Project Pro Feature Deep Dive

A closer look at the tools that help mitigate construction risk at every turn

With refinances down over 70 percent since this time last year, construction lending is a viable option for lenders looking to expand their business. However, many lenders are missing out on this potential growth opportunity, simply because they can’t manage the added risk and administrative workload associated with maintaining a portfolio of construction loans. On the other hand, lenders that have continued to approve construction loans, despite departmental limitations and manual workflows, often find themselves exposed to a high amount of risk resulting from mismanaged loan files, unmet regulatory obligations, and unmonitored loans.

By implementing modern risk mitigation technology, lenders can increase the administrative capacity of their lending teams while improving risk mitigation, collateral management, and portfolio monitoring.

So, whether a lender is trying to expand into construction lending, or protect and grow their existing construction portfolio, a digital solution is a critical piece of the puzzle.

What is Project Pro?

In case you missed our product introduction–Project Pro is Built’s revolutionary digital solution that empowers lenders to mitigate the impact of risk on their construction portfolio through automated project monitoring, robust contractor management, and best-in-class project visibility.

Similar to the toolboxes that builders use to expedite their work, Project Pro contains specialized tools that allow lenders to proactively manage construction financial risk at every turn. In this article, we’ll take a closer look at each component that makes up the Project Pro solution and explore how these elements come together to form the most innovative and holistic approach to construction risk mitigation in the industry today.

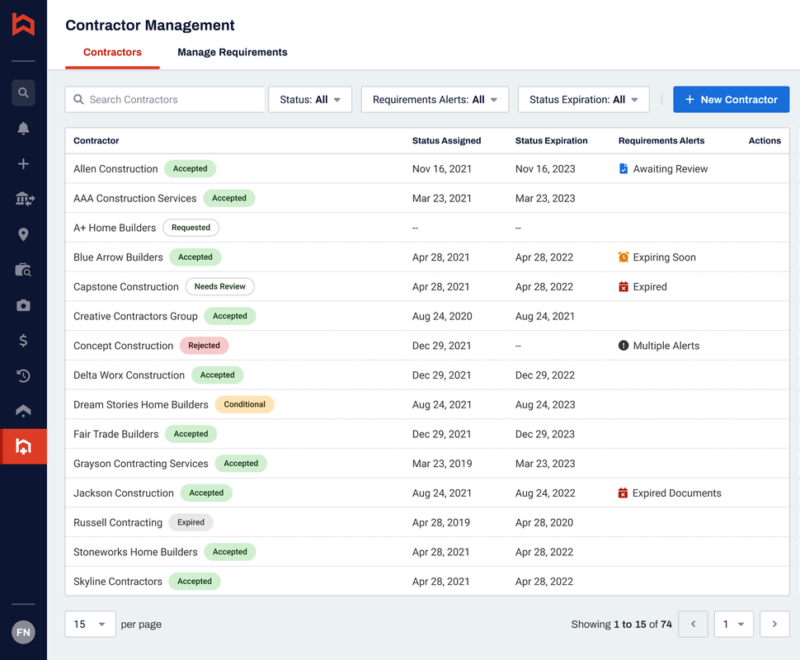

Contractor Management

For lenders, it can be incredibly challenging to determine the trustworthiness of contractors who don’t have a proven track record–especially with a flood of inexperienced contractors taking advantage of today’s high demand. If a problematic contractor is identified, the obvious solution is to replace them. However, this isn’t a decision to be made lightly–especially if the project has made a lot of progress. Firing contractors can potentially be very costly, as they are unlikely to refund any money they’ve already been paid. In addition, any unsatisfactory work that has already been completed may need to be redone. For these reasons, it’s important to have a consistent and reliable process to accept and manage contractor relationships throughout the project.

Project Pro’s Contractor Management is Built’s one-stop shop for both acceptance and ongoing management of contractors. Contractor Management improves upon Built’s already extensive contractor acceptance tools by directly incorporating customer feedback regarding acceptance flexibility and leveraging integrations with industry-leading verification partners.

Contractor Management is:

- A more flexible contractor acceptance experience

Set and customize specific acceptance requirements, including: state license status, insurance coverage, past project performance, and business credit profile.These acceptance requirements are seamlessly integrated into the initial review and tracked throughout the life of the project. In addition, lenders can choose exactly to who acceptance reports are sent.

- Customized questionnaires

Work with Built to create customized questionnaires that will be loaded straight into the Contractor Management experience and sent to contractors directly through Built’s system.

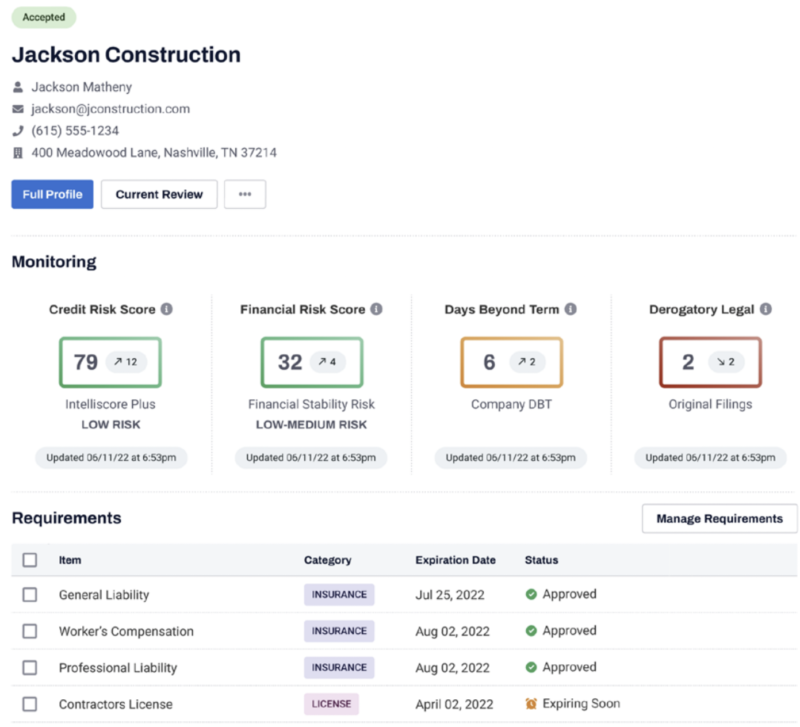

- Easily accessible data & improved visibility

Manage a full directory of contractors and access dynamic contractor information in one convenient location. This visibility allows lenders to identify potential risks in the contractor’s project portfolio before they escalate into further issues. Lenders can also easily access required compliance documentation uploaded directly from the contractor into Built’s system.

Successful construction projects can only be achieved when the contractor is capable of completing the job on time, within budget, and in compliance. Having a robust and intentional contractor management process helps lenders stay ahead of risk–ultimately saving time and money. Project Pro’s Contractor Management gives lenders a comprehensive and innovative contractor management solution that will help them scale their construction lending programs with confidence.

Project Monitoring

The Project Monitoring component of Project Pro allows lenders to proactively mitigate risk by continuously monitoring projects for some of the most prevalent and time-consuming roadblocks for a construction project: contractor issues and involuntary liens.

Contractor Monitoring

Contractor risk is often considered one of the most significant forms of risk associated with construction lending, as the right contractor can make or break a construction project. At best, an incompetent contractor can result in delays, low-quality work, and incorrect installation. At worst, they can create a dangerous work environment. Any contractor issues, regardless of severity, have the potential to cost lenders a significant amount of time, money, and sanity.

With Project Monitoring, lenders can uncover and identify trends or potential risks in a contractor’s project portfolio, allowing issues to be remedied before they cause delays. Active contractor status alerts are presented clearly in the Project Pro Dashboard for easy viewing.

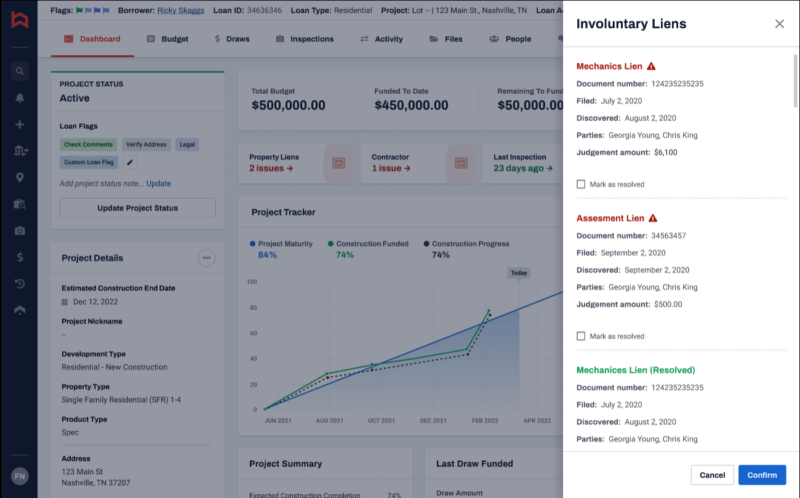

Lien Monitoring

Qualifying contractors based on their payment and credit history is already a big step in the right direction for proactively preventing lien issues. However, this is not always enough, and if a lien is filed (valid or not) it’s important to take it seriously and address it quickly to prevent delays.

Using direct integrations with title data providers, Project Monitoring tracks for involuntary liens on a daily basis–providing lenders with important data, including record type, parties involved, lien amount, and more. Project Monitoring enables lenders to proactively resolve disputes and reduce constraints in the draw process to release funds quickly and maintain compliance.

Project Monitoring is:

- Proactive risk monitoring & mitigation

Receive automated updates on contractor and lien risks associated with a project and find earlier opportunities for resolution. When a contractor or lien issue is identified, lenders are alerted immediately via the Project Pro Dashboard–allowing them to take action quickly.

- Proactive risk mitigation

Identify trends or potential risks in the contractor’s project portfolio before they escalate into further issues.

- Faster funding

Actively monitor and identify potential liens for clients sooner to help them mitigate any issues before a draw is requested. Proactive monitoring leads to less time between draw request and draw funding.

- Easier access to high quality data

Gain access to reliable, contextual data in the Built platform via direct integration with title data providers.

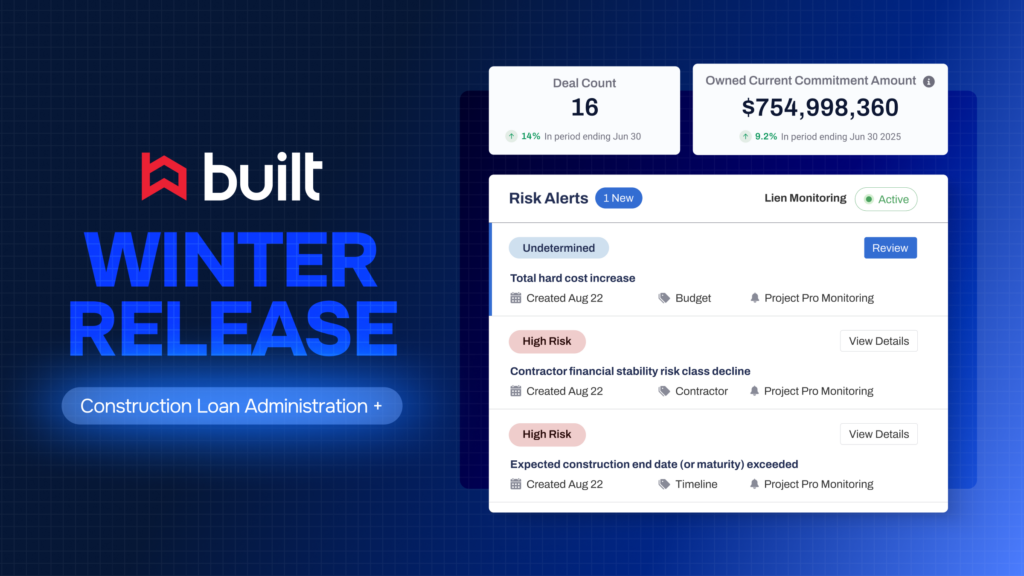

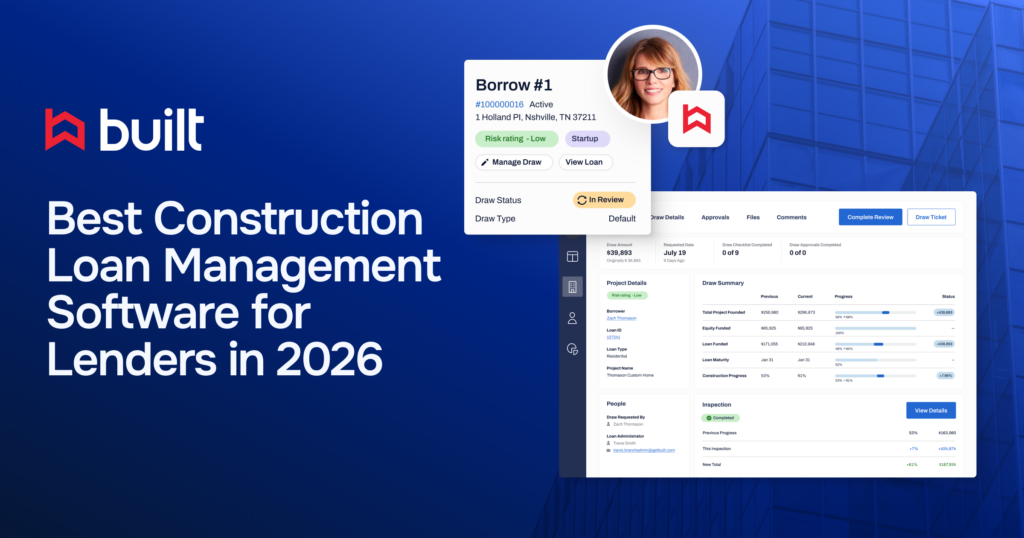

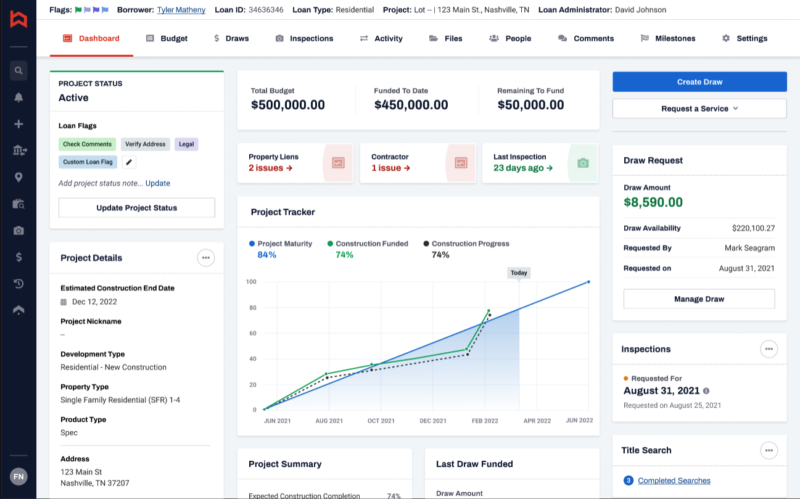

Project Pro Dashboard

Data is only as useful as the context in which it’s presented. The Project Pro Dashboard brings together critical information collected via Contractor Management and Project Monitoring and presents it in a clear and consolidated view, all within the context of the loan. With the Project Pro Dashboard, lenders gain powerful 360-degree visibility into all the data needed to proactively mitigate risk on their loans.

The Project Pro Dashboard is:

- A quick & accurate snapshot of a project’s health

Quickly check loan data and have confidence that the most current and accurate information is being presented. Make decisions that are based on a solid analytical understanding instead of estimations.

- Unmatched transparency & coordination

Allow anyone who is not actively involved with a project to easily get up to speed and step in if a team member is unavailable.

- Proactive risk alerts

Receive timely alerts for any red flags involving a contractor’s status and lien issues.

- Seamless CLA integration

Pull in key loan data such as current draw summaries and project comments to easily track project progression.

The Time is Now–Start Protecting Your Construction Portfolio

By implementing modern risk mitigation technology like Project Pro, lenders can increase administrative capacity, confidently scale their construction lending portfolio, and empower their borrowers to get the job done on time and within budget.

Technology is used in every aspect of our personal and business finances. Why should construction finance be any different? Click here to chat with a Built expert and set up a free Project Pro demo so you can begin mitigating risk and empowering your borrowers to build faster!