Lenders Have Outgrown Generic Construction Loan Management Software — Here’s What’s Next

Lenders face unprecedented pressure to scale their operations. Yet, for many, the path to growth is choked by an invisible-but–persistent bottleneck: their own loan management software.

These generic, one-size-fits-all systems, often older and less flexible, were never built to handle the unique complexities of project-based lending. As a result, they turn a lender’s most important workflow (the construction draw process) into a series of manual, slow, and error-prone tasks.

This article will explore why traditional software has become a liability and what’s next for lenders seeking to overcome these challenges. We’ll examine the key capabilities of purpose-built platforms that equipped to handle the intricacies of construction financing, empowering lenders to unlock capacity, mitigate risk, and lead the industry into a new era of efficiency.

Why Generic Loan Management Software Is Failing Lenders

For construction and real estate lenders, the limitations of generic loan management systems are becoming impossible to ignore.

The operational bottleneck

The most significant operational friction point in construction lending is the draw process. Generic software exacerbates this by creating a series of disconnected, manual steps that prevent lenders from scaling.

A single draw request often requires a cascade of emails, phone calls, and redundant data entry across multiple systems. This creates a fragmented workflow where information is siloed and difficult to track.

As draw volume grows, this manual work requires adding headcount, which is not a sustainable or scalable solution. Lenders are simply adding human resources to an inefficient process instead of solving the fundamental problem.

This creates capacity constraints that prevent portfolio growth without a corresponding, and often disproportionate, increase in overhead.

Lenders also operate without full visibility using these systems. Without a unified, real-time view of a project, it’s impossible to see its true status. This lack of visibility increases risk and delays critical decisions, forcing teams to rely on outdated information and constantly chase down documents to get a clear picture.

The mismatch between software and needs

Beyond the draw process itself, generic platforms simply lack the specific features required for this asset class. They are not built for construction and real estate lending, so they cannot handle the most essential workflows.

- They don’t understand the nuances of a construction draw schedule.

- They cannot natively manage lien waivers and other critical documents.

- They fail to connect inspection data directly to the disbursement process.

This forces lenders to rely on an assortment of workarounds, third-party tools, and spreadsheets, creating a fragmented technology stack that is difficult to maintain and audit.

What’s Next: The Shift to Purpose-Built Solutions

The future of construction lending is in specialized platforms like Built, which are designed to solve the specific operational and risk management challenges of the industry. These next-generation systems go beyond basic loan tracking to offer comprehensive, integrated solutions that automate the most painful workflows. They streamline the entire process, from origination to ongoing asset management.

Feature-driven solutions to core problems

- Automated draw management: Built’s dedicated platform digitizes the entire draw process, from borrower submission to payment. It automates key steps like document validation against the project budget and streamlines approvals with customizable, digital workflows. This replaces manual, email-based processes with a fast, transparent, and trackable system, significantly reducing draw turnaround times.

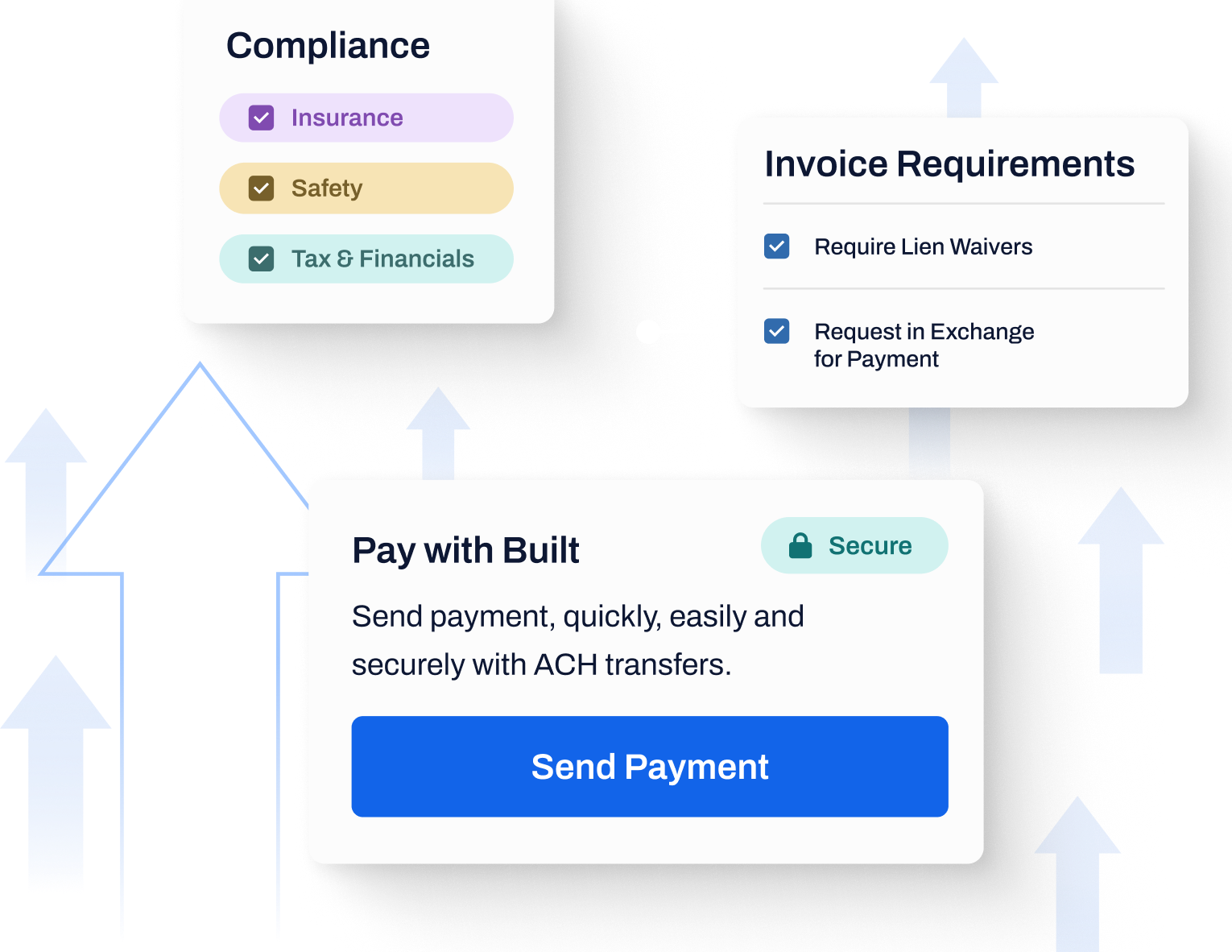

- Integrated document and compliance tracking: Built creates a single source of truth for every loan. It centralizes all project documentation, including contracts, budgets, lien waivers, and inspection data. This provides an audit-ready trail, ensuring compliance and giving lenders a complete, up-to-date record for every project without having to search through scattered files.

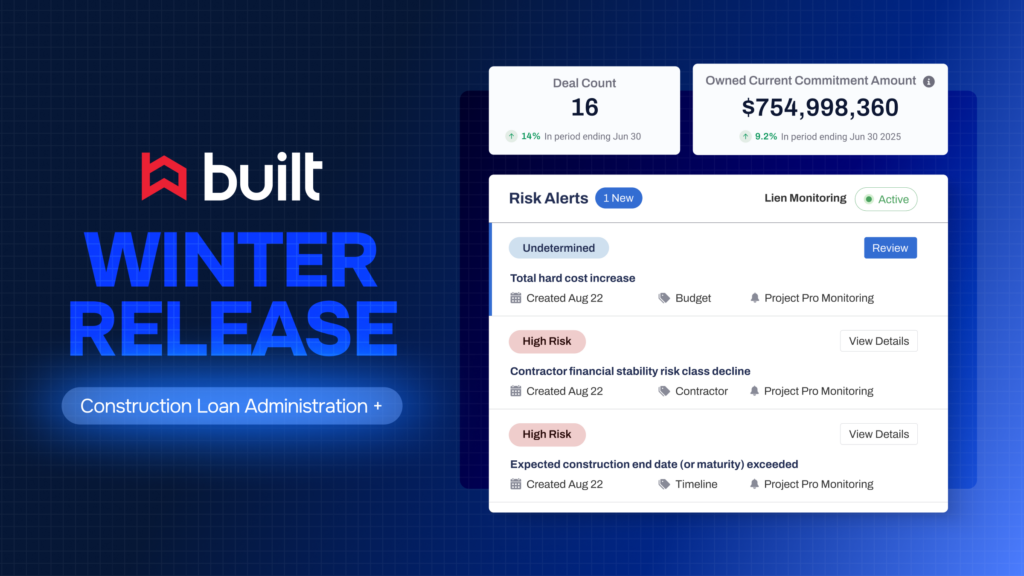

- Real-time risk mitigation: Built provides a risk dashboard with real-time insights into a project’s health. It goes beyond basic loan tracking to flag potential issues as they happen, such as budget overruns, unexpected delays, or expiring permits, allowing lenders to address risks proactively rather than reactively.

- Cloud-based collaboration: Built’s modern solutions are built for secure, centralized collaboration. All stakeholders (lenders, borrowers, inspectors, and contractors) can access relevant project information from anywhere, ensuring everyone is working from the same, up-to-date data. This eliminates communication bottlenecks and improves teamwork, keeping projects on schedule.

The Payoff: Unlocking Capacity and Gaining a Strategic Edge

Moving beyond generic software is not just about fixing a problem; it’s about gaining a significant competitive advantage. By adopting a purpose-built solution, lenders can fundamentally transform their business model to achieve greater scale and profitability.

Unlock lending capacity

Automating the complex draw process is the key to solving the capacity constraints pain point. By eliminating the manual, repetitive tasks that consume your team’s time, you free up valuable resources.

This allows your lending team to focus on revenue-generating activities like sourcing new business, strengthening client relationships, and structuring deals, rather than being bogged down by administrative work.

The result is the ability to double your lending capacity without a corresponding increase in overhead.

Improve the borrower experience

In a competitive market, a seamless and transparent process is a powerful differentiator. When borrowers and builders can submit draw requests easily and receive funds faster, it builds trust and strengthens the relationship.

A purpose-built platform provides a fast, predictable, and transparent experience that generic software simply can’t match, ultimately helping you attract and retain high-quality clients.

Mitigate portfolio-wide risk

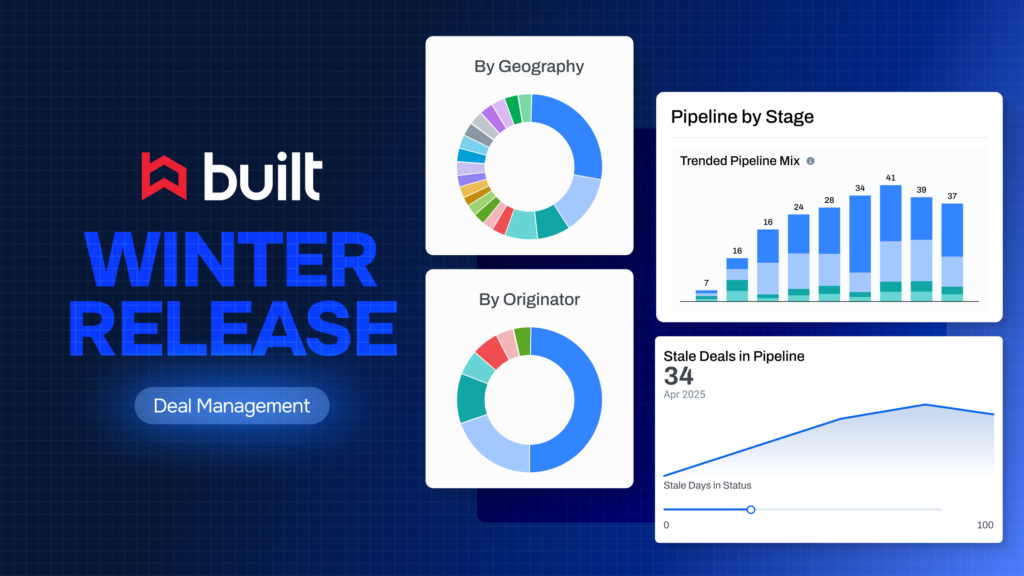

With a specialized solution, you move from a reactive to a proactive risk management posture. By centralizing all project data and providing a real-time dashboard, you gain a constant view of your entire portfolio’s health.

This allows you to identify and address potential risks, such as over-disbursement, cost overruns, or non-compliance, before they escalate. This level of insight protects your assets at scale and gives you the confidence to grow your portfolio responsibly.

The Future of Loan Management is Here

Ultimately, the future of construction lending is about adopting a purpose-built platform that is designed to solve the specific problems of the industry.

The move to a specialized solution is no longer a luxury; rather, it’s a necessity for any lender looking to scale their business, mitigate risk, and lead in a competitive market.

Built is that purpose-built solution, designed to help you solve your draw ops bottlenecks and capacity constraints. Book a demo today to see how we can help you unlock your lending capacity.