Beyond Inspections: Why Lenders Need Construction Loan Monitoring Software for Risk Management

Inspection software has become table stakes for lenders. It validates construction progress, provides documentation, and reduces the risk of overpayment. But as construction loan portfolios grow more complex and risks multiply, software built only for inspections falls short.

The reality is that inspections provide snapshots, not real-time visibility. Reports confirm what happened on-site, but they don’t connect to project budgets, draw requests, or funds disbursement tied to a construction loan agreement.

For lenders navigating tighter margins and rising CRE exposure, those blind spots in construction finance can quickly turn into capital risk.

In this article, we’ll explore why inspections remain essential but insufficient on their own, the risks of relying on standalone inspection tools, and how lenders can unlock stronger risk management by integrating inspections into full construction loan administration.

Why Lenders Rely on Inspections

In commercial real estate lending, few safeguards are as important as inspections. Independent, third-party reviews provide lenders with unbiased verification of construction project progress and collateral condition, ensuring funds are released only when work is truly complete.

The Role of Inspections in Construction Loan Monitoring

For construction lenders, inspections sit at the center of risk management. Each draw request is tied to a milestone. Without on-site verification, lenders risk releasing funds too early, fueling incomplete project budgets, overruns, or even fraud.

Regular inspections confirm that project budgets, funds disbursement, and schedules align, creating a reliable audit trail for compliance.

Beyond construction, inspections also strengthen oversight in broader commercial real estate lending portfolios. They validate tenant improvements, contingency budget use, reserve allocations, and capital expenditures, giving lenders a clear picture of performance across loans and helping them mitigate risk before it escalates.

Where Manual Processes Fall Short

Even when inspections are performed diligently, human error can creep in when reports live in spreadsheets, emails, or shared drives. Versions are misplaced, calculations are inconsistent, and critical insights get buried in static files. These gaps delay decision-making, weaken compliance, and create blind spots in risk management.

Modern inspection workflows centralize reports, photos, budgets, and funding recommendations in one system, reducing errors and delays.

Why Inspections Remain Non-Negotiable

As lending volumes rise and construction loan portfolios become more complex, inspections provide lenders with the independent oversight they need to protect investors and borrowers alike. They remain one of the few tools that give lenders confidence in every draw process, helping to mitigate risk, safeguard their lien position, and ensure proper use of project funds.

By validating milestones and maintaining clear audit trails, inspections make funding faster, more transparent, and better aligned with best practices in construction loan administration.

Lenders Really Need Connected Risk Management

Standalone inspection tools flag issues at the project level, but they can’t provide portfolio-wide risk insight. By integrating inspections directly into loan lifecycle management, lenders can see how site progress aligns with budgets, disbursements, and borrower performance in real time.

This is where Built’s approach stands apart:

Inspection Data in Context

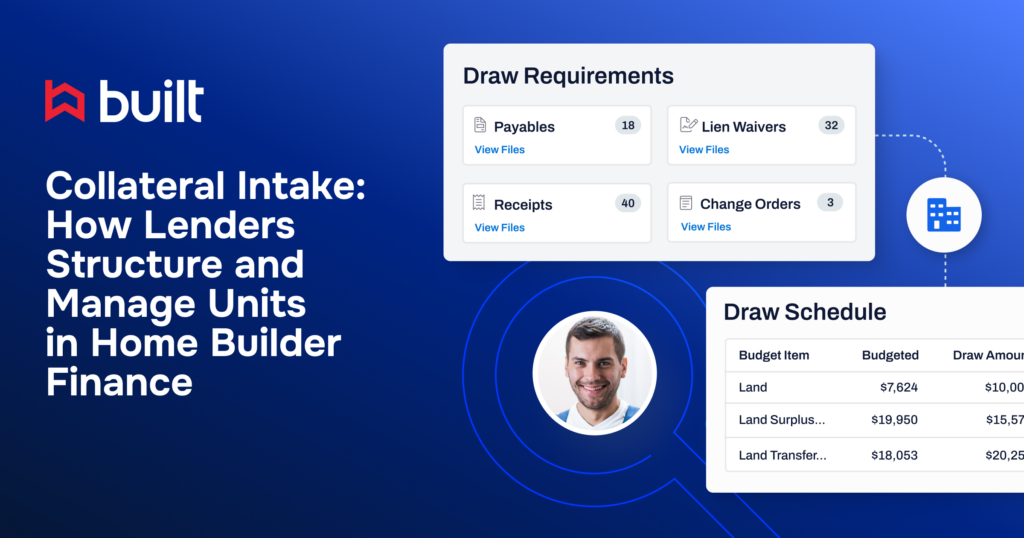

Rather than leaving inspection reports as static PDFs, Built ties every finding directly to draw requests, budgets, and disbursement history. Risk teams see the bigger picture instead of disconnected systems.

Audit-Ready Recordkeeping

Every inspection, funding recommendation, and change order is automatically time-stamped and stored in one system, making it simple to provide oversight to auditors, regulators, and investors.

Portfolio-Level Intelligence

Competitors often stop at a single loan. Built surfaces sponsor performance, contingency burn rates, and covenant compliance trends across an entire portfolio.

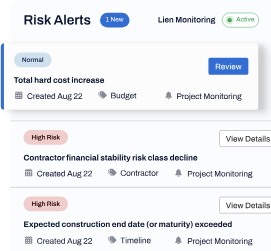

Real-Time Risk Signals

Instead of waiting for quarterly reviews, Built alerts lenders immediately when milestones are issued, budgets are exceeded, or risks emerge, helping them act before capital is at stake.

Industry evidence reinforces this point. According to Visionet, one lender improved data accuracy by 35% through Intelligent Document Processing, which resulted in more reliable loan files and faster investor approvals.

The same principle applies in construction and CRE lending: when inspections are tied to budgets and disbursements in real time, lenders not only move faster, they also gain the accuracy needed to satisfy regulators and investors.

From Inspection Data to Portfolio Insights with Built

In a recent “client success office hours” webinar, Victoria Zetterberg from Built’s client success team showed how lenders can move beyond static inspection reports by using the platform to connect inspection data with the full loan lifecycle. Executive summaries inside the platform give credit and risk teams an early window into percent complete, flagged issues, and funding recommendations, often before the full report is finalized.

More importantly, those inspection details don’t sit in isolation. In Built, they sync with draw requests, budget updates, and disbursement history. That means lenders aren’t just validating a single project in real time. They’re also gaining portfolio-wide intelligence.

Trends like contingency overruns, missed milestones, or sponsor performance issues surface automatically in dashboards instead of being buried in quarterly reviews.

By bringing inspections into a connected system, lenders replace blind spots with actionable insights. The result is stronger construction loan monitoring, more proactive portfolio management, and the audit-ready transparency today’s capital providers expect.

Moving Beyond Standalone Inspection Software

Inspections remain a non-negotiable safeguard in commercial real estate and construction lending. But software that captures inspection data in isolation can’t provide the real-time visibility lenders need to manage risk with confidence.

By connecting inspections with loan data like project budgets, draw requests, disbursements, and covenants, lenders gain a single source of truth that reduces blind spots, strengthens compliance, and scales oversight without slowing down funding.

Inspection software is necessary. However, it only becomes sufficient for today’s risk environment when integrated into a comprehensive construction loan management system. A connected platform ensures accurate audit trails, faster approvals, and proper management of undisbursed funds, all critical to mitigating risk across a growing portfolio.

Don’t let inspections become blind spots. See how Built turns inspection data into portfolio-wide risk insights. Book a demo today.

Lender FAQs on Construction Loan Monitoring Software

Why is value-based inspection reporting recommended for commercial loans?

Value-based inspection reporting is recommended for commercial construction loans because it ties site progress directly to draw requests, funds disbursement, and project budgets. Unlike percentage-of-completion methods, value-based inspections align more closely with how builders invoice, reduce disputes, and give lenders real-time visibility into progress reporting, contingency budgets, and construction workmanship.

How do lenders use the executive summary in inspection reporting?

Lenders use the executive summary in inspection reporting to gain an early window into project budgets, completion dates, and flagged risks before the full report is finalized. The executive summary provides audit trails and funding recommendations that help lenders speed up draw reviews, reduce funding delays, and maintain compliance and proper management across a growing portfolio.

What is the benefit of using a vetted inspection network for construction loans?

Using a vetted inspection network benefits construction lenders by ensuring inspectors are pre-qualified with the right experience, insurance, and compliance checks. This reduces reliance on manual processes, shortens turnaround times, and ensures that detailed reports flow directly into construction loan administration workflows.

The result is stronger oversight, consistent quality in inspection reporting, and the ability to mitigate risk across undisbursed funds and expanding portfolios.