Unlock New Opportunity

& Mitigate Risk

Expedite the collateral add process, accelerate draw turnaround times, open new revenue streams, and remove administrative burden with Built.

Powering Tailored HBF Processes

Built’s Home Builder Finance solutions allow users to draw funds at the line level, or on a per-unit basis, if applicable, for all revolver types.

Track and manage home builder parent facilities to ensure accurate collateral management when drawing on sub-notes with the benefits of full oversight on individual lots.

Manage large, revolving credit facilities with Built as your system of record for collateral management—with the ability to post principal payments at the unit level.

Use Built to control revolving facilities to manage advanced home builder development of single family homes where homes contribute value to a pool of funds managed at the parent level.

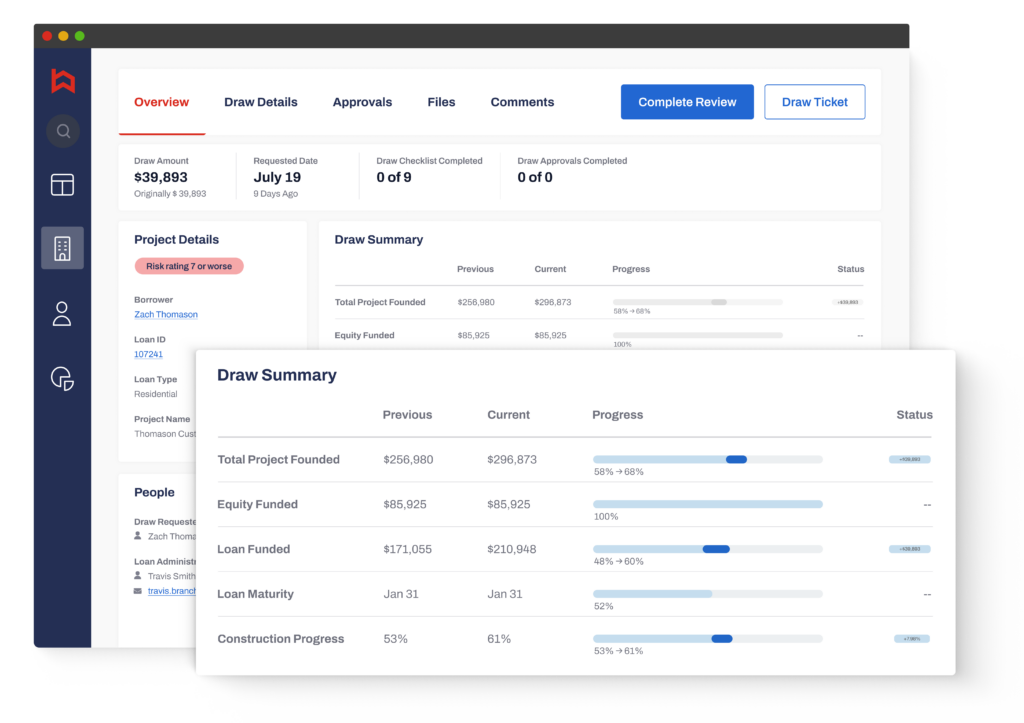

Aggregate Critical Loan Information—All In One Place

Administering home builder lines of credit can be time-consuming and complex without the proper systems and reporting in place to manage collateral and facilitate timely draws.

Manage and maintain collateral and loan documentation in a secure and centralized online location.

Proactively track pipeline and forecast future commitments with real-time data, available to you 24/7—manage your extensive portfolio and make data-backed decisions with confidence.

Provide real-time visibility into portfolio reporting, draw availability, and sub-limitations of loan agreements.

Collaborate with owners, builders, and borrowers for draw management and disbursement in one centralized platform. By decreasing draw time with Built, you’ll improve customer relationships all while decreasing errors and increasing insight for all involved parties.