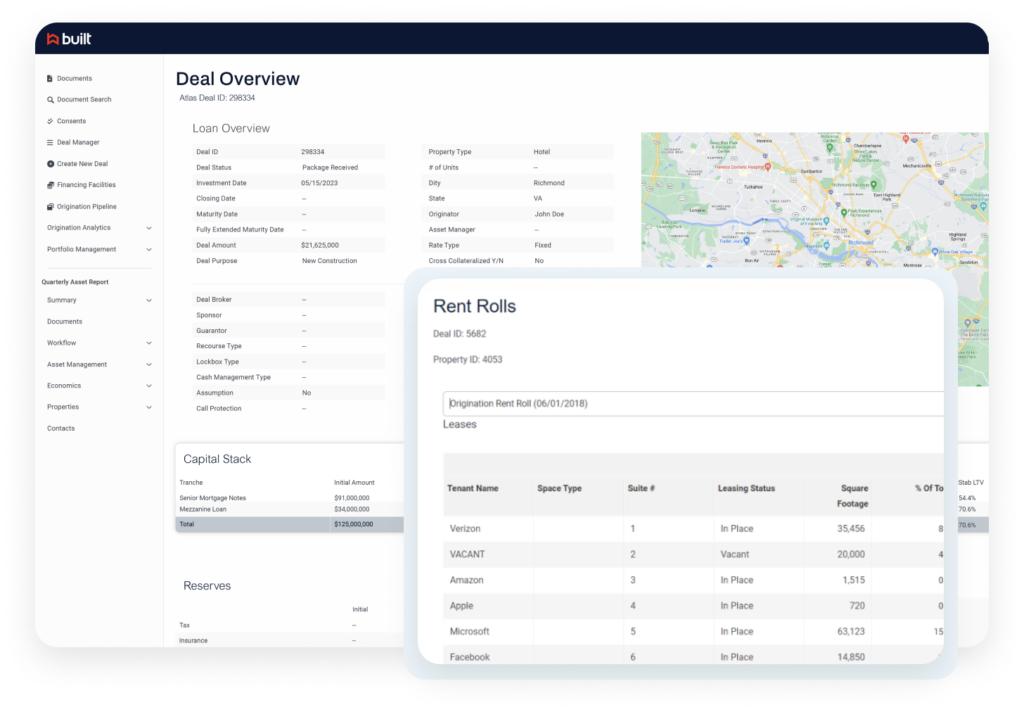

Improve underwriting quality & speed.

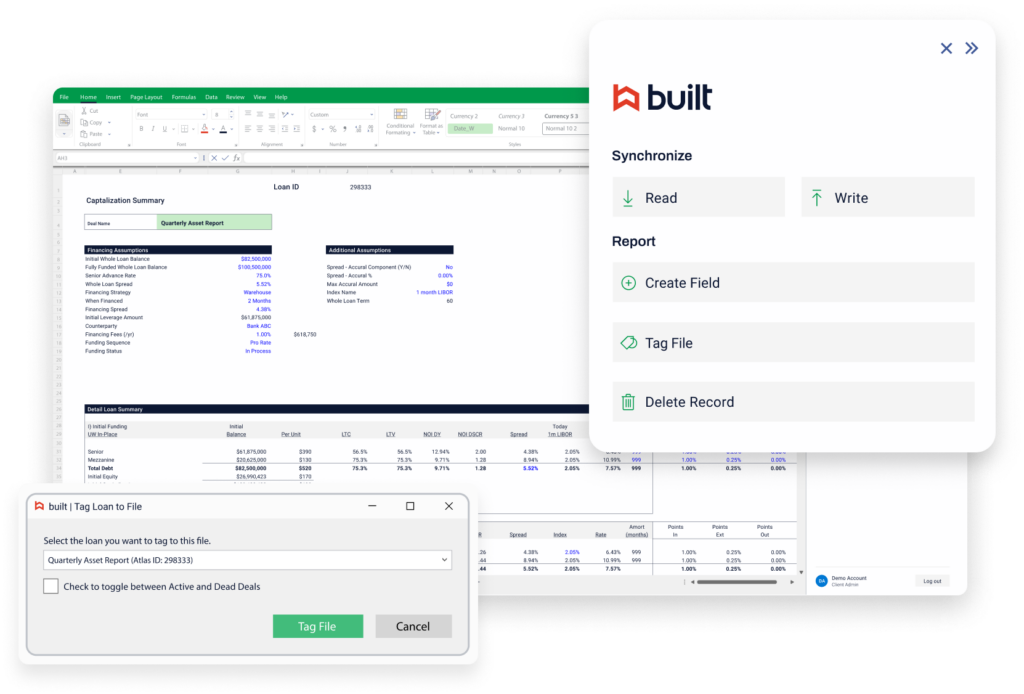

Using Built’s two-way Excel integration, you can seamlessly manage all of your underwriting data directly from your existing workbooks.

Don’t let disparate data systems slow you down.

Bad data can threaten portfolio performance and introduce unnecessary risk to your business. By centralizing data, you’ll have all of the information you need to evaluate the integrity, creditworthiness, and risk of a prospective client or project.

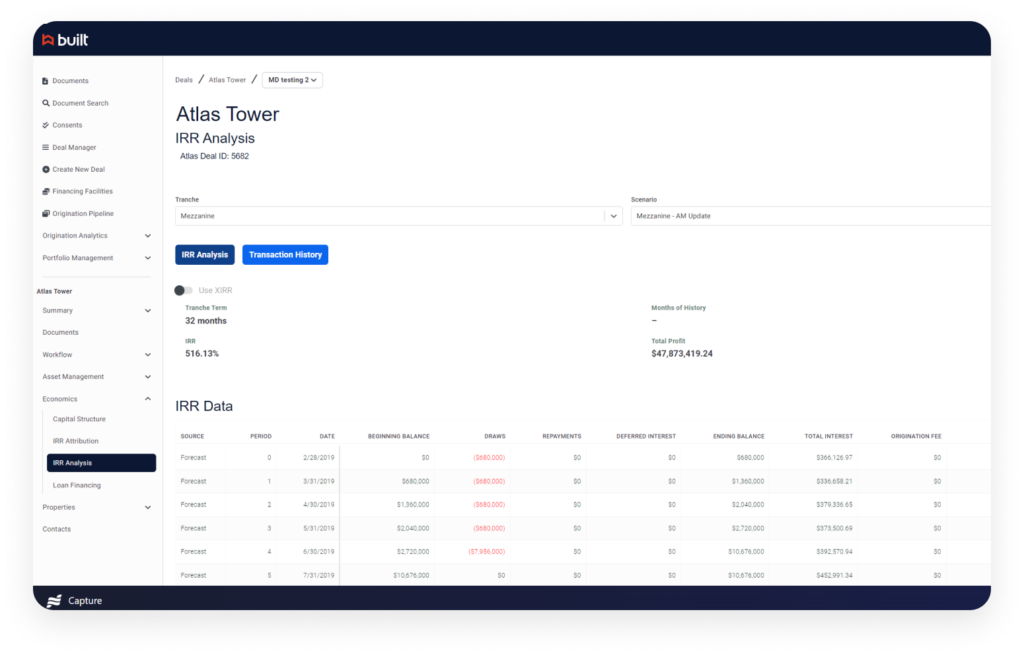

Identify risk faster.

Import underwriting data to run reports and trend analysis.

Easily transfer data into your existing credit memorandum templates by asset type.

View all deal data over time to easily facilitate reporting or modeling trend analysis.

Centralize your deal data while still using Excel.

Synthesize data into Built’s cloud-based platform with our Excel integration.

With one click, you can pull reporting from your native analytic models into the Built platform.

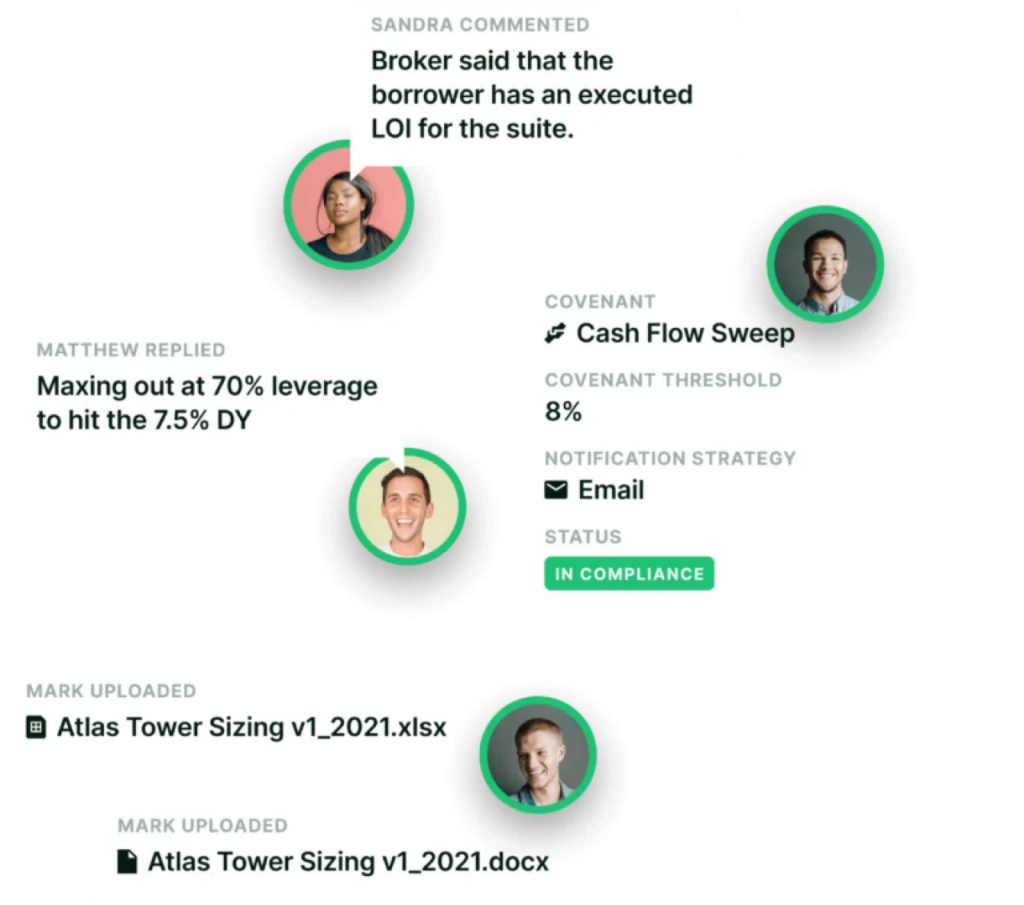

Collaborate on your deals in real time.

Leverage Built’s discussion board to ensure that you’re underwriting team is getting real-time information from your origination and asset management teams.

Work off of the same information rather than siloed spreadsheets to ensure nothing slips through the cracks.