Digital Draw Management: Scaling Construction Schedules for Multi-Project Portfolios

You’re not managing one site. You’re managing a portfolio, and every delayed disbursement, missing waiver, or approval bottleneck doesn’t just slow one build. It compounds risk across your capital stack, erodes timelines, and puts unnecessary pressure on already thin project teams.

A typical construction draw schedule might get a single project over the line. But scaling that same framework across five, ten, or fifteen active developments, each with its own inspection cadence, funding structure, and stakeholder needs, exposes systemic fragility. It breaks. Slowly at first. Then all at once.

And when construction productivity has improved just 0.4% annually since 2000, while other industries like manufacturing have surged ahead (McKinsey), that fragility isn’t surprising. The industry’s failure to digitize and standardize core workflows, including draw management, leaves even the most capable developers vulnerable to preventable delays and funding gaps.

This article unpacks what a scalable construction draw schedule actually requires in a multi-project environment. This isn’t simply milestone tracking or cost templates; it’s a shift away from reactivity, toward real operational control, visibility, and capital pacing.

If you’re still managing draws through spreadsheets, email threads, or recycled templates, this one’s for you.

Why “Typical” Draw Schedules Don’t Scale Across Portfolios

Most owner-developer teams don’t need a definition of a construction draw schedule. You already know it’s the roadmap for releasing funds, typically segmented into five to seven draws tied to major milestones like sitework, vertical construction, or final inspection.

The issue isn’t understanding what a draw schedule is. It’s making sure that structure actually works when you’re juggling five or fifteen active developments, each with its own capital stack, inspection cadence, and documentation workflow.

A typical construction draw schedule might live in Excel. It might get passed between a PM, GC, and fund admin via email. And for one site, it might be “good enough.”

But across a portfolio? That’s where it starts to break. One outdated tracker. One missed lien waiver. One approval based on the wrong scope, and suddenly your entire draw process grinds to a halt. Not because the schedule itself failed but because the surrounding system wasn’t built for scale.

The most effective teams don’t just repurpose templates; they engineer draw schedules that have the following characteristics:

- Aligned to capital pacing strategies

- Connected across internal and external teams

- Transparent enough to maintain funder confidence throughout the cycle

But even the best schedule falls short without infrastructure to support it. Without a centralized, rules-based platform to operationalize your draw process across stakeholders, delays and duplication are inevitable. Portfolio-grade draw management doesn’t just require visibility; it also requires control.

Where Single-Project Logic Breaks Down in Multi-Project Portfolios

Most construction draw schedules follow a familiar logic: five to seven funding events tied to major project milestones, with funds released once documentation is verified and approved.

This setup works until it’s multiplied across a portfolio.

At scale, single-project workflows don’t just become inefficient. They become invisible. Each project ends up siloed, with its own spreadsheet, approval path, and draw cadence. There’s no easy way to see the following:

- Which projects are behind on draw requests?

- Where are lien waivers or inspections causing holdups?

- How are delays in one development impacting overall cash flow pacing?

And here’s the real risk: those gaps aren’t always operational. They’re financial.

When project teams miss inspection windows or delay submitting a draw request, that money doesn’t just sit idle. It drags on the portfolio’s overall capital efficiency. One delayed payment can hold up vendor mobilization on another site. Unclaimed funds stretch timelines. And without a roll-up view, capital partners may interpret the lag as mismanagement.

In discovery calls, mid-market developers have described large sums (sometimes seven figures) sitting unreleased with lenders due to misaligned documentation and inspection schedules. This isn’t because of bad management but, rather, because disconnected systems made it impossible to track readiness at scale.

The issue isn’t intent. It’s visibility. One developer shared the following on Reddit:

“I can get approved for construction loans, but they don’t normally pay me much until I’m weather tight . . . I don’t have the capital to fund between draws for multiple builds simultaneously.”

For owner–developers scaling from a few builds to a dozen or more, this is where strategic draw planning matters. A scalable construction draw schedule doesn’t just organize payments, it also protects capital pacing, supports lender confidence, and prevents the silent drag that erodes margins.

How to Scale Construction Draw Management with Digital Practices

Scaling draw schedules across a portfolio isn’t about duplicating templates. It’s about building a draw management process that can keep pace with layered capital stacks, staggered project milestones, and fast-moving field operations.

To do that, owner-developer teams need more than milestone logic; they need portfolio-grade visibility and control.

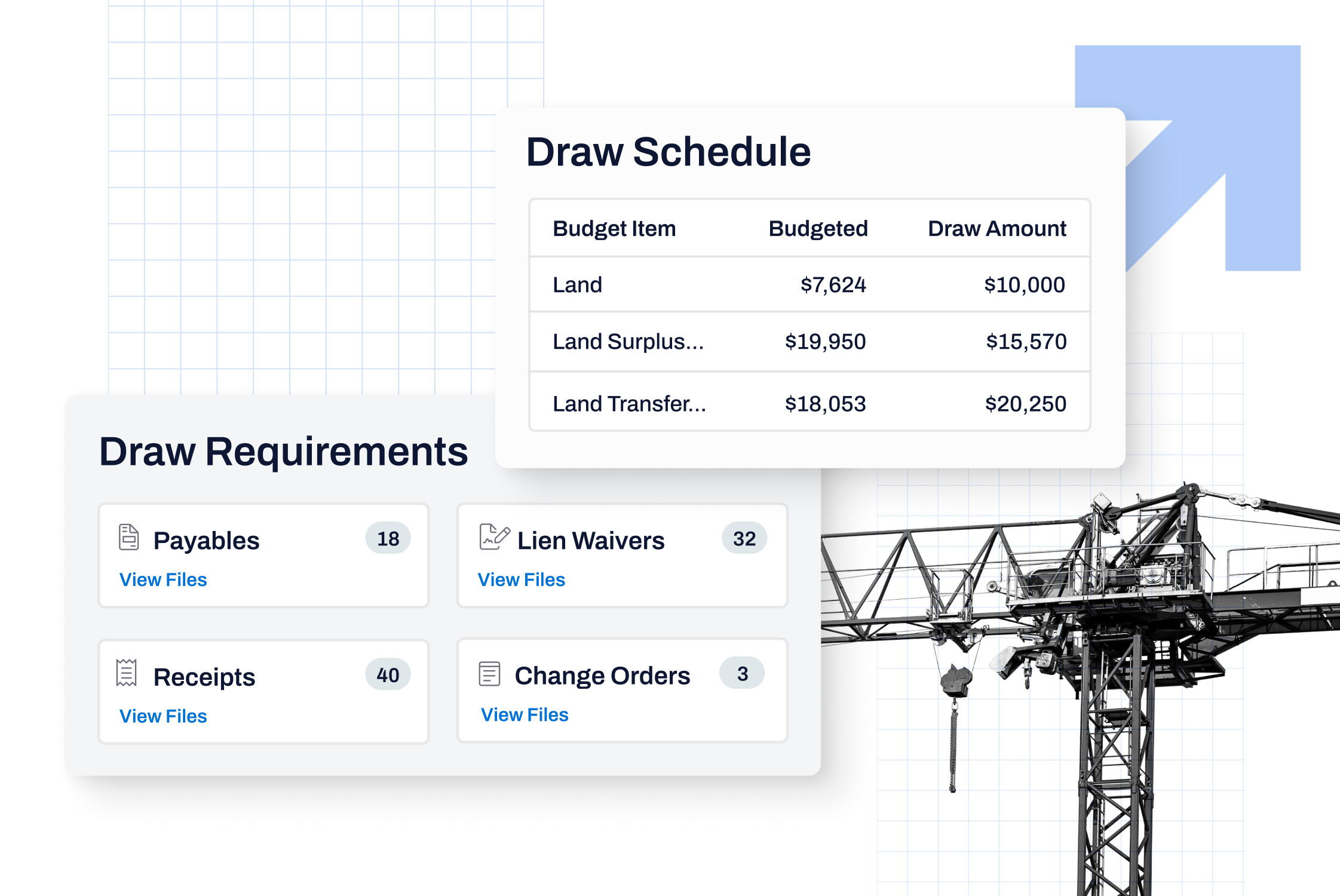

A scalable draw schedule must do more than just track when to release funds. It needs to answer lender questions, flag disbursement risks early, and help developer teams proactively manage capital across builds.

That means the following:

- Coordinated disbursement planning across sites, using consistent progress metrics, not milestone guesswork or manual status checks.

- Live visibility into total capital drawn, pending requests, and vendor payment status, aggregated across all builds and stakeholders.

- Automated lien waiver collection and compliance validation so delays aren’t triggered by missing documentation or last-minute chases.

- Alignment across complex capital stacks, allowing teams to pace equity, mezz, and senior debt against real-time spend, not outdated spreadsheets.

- Standardized cost categorization and draw templates, giving capital partners clean reporting, faster approvals, and audit-ready clarity.

Rod Heisler, owner of Rod Heisler Construction, shared how Built transformed that complexity into control: “Built has helped our business by keeping our subs in line with everything that we require or what our client requires from them . . . I get all the required backup with the invoices, and paying them as a single [step] . . . it’s also getting us paid a lot quicker from our clients.”

This isn’t just stronger financial operations. It’s smarter risk management, cleaner capital pacing, and a foundation for growth, without adding more headcount to manage complexity.

4 Essential Components of a Scaleable Digital Draw Process

A scalable draw schedule isn’t just cleaner, it’s also built to adapt. It needs to flex across asset types, support speed without compromising control, and replace reactivity with structure.

For growing owner-developer teams, that means standardizing and automating four essential components:

1. Cross-Asset Milestone Mapping

Whether you’re breaking ground on horizontal development or navigating phased vertical inspections, scalable draw schedules rely on a unified milestone framework. This creates alignment across teams and makes it easier to benchmark progress and anticipate disbursement needs, no matter the project type.

2. A Shared, Standardized Schedule of Values

When every GC or PM codes line items differently, reporting gets muddy. A standardized schedule of values brings consistency across builds, ensuring cleaner reporting, faster draw approvals, and fewer downstream questions from capital partners.

3. Smart Triggers for Payment Releases

Draws shouldn’t hinge on memory or manual follow-ups. Scalable schedules use intelligent triggers, like lien waiver submission, inspection completion, or verified % complete, to automatically advance the process without introducing risk.

4. Built-In Version Control and Auditability

You can’t scale what you can’t trace. Automated controls ensure changes are logged, approvals are locked, and stakeholders only see what they’re meant to. The result? Fewer delays, fewer errors, and a draw schedule that operates as a live, auditable system, not a static spreadsheet.

This is what separates teams that scale with confidence from those that chase approvals and patchwork fixes. A well-structured draw schedule does more than release capital. It protects it.

Tools That Enable Portfolio-Grade Draw Scheduling

As we’ve discussed, managing construction loan draw schedules across multiple projects demands more than shared spreadsheets. It requires a system that’s purpose-built for capital movement, stakeholder coordination, and financial oversight.

Built’s construction financials platform gives owner–developer teams the structure they need to scale without chaos. Draw schedules, payment approvals, and supporting documentation all live in one environment—with roles, rules, and reporting built in.

- Role-Based Access by Function: Project managers, general contractors, and fund administrators each get access to what they need, nothing more. That means less back-and-forth, clearer accountability, and faster cycle times.

- Disbursement Controls and Draw Guardrails: Built lets you embed your draw schedule logic directly into your workflows. Line items can’t move forward until inspection results, lien waivers, or budget thresholds are met, so nothing slips through the cracks.

- Automatic Audit Trails at Scale: Every action (submission, edit, approval, funding) is logged and timestamped. Whether you’re prepping for a capital call or reconciling monthly close, your audit trail builds itself.

- Portfolio Visibility in Real Time: No more stitching together progress reports across five projects. Built lets you track % drawn, pending requests, and capital pacing across your portfolio, all in one place.

If your team is managing draw schedules across multiple developments, Built’s platform helps you scale with clarity, speed, and control. Book a demo to see it in action.

Real-World Impact: What Happens When It’s Done Right

When owner–developer teams standardize and centralize their draw schedule workflows across projects, the results aren’t just operational, they’re also compounding across financial clarity, lender confidence, and forecasting precision.

Funding cycles move faster

In discovery calls, teams relying on spreadsheets commonly reported 10–14 day draw cycles, held up by inbox approvals, manual validations, or incomplete documentation. After implementing Built’s construction financials platform, some reduced that cycle to as few as two to five days.

With automated validations, structured approval paths, and real-time status tracking, disbursements no longer stall.

Capital partners gain trust

Capital partners from lenders to JV equity stakeholders expect consistency, documentation, and draw auditability. While developers may not always cite it directly, teams using Built have reported faster payments, fewer errors, and audit-ready documentation that improves credibility and strengthens relationships across the capital stack.

Closeouts become cleaner

Lien waivers, inspections, and final approvals are easy to lose track of when projects wrap. But with a live system maintaining documentation and draw status across every line item, teams no longer rely on memory or last-minute follow-ups.

This accelerates turnover and gives lenders confidence at close.

Forecasting becomes actionable

Shared cost codes and standardized draw templates give asset managers a real-time view into spend, risk, and capital pacing. No more re-keying data into internal models or stitching together spreadsheets across projects. Instead, you have a single source of truth that sharpens visibility and speeds decision-making.

For growing real estate developers, scalable draw management isn’t just an operational upgrade, it’s also a strategic advantage. It removes friction from capital movement, de-risks funding delays, and empowers teams to manage growth with confidence.

Stop Rebuilding the Wheel for Every Draw

For growing real estate developers, a scalable construction loan draw schedule isn’t a spreadsheet template; it’s a strategy that protects cash flow, supports lender confidence, and gives your team the control and visibility to manage complexity without friction.

The truth is your risk doesn’t come from the draw schedule itself. It comes from trying to manage it manually, project by project, in systems that weren’t designed for scale.

Built’s construction financials platform helps owner–developer teams operationalize draw schedules across entire portfolios, removing bottlenecks, reducing manual work, and enabling smarter disbursement planning across capital stacks.

If you’re tired of fire drills, version drift, and capital inefficiencies, there’s a better way. Book a demo to see how real teams are managing scalable draw schedules with Built.

FAQs: Construction Draw Schedules at Portfolio Scale

Why do “typical” draw schedules fall short for portfolio-scale developers?

A basic construction draw schedule may work for a single construction project, but it’s not designed for the complexity of managing various stages of funding across a multi-project portfolio. At scale, each construction site comes with its own draw process, cash flow pacing, and payment schedules, which quickly overwhelm project managers relying on spreadsheets.

Scalable draw management requires more than templated spreadsheets; it demands integrated systems that account for project milestones, loan agreement terms, and shifting construction financing.

How do capital partners evaluate draw schedules across a portfolio?

They expect consistency across draw requests, real-time tracking of project progress, and a clear framework for releasing funds. If your draw schedule lacks transparency, or if key documents like lien waivers and budget line items are buried in email threads, capital partners may hesitate to disburse funds.

Developers who build systems that align with industry standards, automate the review process, and centralize financial management consistently gain trust and unlock faster access to funds.

What’s the difference between tracking draws and managing draw risk?

Tracking tells you where the construction draw stands today. But managing risk means proactively aligning each draw request with actual work completed, required inspections, and lender conditions. That includes validating soft costs, controlling for cost overruns, and structuring the draw process to prevent errors, not just fix them.

Teams with centralized systems and role-based access avoid most of the issues that slow down larger projects.

Do all projects in a portfolio need to follow the same draw schedule?

They don’t need to all follow the same timeline but definitely the same logic. A well-structured draw schedule flexes based on site development, asset type, or local conditions, but it still anchors to a consistent construction process and detailed payment plan.

That consistency helps owners maintain control over construction costs, avoid duplication across budget line items, and ensure payment requests are processed in a way that keeps the project moving forward.

Is spreadsheet-based draw tracking sustainable for portfolios?

Only up to a point. In our calls, owner–developers say they hit a breaking point around three to five construction projects, when Excel-based tracking creates delays, lost approvals, and version drift. Without automation, it’s easy to miss interest reserve checks, progress payments, or documentation tied to the loan amount. If you’re still relying on spreadsheets, it’s not just manual: it’s risky.

Mark Murphy leads OGC Sales at Built, where he is responsible for accelerating adoption of payments and standalone solutions purpose-built for real estate owners, developers, and general contractors. He brings deep experience across sales, general management, and operations in technology-driven businesses.

Prior to joining Built, Mark served as General Manager at Apex Service Partners and Operating Executive at Alpine Investors. He also spent over six years at Flexport, where he held multiple leadership roles including General Manager for the South and Northeast regions, and Director & Acting General Manager for San Francisco and Northern California. Earlier in his career, Mark was Chief Operating Officer at Oolong, an INC 500-recognized international trading business.

Mark holds a degree in Mechanical Engineering from Stanford University, where he captained the Varsity Men’s Rowing team.

Related Posts