What Is Mezzanine Financing in Commercial Real Estate?

When structuring a capital stack in a commercial real estate deal, investors often discover they have less than the ideal amount of equity to invest. Typically, investors sell equity or seek more debt financing in such situations, reducing their return on equity (ROE.)

What if investors could load more debt into the deal and maintain their ROE while mitigating the downsides of excessive debt?

This is where mezzanine financing enters the picture. Mezzanine financing gets its name from mezzanine floors in a building that lie a level above the ground floor.

Here’s what mezzanine financing in commercial real estate (CRE) is, how to evaluate whether it’s a good idea for your portfolio, and what to watch out for when opting for mezzanine financing.

What is mezzanine financing in commercial real estate?

Mezzanine financing, or mezzanine loans, in commercial real estate are secondary financing instruments junior to first mortgages. Investors pay them off using cash flow from their properties. In case of default, investors negotiate with lenders to convert outstanding debt into an equity interest in the property.

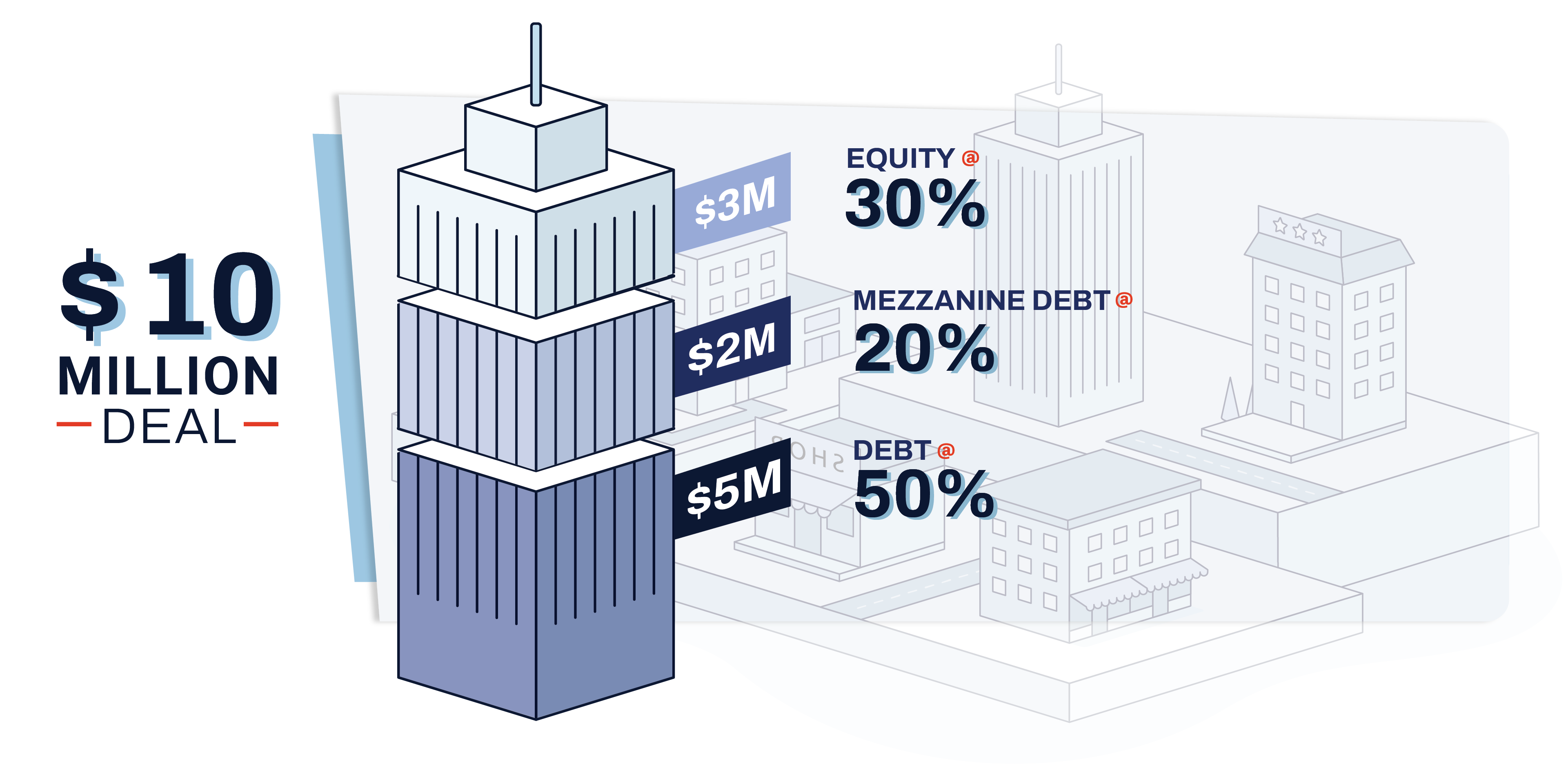

Also called subordinated debt, these loans are not secured to the property, unlike senior mortgages. This makes them a risky choice for lenders. Here’s a simple illustration of a capital stack in a $10M deal that uses mezzanine debt.

Who uses mezzanine financing?

Mezzanine financing in commercial real estate is used by investors to cover the cost of a deal if the amount of senior debt falls short. In case of a default, investors and lenders negotiate to turn outstanding debt into equity stakes in the deal.

Thus, mezzanine financing is a hybrid of debt and equity financing, giving investors the cash they need to boost returns while minimizing the downside that traditional debt brings.

Note that mezzanine financing is not unique to commercial real estate. Mezzanine debt is often used in leveraged buyouts by private equity investors to buy a stake in a target company. In those situations, lenders can demand payouts when investors exit a deal or in periodic installments.

Venture capital investors also use mezzanine debt to fund startups, should the situation warrant it.

How mezzanine financing works

Mezzanine financing is unsecured junior debt, sitting below the first mortgage and other debt instruments used to fund a commercial real estate deal. In case of default, mezzanine debt is paid last and sits one step above equity in the capital stack.

Given this situation, mezzanine debt has the following characteristics:

- Carries high-interest rates—sometimes as high as 30%. Higher interest rates compensate lenders for the additional risk.

- The principal is usually not amortized—making mezzanine debt payments interest-only. However, lenders can amortize the principal if they deem the deal’s prospects riskier than normal.

- Lenders can seize equity—in case of a default. Since mezzanine debt lies one step above equity in the capital stack, lenders can demand equity compensation or choose to receive funds after senior debt is paid off.

Four advantages of mezzanine financing

Mezzanine financing offers lenders and investors a few advantages. Here they are in no particular order.

1. Mezzanine financing can boost a deal’s return on equity.

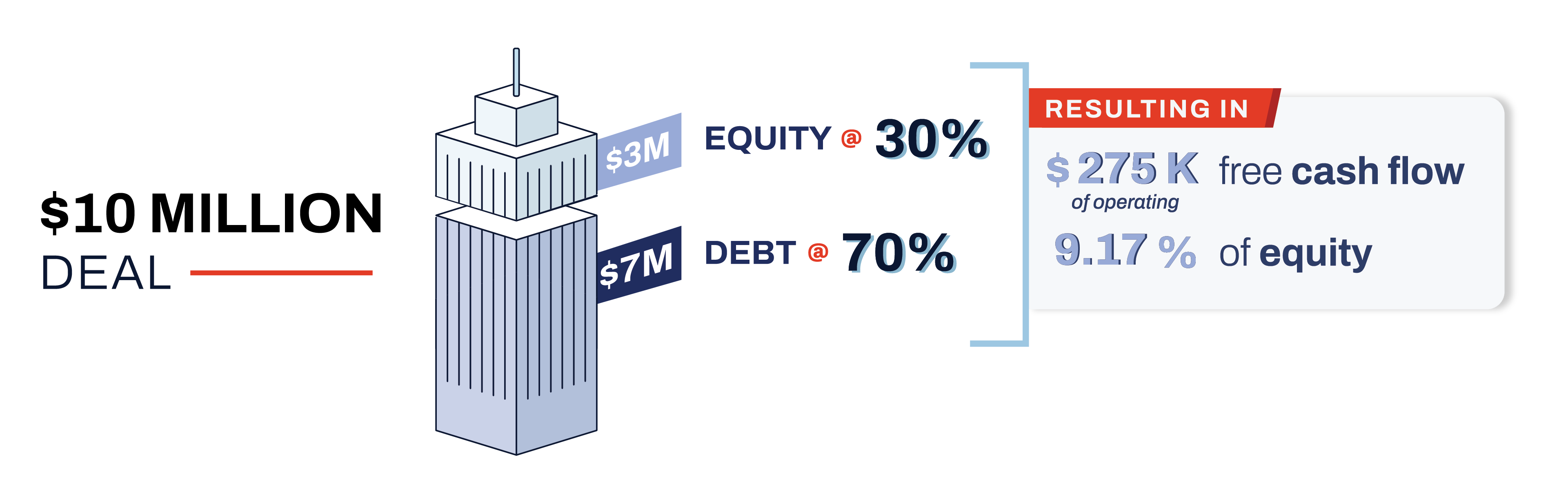

Mezzanine debt increases the amount of debt in a deal’s capital stack, increasing leverage, and an investor’s ROE. Here’s an example illustrating an ROE boost with mezzanine debt on a $10M property.

Let’s assume debt financing covers $7M, and you have $2M to invest as equity. This leaves a shortfall of $1M, which you raise by selling equity in the deal.

Here’s what the capital stack looks like, along with our assumptions of cash flows from operations:

| Purchase price | $10,000,000.00 |

| Debt | $7,000,000.00 |

| Equity | $3,000,000.00 |

| Net Operating Income | $800,000.00 |

| Debt Service | $525,000.00 |

| Operating FCF | $275,000.00 |

| ROE | 9.17% |

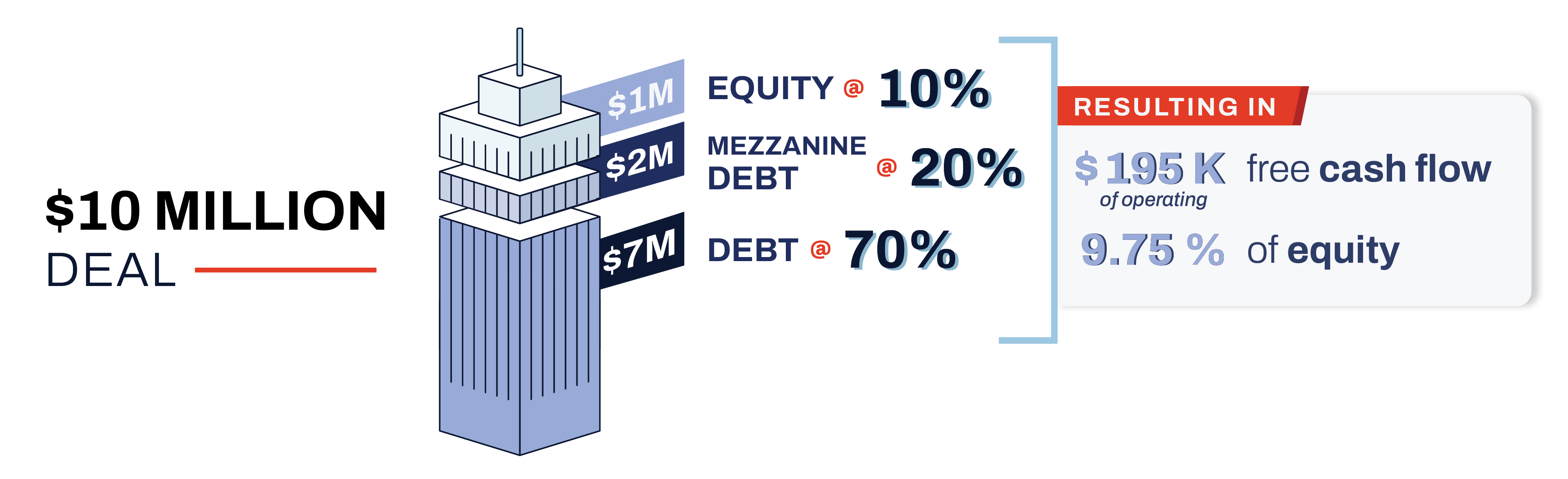

Here’s what happens if we include mezzanine debt instead of selling $1M in equity.

| Purchase price | $10,000,000.00 |

| Debt | $7,000,000.00 |

| Mezzanine | $1,000,000.00 |

| Equity | $2,000,000.00 |

| Net Operating Income | $800,000.00 |

| Debt Service | $525,000.00 |

| Mezzanine debt service | $80,000.00 |

| Operating FCF | $195,000.00 |

| ROE | 9.75% |

This deal’s ROE increases to 9.75% compared to 9% without mezzanine financing. Note that we’ve simplified many elements of this deal and assumed a mezzanine payout structure that offers the lender some security (hence the comparatively low-interest rate.)

Note that mezzanine financing will not always boost ROE since much depends on the terms a lender offers post-negotiation.

2. Mezzanine financing reduces the money an investor needs to enter a deal.

Mezzanine financing reduces the money investors have to put down in a deal. In our previous example, we assumed senior debt covered the bulk of the financing needed to secure the property. However, if senior debt fell short, the investor would have lost the deal.

Mezzanine debt bridges the gap between the property’s purchase price and existing financing. Thus, it gives investors more opportunities, boosting their portfolio returns in the long run.

3. Mezzanine financing can reduce tax burden.

Mezzanine debt interest payments can be tax deductible, increasing net income and free cash flow in a deal. Note that these payments are not always tax deductible since much depends on the financing terms investors negotiate with the lender.

4. Mezzanine financing does not impede further debt raises

Mezzanine debt in real estate is listed as equity on the balance sheet, despite being debt. As a result, the company’s debt-to-equity ratio does not take a hit, giving investors the chance to secure more debt financing.

Note that this advantage is cosmetic due to mezzanine debt’s accounting treatment. In reality, mezzanine debt burdens the deal’s cash flow and reduces its margin of error (as we will explain in the next section.)

However, should an investor need to secure more debt financing, mezzanine debt does not hamper their chances.

The risks of using mezzanine loans in commercial real estate

Mezzanine debt is a good choice for both lenders and investors in commercial real estate. However, it creates a few disadvantages every deal stakeholder must be wary of.

Mezzanine debt carries higher interest rates.

Investors must bear higher interest rates if they opt for mezzanine financing. They can lower these rates by negotiating some form of collateral or ceding equity control with lenders. However, no amount of negotiation will reduce mezzanine interest rates to below those of traditional debt.

These higher interest rates reduce an investor’s margin of safety in the deal since operating cash flows have to fund two types of debt, instead of just one. Thus, while ROE increases, the amount of free cash flow decreases.

Mezzanine debt default leads to a loss of equity.

Before offering financing, mezzanine debt lenders negotiate equity terms with investors. These negotiations can place investors in a tough spot should a default occur. For instance, a lender might finance just 10% of the deal but claim a large equity stake if the investor defaults on payment.

In challenging circumstances, an investor could lose their stake in the property while receiving comparatively little financing when times are good.

Mezzanine debt increases operational risk for investors.

Mezzanine debt interest rates depend on the risk a lender perceives in a deal. Lenders will offer higher interest rates if a deal presents more risk. Some lenders may not increase rates by much but demand operational control in the deal.

While this is a topic of negotiation, investors must be careful when ceding control of deal operations to a lender since this could jeopardize returns. A lender, for instance, might demand changes that secure its interest payments but lower overall free cash flow.

Mezzanine loans are unsecured.

From a lender’s perspective, mezzanine financing is risky since it is not secured with property. While lenders can negotiate equity terms in case of a default, this is still a situation they wish to avoid. In a default, the equity might be worthless, and the primary lien holder might be unwilling to negotiate, leaving lenders in a hole.

Mezzanine financing benefits investors and lenders but presents significant risks that need management. Built’s platform for asset managers streamlines deal and draw management processes, ensures covenant compliance, and mitigates investment risk.

Ready to get started? Our team is eager to discuss how we can meet the evolving needs of your commercial real estate investment portfolio. Schedule a free demo today.

Related Posts

Built Names Chris DeVito as Vice President of Product