Why ACH Is the Best Construction Digital Payment Method

$280 billion. That’s the cost of slow construction payments in the US. It’s not unusual for contractors and material suppliers to wait up to three months before getting paid for their work or materials. Because of this, contractors and suppliers often raise their prices to help counteract the effects of waiting so long. Some have even decided not to work with those who pay the slowest.

But higher costs aren’t the only effect. Payment delays can also cause businesses in the industry to struggle with cash flow, leading to work stoppages and delays, legal issues, and mechanics liens.

When payments are made, most contractors still use paper checks, which can be a costly alternative. Not only are the checks costly, but using them adds to the delay, as most are sent through the mail. In addition, they’re especially vulnerable to fraud and theft.

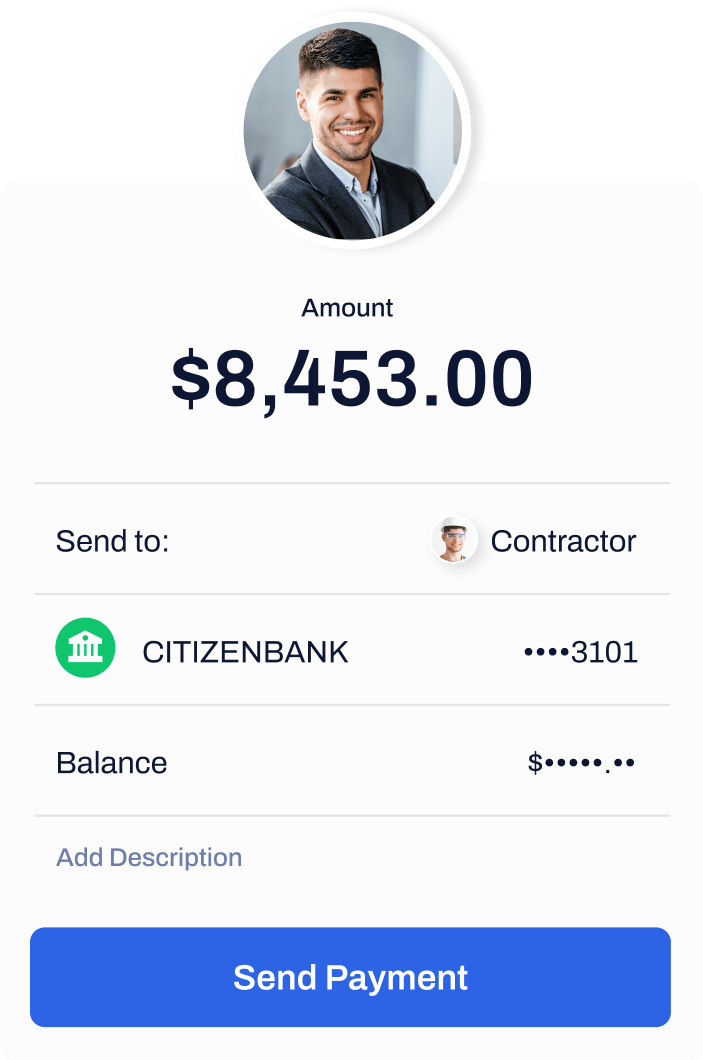

Electronic payment methods are gaining popularity, but many remain skeptical. When handled correctly, they offer faster payments, reduced costs, and greater security. There are several methods for making electronic payments, but ACH bank transfers provide an efficient, low-cost, and secure way to send funds. In this article, we’ll examine ACH payments and compare them to other methods of payment so you can choose the option that’s best for you.

What is ACH?

ACH stands for automated clearing house and refers to fund transfers made between bank accounts. The most popular form of ACH is direct deposit, which many companies use to pay their employees. ACH can also be called electronic funds transfer (EFT) and is used by many to pay regularly occurring bills, such as mortgages or utility bills.

These transfers usually take three to five business days to clear both sides of the transaction. The delay is often due to the banks on either side of the transaction confirming fund availability.

There’s a small processing fee (if any, depending on the processor) for each ACH transaction. The Association for Financial Professionals 2022 Payments Cost Benchmarking Survey found that the median cost businesses are charged for ACH ranges from $0.26-0.50 per transaction. These fees will vary depending on whether you’re using a bank or other service provider, and some may allow you to send ACHs for free.

ACH transactions are overseen by NACHA, the National Automated Clearing House Association, an independent organization that develops the rules that enable direct deposits and ACH payments. NACHA also provides training, education, and certification for payment professionals and oversees trillions of dollars in payments each year.

Why Companies Are Using Electronic Payment Methods

According to the AFP 2022 Payments Cost Benchmarking Survey, the top three reasons organizations are moving from paper checks to electronic payments are:

92%

Increased efficiency

85%

Reduced cost

67%

Fraud prevention

Security Is a Priority

When dealing with any electronic payment, whether ACH or a wire, keeping banking information secure is very important, so many rely on data encryption to protect this information. Vendors should not send bank accounts and routing numbers through email. Make sure that the ACH processor you choose has robust security and, preferably, asks your vendors to provide their information through a portal so you don’t have to be responsible for securing the data.

Checks are highly vulnerable to fraud and other criminal activity compared to the security of ACH and paper checks. Checks can be stolen, lost, or forged. The 2024 Association for Financial Professionals Payments Fraud and Control Survey Report found that 65% of respondent organizations had faced check fraud. Since construction payment amounts are often large, criminals have even more incentive to target the industry.

Sending checks through the mail is inefficient and expensive, and there isn’t a guarantee that the recipient will receive the check. The 2024 AFP Payments Fraud and Control Survey Report found that fraud due to interference with the United States Postal Service (USPS) was up 10% over 2023, with 20% of respondents reporting this. According to a CBS News report in 2024, mail theft has skyrocketed, from fewer than 60,000 complaints in 2018 to more than 250,000 in 2023.

Benefits of Using ACH

Using ACH to pay construction project costs provides several benefits:

- There are no outstanding checks to reconcile or get lost in the mail. Fund transfers happen quickly, so you know where your bank balance is at any given time.

- Everyone gets paid faster and has instant access to their funds. This allows contractors to get the best prices from suppliers, reducing costs project-wide.

- Low processing fees. ACH costs less than paper checks or electronic wires.

- Reduced cash flow problems. When payments are faster, contractors and suppliers can pay their costs and overhead without worrying about having enough money, seeking financing, or relying on credit cards.

- Reduced risk of fraud. ACH transfers are less likely to be tampered with than paper checks sent through the mail.

- Can handle a large number of transactions. It’s easy to send a large batch of payments simultaneously, and you save time signing checks and stuffing envelopes.

- Payments can be automated to save time. By scheduling and automating payments, you save time.

Comparing ACH to Other Payment Options

Here is a comparison of three payment options: checks, bank wires, and ACH transfers.

| Speed | Cost | Internal Processing Time | |

| Checks | 7-10 days | $4-20 (Printing, postage, envelope, processing time, bank charges) | 6-10 hours per week (printing checks, signing, reconciling) |

| Wires | Same day | $10-15 (Can be up to $60 per wire) | 1-4 hours per week |

| ACH | 3-5 days | Free, or up to $0.75 per transfer | 1-4 hours per week (making payments, reconciling) |

In the AFP 2022 Payments Cost Benchmarking Survey, respondents were asked about their processing time for paper checks and ACH.

Check processing times per week

The check process includes the following tasks:

- Payment/invoice approvals

- Check printing, both onsite and offsite

- Remittance printing

- Signatures

- Folding, stuffing envelopes, postage

ACH processing times per week

The check process includes the following tasks:

- Payment/invoice approvals

- Payment selection and submission

- Final approvals

With construction projects, additional documents, such as lien waivers or affidavits, may need to be included with each payment. Creating, printing, and sending these documents adds to the costs and time consumed with paper checks. Some documents can be sent and signed electronically, significantly reducing processing times and printing and postage costs.

Why You May Not Want to Use Your Bank for ACH Processing

There are several drawbacks to using a bank for ACH processing.

- File format requirements

Banks usually require ACH transactions to be uploaded in a specific format (Nacha). This can be cumbersome, requires additional training, and must be done manually.

- Limited customization

Banks have limited capabilities for complex transactions and payment workflows.

- Must track compliance and lien waivers separately

Bank capabilities don’t include documentation and compliance tracking.

- Doesn’t integrate with existing software

You’ll have to manually enter payments into your project management and/or accounting software, increasing the potential for errors.

- Low daily limits

Banks may put daily limits on the amount you can transfer, which doesn’t work with the magnitude of construction payments.

Consider a third-party processor designed specifically for construction to help reduce errors, streamline the payment process, and meet the industry’s complex payment process needs.

Getting Started With ACH

Here’s a step-by-step approach to getting started with ACH payments:

- You must first sign up with a processor who communicates with the banks to make the transfers. Options include banks and merchant services providers. Some have limits on the number/value of the transactions, and there are a variety of fee structures. Research your options, paying attention to the limits and fees and comparing them to your needs. Also, look for solutions that integrate with your existing software (accounting and project management) and those tailored to the construction industry.

- Complete the onboarding process with your chosen processor. Note that if you have selected a bank to initiate your ACHs, you’ll have to create a special file format (called Nacha). Ensure you have that capability, or ask the bank to show you how.

- Train all employees and vendor personnel on the processor’s system. It’s important that your payees know what to expect on their end, too (how to communicate their bank info, check payment status, and what to do if there’s an issue).

- Start with a trial with a few vendors or projects.

- Securely collect your selected vendors’ bank information (routing and account numbers).

- Process ACH payments through the system. Check with vendors to make sure they receive the funds. If there are issues, work with the processor to rectify them.

- Roll out to all vendors once the system is working smoothly.

Benefits of Built’s ACH Payment Processing

Built’s ACH payment processing service allows you to pay your contractors and suppliers easily and securely. With our robust portal, you can:

- Pay multiple vendors at the same time

- Confirm that the necessary compliance documents are on file

- Share payment status and details with vendors

- Provide secure onboarding for vendors

- Keep your vendors’ financial information secure (Built follows strict SSL, SOC 2, and Data Privacy regulations)

Related Posts

Want to learn more?

Connect with our team for a customized demo and see how Built can streamline your workflows and boost your business.