Construction Loan Reporting: Key Takeaways from Built’s Reporting & Analytics Webinar

Unlock better portfolio visibility, identify risk faster, and give every stakeholder the data they need—without waiting on spreadsheets.

In today’s construction lending environment, access to real-time reporting isn’t a luxury—it’s a necessity. For lenders managing complex portfolios, the ability to monitor risk, customize reports, and respond quickly to portfolio changes has become mission-critical.

In a recent webinar, Built’s Sam Tyagi (Director of Product) and Chris Radebaugh (Senior Solutions Engineer) gave a comprehensive walkthrough of the Reporting & Analytics Module. Whether you’re new to Built or looking to level up your reporting capabilities, here are the most important takeaways on how to make Construction Loan Reporting work harder for you.

Meet the Experts

Sam Tyagi

Director of Product at Built

Sam leads the product team focused on data, analytics, and other platform infrastructure. She’s responsible for launching Built’s Reporting & Analytics Module and works closely with engineering to turn customer feedback into powerful features.

Chris Radabaugh

Senior Solutions Engineer at Built

Chris previously managed a construction loan portfolio and brings that experience into every client conversation. He helps lenders maximize value from Built by tailoring the platform to their real-world workflows.

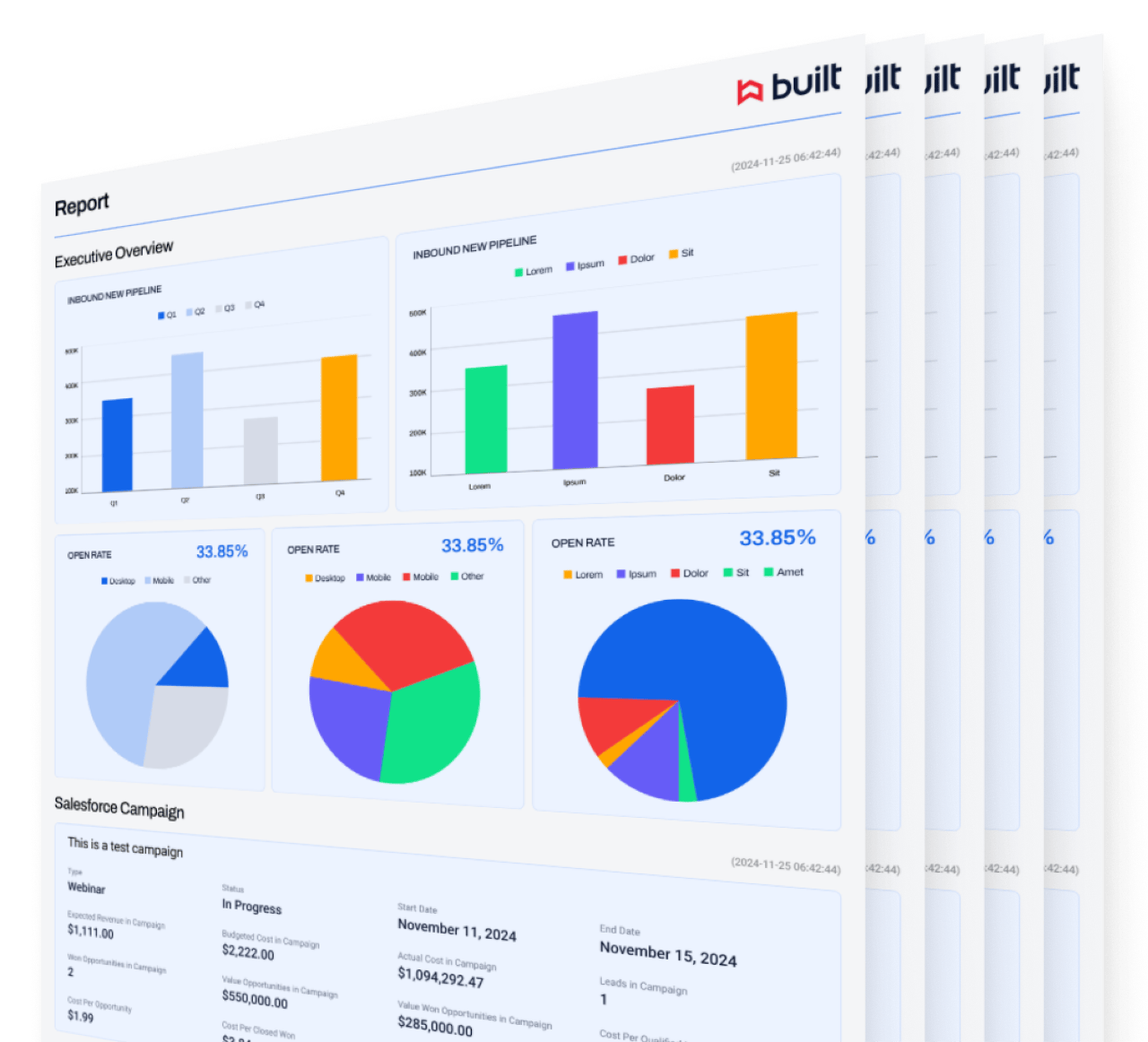

Meet Built’s Reporting & Analytics Module

Built’s platform offers enterprise-grade reporting for lenders of all sizes. Here’s how the module unlocks smarter Construction Loan Reporting:

Custom Reports, Your Way

With Built’s self-service reporting & analytics toolkit, you can:

- Copy and modify any of Built’s default dashboards

- Build entirely custom dashboards from scratch

- Filter and drill down by project, borrower, builder, or geograph

“Everything is powered by a full service BI tool underneath,” said Sam. “You can create reporting tailored to your organization’s unique needs.”

Automated Schedules and Alerts

Users can schedule reports to send to internal or external stakeholders daily, weekly, or monthly. You can even set email alerts triggered by specific data changes—like low interest reserves, upcoming maturities, or overfunded loans.

Chris walked through how alerts can help frontline teams act faster: “These are real-time triggers that remove the need to manually track exceptions.”

Time-Series Insights at Your Fingertips

The module includes daily snapshot tables, meaning you don’t just see what’s happening now—you can analyze what changed and when. This enables trend tracking and risk forecasting.

A Closer Look: Key Dashboards Built In

The Reporting & Analytics module includes powerful dashboards that give construction lenders a full view of their portfolios, here are four examples you’ll get access to:

Compliance Risk Dashboard

This is your executive-level overview. It highlights risk at a glance:

- Projects that are stalled

- Overdrawn loans

- Loans nearing maturity

- Interest reserves that are running low

Each metric is clickable, allowing users to drill into the underlying deals. It’s a live pulse-check across your entire book of business.

Stakeholder Management Dashboard

Get full visibility into your stakeholders—whether they’re borrowers, builders, or third-party inspectors:

- Identify frequent delays tied to specific parties

- Track user engagement across stakeholder base

- Spot upcoming opportunities for renewals or refinancing

- Plan outreach campaigns to borrowers, general contractors, inspectors or other stakeholders

- Spot patterns across your builder or borrower base

Concentration Risk Dashboard

Monitor your exposure in real-time:

- Filter by borrower, geography, contractor, loan type, and more

- See exposure by category with automatic aggregation

- Drill down into asset- or deal-level risk in seconds

Chris noted, “What used to take hours of spreadsheet work now takes seconds.”

He also recommends lenders revisit this dashboard monthly or quarterly to stay ahead of shifting risk profiles.

Deal Actions Dashboard

This is the dashboard for day-to-day operations:

- View outstanding draws, pending approvals, and overdue items

- Keep deals moving with clear action items

- Sort tasks by stakeholder, geography, or risk level

- Analyze task/milestone completion performance of external stakeholders such as Borrowers, GCs, inspectors as well as internal stakeholders like loan officers and loan admins

Built for Lenders, By Lenders

One of the biggest strengths of Built’s analytics engine is its unified data model. That means:

- Every loan—from consumer to commercial construction loans, and stabilized CRE—feeds the same dashboards

- You get a single source of truth across the platform

- Insights are accessible regardless of department or product line

As Sam shared, “It’s not just a dashboard—it’s a unified lens across your entire portfolio.”

Chris, who previously managed a construction loan portfolio before joining Built, reinforced that perspective: “I’ve lived the pain of managing reports manually. What we’ve built here is something I wish I had in my previous role.”

With customizable dashboards, automated alerts, and self-service analytics, you can eliminate bottlenecks and proactively manage risk across your portfolio.

Meet the Experts

Sam Tyagi

Director of Product at Built

Sam leads the product team focused on data, analytics, and other platform infrastructure. She’s responsible for launching Built’s Reporting & Analytics Module and works closely with engineering to turn customer feedback into powerful features.

Chris Radabaugh

Senior Solutions Engineer at Built

Chris previously managed a construction loan portfolio and brings that experience into every client conversation. He helps lenders maximize value from Built by tailoring the platform to their real-world workflows.

Get Started with Construction Loan Reporting

Whether you’re managing a commercial portfolio or scaling operations across loan types, Built’s Reporting & Analytics module gives you the tools to act faster and reduce risk with confidence.

Related Posts

Identifying Opportunities In CRE: Industrial Shows Strength