Many Banks Are Overexposed to Commercial Real Estate — But It’s Not All Bad

In a heightened interest rate environment, lenders are on edge, especially those with substantial commercial real estate portfolios. Banks with a high level of exposure to CRE mortgages and CRE construction loans are at risk as maturities are coming to fruition in a much higher interest rate landscape than when they originated.

To be frank, some banks are overexposed to CRE and face converting loans to non performing, ultimately leading to charge-offs. Resulting in losing out on interest income they’re dependent on. But there’s a way around this risk without having to make outrageous financial maneuvers.

Managing banks’ lending portfolios with hyperproficient financial technology can mitigate loans moving to Non Performing status, even for those overly focused on CRE. Let’s delve into the problem of overexposure to CRE, plus how to use software to nip non-performing loans in the bud.

What overexposure means (+ why banks should care)

Florida Atlantic University organized data from the Federal Financial Institutions Examination Council regarding U.S. banks’ exposure to risk from commercial real estate.

According to FAU’s analysis, 67 of the 157 largest banks in the U.S. have a CRE total to equity ratio above 300%. “Any ratio over 300% is viewed as excessive exposure to CRE, which puts the bank at greater risk of failure,” the university writes.

For CRE loans with end-of-term balloon payments that originated in the pandemic’s low interest rate environment, there’s a high chance of borrowers being unable to pay up or refinance when the time comes. Already, banks are seeing rising non-performing loans and charge-offs. For example, Bank of America reported after its fiscal Q3 in 2023 that its NPLs, or those with 90+ days of payments past due, increased to upwards of $5 billion, up from the previous quarter’s $4.27 billion. This, Bank of America said, was primarily a result of its CRE portfolio.

The increase in NPLs is often viewed as a precursor to economic recessions. Historically, during recessions, banks reduce new lending activities, further feeding higher NPL percentages in the wake of shrinking loan portfolios. But there is a light at the end of the tunnel: Loan maturity from pandemic-era loans extends into 2026, meaning there’s still time to manage the risk and make the most of CRE portfolios.

3 strategies for mitigating NPLs and charge-offs in CRE portfolios

For banks overexposed to CRE, mitigating NPLs and charge-offs is an active endeavor. Here are three strategies to use:

1. Set aside an adequate allowance.

Morgan Stanely noted in its fiscal Q3 2023 earnings release that it put aside $134 million for credit losses — down from $161 million in the previous quarter, but substantial nonetheless. This was a result of “deteriorating conditions in the commercial real estate sector,” the bank said.

This is an example of maintaining an adequate allowance for loan and lease losses to help cover estimated losses on loans. Ultimately, this is a proactive approach to ensure banks can absorb defaults of all kinds, including those from CRE loans. “A bank that fails to maintain an adequate allowance is operating in an unsafe and unsound manner,” writes the Office of the Comptroller of the Currency.

2. Manage risk with real-time data.

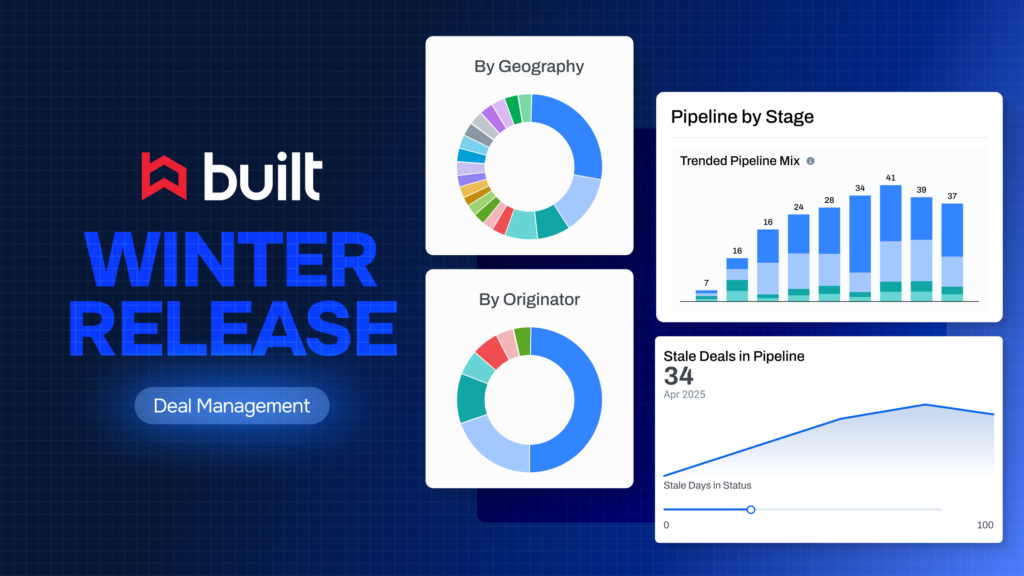

It’s essential to regularly stress test your CRE portfolio, producing scenario analysis to manage risk before it falls in your lap. Using strategic CRE software can help you access the data needed for this practice.

Ultimately, banks that use real-time data to manage risk are better able to anticipate potential losses and proactively adjust their reserves. Plus, banks with a CRE tech stack and strong risk management frameworks are better equipped to handle adverse economic conditions, despite substantial CRE exposure.

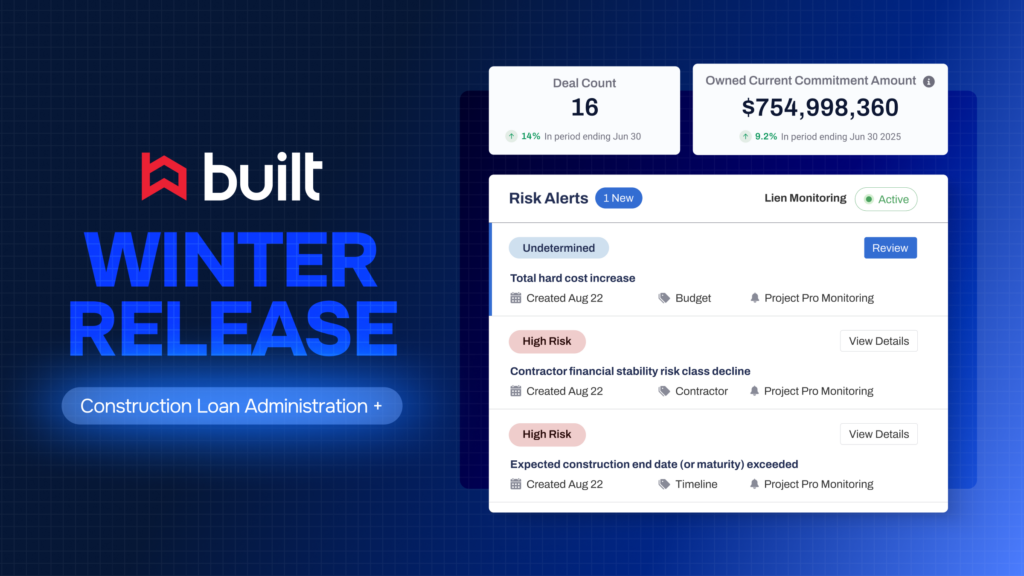

Moreover, relying on centralized and transparent CRE portfolio data through an integrated platform enhances your (and regulators’) ability to understand and manage associated risks. For example, Built’s CRE Asset & Portfolio Management platform allows lenders to harness data in real time. With Built, you can generate reports in seconds, not days, for more informed decision-making. Plus, spot risks before it’s too late with event-based notifications on the fly.

3. Identify problem loans early.

Use your CRE software to identify problem loans early by continually monitoring loan performance and identifying deteriorating loans. With this information, you can promptly take corrective action.

Take Built’s platform for an example of how this works. Using a cloud-based system for managing all relevant deal information, users can clearly and easily highlight concentrated risks, be proactive vs. reactive in asset management, and decrease NPL and charge-off allowance burden.

Tech spins CRE risk 180 degrees

While significant CRE exposure increases a bank’s risk in a low-to-high interest rate scenario, the real determinant of financial stability is the adequacy of the allowances and reserves maintained to cover potential losses, plus effective technology-led risk management.

Even banks with heightened risk of CRE loan NPLs and charge-offs have the time — and the ability — to manage that risk in an effective and efficient manner. Naturally, technology is the propellent that enables a one-eighty of CRE risk.