How Lenders Unlock End-to-End Visibility with Loan Lifecycle Management

In our recent webinar, Winning More with Less: Unlocking End-to-End Visibility to Drive Smarter Growth from Origination to Asset Management, Built’s senior solutions engineer Ali Ludwig explored how lenders can better manage the loan lifecycle with modern loan management software while still working within existing workflows.

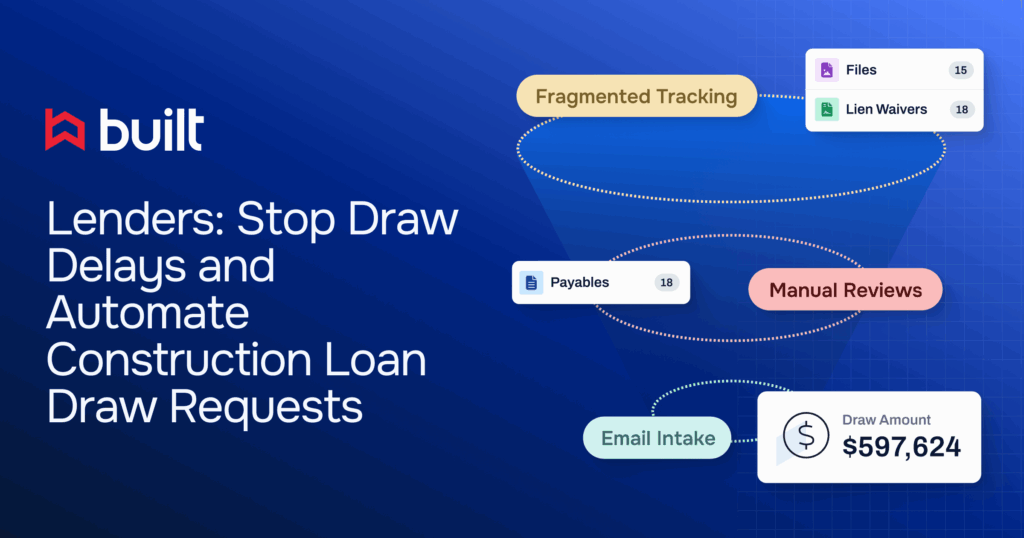

The need for visibility is clear. Managing portfolios in Excel or other scattered systems has long been the norm for financial institutions, but in today’s environment of tighter capital and rising investor expectations, that approach comes at a cost. It creates slower deal cycles, fragmented data, and hidden risks.

And the stakes are only getting higher: the Federal Reserve (FEDS Notes, May 2025) reports that private credit alone has expanded nearly fivefold since 2009, reaching $1.34 trillion in the U.S. and $2 trillion globally by mid-2024. For mid-market lenders, this growth adds pressure to modernize operations, improve operational efficiency, and reduce potential risks while maintaining strong customer satisfaction.

In this article, we’ll recap the key insights from the webinar and expand with added industry context, showing how lenders can streamline origination, strengthen underwriting, modernize loan asset management software practices, and gain portfolio-level visibility that turns data into a strategic advantage.

Where Visibility Breaks Down in the Full Loan Lifecycle

Ali structured the webinar around the full loan lifecycle: origination, underwriting, loan asset management, and portfolio oversight. While the stages differ, a common theme runs through them: critical data often remains locked in static spreadsheets or siloed systems. For financial institutions, that means slower decisions, fragmented reporting, compliance blind spots, and potential risks that surface only after they’ve become problems.

In the sections that follow, we’ll look at how those visibility gaps show up at each stage of the lifecycle and how addressing them early can create better outcomes downstream.

1. Origination and Deal Pipeline Management for Lenders

Origination is where visibility challenges often begin. Deals typically arrive as offering memoranda or borrower packages, and most lenders rekey only a limited set of fields into Excel or a basic tracker. That manual approach creates three issues:

- Only a fraction of available data makes it into the pipeline (often 15–30 points per deal).

- Reports lag behind reality since updates are tied to quarterly or weekly cycles.

- Early insights like comps, borrower patterns, or market exposure are lost before they can inform strategy.

The impact compounds quickly. Without accurate or timely pipeline data, lenders struggle to see how opportunities are shifting, which deals are stalling, or why certain asset classes are underperforming.

Turning Intake Data into Strategic Insight

In the webinar, Ali showed how digitizing intake changes this equation. Instead of static spreadsheets, pipeline dashboards can present real-time views of deal flow by stage, geography, property type, or originator. They can be filtered, exported, and even scheduled to arrive before team meetings, so everyone is aligned on the latest data.

Those insights aren’t theoretical. Ali shared an example where the pipeline report projected $1.7B in new originations for 2025, with multifamily and industrial driving most of the growth. Just as importantly, the analysis revealed a pattern: office deals were disproportionately being lost on pricing, which is a clear signal to reassess strategy in that sector.

The Takeaway

When lenders capture more complete data at origination, they set themselves up for stronger underwriting and faster portfolio insights. Visibility gained early prevents blind spots and creates an advantage that carries through the entire lifecycle.

2. Underwriting Bottlenecks and Loan Lifecycle Management

Once a deal enters the pipeline, underwriting becomes the next bottleneck for visibility. Most lenders still rely on complex Excel models built over years, which are flexible but difficult to standardize.

Key challenges include the following:

- Models live in individual desktops or shared drives, making version control difficult.

- Output is often disconnected from the systems used in later stages of the loan lifecycle.

- Even when models are robust, the insights stay siloed in spreadsheets rather than feeding into portfolio-level analysis.

The result is that underwriters can spend more time formatting and reconciling data than actually analyzing risk. And because outputs aren’t standardized, comparing assumptions across deals or surfacing systemic risks across a book can be difficult.

Industry research echoes this pain. Deloitte notes that outdated, paper-based, and siloed credit processes are a primary reason approvals drag on, adding days or even weeks to “time to yes.” In fact, one European bank cut mortgage approval times from 15–20 days to 3–5 days simply by digitizing its credit review and underwriting workflows.

How Built Enhances Excel Underwriting

In the webinar, Ali emphasized that underwriting doesn’t need to abandon Excel; instead, it can be enhanced. By layering a lightweight connection on top of existing models, lenders can continue using their preferred spreadsheets while automatically pushing structured data back into a centralized system. That ensures calculations such as NOI, LTV, and DSCR update in real time without manual entry.

Ali demonstrated how this shift enables faster reporting. Term sheets, credit memos, and quote sheets can be generated directly from the centralized data, reducing turnaround time and ensuring consistency across teams. When assumptions change, such as spread widening or appraisal values updating, the metrics refresh automatically.

The Takeaway

Underwriting works best when Excel remains the modeling engine, but the outputs flow into a single source of truth. This balance preserves analyst flexibility while giving decision-makers real-time visibility across the portfolio.

3. Loan Asset Management Software: Why Visibility Matters

Even after a loan closes, visibility challenges continue. Asset managers are responsible for monitoring performance, covenants, reserves, and borrower updates, yet many still rely on quarterly reviews and static spreadsheets.

That creates several problems:

- Data from borrowers (rent rolls, operating statements, T-12s) often arrives in inconsistent formats.

- Updates may be entered manually into models, delaying reporting and increasing error risk.

- Between reviews, lenders lack a clear picture of how an asset is actually performing.

The cost of this gap is significant. Without timely updates, portfolio managers monitoring commercial real estate loans can miss early warning signs like declining occupancy or debt service coverage slipping toward a threshold. By the time issues appear in a quarterly review, the window to respond proactively may have closed.

Whether it’s monitoring reserves in multifamily lending or tracking inspections in construction loan monitoring, quarterly snapshots often miss critical changes in performance.

Industry research reinforces the stakes: nearly three-quarters of asset managers say they’ve lost investors because of inefficient, outdated processes such as manual onboarding and compliance. It’s a reminder that operational inefficiency slows reporting and undermines confidence when stakeholders expect speed and transparency.

From Quarterly Snapshots to Continuous Monitoring

The webinar showed how lenders can change this dynamic by bringing borrower and servicer data into a centralized system. Information can flow in three ways:

- Directly from Excel, when underwriters or asset managers re-underwrite.

- Via AI extraction of documents such as rent rolls or T-12s.

- Through direct integrations with servicers, pulling balances and operating data automatically.

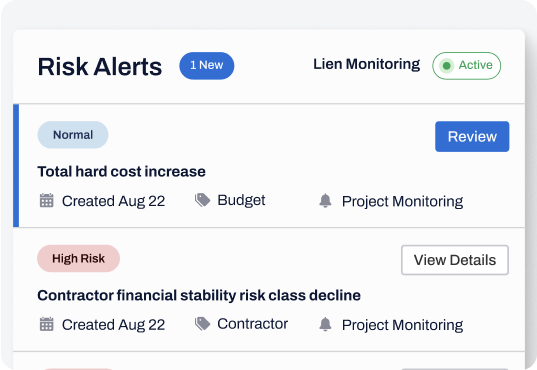

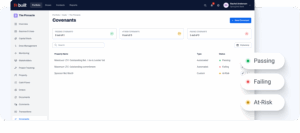

Once centralized, the data powers real-time dashboards. Ali demonstrated how capital stacks, reserve balances, and budget draws can be tracked continuously, not just at quarter-end. Rent rolls and cash flows are time-stamped, making it easy to compare “as underwritten,” “as projected,” and “as actual” side by side. Most importantly, covenant checks and milestone alerts trigger automatically when metrics move into at-risk or failing territory, sending notifications directly to users.

The Takeaway

Asset management no longer has to be a reactive process. With ongoing data feeds and automated covenant monitoring, lenders can spot issues early, intervene faster, and spend less time chasing documents, which shifts the focus from data collection to decision-making.

4. Loan Portfolio Management and Risk Visibility for Lenders

The final stage Ali covered in the webinar was portfolio oversight, where the value of visibility across origination, underwriting, and asset management comes together. For many lenders, this is the stage where limitations in data are most obvious:

- Portfolio reports are often static decks or spreadsheets, updated only quarterly.

- Concentration risk across geographies, property types, or sponsors can be hard to see until after problems surface, especially in construction loans where progress monitoring and inspections are critical.

- Disaster events or market shifts require manual cross-checks against loan files, which slows response times.

This lack of real-time oversight creates blind spots. For example, a portfolio might appear balanced in aggregate, but closer inspection could reveal outsized exposure to one borrower, one market, or one asset class, risks that only become visible when a disruption occurs.

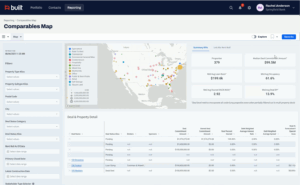

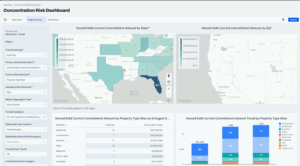

How Real-Time Oversight Strengthens Portfolio Strategy

In the webinar, Ali demonstrated how lenders can change this with centralized, time-stamped data that rolls up to the portfolio level. Dashboards can show the following:

- Portfolio growth quarter over quarter, with the option to include pipeline deals for a forward-looking view.

- Concentration risk by borrower, geography, or property type, highlighting where commitments are clustered.

- Disaster overlays using FEMA data, instantly showing which loans are in affected areas.

- Sponsor performance history, with every past deal tied back to the same counterparty for quick reference.

Ali shared a simple but powerful example: a dashboard showing that 37% of a portfolio’s exposure sat in Florida. With hurricane season approaching, that concentration flagged a potential vulnerability that might otherwise have been buried in spreadsheets.

The Takeaway

Portfolio oversight is no longer just about retrospective reporting. With connected data, lenders gain forward-looking insights into growth, risk concentrations, and external shocks, helping them act faster, allocate resources more effectively, and give stakeholders confidence in the strength of the book.

How Connected Loan Data and Loan Lifecycle Management Become a Strategic Advantage

The throughline is clear: data should be a source of power, not pain.

When lenders can trust a single system of record across the loan lifecycle, they shorten cycle times, reduce human error, and make more informed decisions, turning valuable insights into a competitive advantage. Faster deal execution, stronger risk management, and smarter portfolio decisions all flow from the same foundation: reliable, connected data.

For lenders navigating tighter margins and rising investor expectations in commercial real estate finance, that advantage can mean the difference between keeping pace and pulling ahead. To dive deeper, you can explore the full webinar recording or connect with our team to see how these strategies apply in practice.

FAQs on Loan Lifecycle Management for Lenders

What role does loan lifecycle management software play for lenders?

Loan lifecycle management software helps lenders manage the full loan lifecycle, from origination and underwriting to servicing, monitoring, and portfolio oversight, in a single connected system. By replacing siloed spreadsheets and manual processes, financial institutions gain greater operational efficiency, reduce human error, and improve compliance.

With real-time visibility into projects and borrowers, lenders can make more informed decisions, manage potential risks earlier, and deliver a smoother customer experience.

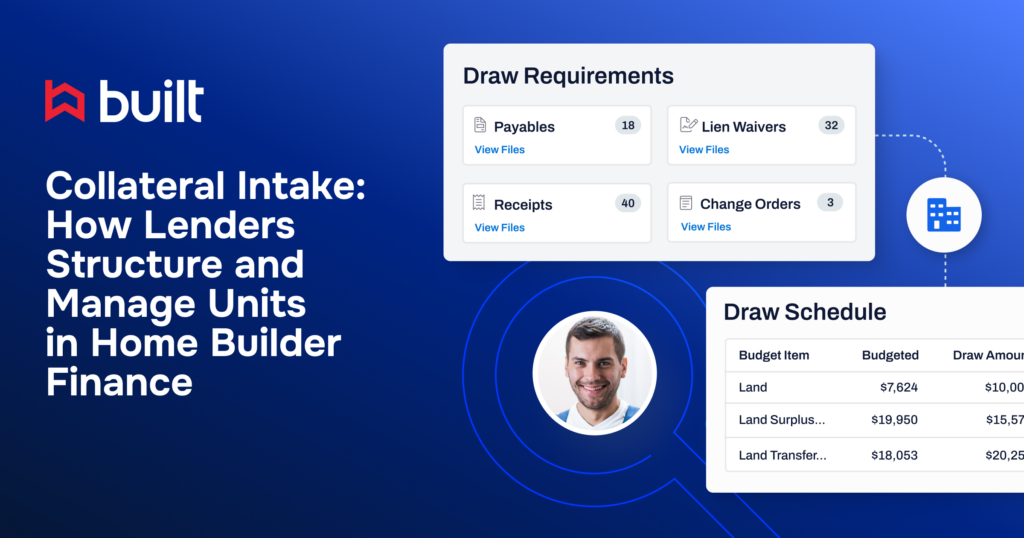

How does construction loan monitoring fit into portfolio oversight?

Construction loan monitoring strengthens portfolio oversight by giving lenders real-time visibility into inspections, budgets, and disbursements. Tracking progress against projections ensures that work is completed on schedule and within budget, while monitoring change orders and compliance documentation reduces potential risks.

By integrating this data into loan portfolio management dashboards, lenders can spot early warning signs like project delays or cost overruns before they escalate. This improves transparency, operational efficiency, and borrower confidence across construction portfolios.

Why is end-to-end visibility critical in commercial real estate lending?

End-to-end visibility gives lenders a single system of record across the full loan lifecycle. Without connected loan management software, financial institutions often face slower deal cycles, compliance blind spots, and higher operational costs due to fragmented processes and human error.

With modern loan lifecycle management, lenders can monitor construction loans, track inspections, and align servicing data in real time. This improves operational efficiency, reduces potential risks, and supports informed decisions. For commercial real estate lenders, visibility also strengthens customer relationships by ensuring transparency, faster reporting, and a smoother borrower experience.