Built’s 2024 Lender Survey Says State of Financing is Looking Up

Built surveyed 117 lenders all over the U.S. around the start of 2024 to get their views on the current lending and economic landscape.

Overall, the understanding of the market is hopeful yet pragmatic. Lenders recognize they need to make some adjustments to adapt to the current climate, but that it’s highly possible to thrive in the conditions.

According to Built’s director of analytics Dan Gendler, “Lenders are generally optimistic for the state of the economy this year. While they have some underlying concerns such as government regulation and the speed to project completion, they generally see a positive environment for rates and expect consumers locked into low interest rate loans to gravitate towards home equity lines of credit. We’re also seeing more alternative sources of lending stepping in where the banks can’t take the risk, whether it’s due to regulation or balance sheet flexibility.”

Are we really in a recession?

Despite all the talk of a recession in recent years, respondents of Built’s lender survey come bearing a different perspective. The majority of respondents, 66%, believe the U.S. is not currently in nor approaching a recession. The remaining respondents believe the U.S. is going to enter a recession in 2024 (19%) or is already in one (15%).

Despite this relative optimism, 75% are still somewhat or very concerned about the macroeconomic environment moving forward. Meanwhile, 59% anticipate government regulation to have a somewhat or very significant impact on their financing decisions this year. And a majority (80%) of lending institutions say they’re somewhat or very concerned about increased length of construction projects over the next 18 months.

Looking at this balance of forward-thinking pragmatism in the real estate market, the results suggest lenders are poised to change how they finance and, potentially, the processes behind the financing.

The rate of change

Where are interest rates headed? According to our lenders, 74% anticipate the 30-year mortgage rate to decrease by January 1, 2025. Most of the remaining respondents believe rates will remain stable (16%), with some (10%) anticipating an increase from the current climate in 2024.

Of those who expect interest rates to decrease over the course of the year, about a third project rates to fall somewhere between 0.51–1 percentage points. Another 24% see rates falling between 1.01–1.5 percentage points.

Built respondents largely expect consumers who are locked into low interest rates to gravitate towards alternative borrowing solutions such as home equity lines of credit (HELOCs).

When asked if they’ve seen a shift or renewed focus on HELOC products, 60% of respondents said yes. On the contrary, just 21% of respondents were sure that they had not noticed this shift.

With lending product options, 44% of respondents remain unmoved by lending competition while a quarter are somewhat unconcerned.

Lenders do not exist in a vacuum

Due to tightening of liquidity or balance sheets, 41% of lending institutions expect to become a referral source of construction loans to non-bank lenders (such as Apollo, Blackstone, and others) who are able to originate these loans.

While a minority of respondents say their lending institution has not experienced liquidity or balance sheet tightening, about a quarter (27%) of lenders do not expect to become a referral source of construction loans to non-bank lenders.

When traditional lending institutions cannot take the risk due to regulation or balance sheet flexibility, more alternative sources of lending are stepping in to fill the gap.

How to adapt

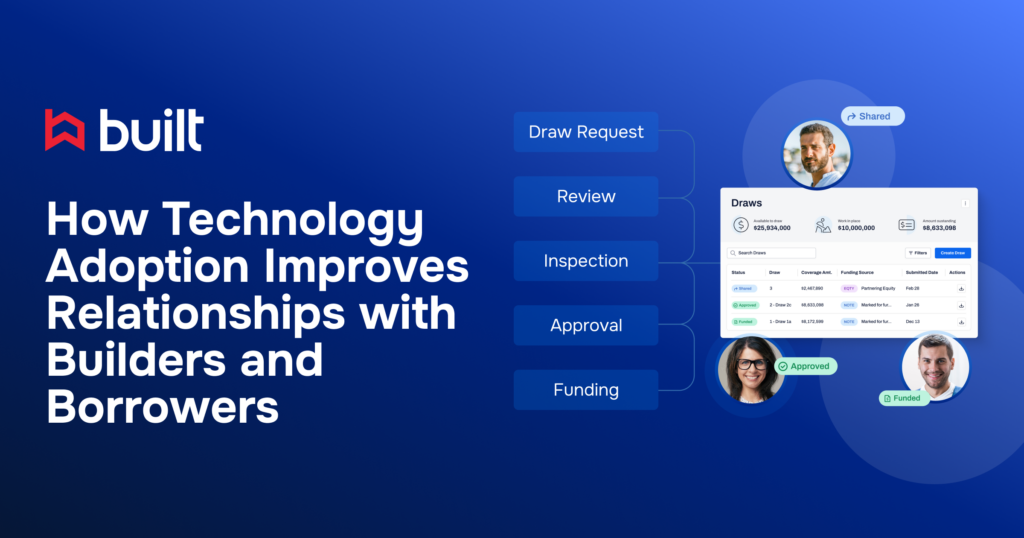

Strategic investments in 2024 are a necessity for lenders who want to thrive in the current economic climate. Lenders who aim to improve their strategic investments this year acknowledge a number of methods that would help them do so. These are the top five methods, in order:

- Products to help stakeholders on projects collaborate more effectively (for example, owners and lenders, co-lenders, and more) — 29% of respondents tout this solution as a way to improve their strategic investments in 2024

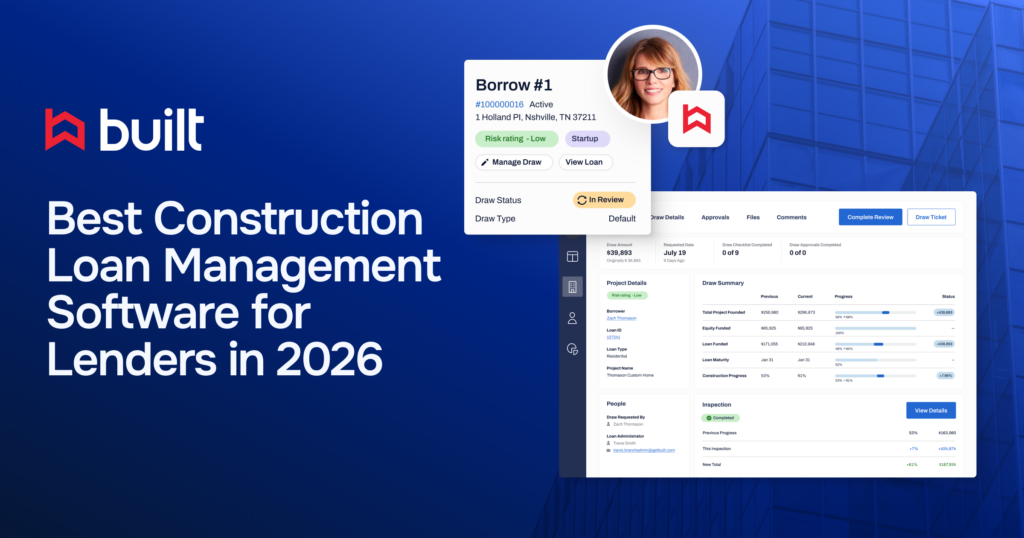

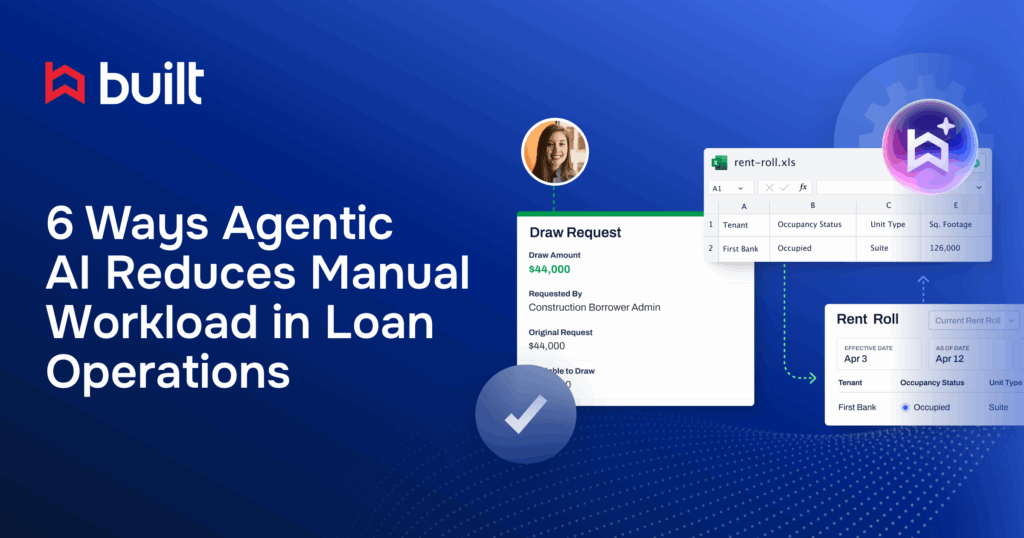

- Software solutions to improve workflow and efficiency — 15%

- Software solutions to improve revenue outcomes or internal rate of return (IRR) — 15%

- Marketplace solutions to help lenders purchase goods or services more efficiently (for example, inspections, appraisals, and more) — 15%

- Data products to harness data and insights for improved decision making — 14%

Ultimately, lending institutions in the real estate financing space have a choice to make: Do they take action, or do they wait for the market to adapt to them? If you’re in the former camp, you’re more likely to thrive in a shifting environment.