The Real State of CRE in 2025: What Community Lenders Should Know Now

Headlines paint a chaotic picture of CRE: surging industrial and multifamily, struggling office, and cautiously returning investor appetite. The hard data, however, tells a clearer, less dramatic story.

The FDIC’s Q2 2025 report shows the banking industry on solid footing. Asset quality remains “generally favorable,” with PDNA at 1.50%, well below pre-pandemic levels. Community banks outperformed, posting 12.5% higher net income. The number of “problem banks” is also in line with historical norms at 59.

While stress persists, it’s not spiraling: MSCI data shows more distress was resolved than added last quarter for the first time in nearly two years, indicating market stabilization. Distress remains concentrated in office, while industrial and multifamily strengthen. Concurrently, lenders are stepping up: The MBA reports commercial/multifamily originations jumped 66% year-over-year in Q2, with banks doubling their activity.

The clear picture: CRE isn’t collapsing, it’s recalibrating.

Where the CRE Market Really Stands Today

Despite noisy headlines, the underlying CRE environment is clearer and more stable. Stress is visible and manageable, not systemic. Three themes define the moment.

1. Selectivity is the new normal

Lenders aren’t retreating from CRE; they’re being more deliberate.

The July 2025 Fed SLOOS shows banks tightened standards on most commercial real estate loans, especially construction and non-farm nonresidential. Smaller banks reported more tightening than large ones, reflecting caution around office, rising operating costs, and refinance risk.

Demand for CRE credit softened modestly, particularly for construction and non-owner-occupied assets. This created a gap, causing borrowers to increasingly prioritize trusted relationships.

What this means:

Credit hasn’t dried up. It has shifted toward relationship-driven lending and disciplined underwriting.

2. Activity is thawing

While credit standards tightened, real lending activity is picking up quickly.

The MBA’s Q2 2025 originations report shows commercial/multifamily lending up:

- 66% year-over-year

- 48% quarter-over-quarter

- 108% YoY growth from depository institutions

Industrial, healthcare, and retail led the gains, and even office lending surged 140% YoY from very low 2024 levels.

This aligns with broader market trends: investor appetite is returning, leasing activity is up in industrial and multifamily, and lower rates are expected to support transaction volume into 2026.

What this means:

Capital is flowing again, but selectively. Lenders who can respond quickly, manage draws efficiently, and maintain clean files are the ones capturing this rebound.

3. The risk is measurable, not mysterious

Regulators, lenders, and investors are aligned on the areas to watch, and that clarity is part of the opportunity.

- Office remains the core stress point. MSCI data shows office accounts for nearly half of all known distress, though the pace of new distress formation has slowed.

- Refinance risk is real but visible. The OCC’s FY 2025 Supervision Plan highlights office vacancies, multifamily expense pressures, and maturity exposure as top priorities, with regulators urging banks to ensure sound concentration management and renewal practices.

- Asset quality remains solid. Community bank credit performance continues to outperform the industry aggregate.

- Distress isn’t spreading. More distress was resolved than added last quarter for the first time in nearly two years, according to MSCI.

What this means:

Because the risks are concentrated and well-defined (office exposure, rising operating costs, and maturity walls), lenders with strong portfolio visibility and disciplined construction-loan administration can navigate them confidently.

Why Community Lenders are Uniquely Well-Positioned

The current CRE cycle rewards lenders with tight credit discipline, relationship-driven portfolios, and strong balance-sheet fundamentals. By those measures, community banks are entering this phase from a position of strength. Three structural advantages stand out.

1. Portfolio performance outpacing the industry

FDIC Q2 2025 data shows community lenders outperforming on nearly every core credit metric:

- PDNA is materially lower for community banks (≈ 1.27%) vs. 1.50% for the industry.

- Reserve coverage remains robust at ~163%, well above pre-pandemic norms.

- CRE charge-offs remain low, with NCOs around 0.12%, despite broader sector stress.

- Profitability is strong, as quarterly net income rose 12.5%, NIM climbed to 3.62%, and pretax ROA hit 1.33%.

In a selective lending environment, regulators and investors reward banks that show consistent credit quality, and community lenders enter 2025 with exactly that footing.

2. A safer mix of CRE credit

Community banks’ CRE exposure is structurally different, and inherently less volatile than portfolios dominated by investor-owned properties. Below are two research-backed advantages:

More owner-occupied CRE, less speculative exposure

Academic and industry studies consistently show that owner-occupied CRE performs better in downturns due to:

- stable cash flow tied to the borrower’s operating business

- higher borrower commitment to property upkeep and repayment

- lower vacancy and market-cycle sensitivity

This mix helps explain why community banks’ PDNA and NCO rates remain well below industry aggregates even as office stress persists.

Relationship lending equals better early warning

Community banks maintain closer borrower relationships, which research shows leads to:

- earlier identification of financial stress

- faster restructuring or modification decisions

- lower default rates compared to transactional lending models

In a market where “visible risk” matters, relationship-driven insight is a real structural advantage.

3. Proactive balance-sheet rebalancing

Community and regional banks have not been passive observers; they’re actively adjusting portfolios to stay ahead of CRE risk.

Across the industry in 2025, banks have been:

- Rebalancing CRE exposure, including high-profile examples like Atlantic Union Bank’s $2B sale of performing CRE loans to Blackstone to free liquidity and reshape risk.

- Tightening underwriting selectively, especially in office and multifamily segments where operating expenses and refinance risks are rising.

- Increasing onsite inspections, tracking rent rolls, and monitoring liquidity to manage maturing loans in a higher-rate, lower-valuation environment.

- Adopting technology (cash-flow analysis, rent-roll automation, portfolio dashboards) to strengthen oversight and meet regulatory expectations.

- Engaging proactively with borrowers through quarterly check-ins, cash-flow stress tests, and refinance-readiness assessments.

These steps reflect exactly what regulators want to see: measured growth, strong controls, and forward-looking governance.

Why it matters now:

When lending standards tighten and exam scrutiny increases, lenders who’ve already rebalanced and modernized their portfolio-management approach are positioned to keep lending, while others pull back.

Where the Hidden Risks Still Live

Even with stable credit performance and improving market conditions, community lenders still face risks that don’t show up in macro headlines. The most significant threats today are operational blind spots that can quietly accumulate into supervisory, reputational, or financial problems if left unaddressed.

Two areas stand out.

1. Concentration visibility gaps

Most community banks know their CRE portfolios well. But many still struggle to see risk at the level regulators expect today—by collateral type, occupancy, rate vintage, maturity windows, and exposure to stressed segments like office or multifamily.

The OCC’s FY 2025 Supervision Plan emphasizes:

- stronger concentration-risk management

- clearer documentation of collateral values and credit utilization

- deeper review of maturity and renewal exposures

- refinements to risk ratings and credit-risk reviews

- forward-looking portfolio assessments, not reactive ones

These priorities reflect a simple reality: as refinancing risk builds and office values continue to adjust, banks need granular segmentation to identify where exposures cluster.

Why this is a risk:

Without this level of visibility, early warning signals can be missed, and examiners increasingly expect banks to prove they can quantify and monitor these concentrations in real time.

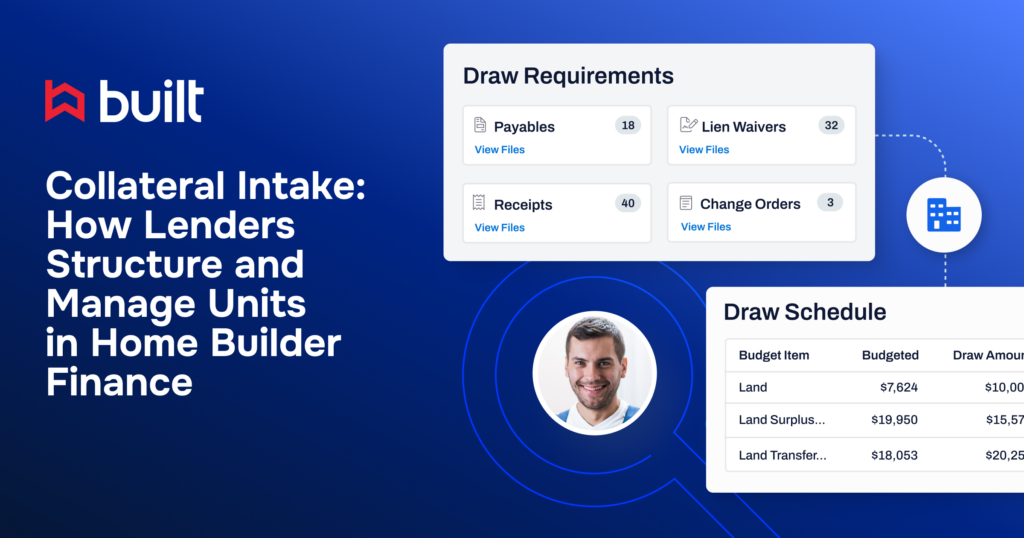

2. Construction draw administration weak spots

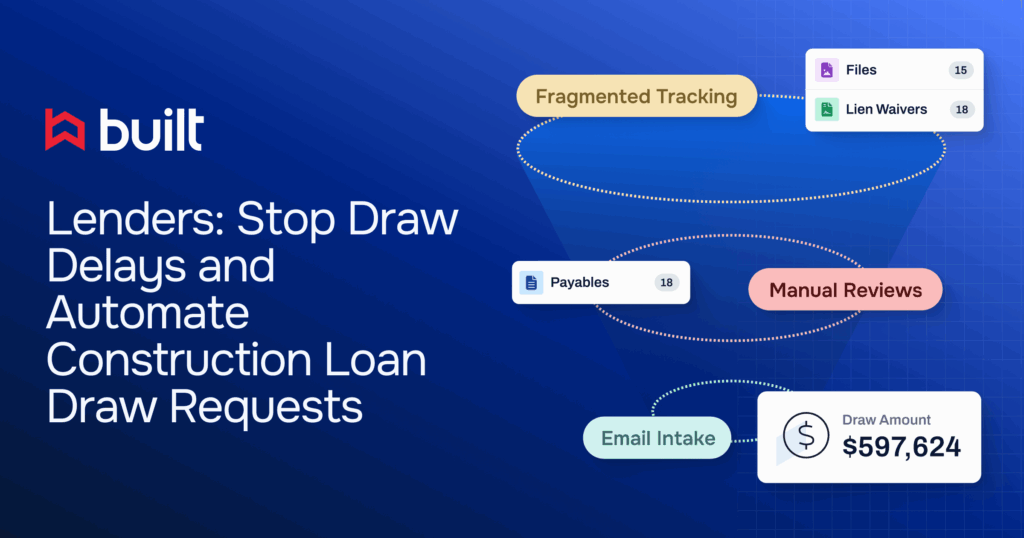

The second major blind spot is construction-loan operations—an area where even well-run institutions often rely on manual workflows that haven’t kept up with today’s risk environment.

Across the industry, manual draw processes create friction and vulnerability:

- skipped eligibility checks

- missing or inconsistent lien waivers

- delayed inspections

- mismatched invoices and budget line items

- fragmented documentation trails across email, spreadsheets, and file shares

These issues may seem small in isolation, but together they create regulatory, audit, and reputational risk, especially as construction pipelines expand again and lending standards tighten.

Built’s internal data (from the AI Draw Agent pilots) shows how common these operational misses are. In early-access deployments, the agent:

- flagged 90+ instances where required processes weren’t followed

- reduced draw-review times from 15–20 minutes to 2–3 minutes

- cut turn times from 6–8 days to ~1 day

- cleared weeks-long backlogs

- accurately processed thousands of inspection, HUD, and document reviews

- consistently caught missing or inconsistent documents and scope-change issues

These results highlight an important point: Operational variance, not credit weakness, is often the real source of draw-administration risk.

Why this is a risk:

Manual draw processes create inconsistencies examiners can trace directly to governance gaps. As volumes rise, they also slow borrowers down and strain frontline teams, even when credit performance is strong.

The Framework Lenders Need Now: Visibility, Standardization, Control

In a selective market defined by concentration risk, the most resilient lenders pair strong credit culture with repeatable operational systems. This framework is built on three pillars:

1. Visibility

Visibility means knowing your exposures with precision, not quarterly, but continuously. Regulators demand granular segmentation far beyond basic categories to identify cluster risk.

To manage exposure effectively, lenders need:

- Continuous, granular segmentation (asset class, occupancy, rate vintage).

- Real-time insight into emerging stress (e.g., DSCR declines, covenant breaches).

- Maturity mapping and line-item clarity inside construction budgets.

Built supports this level of visibility through integrated portfolio and project-level data, dashboards, and maturity insights, providing a real-time view into concentration points and early-warning signals.

2. Standardization

Where visibility shows the risk, standardization ensures every loan is administered the same way, every time.

Regulators are explicit: banks must maintain uniform processes, reliable documentation, and predictable controls across all CRE and construction workflows. Standardization eliminates inconsistencies caused by manual processes.

Standardization requires:

- Consistent draw workflows aligned with policy

- Uniform approval paths for inspections, budgets, and exceptions

- Automated checklists to ensure every requirement is met

- Audit-ready documentation generated as part of the process

This is where Built’s broader platform shines. It eliminates process variance through structured workflows, automated notifications, and centralized recordkeeping.

3. Control

The final stage is control: establishing policy-aligned guardrails that ensure consistency, document decisions, and escalate risk appropriately. Control is not restrictive; it gives lenders the confidence to lend with discipline.

Examiners evaluate control through questions like: Are decisions documented and traceable? Does the bank consistently apply its own credit and operational policies?

Effective control includes:

- Policy-aligned automation to enforce rules at the point of action.

- Clear escalation logic for risk triggers (overages, occupancy issues).

- Complete audit trails for every decision and action, including exception routing with rationale.

- Automated evidence capture (photos, budgets, invoices) to ensure documentation is always audit-ready.

Built supports this through platform controls and AI-enabled capabilities, offering policy-as-code enforcement, consolidated audit trails, and configurable rules for risk triggers. These capabilities provide control without slowing down lending volume.

Visibility ensures lenders see the risk, standardization ensures teams manage the risk consistently, and control ensures policy and compliance keep pace with volume. This is the model resilient lenders follow.

What This Means for Built

The themes emerging in today’s CRE environment: selectivity, disciplined growth, concentration visibility, and operational consistency, line up directly with what Built has always helped lenders achieve. As capital returns to the market and standards remain tight, operational discipline becomes a competitive advantage.

Built’s role is not to replace credit judgment or human expertise. It supports lenders by operationalizing the behaviors the market now rewards across four key areas:

1: Portfolio clarity that supports responsible growth

With refinancing risk, office bifurcation, and maturity walls increasingly in focus, lenders need real-time insight into portfolio exposure. Built’s platform is designed around that clarity — giving teams visibility into budgets, inspections, maturity timelines, and concentration points without waiting for month-end reporting cycles.

2: Standardization that builds confidence across teams and examiners

In a market where small process misses can create outsized audit findings, consistency is no longer optional. Built helps lenders move from manual, inconsistent workflows to repeatable, policy-aligned processes — making every draw, inspection, and approval follow the same playbook.

3: Controls that match the moment

The shift toward policy-aligned automation isn’t about speed. It’s about ensuring rules are applied consistently, escalations happen predictably, and decisions are documented.

Across early-access programs, lenders have already seen operational work shift from hours to minutes, backlogs disappear, and exception handling become clearer.

4: Automation that frees teams to focus on judgment, not paperwork

As origination volume increases, lenders with lean teams can’t afford to get stuck in manual document checks or fragmented reviews. Built’s broader construction administration tools and AI-enabled capabilities take on the repetitive, evidence-heavy tasks so credit and operations teams can spend more time on complex decisions, borrower engagement, and risk-sensitive files.

The lenders winning in this cycle are the ones who can move quickly without losing control. Built strengthens the systems those decisions rely on. In a market defined by visibility, standardization, and control, this is a strategic advantage.

The Market Isn’t Collapsing, It’s Evolving

Despite the noise, today’s CRE environment is a reset, not a crisis. The data is clear: credit performance remains stable, sector-specific stress is contained, and lending activity is returning with real momentum. What’s changing is how lenders need to operate.

Community lenders are built for this moment. Their relationship-driven models, safer CRE mixes, and longstanding credit discipline give them an advantage in a cycle where selectivity matters more than speed alone. And as the market shifts into a more disciplined phase, the lenders who lean into operational rigor will be the ones who continue to grow while others hesitate.

The winners in this next chapter will be the institutions that pair their relationship expertise with modern operational rigor, combining the judgment that has always defined community banking with the tools that bring consistency, confidence, and clarity to every decision.

For lenders ready to operate with intention, this cycle offers not just resilience, but opportunity.

Andy brings years of experience partnering with community and regional lenders to optimize their CRE construction lending programs. Leveraging a background in enablement, communications, and strategic leadership, he’s worked with hundreds of institutions to test workflows, train teams, and strengthen the controls that support safe, efficient draw administration. At Built, Andy focuses on making construction lending processes clearer and more consistent, ensuring lenders can move faster while maintaining confidence in every project.