Streamline Commercial Lending

Built transforms manual processes into streamlined workflows that enable commercial lenders to decrease risk and increase interest income.

There’s a better way to manage your portfolio.

For commercial lenders information is often siloed, between spreadsheets, shared drives, or core accounting systems—all of which are time consuming to manage and prone to risk. Loan administrators and asset managers often get stuck retroactively repeating work, focused on unsustainable processes and unreliable data.

Commercial Real Estate

Track and manage your affordable housing portfolio by keeping tabs on the tax credits and municipal funds in the capital stack.

Oversee your bought and sold portions of a loan right in the Built platform where you can easily share information and funding decisions.

Whether you are offering PACE financing, EB-5, or any other nuanced capital source, Built can set the structure for funding so you can rest assured sources are correctly allocated to the proper uses.

Commercial & Industrial

For owner occupied loans, make sure your customers can get their business off the ground with a system that is easy to use and enables transparency, so they can request funds online. Providing a digital construction loan experience not only simplifies the process, but also powers the digital experience customers have come to expect.

Add structure and guidelines to the way SBA and USDA loans are administered with Built—so you can provide more loans with less work. And, Built helps ensure you’re maintaining compliance with government regulations while providing a state-of-the-art customer experience. Win, win.

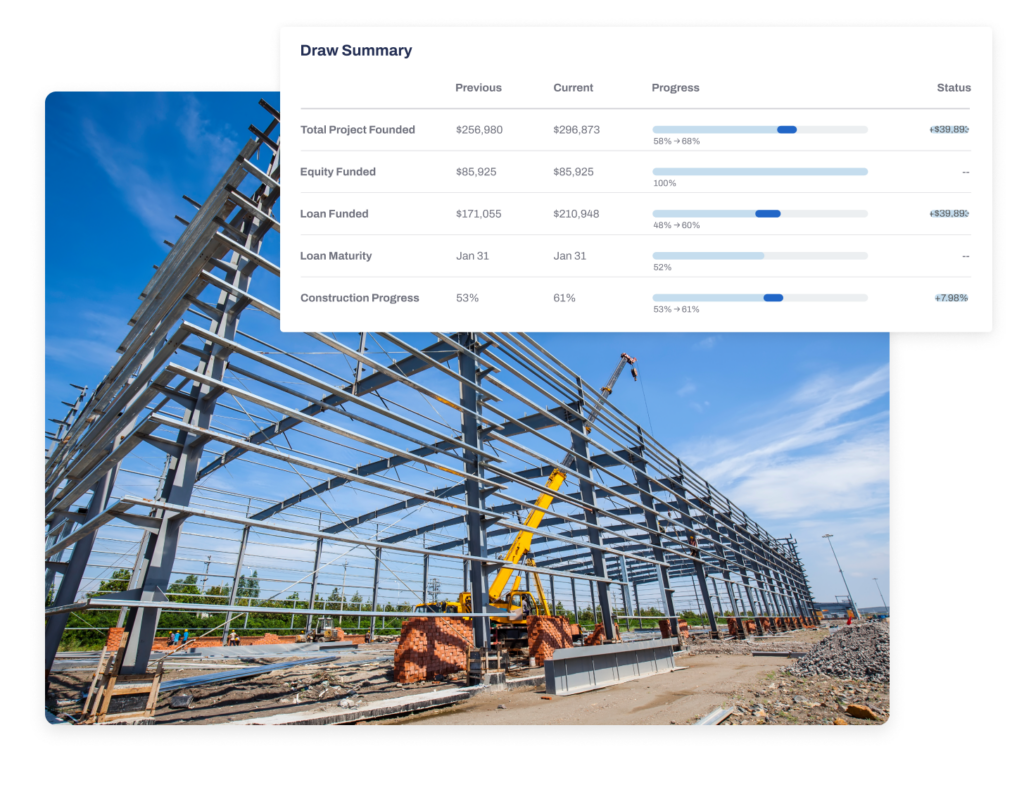

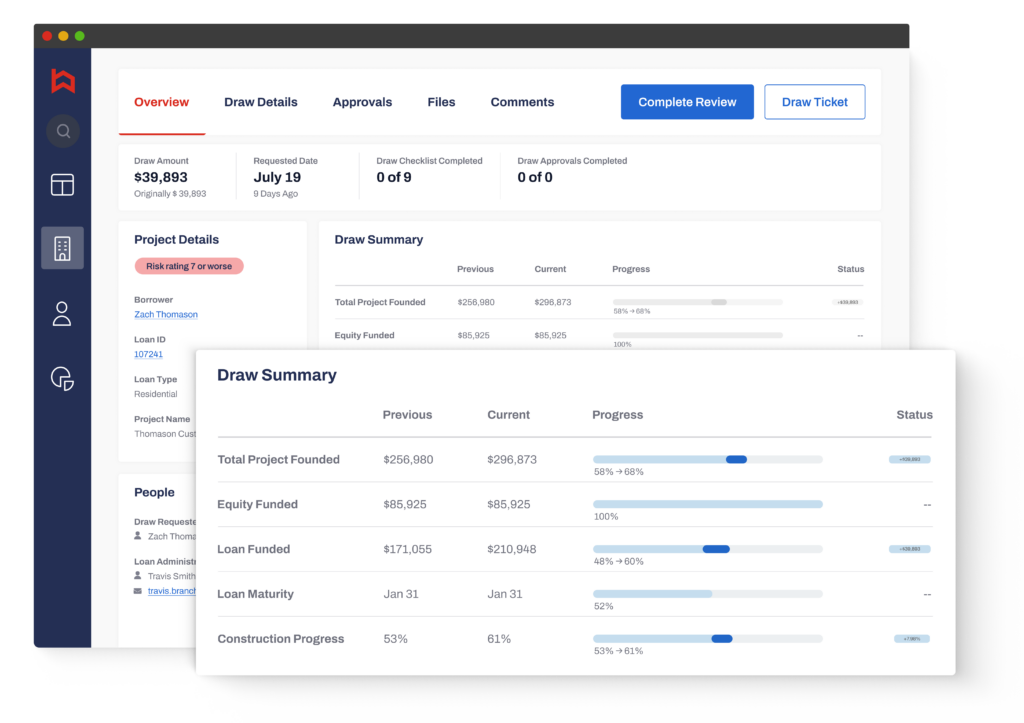

Set Your Portfolio Up to Scale

Centralize your construction portfolio on Built to gain full visibility for commercial and industrial projects. Spend less time on administrative overhead and more time focused on portfolio growth.

Speed up the processing of payment draws separately from and concurrently to progress draws with longer cycle times due to reliance on third-party inspections and title endorsements, leading to more NII pick-up and happier customers and vendors.

Directly engage inspectors or title companies from the draw review screen and attach pay applications and backup to new draw requests within the platform.

Real-time access to portfolio-wide reporting, including portfolio summary data, concentration reporting, risk management reporting, proactive alerts, operations management, and performance reporting; all filterable and exportable to .pdf or .csv.

Spend less time pulling together information for examinations with Built through its automatic creation of life-of-loan compliance reports, which are updated in real-time and capture all draw review and funding activity.