Guide to Construction Accounts Payable

On This Page

- Guide to Construction Accounts Payable

- What is Construction Accounts Payable?

- Schedule of Values

- Retainage

- Billing Forms

- Accounts Payable Payment Methods

- Lien Waivers

- Vendor Compliance

- Keys to an Effective Construction Accounts Payable Process

- Automating the Construction Accounts Payable Process

- What to Look for in Construction Accounts Payable Software

- How Built Can Help

Tracking costs is particularly important in construction because contractors rely on accurate cost reporting to determine the profitability of their projects and the company as a whole. Besides labor costs, most other job expenses come in the form of invoices from material suppliers or subcontractors. The collection, recording, and payment of both job-related and administrative invoices is called accounts payable (AP).

While the accounts payable process, as described above, seems simple, there are additional concepts in construction that complicate it. This guide will provide an overview of these concepts, so you can clearly understand their implications.

First, we will define construction account payable, talk about its unique features, discuss the three cost types, and go over how to record each cost type in the accounting general ledger.

Next, we will introduce the schedule of values, which is a breakdown of the contract that is used to facilitate progress billing. We’ll go over what’s included in the schedule and what to look for when reviewing one.

The concept of retainage or retention is unique to construction, so we will define it, show how it affects accounts payable, and go over how to record it in the general ledger.

Then, we’ll review the three invoice types and provide examples of each. We’ll also take a detailed look at the AIA G702/G703 progress billing form, which is standard for most contractors.

After we review invoices, we’ll detail the variety of ways that payment can be made to subcontractors and suppliers, from paper checks to ACH and payment apps. Each method has its pros and cons, which we will present so you can make the best decision for your company.

When a contractor doesn’t receive payment for their work, they can use an instrument called a mechanic’s lien to recoup their funds. We’ll discuss the process of filing a lien, including which documents need to be sent out as a job starts to ensure that a contractor or supplier has the right to file one. Also, we’ll take a detailed look at lien waivers, a legal form that is used to ensure that a mechanic’s lien will not be filed and is often exchanged for payment.

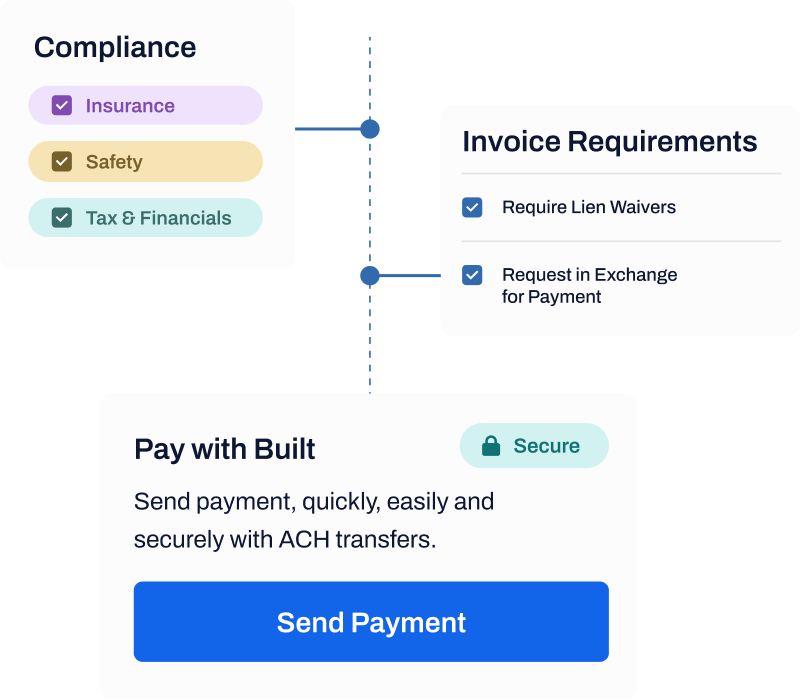

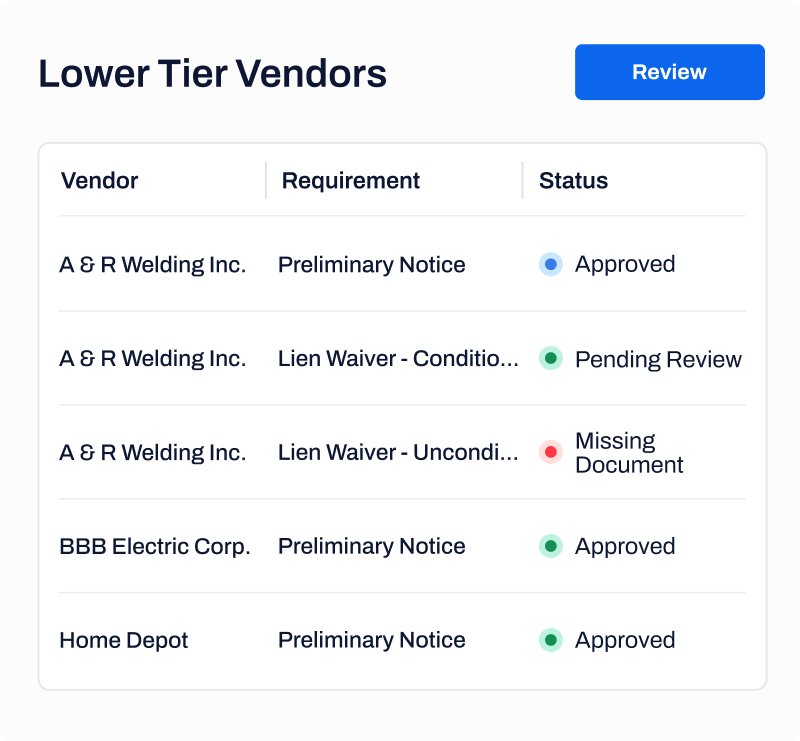

Next is the topic of vendor compliance. Contract language often stipulates that all contractors on a project are licensed and insured, and possibly bonded. Checking for these licenses, insurance policies, and bonds often falls to the AP department. We’ll discuss how to track these documents and what to do when a vendor is not in compliance.

We’ll then dive into the keys to an efficient construction AP process, starting with explaining the steps. Ensuring that your process is efficient will help save time and money in the long run.

Automation is a tool you can use to improve efficiency, and so we’ll discuss a variety of ways you can implement automation into your AP process to save time and improve data accuracy.

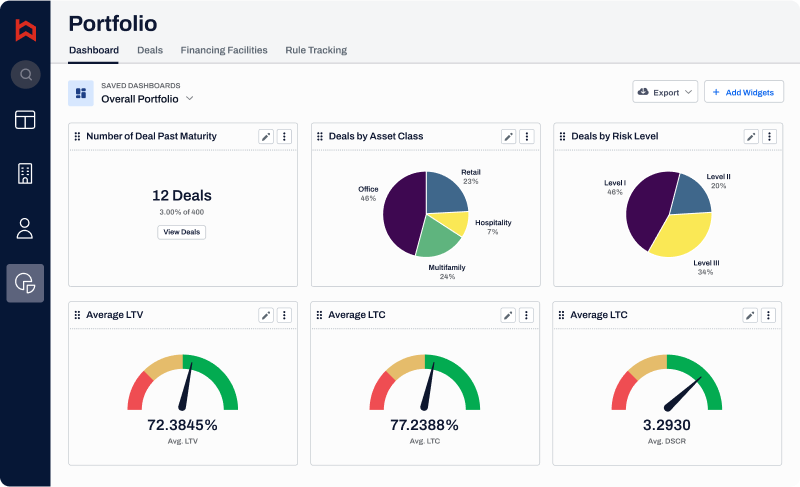

The last two sections of this guide will go over what to look for in construction accounts payable software and how Built can help you improve the efficiency of your current process without having to change accounting software.

We hope that this guide will help you better understand construction accounts payable and its unique features, so you can improve the efficiency of your current process by embracing software with automation features.

What is Construction Accounts Payable?

Accounts payable (AP) is a term that refers to how much a company owes its vendors for expenses related to the business. When a bill is received from a vendor, it is considered accounts payable until it is paid.

Companies that use the accrual accounting method, as opposed to the cash method, need to track their expenses through accounts payable so they know how much money they owe their vendors at any point in time. The amount changes as bills are received and paid.

Often in construction, companies pay their bills when they receive payments from their customers. This is not only because they have the necessary influx of cash to cover the expenses, but also because bills are often tied directly to a project, and they want to pay the costs associated with that project with the funds received from their customer.

Knowing how much you owe on each project is crucial for determining how much to bill your customers. You must be able to cover both the job expenses and general business expenses from what you bill. If you don’t have an accurate accounting of your costs, you may not bill enough, leaving you with a cash flow shortage.

Why is construction accounts payable different?

While all businesses have accounts payable, there are a few features that make it different in construction. While paying material suppliers and overhead costs are pretty straightforward, when it comes to paying contractors and subcontractors, there are several differences to note:

- Contractors often bill against a schedule of values based on how much work has been completed.

- An amount, called retainage or retention, is withheld from each payment to a contractor, and is paid in full at the end of a project.

- Contractors can use mechanics liens to enforce payment of their invoices, and are often asked to sign lien waivers before and after they are paid.

- In order to ensure that a contractor is in compliance with their contractual obligations, payment may be withheld until several compliance documents are received and verified.

We will be exploring these differences in more detail in later sections of this guide.

Cost types

Contractors generally incur three types of costs: direct, indirect, and overhead.

Direct costs are directly related to a project or work the contractor is performing for a customer. For example, the purchase of bricks, mortar, and rebar from a supplier are direct costs for a masonry contractor. When they are recorded in accounting, direct costs are generally posted into a cost of goods sold ledger account.

Indirect costs aren’t directly related to a specific project but are necessary for the work to be performed. They include things like tools, personal protective equipment, vehicles, or insurance. These costs may benefit several projects and tend to vary with the amount of work. For the masonry contractor above, hammers, trowels, and vehicle insurance costs are indirect costs. When they are entered into accounting software, indirect costs are generally posted to an expense ledger account.

Overhead costs are expenses related to being in business. They don’t benefit projects, per se. Things like liability insurance, building lease or rent payments, office supplies, and taxes are considered overhead costs. In accounting, overhead costs are generally posted to an expense ledger account.

Recording AP transactions

While most of today’s construction AP transactions are entered into accounting software systems, it’s still valuable to understand how to record them in the general ledger system, especially during troubleshooting.

Recording costs

Each cost type (direct, indirect, overhead) is recorded slightly differently. The main difference, besides the general ledger account, is that job or project information is recorded for direct costs and sometimes for indirect costs (depending on your CPA’s preferences). The separation of costs by project is called job costing and is one of the main differences between construction accounting and regular accounting. Contractors rely on job costing to know if their projects are profitable, as well as if their estimates are accurate.

Direct costs

To record a direct cost to accounts payable, debit the cost of goods sold account and credit accounts payable. You’ll also record the project information, including name/number, cost code(s) or phase(s), and cost type.

| Debit | Credit | ||

| Cost of good sold | $$$$ | Job, cost code/phase/type | |

| Accounts payable | $$$$ | Job, cost code/phase/type |

Indirect costs

To record an indirect cost to accounts payable, debit the cost or expense account and credit accounts payable. If your CPA directs you to, you will also record the project information.

| Debit | Credit | ||

| Cost or expense account | $$$$ | Job, cost code/phase/type | |

| Accounts payable | $$$$ | Job, cost code/phase/type |

Overhead costs

Overhead costs are recorded by debiting the expense account and crediting accounts payable. No project information is required.

| Debit | Credit | |

| Expense account | $$$$ | |

| Accounts payable | $$$$ |

Recording payments

All accounts payable payments are recorded the same, regardless of cost type: debit the accounts payable account and credit the bank or payment account.

| Debit | Credit | |

| Accounts payable | $$$$ | |

| Bank or payment account | $$$$ |

Cash flow concerns

While it is always important to ensure that you have enough money in the bank to cover your expenses, construction contractors need to pay particular attention to their cash flow because of the way projects are billed.

To illustrate, assume that a masonry contractor has just completed construction of a brick wall at an industrial park. The contractor needs to bill their customer enough to cover not only the expenses related to the wall, but also the indirect and overhead costs incurred during the time the work was being performed. The amount of indirect and overhead costs will be based on the volume of work the contractor has going on at the time.

Contractors often pay for project expenses only after they’ve been paid by their customer. While this makes sense for direct costs, indirect and overhead costs do not have a specific schedule to be paid. Also, vendors may not want to wait until a customer pays to receive their money. This means the contractor could be forced to pay for materials and other costs before the income associated with those costs comes in, which could lead to cash shortages.

Mistakes entering accounts payable can be detrimental to a company’s cash flow and financial health. If the company thinks they owe more than they do, it can lead to overbilling customers to cover the anticipated expenses. Understating accounts payable could lead to the company not billing their customers enough and not having enough cash to pay their bills. Either way, accuracy is extremely important.

Next, we’re going to look at a tool that is used by contractors to bill for the work that has been completed to date, called a schedule of values.

Schedule of Values

While it is always important to ensure that you have enough money in the bank to cover your expenses, construction contractors need to pay particular attention to their cash flow because of the way projects are billed.

To illustrate, assume that a masonry contractor has just completed construction of a brick wall at an industrial park. The contractor needs to bill their customer enough to cover not only the expenses related to the wall, but also the indirect and overhead costs incurred during the time the work was being performed. The amount of indirect and overhead costs will be based on the volume of work the contractor has going on at the time.

Contractors often pay for project expenses only after they’ve been paid by their customer. While this makes sense for direct costs, indirect and overhead costs do not have a specific schedule to be paid. Also, vendors may not want to wait until a customer pays to receive their money. This means the contractor could be forced to pay for materials and other costs before the income associated with those costs comes in, which could lead to cash shortages.

Mistakes entering accounts payable can be detrimental to a company’s cash flow and financial health. If the company thinks they owe more than they do, it can lead to overbilling customers to cover the anticipated expenses. Understating accounts payable could lead to the company not billing their customers enough and not having enough cash to pay their bills. Either way, accuracy is extremely important.

Next, we’re going to look at a tool that is used by contractors to bill for the work that has been completed to date, called a schedule of values.

What is a schedule of values?

The percentage of completion billing method requires that the project work be broken down into smaller chunks where progress can be more easily measured. This may be a simple breakdown for a subcontractor, such as material and labor, or a more complex list of all the activities necessary to construct a building.

Each line or scope of work is given a value for that work. All of the items together add up to the total contract amount. This schedule, or list, of scopes and values is called a schedule of values (SOV). Often, contractors will use a structure similar to the Construction Specification Institute’s code breakdown to ensure that all the scopes of work are listed.

Here are a couple of examples of a schedule of values:

Simple schedule of values for subcontractor:

| Scope or description | Value |

| Materials | $5,000 |

| Labor | $10,000 |

| Contract total | $15,000 |

General contractor schedule of values:

| Scope or description | Value |

| Earthwork | $100,000 |

| Foundation | $50,000 |

| Masonry | $40,000 |

| Framing | $50,000 |

| Windows/Doors | $20,000 |

| Roofing | $25,000 |

| Finishes | $75,000 |

| Mechanical | $30,000 |

| Plumbing | $20,000 |

| Electrical | $30,000 |

| Contract Total | $440,000 |

For the purposes of accounts payable, it’s important to know that these schedules are used by both general contractors and subcontractors to bill for their work. Columns are added to show the progress of the work and how much has been billed to date. You may see the following information in a completed SOV attached to an invoice:

- Percent completed to date

- $ value of materials stored on site (not installed) during the billing period

- $ value of work completed during the billing period

- Total $ value of work completed to date

- Balance to finish

- Retainage held

Reading and understanding these schedules is important in determining how much work a contractor is billing you for.

What is included in a schedule of values

Although we won’t be covering how to make an SOV in this guide, it’s valuable to know what is included in the calculations used to create one.

When creating a schedule of values, contractors should include:

- All material costs and markups

- All labor at the appropriate billing rate

- All project management time at the appropriate billing rate

- Profit and overhead (sometimes this is listed as a separate line item)

The total of all the items or scope values should equal the contract amount.

Change orders

When changes to a contractor’s contract are approved, a change order is issued. When the contractor wishes to bill for the extra work, the change order is listed as a separate line on the SOV. The columns on the SOV function the same as they do for the original contract, with progress on the work billed in the same manner as the original contract.

Things to watch out for

Here are a couple of things to be on the lookout for when reviewing a schedule of values:

- Contractors may “front load” the SOV so they can get a majority of the contract paid for in the initial stages of the project. Look out for mobilization line items and make sure they don’t represent a disproportionate amount of the overall contract price.

- Line items should be specific enough that there’s no confusion about what work is included. The amount of detail that needs to be provided will depend on the overall contract amount and the owner’s or general contractor’s requirements. The more detail provided, the more accurate the invoice will be, generally.

- Approved changes should be added to the SOV as the project progresses. This ensures everyone is working from the same data.

One of the columns you’ll often find in the SOV is called retainage or retention. We’ll look at what this is in the next section.

Retainage

Retainage, or retention, is a concept unique to construction contracts and accounting. It is used as a way to guarantee that contractors finish their work as specified and don’t run off before a project is completed. It’s almost exclusively used in commercial construction for both private and public projects.

Retainage is a withholding of a percentage of each payment. The amount withheld varies by the project and is set by the contract documents. Usually it is between 5-10%. The owner withholds it from the general contractor’s payments and usually the GC passes it down to each of their subcontractors. The funds build up as the project progresses, and everyone is paid the amount owing after the project is completed and the owner has taken possession of the building or space.

Some states have statutes that cap the amount of retention that can be withheld on projects within that state, so be sure to do your research when starting work in a new state.

How retainage affects AP

Let’s take a look at how retainage affects accounts payable with an example:

ABC Masonry has a contract for $100,000 with XYZ Contracting (the general contractor) that stipulates that the retention for the project is 10%.

ABC bills XYZ $50,000 for the first month of work. Retention is calculated by multiplying the invoice amount by 10% ($5,000). This is withheld from their payment, so they will only get paid $45,000 ($50,000 – $5,000).

When XYZ records the invoice in accounts payable, they need to show that they owe ABC $45,000 and $5,000 is retainage. Most contractors use a “retention payable” ledger account to track these amounts. That way their records will show that ABC billed for the full $50,000, with $45,000 due right away and $5,000 at the end of the project.

The second month, when ABC bills for the remaining $50,000 of their contract, they will again receive a payment of only $45,000. Now, XYZ’s books will show $10,000 in retention payable ($5,000 from each invoice). And once the project is complete and the masonry has been accepted, XYZ will pay ABC the remaining $10,000 balance.

Calculating the amount of retainage that should be withheld and tracking how much is owed to each contractor can get cumbersome, especially on large projects that may last months or years. This is why it pays to use accounting software that is specifically designed for construction. Standard business accounting software doesn’t track retention, so you have to do it manually.

How to record retention in accounting

Now we’re going to follow the example above and show how XYZ Contracting records ABC’s invoices and the subsequent payments.

- ABC bills XYZ $50,000, with $5,000 in retention

| Debit | Credit | |

| Accounts Payable | $45,000 | |

| Retention Payable | $5,000 | |

| Cost of Goods Sold | $50,000 |

- XYZ pays ABC $45,000

| Debit | Credit | |

| Accounts Payable | $45,000 | |

| Bank | $45,000 |

- This is repeated for the second invoice of $50,000 and subsequent payment of $45,000. Now ABC is owed $10,000 in retention.

- When the project is complete and the work has been accepted, some contractors choose to move the retention payable amount into accounts payable to show that the amount is now due. This is done through a simple journal entry (not required):

| Debit | Credit | |

| Retention Payable | $10,000 | |

| Accounts Payable | $10,000 |

- XYZ now pays ABC the remaining balance.

| Debit | Credit | |

| Accounts Payable | $10,000 | |

| Bank | $10,000 |

Or if XYZ doesn’t move the retention payable to accounts payable:

| Debit | Credit | |

| Retention Payable | $10,000 | |

| Bank | $10,000 |

Construction invoices take many forms, from simple materials and service invoices to complex contract breakdowns. Next we’re going to look at the differences between these form types and when to use them.

Billing Forms

Unlike other industries, in construction the form or format of an accounts payable invoice matters. While material suppliers and some service contractors can get away with just about any invoice format, contractors and subcontractors are often required by contract to format their invoices in a specific way. We’re going to spend some time going over the different invoice types, and then we’ll look at some forms that may be used for each type.

AP invoice types

We’re going to break down AP invoices into three types: materials/other costs, service, and progress on contract.

- Materials/other costs – These invoices are sent from material suppliers or other vendors and usually contain a list of products provided, quantities, and the price. Invoices for overhead costs are also of this type.

- Service – Service invoices usually include charges for labor and materials, with a detailed breakdown showing quantities and unit prices.

- Progress on contract – General contractors and subcontractors submit these invoices when they are billing for a portion of the contract amount on a project. They include information on the contract value, portion being billed, total completed on the project, and retention held.

AP invoice forms

Materials and other costs are often billed using a simple invoice form. There may be just a line or two showing what is being billed, or the vendor may provide a complete list of materials, quantities, and unit prices.

Services are often billed on a form that includes a detailed description of the work performed, then a breakdown of the labor costs, showing hours and rates, and a list of all materials provided, including quantities and pricing.

However, when contractors and subcontractors invoice their progress on a contract, they are often required by contract to use a progress billing form similar to the AIA G702/703. These forms are provided by the American Institute of Architects and are an industry standard. Because they can be complex and contain a lot of information, we’re going to review them in some detail.

The G702 form has three sections: project information, contractor’s application for payment, and architect’s certificate for payment.

- Project information: As its name implies, the first section of the G702 provides general information on the project and some specific information on the application for payment. You’ll find things like the owner’s name and address, project name and address, the payment application number, and contract information.

- Contractor’s application for payment: This section provides a high-level summary of the contract and the progress invoice amount. There are two subsections: the summary of the application and the contractor’s certification.Fields in the summary of the application subsection include:

- Original contract amount

- Net change from change orders – There is also a section (see j below) that summarizes the changes issued throughout the project and during the billing period.

- Revised contract amount to date – Original contract amount plus or minus change orders.

- Total of work completed and stored to date

- Retainage calculation – Total work completed multiplied by the retainage percentage.

- Total earned less retainage – Total work completed less calculated retainage.

- Previous amount billed – Total of all previous invoices/payments.

- Current payment due

- Balance to finish contract – Revised contract amount less total of work completed to date.

- Breakdown of approved change orders – Shows summary of changes approved in the current billing period and project to date.

The contractor’s certification subsection is where the contractor certifies that the application represents a true statement of the work completed to date. The contractor signs and notarizes the application here.

- Architect’s certificate for payment: This section is used when the general contractor submits their application to the owner. The architect often reviews the invoice and certifies it, so the owner knows that the stated work has been completed. For subcontractors, this section is often left blank.The G703 form provides a breakdown of the work from the schedule of values, along with information on how much is being billed on each line item on the schedule. Its columns include:

- Numerical line item for reference

- Description of work (usually from the SOV)

- Contract amount for each item

- Amount of work completed from the previous application

- Amount of work completed for this application

- Value of stored materials (not installed)

- Total of completed work and stored materials (including percentage of contract value)

- Balance to finish

- Retainage calculation

At the bottom of the form, each column is totaled. These values should match the summary provided on the G702.

Unlike other invoice forms, on the G702/703 it can be a bit confusing to determine how much the payment application is for. This is because on the G702 the “Current Payment Due” line has retainage subtracted from it already. But on the G703, the total of the “This Period” and “Materials Presently Stored” columns does not.

When entering an invoice that uses this format, or one similar, it’s important to know which value you need to enter into your accounting software. If your software tracks retainage, you’ll need to enter the amount from the G703 (sum of column E “This Period” and column F “Materials Presently Stored”). If your software doesn’t track retainage, you’ll need to enter the amount from the G702 (line 8 “Current Payment Due”).

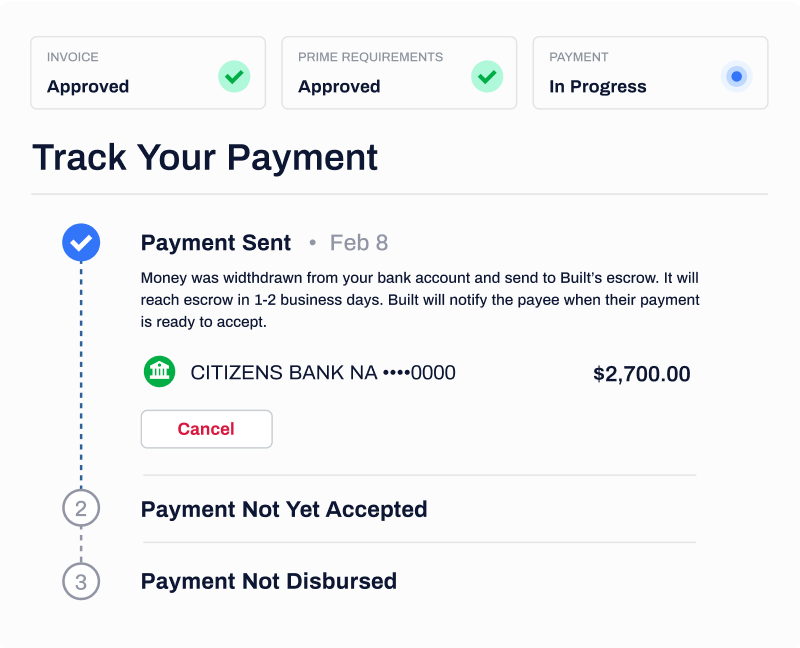

Now we’ll look at the various ways accounts payable invoices can be paid. These days there are several options available.

Accounts Payable Payment Methods

For many years contractors have paid their vendors with paper checks, whether handwritten or printed from a computer. While they are effective, using paper checks also comes with several disadvantages, including mailing delays and the potential for fraud.

These days there are more options for making payment.

ACH/Bank transfers

Automated clearing house (ACH) fund transfers, or bank transfers, move money directly from one bank to another. There’s no paper and no card numbers, and transfers are usually completed in three to five business days. You may have to pay a small fee for each transfer, depending on your provider and their policies. Be aware that you’ll be responsible for keeping your vendors’ bank account information secure and confidential, and there may be daily limits to how much you can send.

Wires

A wire transfer is similar to an ACH or bank transfer. Your bank or financial institution will handle the transfer and they are often made almost instantly, so funds will be withdrawn on the same day or the next business day. They’re more expensive to send, and the receiver can be charged a small fee for receiving the funds as well. However, there’s no limit to the amount that can be sent via wire.

Credit cards

With credit cards you can pay for expenses even if you don’t have the money available right away, since payment isn’t actually due until you receive the statement. Many vendors accept card payments, and some cards provide perks or bonuses for using them. On the other hand, interest rates are high, there may be an annual fee for having the card, and late fees and other penalties can be expensive.

Virtual cards

Virtual cards function the same as credit cards, but they are often only used once or have a strict limit. You can create as many virtual cards as you need on-demand. And since the real card numbers aren’t given out, they are more secure.

Payment apps

Some costs may be paid by payment apps (PayPal, Venmo, Square, etc.). They make sending payments as easy as knowing a vendor’s phone number or email address. This reduces the amount of confidential information that needs to be exchanged, making payments more secure. Many of the apps will send money for free, except when a credit card is used, and the funds are transferred in one to three business days. In general, they aren’t designed for sending large sums of money.

Pros and Cons

Here’s a summary of the pros and cons of each type of payment method:

ACH/transfers/wires

Pros

- Faster payment than mailing checks

- More efficient AP processing

- Provides proof of payment

- Reduced chance of fraud or forgery

- Less expensive to process than checks

Pros

- Takes time to setup

- Wire fees can add up

- Limit to funds you can send daily

- Need to keep vendor bank information secure

Credit cards

Pros

- Easy to get (depending on credit history)

- Allows you to defer paying

- Provides almost instant payment to the vendor

- Build credit

- Lots of card options

- Card perks (miles, cash back, etc.)

Pros

- Not all vendors take them

- Late payments and over limit spending damage your credit

- Easy to overspend

- High interest rates and fees

- Limit on purchases

- Security issues

Virtual cards

Pros

- Improved security

- Tight limits can help control spending

- Almost instant payment to vendors

Pros

- Limit on purchases

- Not all vendors take them

- High interest rates and fees

Payment apps

Pros

- Don’t need to exchange account information

- Free / low cost

- Easy to set up

Pros

- Not all vendors accept payment through them

- Limit to how much money can be sent

A common partner to payments is the lien waiver. In the next section we’ll discuss what they are and why you should collect them.

Lien Waivers

On many projects you’ll need to collect a document called a lien waiver either before or after, or sometimes both, you make a payment to a supplier or subcontractor. These forms are important in construction as they provide proof that a payment was made and protect project owners from unnecessary liens on their property.

What is a mechanics lien?

A mechanic’s lien is a way to guarantee payment to contractors and material suppliers. In construction, once work is completed, there’s no way to “take back” what was done if the customer doesn’t pay for it, so contractors and suppliers can file a lien against the property. The lien ensures payment by forcing the sale of the property if the owner doesn’t pay the amount owing. Mechanic’s liens are regulated by state law, and each one has its own process and procedure for filing, so it pays to know the laws in the state(s) you work in.

Preliminary notices and the right to lien

The “right to lien” means that a contractor or supplier has the legal ability to file a lien on a subject project. In some states, this right is implied just by entering into a contract with a contractor or builder. In other states, there are a specific set of steps that each contractor or supplier must complete before they can file a lien. If the steps aren’t completed, then the supplier or contractor forfeits their right to file a lien on the project.

Many states require the sending of a preliminary notice of the right to lien (also called just a preliminary notice or a prelim). These notices are sent to the property owner to let them know that the contractor or supplier has begun work or provided materials to their property. It provides details about the project and the work being performed, as well as counseling the owner on how to avoid incurring a mechanic’s lien. Some states require these notices to be sent so many days before work starts, and others require on-going notices as the project moves along. If the preliminary notice(s) are not sent, the contractor or supplier cannot file a valid lien.

What is a lien waiver?

One of the ways to protect a property owner from a mechanic’s lien is to require contractors and suppliers to sign a form called a lien waiver. The waiver acts as a receipt for payment, stating that the vendor has been paid for work or materials through a certain date and that they waive their right to file a lien for that work.

There are four basic types of lien waivers:

- Conditional progress waiver – States that the vendor agrees to waive their lien rights if they are paid for work or materials up to a certain date. Waiving of lien rights is “conditional” upon payment. The amount owing is stipulated on the form.

- Unconditional progress waiver – States that the vendor has received payment and agrees to waive their lien rights for work or materials up to a certain date. Payment has been received, so lien rights are waived “unconditionally.” The amount of the recent payment is often stipulated on the form.

- Conditional final waiver – States that the vendor agrees to waive their lien rights if they are paid for all work or materials on a job. The balance owing is stipulated on the form. This form is used at the end of a job or when a contractor or supplier has completed their scope of work.

- Unconditional final waiver – States that the vendor has received payment, is paid in full for the project, and agrees to waive their lien rights unconditionally on the project. This form should only be used after sending the final payment on a project (often the retainage).

Lien waiver versus lien release

We’ve established that a lien waiver is a document used during the construction payment process to protect the project owner from the filing of a mechanic’s lien. A lien release, on the other hand, removes a mechanic’s lien once it’s been filed and recorded. It states that the lien filer has been paid the amount they’re owed and is releasing the lien they hold. Once this form is received by the local jurisdiction, the lien will be removed from the property.

In everyday conversations you may hear the two terms used interchangeably, but they have a very different meaning.

Lien waiver formats

Twelve states have statutory language that specifies the form or the wording of a lien waiver. Before issuing a waiver in one of these states, you’ll need to research those requirements to ensure that your form will be legally accepted. The twelve states with statutory lien waiver forms are:

- Arizona

- California

- Florida*

- Georgia

- Massachusetts

- Michigan

- Mississippi*

- Missouri

- Nevada

- Texas

- Utah

- Wyoming*

*Florida doesn’t require a statutory form but offers one as a safe option. Mississippi and Wyoming require waivers to be notarized.

For work in the rest of the states, there is no specific requirement for the form or wording of the waiver. However, there’s certain information you want to be sure to include on each waiver:

- Vendor name

- Job name and address

- Whether the waiver is conditional or unconditional (has payment been received or not)

- Amount owed (conditional) or received (unconditional)

- Date through which the vendor has been paid

- Space for signature, title, and date signed

- Space for notarization, if required

Automating the creation and collection of lien waivers

The process of creating, collecting, and tracking lien waivers can be quite complex. It involves:

- Determining the correct waiver type/form

- Filling in the required information (vendor name, project info, amount, etc.)

- Sending the waiver to the vendor for signature and notarization, if required

- Upon return, marking the waiver as complete

- Sending reminders for outstanding waivers

- Collating signed waivers for inclusion in the payment application to your customer

If you’re still doing all this work manually, you could be wasting several hours each month. By automating the creation and collection of lien waivers, you could have more time to work on other important tasks.

Lien waiver automation speeds up the process by:

- Setting up waiver templates with data fields to import required information

- Allowing for electronic or manual signatures and notarizations

- Tracking the status of each waiver and providing reports on outstanding documentation

- Reminding vendors of outstanding waivers

- Filtering signed waivers for export and inclusion with your payment application

Before you pay your vendors, particularly subcontractors, you’ll want to make sure that they are meeting all their contractual obligations by tracking their licensing status, insurance, and other compliance data. We’re going to look into vendor compliance more in the next section.

Vendor Compliance

Ensuring that your vendors, especially subcontractors, have the correct licensing and insurance is an important function in accounts payable. Often, payments can be used as leverage to ensure compliance with contract requirements, so it falls to the AP department to verify compliance before payments are made.

What vendor compliance documentation is required in construction?

The exact documentation and limits that are required vary by state and project. Usually, they are spelled out in the project contract with the general contractor. However, there are a few common items that you’ll want to check to determine if a vendor is in compliance:

- Tax/Payment – Some or all of your vendors (depending on your company policy) will need to provide an IRS W-9 form that discloses the type of business they are and provides their tax identification number. You may also track whether the vendor has sent a preliminary notice (related to mechanic’s liens).

- Insurance – Verify that the business has general liability and workers compensation insurance, at a minimum. If they have company vehicles, you’ll want to ensure that they have insurance to cover those as well. Some projects may also require specialized coverage, such as professional liability or umbrella policies.

- Licensing – In many states, contractors are required to be licensed through a state agency or contractors’ board. Licensing ensures that they have industry knowledge and the minimum insurance and bonding requirements.

- Bonding – Bonds protect you, as the vendor’s customer, from substandard or incomplete work. If there is a dispute, you can file a claim against their bond and hopefully recoup your losses. Bonds are often required for licensing, as well as on a project-by-project basis.

- Safety/Training – You may have requirements about safety or worker training documents, such as providing a safety plan, toolbox talks, MSD sheets, OSHA 300 information, or training certificates.

Tracking compliance

Collecting and tracking all these compliance documents can be time consuming. For every document you need to:

- Request it

- Save it

- Enter the information into the vendor’s record

- Monitor it for expiration

- Send a reminder for documentation not received

- Request new documents when the old one has expired

The vendor will supply the tax/payment information, insurance/bonds, and safety information. Contractor licensing can be verified by visiting the state’s contractor board or licensing website. Make sure that you have the right company name, the license is for the type of work they will be performing, and that the license is in good standing.

You can enter/track compliance data by setting up fields in the vendor’s record in your accounting software. Some software packages include notifications to let you and/or the vendor know that a compliance item has expired.

What to do when a vendor is not in compliance

Your company’s policies and the project-specific contract requirements will dictate what you can do when a vendor isn’t in compliance. Usually, companies simply continue to remind the vendor until the documents are turned in. Others may be stricter and hold payment or tell the vendor they can’t be on site until their paperwork is completed. Some documents are more important than others, so it will be up to management to determine the consequences for not being in compliance.

Compliance documents are often reviewed as part of an insurance or tax audit. Auditors will be looking for copies of insurance certificates, W-9s, and other documents. Make sure that these documents are easily accessible and stored in an organized fashion. Failure to provide the necessary documentation at an audit can result in penalties and fines, so it’s important to make sure your compliance program is operating smoothly and effectively.

All the topics we’ve covered so far are significant in the construction accounts payable process. Now we’ll put them all together and discuss key elements of an efficient process.

Keys to an Effective Construction Accounts Payable Process

Like most business functions, there is a process for receiving bills and getting them paid. Each company will have their own version of this process, depending on the size of the company, the volume of work they perform, and their company structure.

AP may be entered, processed, and paid for by one person or by a team of several people. But no matter how big your AP department is, there are a series of steps that need to be taken for invoices to get paid:

- Issue commitments – Project managers buy out each project, determining what material suppliers and subcontractors will be providing materials and labor. These commitments (purchase orders and subcontracts) are entered into the accounting software so amounts billed against them can be tracked.

- Invoices are received – Vendors send invoices for the goods delivered and progress invoices for the portion of their work completed each month.

- Invoice approval and coding – Project managers review each invoice, matching it to the appropriate commitment and comparing it with the balance remaining to bill. Invoices are coded to the proper project, cost code, and cost type. If there are any discrepancies or issues, the project manager works with the vendor to either issue change orders or revise the invoice.

- Schedule payment – Depending on the terms of the contract or purchase order, invoices are scheduled to be paid either upon receipt of customer payment or on a set date each month. Before payment is made or sent, vendors must provide the required compliance documentation (licenses, insurance certificates, bonds, etc.)

- Send payment – Even today, the common practice is to pay vendors with written checks. They must be printed and signed, then mailed. If lien waivers are required, they are sent before or after the payment (or both).

- Collect and track lien waivers – As signed lien waivers are returned, they are tracked. Reminders are sent for missing waivers.

Keys to improve your accounts payable process

If you are just beginning to develop your AP process, or if your current process isn’t as effective as you’d like, here are some keys to help improve it:

Have a single point of contact for all AP invoices

Having one person, or email address, receive all your AP invoices helps reduce vendor confusion and ensure that nothing gets lost. If vendors have to send their invoices to different people depending on the project or the type of work they are performing, it can be confusing when they have multiple projects going on at the same time. Having a single contact also makes it easier to track down a lost or misplaced invoice.

Encourage vendors to email their invoices in, instead of sending them by postal mail or fax. Emailed invoices can be easily searched for and reprinted or routed electronically.

Use integrated document management

Although construction as a whole is a little behind the adoption of technology, a paperless office is one area that only provides more dividends as time goes by. Saving or scanning AP invoices helps ensure you’ll always have a copy of the document without taking up real estate in your filing cabinet.

Digital files can be stored on a server or in the cloud. Your best bet is to take advantage of the document management feature of your accounting software. Usually, a copy of the invoice can be easily attached to the invoice record, making it easy for anyone to view the source document.

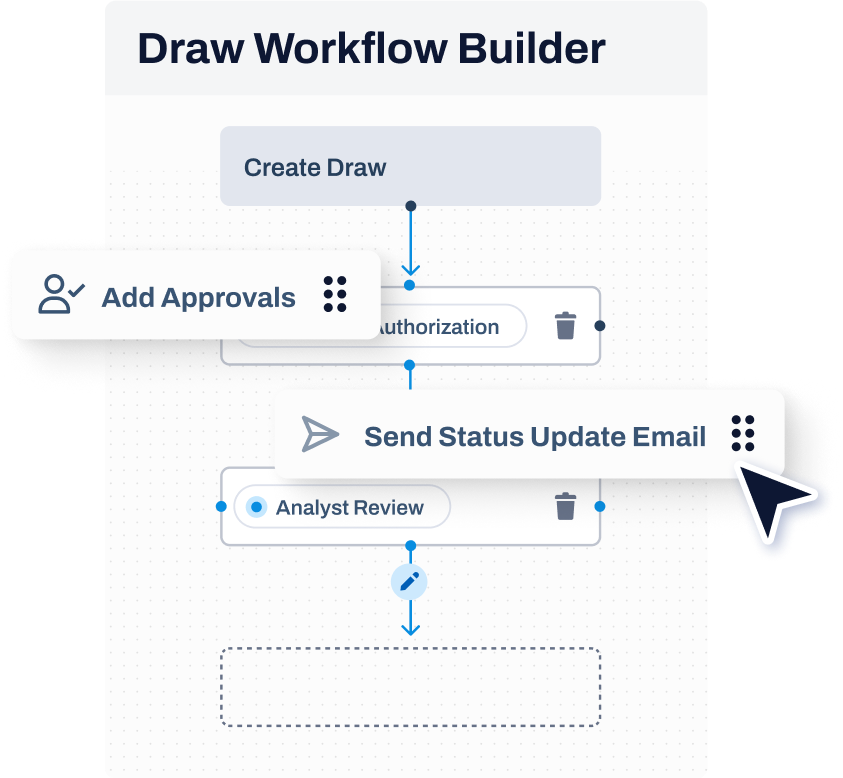

Use defined approval workflows

One of the best ways to prevent missing invoices is to use an invoice approval workflow. The workflow defines who needs to review and sign off on each invoice before it can be paid. Most software solutions offer electronic routing of invoices, often specific to each project or type of invoice. For instance, job-related invoices can be routed to the project manager and then to an administrator for final approval, while overhead invoices are routed directly to the office manager.

These systems allow you to know where each invoice is in the approval process, helping to ensure that invoices aren’t misplaced or lost. Features like reminder emails and reporting on outstanding approvals help keep the process moving to ensure prompt payment.

Analyze reports for errors

As a final step before you post your AP invoices in your accounting software, run a detailed report that shows where each invoice is coded, the general ledger account(s), and any commitments the invoice is associated with. Review the report for errors or typos, make any changes, and then post your invoices. It’s much easier to make corrections before an invoice is posted, than to discover it later and have to reverse and reenter it.

Make vendor payments electronically

Using electronic payment methods, like ACH, makes the payment process simpler. Some accounting software packages have the ability to facilitate these payments (or use a third-party to process them), even in bulk. Taking advantage of these tools improves efficiency, reduces paperwork, and helps you pay your vendors faster.

Automate as much as possible

To improve efficiency and reduce the chance for errors, automate as much of the AP process as possible. This can take the form of automated coding, character recognition, and electronic payments. Many software solutions have these features, which can help speed up your AP processing and reduce typos, leaving you more time to work on other tasks.

With these keys in mind, let’s now look at the benefits of automating the AP process and specific ways you can do so.

Automating the Construction Accounts Payable Process

According to a study from the Journal of Accountancy, humans make errors in manual data entry at the rate of between 1 and 5 percent. A study in 2008 reported rates between 18 and 40 percent. While this may not seem like much, when dealing with a large number of AP invoices, with a lot of data to enter, mistakes can have a significant financial impact on a company. Just one extra zero could mean the loss of thousands of dollars.

Benefits of automating accounts payable

Automation can help reduce the number of data entry errors and is one of the primary arguments for adopting the technology. With OCR (optical character recognition) and other technologies, software can read and extrapolate the required information from an electronic image of an invoice, with humans only providing data verification.

Other benefits include:

- Time savings – Reduced time for data entry, approval, and payment.

- Cost savings – Manual invoice processing can cost up to $35 per invoice, only $5 per invoice with automation. Processing costs include labor, document storage, postage, and printing.

- Fraud detection – Automation enforces approval hierarchies and processes, ensuring adherence to internal and external policies. It also helps detect duplicate invoices and payments.

- Scalability – Automated systems can handle a larger volume of invoices in the same amount of time when compared to manual processes.

- Enhanced vendor relations – Paying vendors faster leads to improved relations and better payment terms.

How to automate AP

Now we’ll look at various ways the accounts payable process can be automated with the help of a software solution.

- Use an invoicing portal to collect progress invoices

Vendors are given a custom link to submit their progress invoices. The link shows the schedule of values for their contract and any approved change orders, and each line is cost coded to match up with the estimate and owner billing. Subcontractors enter the amount of the progress invoice on the schedule of values and retention is automatically calculated. This helps eliminate billing over the contract amount and billing for unapproved changes, as well as coding the invoice. - Electronically route invoices for approval

Invoices can be electronically sent to project managers or administrators for coding and approval. Software uses rules that you set to ensure that the invoices are routed to the correct person(s). There are two types of routing workflows: sequential and parallel. Sequential workflow sends an invoice to one person at a time, with each person having to approve/code the invoice before the next person sees it. Parallel workflow sends an invoice to multiple people at the same time. From there, the invoice must be approved/coded by one or all of them. - Integration with accounting software

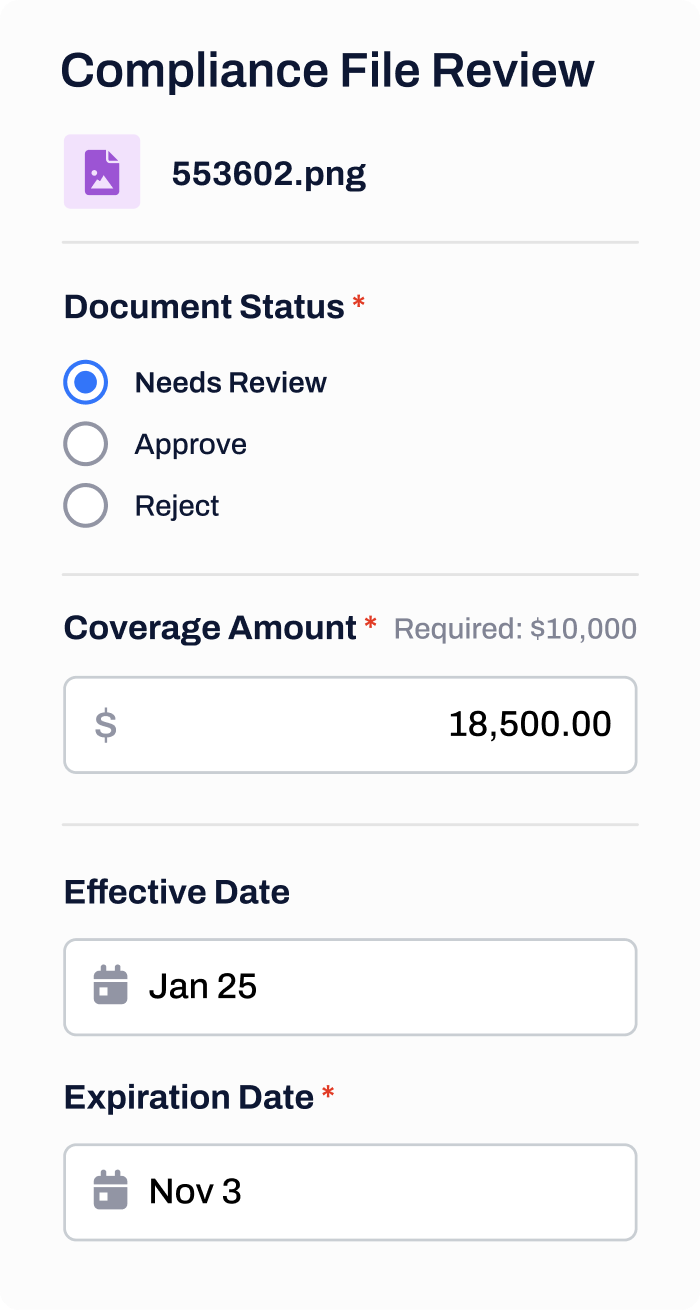

When collecting progress billing information through a portal, as was discussed in point number one, the information collected can be directly imported into your accounting or ERP software. This saves time by eliminating the need for duplicate data entry and improves the accuracy of your cost data, as the chance of human error is significantly reduced. - Checking compliance documentation

Instead of relying on manual checks for verification of compliance documentation, the process can be automated to save you time. Through a portal, vendors upload their documentation and are notified about missing information or expiring licenses or insurance. You can also collect and store non-traditional compliance information which you may need specific to your industry or project. Through the portal you can quickly see if a vendor is in compliance and know what is missing in real time. - Make payments based on conditions

Once you have been paid for your work on the project and it’s time to pay your subcontractors and suppliers, ACH is the most secure form of payment. It’s quick and easy to send payment to multiple vendors at the same time, and the progress of the money can be tracked by both you and your vendors, eliminating the guesswork of finding missing checks. Payments can be tied to conditions, such as receipt of a lien waiver or required compliance documentation. This helps ensure that you have all the information you need for audits or other compliance checks.

By automating as much of the accounts payable process as possible, you will save your team time and money, as well as reduce the chance for errors and lost payments. When you pay your vendors faster, you will also reap the rewards of better relationships with them, which could affect financing and payment terms. Automation stands to be a great investment with rewards that far outweigh the costs.

How do you get all these features? You must look for them when shopping for accounts payable software. Next, we’ll explore what to look for in AP software.

What to Look for in Construction Accounts Payable Software

Most accounting software cannot handle the unique needs of the construction industry. From retainage to progress billing and job costing, standard accounting solutions don’t provide what is considered the basics of construction accounting. So, when you’re looking for accounting solutions for your contractor or supplier business, it pays to invest in customized software specifically designed for construction.

In addition to selecting industry-specific software, there are a few other capabilities you should look for:

- Integration with other software you use – If your AP data needs to be exported to other software that you use for other functions, make sure that it is capable of sharing data with those other solutions. It does no good, and will cost you more in the long run, if you fail to check for this and end up having to enter data by hand to get the reports and information you need.

- Automated tasks – Choose software that will allow you to automate as many tasks as possible. From compliance checks to lien waiver exchanges, the more you can rely on the software, the less time your team has to spend on manual processes. This frees them up to complete more important tasks.

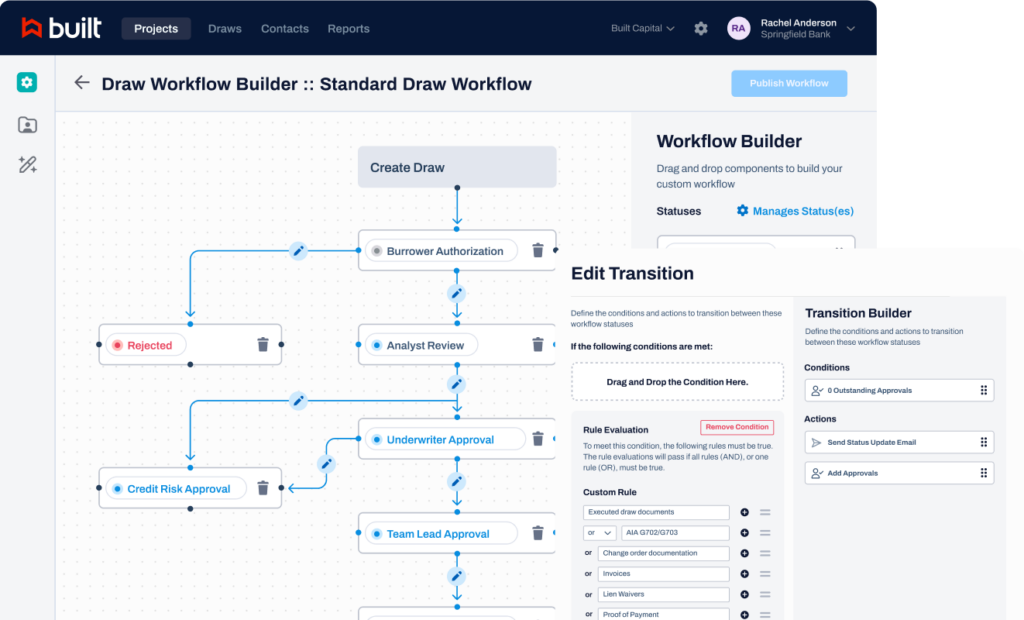

- Flexible workflows – The ability to create custom workflows, such as invoice approvals, is key to improving efficiency. Software that only provides limited options won’t grow with your company and will require workarounds or you’ll need to upgrade your software as you grow. Changing software is a complex process, and you’ll want to limit the number of times you do so.

- Robust reporting – Entering data in an accounting system isn’t worth much if you can’t get the reporting you need. And construction has unique reporting requirements, like work in progress and job costing reports, that aren’t part of the standard business reports in most software. By investing in industry-specific software that’s designed to produce the exact reports you need out of the box, you’ll save valuable time and energy. You’ll also avoid the extra cost of hiring report designers or paying your staff to put together the information you need to run your business from day to day.

- Audit trail – When it comes to compliance and audit testing, it’s vitally important that your accounting software keeps an audit trail record. This record shows exactly who did what and when and is key evidence when it comes to internal fraud and helps track when mistakes were made. Make sure that the solution you choose provides this information or you may have difficulty if you suspect fraud or run into trouble down the line.

How Built Can Help

Built has robust tools that can help you automate your accounts payable process so you can spend more time concentrating on the details of your business. From receiving invoices to payments and lien waivers, we’ve got you covered. Here are just some of the features you can use to simplify your AP process:

- Invoice collection

Vendors submit their progress invoices through our portal, providing built-in controls to help ensure that they submit a correct invoice the first time, reducing time spent on revisions. Vendors can only invoice for the remaining amount on their contract, including approved change orders. Direct cost invoices can also be submitted through the portal and all invoices are immediately visible on the back end, so you know exactly what you owe in real time. - Automated approval workflows

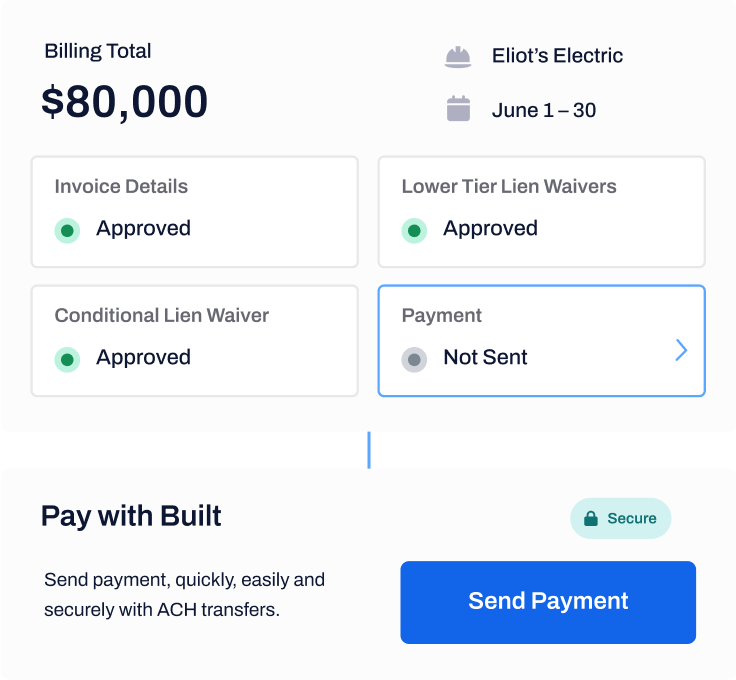

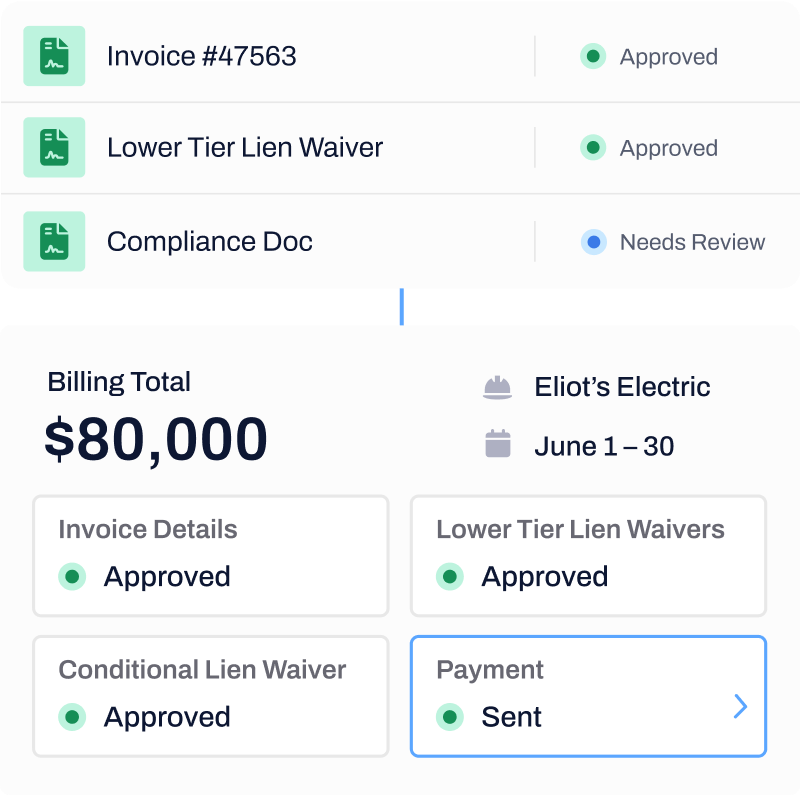

Invoices are automatically routed to the necessary people for approval and coding. Customized options allow for both sequential and parallel flows, allowing you to design the process that works best for you. Communicate with vendors, request revisions, and let your vendors know the status of their invoice from inside the solution. With greater visibility, you reduce the number of questions from vendors. And without paper invoices to get lost or misplaced, you always know exactly where you stand with job costs. - Creating and tracking lien waivers

With a library of statutory lien waiver templates and the ability to create your own, you can quickly create the waivers you need. Just drag and drop the invoice or payment details and send them to your vendors for electronic signatures. Waivers can be sent when vendors submit an invoice, upon request, or in exchange for payment. Quickly see the status of waivers, filtered by project or billing period, so you can easily follow up on missing signatures with bulk reminders. When you’re ready to submit waivers with your draw request, you can filter and export them by project and billing period. - Tracking compliance documentation

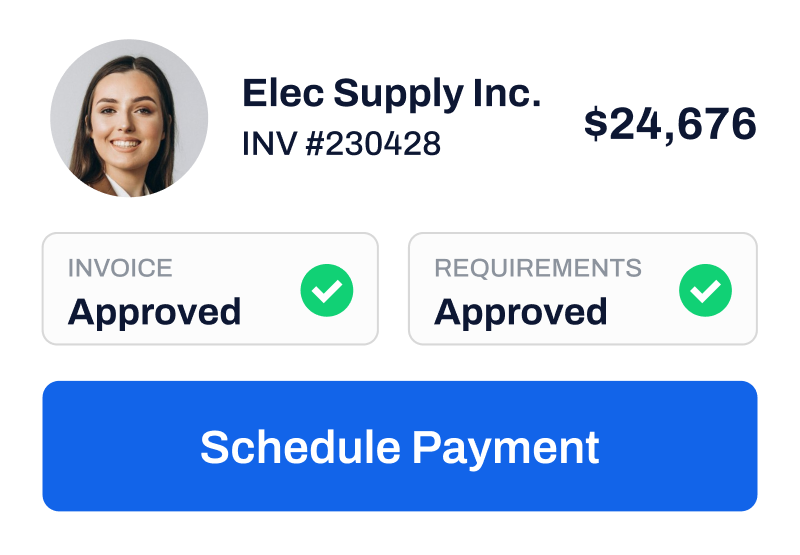

Request, collect, and track the receipt of standard and custom compliance documentation. Includes the ability to track and store notices, certificates of insurance, safety documents, and financial statements all in one place. Get alerts when insurance or licensing is about to expire and send automated reminders to vendors to provide updated documents. Protect yourself from audits by ensuring you remain in compliance with licensing, insurance, and contractual requirements. - Sending payments

You can manage project funds, send electronic payments, and track payment status across projects and vendors all in the same place. Vendor onboarding provides the privacy and security needed to store confidential information, like tax identification numbers and bank routing and account information. Payment status and details can be shared with your vendors, providing more visibility and reducing the time spent answering vendor inquiries. Faster payments help build better vendor relationships. - Integration with major software providers

Seamlessly integrate our portal with your accounting or ERP solution to avoid duplicate data entry, which could lead to errors. Built integrates with the following software:- Quickbooks Online

- Sage 300 CRE

- Plaid

- DocuSign

- Procore

For more information about how Built can improve your construction accounts payable process, take a tour of our solution or contact sales today.

Want To Learn More?