The 4 Best Construction Draw Management Software for Owners and Developers (2026 Review)

Choosing the right construction draw management software is a key decision for owners and developers managing multiple active projects. As capital stacks become more complex and oversight expectations increase, the tools used to manage draw requests, approvals, and disbursements directly affect cash flow, compliance, and portfolio control.

While many platforms claim to support construction draw workflows, they are not built for the same operating scale or capital complexity. Tools designed for general project management or accounting often struggle to scale across portfolios, enforce capital source rules, or provide the level of audit-ready oversight owner-developers require.

This guide compares four of the most widely used construction draw management platforms through the lens of owner–developer needs. Rather than focusing on surface-level features, we evaluate how each tool handles capital controls, approval workflows, portfolio visibility, and operational complexity as project count and funding structures grow.

The goal is simple: to help owner–developers understand which draw management software fits their scale, capital structure, and internal workflows — and when certain platforms may fall short.

Below, we break down each solution, outline its strengths and limitations, and explain when it makes sense based on real-world owner–developer use cases.

Key Takeaways

- Not all draw software is built for owner–developers: Tools designed for general project management or accounting often fall short when managing capital controls, approvals, and portfolio oversight across multiple active projects.

- Fit depends on how capital and approvals flow: The right platform should align with your capital structure, approval complexity, and reporting needs. Capabilities like capital stack enforcement, automated workflows, audit-ready trails, and portfolio-level visibility directly affect scalability and risk.

- Purpose-built platforms outperform as portfolios grow: Software designed specifically for construction draw management provides stronger governance, clearer accountability, and more consistent execution as project count and funding complexity increase.

What Owner–Developers Should Look for When Comparing Construction Draw Software

Construction financing has become more constrained and complex in recent years. According to Commercial Property Executive (May 2024), construction financing volume fell 38% in 2023 to $47.1 billion, as lenders reduced leverage and institutional capital slowed. For owners and developers, this shift raises the stakes around capital controls, compliance, and how draw funds are released and tracked across active projects.

In this environment, draw management software plays a direct role in financial governance and portfolio oversight. More than a workflow tool, it functions as a system of record that coordinates approvals, enforces funding rules, and maintains accountability across internal teams and external stakeholders.

The strongest platforms go beyond processing individual draws. They account for where capital comes from, how it moves through a project, and who is responsible at each step as portfolios and funding structures become more complex.

Capital stack intelligence (critical for multi-project owner–developers)

Tools that lack native capital stack enforcement force teams back into spreadsheets or external controls. Effective draw platforms apply capital stack logic directly—enforcing equity, debt, and mezzanine rules by funding source to prevent disbursement errors and covenant violations.

Automated approval workflows

Manual review cycles introduce delays and risk. A strong platform automates approval routing based on draw size, project phase, or lender requirements, ensuring compliance without slowing down capital movement.

Integrated systems

Draw management doesn’t operate in isolation. Leading platforms integrate directly with accounting systems, inspection providers, and document storage tools so draw status, approvals, and funding data stay synchronized across systems.

Portfolio-level visibility

If you manage multiple active projects, prioritize platforms with portfolio-level visibility—centralized dashboards that surface budget exposure, draw pacing, stalled activity, and risk signals across the portfolio.

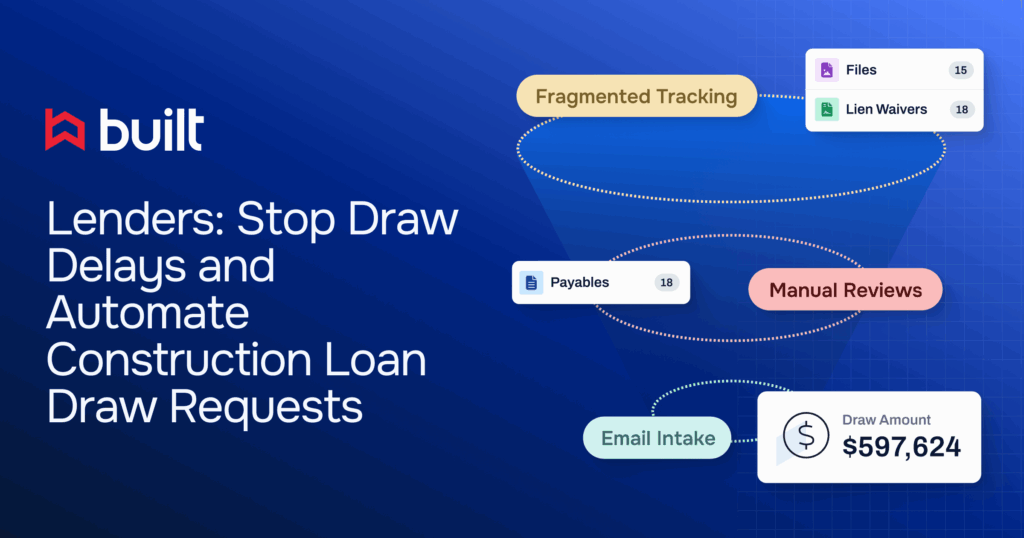

Replacing spreadsheet-based draw tracking

When draw workflows rely on email and Excel, documents go missing, version control breaks down, and data silos emerge. Top-tier platforms fully replace spreadsheet-based draw tracking with centralized workflows, real-time collaboration, and system-enforced version control—eliminating the need to manage critical financial processes offline.

Audit-ready controls

Draws touch multiple stakeholders, from internal finance teams to external auditors. Great software enforces retainage rules, disbursement thresholds, and time-stamped approvals by default, making audit readiness a built-in feature, not a scramble.

How We Evaluated These Tools

We assessed each platform based on five criteria that matter most to owner–developers managing multiple projects:

- Capital stack enforcement

- Draw workflow automation

- System integrations

- Portfolio-level oversight

- Audit readiness

The goal was not to crown a universal winner, but to clarify which tools fit which operating models and where tradeoffs emerge as portfolios scale.

Top Construction Draw Process Software Ranked by Owner/Developer Fit

| Feature Dimension | Built | Rabbet | Procore | Buildertrend |

|---|---|---|---|---|

| Draw Workflow Automation | Excellent (Custom Logic, Integrates Waivers/Inspections) | Good (SLA-driven routing, document-centric) | Fair (Requires heavy configuration in Financials module) | Basic (Simple pay apps, no conditional logic) |

| Capital Source Enforcement | Best (Native Stack Logic, Enforces Equity/Debt Waterfall) | Limited (Basic tagging, manual enforcement needed) | None (Focuses on cost codes, not capital structure) | None (Treats all funds uniformly) |

| System Integration | Excellent (Native Accounting & Lender Tech APIs) | Good (Procore, some Accounting) | Excellent (Deep ERP integrations) | Basic (QuickBooks, Xero) |

| Portfolio Oversight | Best (Real-time, Centralized Risk Dashboards) | Good (Loan/Draw Status Grouping) | Fair (Requires config, not native to financial flow) | Poor (Project-by-project siloed view) |

| Audit Readiness | Best (Time-stamped, Auto-compiled Draw Packets) | Good (Document-centric audit trail) | Fair (Manual documentation assembly required) | Poor (Limited standardized audit trail) |

| Best For | Multi-Project Developers with Complex Capital Stacks | Mid-Sized Developers Focused on Document Compliance | Large GCs/Developers with Existing ERP Infrastructure | Small Residential Builders Needing Basic PM/Budgeting |

Next, we review four widely used construction draw platforms through the lens of owner-developer needs, focusing on how each supports draw management in multi-project and capital-intensive environments. This section focuses on evaluation criteria rather than implementation details.

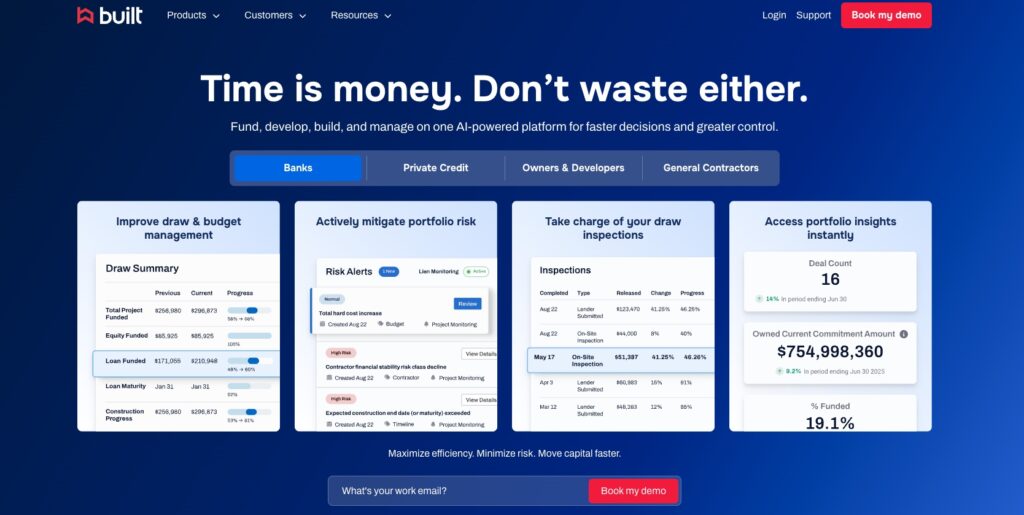

1: Built Technologies

Best for: Owner-developer hybrids managing complex capital stacks, multiple projects, and internal/external compliance requirements.

Overview

Built Technologies is a financial workflow platform purpose-built to replace fragmented construction draw processes. It serves both lenders, developers and contractors, but it stands out for owner-developer teams because it handles capital-specific complexity, like disbursement rules, interest reserves, and audit governance, while remaining easy to adopt across lean field and finance teams.

Feature-by-Feature Breakdown

1. Capital stack intelligence

- Built understands the layered nature of construction financing. Its disbursement engine allows capital rules (e.g., equity-first, senior/mezz splits, retainage rules) to be enforced within each draw.

- Supports Pari Passu, interest reserve management, and logic that adapts to project phase and lender constraints.

- Eliminates the risk of funding from the wrong source or violating covenants, unlike general PM tools.

2. Draw workflow automation

- Built digitizes every draw step: from request to validation to approval to funding.

- Automated rules route approvals by role, amount, or project risk profile.

- Notifications and draw milestone tracking reduce human delays and ensure SLAs are met.

- Inspections and lien waivers integrate directly into the workflow (no email chasing).

3. System integrations

- Native integrations with accounting platforms (Sage Intacct, QBO), inspection tech, and lien waiver tools.

- Export-ready reporting connects to internal BI or loan systems.

- Built’s API framework allows institutions to plug into their broader tech stack without expensive middleware.

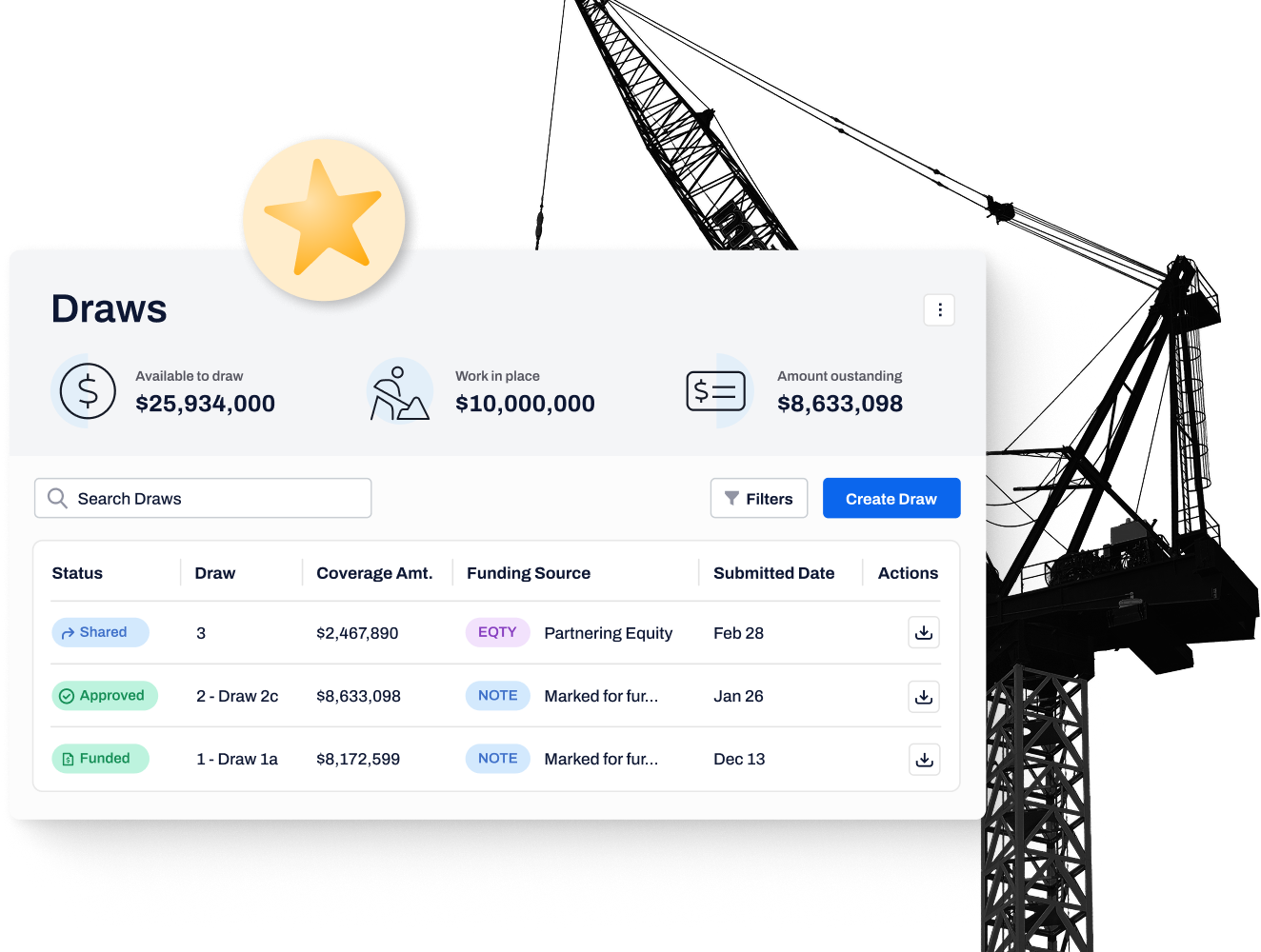

4. Portfolio oversight

- Real-time dashboards show pacing across builds, overdrawn projects, stale loans, and pending inspections.

- Portfolio-level compliance metrics surface in a single view (e.g., interest reserve sufficiency, past-maturity alerts).

- Customizable by business line, funding source, or region.

5. Audit trail and compliance

- Every action is logged: submission, inspection results, comments, change orders, approvals, fund release.

- Compliant with lender and auditor expectations by default.

- Draws can be exported with full supporting documentation for back-end review or lender distribution.

6. User experience and adoption

- Designed for adoption by field teams, finance users, and third-party vendors.

- No finance background required to submit or track draws.

- Excel starter-pack available so users can start in spreadsheets and convert into digital workflows gradually.

7. Pricing

- Portfolio-level SaaS pricing; no per-draw or per-user fees.

- Predictable, scalable cost aligned to portfolio size and complexity.

Draw management in practice

- Users submit draws through a clean portal with photo uploads, document auto-tagging, and system-synced cost codes.

- Inspection requests and lien waivers are automatically triggered.

- Approvals route in-platform with timestamps, and notifications alert finance teams when draws are ready to fund.

- Funds disbursed via connected systems, all with traceable logic.

Excel chaos elimination

- Excel not required at any stage post-implementation.

- Version control, document backups, and approval records live in-platform.

- Starter Excel templates help teams migrate their existing logic into Built’s system gradually.

Scalability and audit readiness

- Built scales from 1 project to 1,000+ without changes to workflow structure.

- Full audit trails are always available without extra configuration.

- Lenders and auditors receive compliant draw packets with click-through approval chains.

Bottom line: When to choose Built

Built is the right choice for owner-developer teams that need to automate draw workflows at scale; enforce capital source rules across equity, mezzanine, and debt tranches; and maintain audit-ready records without additional effort.

It’s especially well-suited for organizations managing multiple active projects and stakeholders who require unified portfolio visibility and seamless adoption by both finance and field teams. The only scenario where Built may be more than you need is if you’re a single-project builder with no funding complexity and are simply looking for a low-cost, lightweight tool.

Want to see how owner-developers replace spreadsheet-based draw workflows at scale? Explore how Built centralizes draw requests, approvals, documentation, and draw package creation across multiple projects.

2: Rabbet

Best for: Mid-sized developers and lenders seeking automated document control and financial governance but not managing high draw volumes or complex capital stacks.

Overview

Rabbet markets itself as a draw management and compliance automation tool for real estate developers and construction lenders. Its strengths lie in documentation workflows, approval routing, and visibility across multiple loans or projects. However, its design and pricing model reflect a lender-first DNA, which can create friction for owner–developer hybrids operating in fast-paced environments or seeking simplicity.

Feature-by-feature breakdown

1. Capital stack intelligence

- Rabbet includes basic capital source tagging but lacks native enforcement of capital waterfall logic.

- Disbursement sequencing (e.g., equity-first, mezzanine after 50% LTC) must be tracked manually or externally.

- Good at surfacing compliance blockers, but not a full replacement for capital source governance.

2. Draw workflow automation

- Solid workflow routing tied to SLAs and approval tiers.

- Stakeholder portals (e.g., inspectors, borrowers) improve transparency.

- SLAs can trigger alerts, but routing logic is less granular than other options (no multi-criteria conditions by phase or funding source).

- Strong doc-level tracking; less strong in funding logic automation.

3. System integrations

- Offers integrations with Procore and some accounting platforms.

- Lacks Built’s API breadth; most deeper finance integrations are manual or via export.

- Strong document OCR and indexing reduce document errors but double entry persists in external systems.

4. Portfolio oversight

- Dashboards show loan activity, draw volume, and key metrics like outstanding compliance items.

- Users can group by lender, project, or funding status.

- Useful for asset managers or lenders viewing 5–50 loans. Less optimal for developers managing construction across phases or stakeholders.

5. Audit trail and compliance

- All approval steps are logged; draw packets can be compiled quickly.

- Users can trace document history, status changes, and approvals.

- However, audit visibility is document-centric, not portfolio-comprehensive.

6. User experience and adoption

- Interface is clean, but workflows reflect lender-centric terminology and logic.

- Developers may face a steeper learning curve unless paired with lender teams.

- Borrower/owner teams must adapt to Rabbet’s compliance-first language and flow.

7. Pricing

- Two pricing structures:

- Per-draw model:

- Lite: $109/draw

- Standard: $159/draw

- Premium: $199/draw

- Per-project subscription model:

- Lite: $350/project–month

- Standard: $550/project–month

- Premium: $775/project–month

- Per-draw model:

Draw-heavy teams can experience rapidly escalating costs, particularly if they process 20+ draws/month across several projects.

Draw management in practice

- Users upload draw documents or submit via portal.

- Rabbet automatically tags, indexes, and routes documents for review.

- Approval logic is linear and fast, but funding logic must be confirmed manually.

- Draws are exported as compliance packets for lenders or capital partners.

Excel chaos elimination

- Strong document management and indexing mean fewer rogue spreadsheets.

- However, many developers still rely on external Excel files for budget controls, capital stack logic, or inspection schedules.

- Platform assumes project-by-project control, not cross-project draw dependency mapping.

Scalability and audit readiness

- Suitable for portfolios of 10–50 projects with moderate complexity.

- Efficient audit packet creation for individual draws.

- Not optimized for rapid, high-frequency portfolios unless paired with high-level admin support.

Bottom line: When to choose Rabbet

Rabbet is a strong fit for developer–lender teams that prioritize compliance automation, document tracking, and SLA-driven workflows. Its platform excels at organizing draw documentation, indexing approvals, and assembling lender-ready packets, making it especially useful in environments where audit preparation and capital partner alignment are central.

However, Rabbet is less suited for owner–developers managing high draw volumes across multiple projects, or those requiring capital stack enforcement, scalable pricing, or intuitive adoption by non-finance users.

3: Procore

Best for: Large-scale general contractors and developers with internal IT resources, enterprise ERP integrations, and centralized construction ops across many disciplines.

Overview

Procore is one of the most well-known names in construction tech, offering a vast suite of tools across project management, financials, quality/safety, and field collaboration. While not purpose-built for capital-side draw governance, Procore offers financial modules that support draw processing, cost control, and documentation workflows if heavily configured.

For owner–developer teams, Procore can work but only with the time, budget, and staff to tailor it to draw-specific needs.

Feature-by-feature breakdown

1. Capital stack intelligence

- Not supported natively. Procore lacks logic to enforce draw sequencing tied to funding source (e.g., equity-first, split by senior/mezz).

- Users must track capital stack compliance via external spreadsheets or ERPs.

- Built-in tools focus on cost codes, not capital structure or waterfall enforcement.

2. Draw workflow automation

- Offers customizable workflows through Procore Financials.

- Can route approvals, track retainage, and tie draws to schedule-of-values (SOV) and contract milestones.

- However, draw workflows are complex to configure, and changes often require admin or IT support.

- No default inspection or lien waiver integrations like Built.

3. System integrations

- Deep ERP integrations (e.g., Viewpoint Vista, Sage 300 CRE) allow for synchronized financials.

- APIs support custom data pushes to accounting or analytics systems.

- However, Procore lacks native integrations with lender tools, lien waiver platforms, or inspection marketplaces.

4. Portfolio oversight

- Dashboards show project health, budget status, and RFI activity.

- Portfolio-level oversight requires configuration and setup, so it’s not native to financial workflows.

- Reporting tools exist, but they’re not optimized for capital oversight (e.g., overdrawn alerts, interest reserve tracking).

5. Audit trail and compliance

- Financial events are logged and can be exported.

- Change events, budget mods, and approvals are traceable, but documentation assembly for auditors must be done manually.

- No built-in compliance file generator or audit-ready export for capital partners.

6. User experience and adoption

- Procore’s interface is highly capable but dense, designed for teams familiar with construction financials and PM workflows.

- Draw-specific tasks may require navigating across modules (Cost Management, Documents, Commitments).

- Mobile and offline access are strong for field teams.

7. Pricing

- Pricing is contract-based, typically structured by annual volume and number of active projects.

- Entry-level starts around $375–549/month for PM tools, but full financial + ERP suites can cost $10K–80K+/year.

- Unlimited users included; setup, training, and support are additional investments.

Draw management in practice

- Draws are typically tied to contracts, commitments, and SOV entries.

- Subcontractors or internal teams request progress payments.

- Admins validate work, collect lien waivers externally, and route for approval.

- Data can be synced with ERP, but many steps (compliance checks, fund releases, inspections) are outside the platform.

Excel chaos elimination

- Procore reduces Excel usage for budget tracking and sub invoicing, but it does not eliminate spreadsheets for capital draw management unless deeply customized.

- Users often export data for capital partners or draw packet assembly.

Scalability and audit readiness

- Procore handles scale well in terms of number of users and projects.

- However, audit support is manual, with no standardized draw documentation output for lenders or institutional partners.

Bottom line: When to choose Procore

Procore is a solid fit for large-scale developers or general contractors with established internal operations, especially those already using the platform for field coordination and project management. If your team has the IT resources to configure complex financial workflows and you need deep ERP integrations and contract compliance tracking, Procore can deliver significant value.

However, it’s not ideal for owner–developer teams that need built-in capital stack enforcement, pre-configured draw workflows, or audit-ready documentation for lenders and funding partners. Without a dedicated admin, the platform’s complexity can outweigh its benefits.

4: Buildertrend

Best for: Residential and small-to-mid-market builders seeking lightweight budgeting, scheduling, and team collaboration tools, not full draw governance.

Overview

Buildertrend is designed for small-to-midsize builders, remodelers, and contractors. It combines scheduling, financial tracking, CRM, and daily field logs into a single platform. While it includes basic invoicing and payment workflows, it does not offer capital stack intelligence, audit-grade controls, or true draw management workflows, which makes it a limited fit for owner–developer teams managing multi-project portfolios and institutional funding.

Feature-by-feature breakdown

1. Capital stack intelligence

- Not supported. Buildertrend treats all funds uniformly. There is no mechanism to enforce source-of-funds disbursement logic (e.g., equity vs. debt vs. mezzanine).

- Retainage can be tracked on invoices but not governed by capital source or compliance rules.

2. Draw workflow automation

- Supports basic invoice submissions and progress billing.

- Change orders and pay apps route through approval steps, but there’s no conditional logic, SLA triggers, or stakeholder segmentation.

- Lender-side requirements, inspections, or legal compliance steps must be tracked manually or outside the platform.

3. System integrations

- Integrates with QuickBooks (Online & Desktop), Xero, and some CRMs.

- No native integrations with inspection providers, lien waiver systems, lender portals, or capital tracking tools.

- All advanced compliance tracking or financial modeling must live in Excel.

4. Portfolio oversight

- Buildertrend operates on a project-by-project basis. There is no native dashboard for multi-project budget pacing, draw timing, or risk flagging.

- Users must log into each project separately, which fragments visibility and slows executive oversight.

5. Audit trail and compliance

- Tracks approvals of change orders and invoices, but does not generate a complete audit trail for capital or funding partners.

- No standardized documentation export or draw packet functionality.

- Risk of lost context or missing approvals if workflows are not strictly enforced.

6. User experience and adoption

- Simple and intuitive interface. Highly regarded for ease of use in residential GC space.

- Onboarding is quick for field teams and small internal offices.

- Mobile experience supports daily logs, photo uploads, and to-dos, but navigation becomes clunky in multi-project setups.

7. Pricing

- Tiered monthly pricing:

- Core: ~$299/month

- Pro: ~$499/month

- Premium: Custom quote (~$799–1,099/month)

- Unlimited users and projects; advanced financial features only in higher tiers.

- No per-draw fees, but pricing reflects a horizontal PM feature set, not financial workflow depth.

Draw management in practice

- Subcontractors submit invoices tied to cost codes or SOVs.

- Teams review and approve payments manually.

- Lien waivers, inspections, or capital constraints are not integrated.

- Funding approvals, source validation, and lender coordination happen offline.

Excel chaos elimination

- Buildertrend reduces spreadsheet use for single-project budgets.

- It increases fragmentation at scale, since there’s no cross-project oversight or portfolio governance.

- Owner–developer teams still maintain spreadsheets for capital stack tracking, funding schedules, and reporting.

Scalability and audit readiness

- Functional for builders managing a few active projects.

- Not scalable for institutional or multi-phase portfolios needing oversight or third-party audits.

- Documentation lives in project silos and lacks central audit readiness.

Bottom line: When to choose Buildertrend

Buildertrend is well-suited for residential builders, remodelers, or smaller contractors managing a limited number of projects who need simple scheduling, purchase order management, job costing, and client communication tools. Its user-friendly interface and mobile functionality make it easy to adopt for teams focused on day-to-day project coordination rather than complex financial workflows.

However, it’s not built for owner–developer teams managing investor-backed projects, requiring portfolio-wide visibility, or seeking to enforce draw governance and eliminate spreadsheets. If your workflow includes capital stack complexity or audit-ready funding processes, Buildertrend will likely fall short.

How to Choose the Right Tool for Your Project

Selecting the right draw management platform starts with understanding your operational environment. Different tools support different levels of scale, risk exposure, and internal process maturity.

Owners and developers should evaluate fit based on how capital moves through their organization and how much control is required across projects.

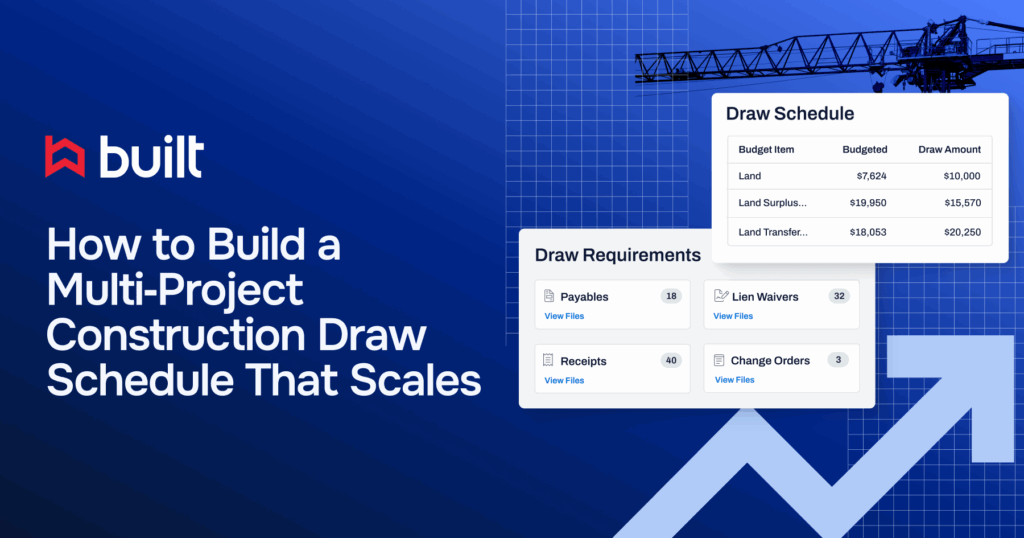

Project volume and capital sources

If you’re managing more than a handful of active builds, especially those financed with layered capital (bank debt, mezzanine, equity), you need a platform that supports capital stack logic and portfolio-level control. Tools that lack source-of-funds enforcement may work for single-project use but can introduce risk at scale.

Stakeholder complexity

Consider the number and type of stakeholders involved, including internal finance teams, lenders, equity partners, inspectors, and vendors. The more moving parts, the more important it is to have configurable workflows, approval hierarchies, and transparent documentation. Choose a system that supports collaboration across roles without relying on email chains or offline packet assembly.

Disbursement risk tolerance

If funding mistakes, noncompliant disbursements, or slow approval cycles pose real risk to your timelines or partner relationships, audit-readiness and workflow control should be non-negotiable. Look for platforms that enforce draw sequencing, capture time-stamped approvals, and centralize inspection and lien documentation.

Internal process maturity

Teams with lean operational overhead may need more guided workflows and turnkey integrations. If you lack in-house IT or financial systems admin support, opt for a platform with intuitive UX, Excel import options, and out-of-the-box integrations.

Conversely, larger teams with ERP systems or dedicated admins can consider more configurable, but complex, solutions.

Centralizing Capital Movement Is the New Standard

Construction is inherently complex. Funding it doesn’t have to be. For owners and developers managing millions in capital across dozens of active builds, tools like Built transform the draw process from a source of bottlenecks into a competitive advantage.

Spreadsheet chaos, manual approvals, and disconnected systems aren’t just inefficient. They’re also risky. Capital missteps delay disbursements, erode lender confidence, and slow down entire development timelines. In today’s capital environment, centralizing your draw process is a strategic imperative.

Whether you’re a mid-sized developer navigating multiple funding sources or an institutional owner scaling your pipeline, the right platform brings structure, transparency, and control to every dollar moved.

Ready to Move Faster With Confidence? Ditch the spreadsheets, Digitize draw workflows And Unify capital oversight across your portfolio with Built. Book a demo today.

Construction Draw Software: FAQ for Owner-Developers

What is a construction draw, and how does the process work?

A construction draw is a staged release of funds based on verified project progress. For owner–developers, the process typically includes submitting a draw request, validating documentation, completing inspections, routing approvals, and releasing funds according to loan or capital agreements. Draw management software centralizes these steps so approvals, documentation, and funding logic stay consistent as project count and capital complexity increase.

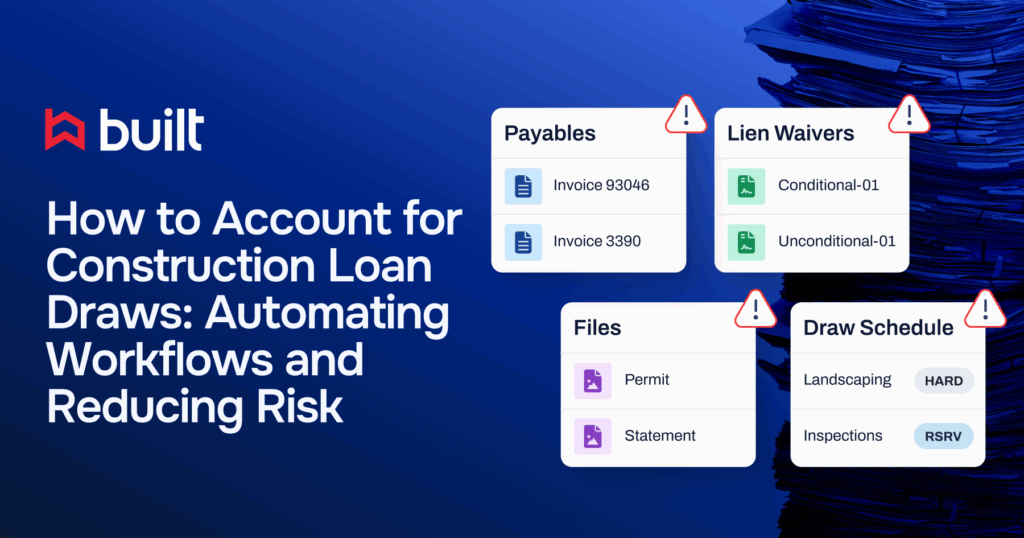

What documents should construction draw management software help manage automatically?

At a minimum, construction draw software should centralize invoices or pay applications, inspection reports, lien waivers, budget updates, and approval records. Platforms designed for owner–developers also track document status in real time and prevent funds from being released until all required conditions are met—reducing manual checks and compliance risk.

What reporting capabilities matter most for owner–developers?

For owner–developers, reporting matters most at the portfolio level. The best draw platforms provide real-time visibility into draw pacing, budget exposure, approval bottlenecks, and compliance status across projects. Advanced tools also offer export-ready data or APIs that connect draw activity to internal BI systems, enabling accurate cash flow forecasting and audit preparation without manual reconciliation.

What are the risks of using Excel for construction draw management?

Excel-based draw tracking creates risk as project count increases. Without system-enforced validation or approval logic, spreadsheets can lead to duplicate payments, unauthorized disbursements, missing documentation, and inaccurate cash flow forecasts. Purpose-built draw software replaces these manual controls with automated checks tied directly to funding rules and project progress.

Why do spreadsheet-based draw processes delay payments?

Spreadsheet-based draw processes delay payments because tracking approvals, retainage, inspections, and documentation requires constant manual coordination. Missing or outdated information often stalls funding even when work is complete. Draw management platforms issue payments only when predefined milestones and compliance conditions are met—reducing friction and improving payment timing.

How do draw management platforms support audit readiness?

Draw management platforms support audit readiness by automatically recording every action taken during the draw process, including submissions, inspections, approvals, and fund releases. These time-stamped records create a complete audit trail that can be reviewed at the project or portfolio level, eliminating the need to reconstruct draw history after the fact.

Mark Murphy leads OGC Sales at Built, where he is responsible for accelerating adoption of payments and standalone solutions purpose-built for real estate owners, developers, and general contractors. He brings deep experience across sales, general management, and operations in technology-driven businesses.

Prior to joining Built, Mark served as General Manager at Apex Service Partners and Operating Executive at Alpine Investors. He also spent over six years at Flexport, where he held multiple leadership roles including General Manager for the South and Northeast regions, and Director & Acting General Manager for San Francisco and Northern California. Earlier in his career, Mark was Chief Operating Officer at Oolong, an INC 500-recognized international trading business.

Mark holds a degree in Mechanical Engineering from Stanford University, where he captained the Varsity Men’s Rowing team.