WASHINGTON — The American Bankers Association today announced its endorsement of a construction lending platform provided by Built Technologies, a Nashville-based fintech company. The technology offered by Built reduces the cost of servicing and transforms the user experience on residential and commercial construction loans by connecting the borrower, builder, inspector and lender through an online platform.

The construction lending space is unique because loans are funded as construction is completed, a process that requires coordination between the lender, borrower, builder, inspector and others. Despite its challenges, the space has seen very little innovation, with most of the process and data being managed on spreadsheets and through emails, phone calls and faxes.

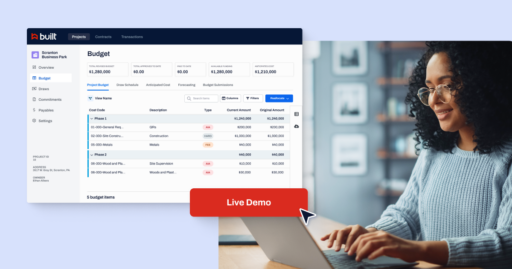

Built’s software was specifically designed to complement banks’ core systems and spans all types of residential and commercial construction loan products. Perhaps most important, by digitizing the construction loan administration process, Built is able to provide banks with unprecedented real-time insights and construction portfolio analytics.

“Our construction loan clients love this technology because everyone can collaborate online, so draw requests are more efficient and funds are released faster,” said Sharon Armstrong, residential construction manager at Pinnacle Financial Partners. “It’s beneficial to the bank as well as its borrowers. Built allows for faster draw turnaround times, and our builders enjoy having real-time information at their fingertips.”

Key features of Built’s construction lending platform include:

- Built Insights provides portfolio dashboards, management reporting, portfolio trends, operational KPI’s, benchmarking, and proactive risk alerts

- All parties to the transaction, including borrowers, builders, inspectors and banks have access to the platform. This enables the parties to interact and collaborate with one another transparently.

- Digital draw administration is managed on the platform, making the process more efficient, timely and compliant. After setup, project budgets are automatically recorded and reconciled during construction, eliminating the need for spreadsheets.

- Lenders and draw inspectors are provided a portal to capture and upload site photos and inspection reports.

- All files and documents related to the transaction are organized in one place, allowing easy access for reporting, risk management and record management.

- Cloud-based software can operate as a stand-alone system or can be connected to a bank’s core system, loan origination system and other trusted systems.

“We are delighted to be chosen as the ABA endorsed provider for construction lending technology,” said Chase Gilbert, CEO, Built Technologies. “We were impressed by the ABA’s due diligence process when choosing to work with us and it’s great to know we’re completely aligned on what their members need to solve this important problem.”

Built has raised over $25 million of venture capital from leading financial technology institutional investors. After going live with its first clients in 2015, Built now works with more than 50 banks across the country ranging from $100 million to more than $120 billion in total assets.

Built was also named one of the 20 FinTech Forward Top Companies to Watch by American Banker and BAI in 2016, a finalist for Bank Director’s “Best of FinXtech” Awards in 2017 and 2018, one of Housing Wire’s 2017 and 2018 TECH100 Winners and was awarded Growth Stage Company of the Year in 2017 by Nashville Technology Council.

As part of the endorsement, ABA members will receive advantaged pricing. Click here for more information about ABA’s endorsement of Built’s construction lending platform.

The American Bankers Association is the voice of the nation’s $17 trillion banking industry, which is composed of small, regional and large banks that together employ more than 2 million people, safeguard $13 trillion in deposits and extend nearly $10 trillion in loans. Learn more at aba.com.

{{cta(‘b3d53a05-e158-48ab-87b8-ee1a0803894e’)}}