Why Construction Loan Compliance Problems Only Show Up During Exams

Compliance failures and construction loan issues develop long before an exam begins. The regulatory process simply applies a level of scrutiny that many internal systems aren’t built to withstand.

During an exam, lenders must demonstrate an end-to-end management process rather than a collection of individual tasks. This transition often exposes the fragility of daily operations.

Systems that appear functional usually depend on manual workarounds and institutional knowledge. Regulators, however, look at the full picture, making these hidden gaps visible.

The Illusion of Day-to-Day Control

In daily operations, construction lending feels manageable because the work is compartmentalized. When tasks are divided among different people, vendors, and systems, each component appears to function as expected.

The typical workflow relies on a series of independent handoffs:

- Inspection and documentation: Loan officers order inspections, third-party inspectors report back days later.

- Legal and Title: Title updates are ordered and reviewed separately by closing or legal teams.

- Tracking and disbursements: Lien waivers arrive on their own timelines while accounting tracks availability in a separate system.

- Post-close compliance: Insurance and forms are often validated after the fact.

Individually, these steps feel secure. Each handoff seems reasonable, and every task has a check.

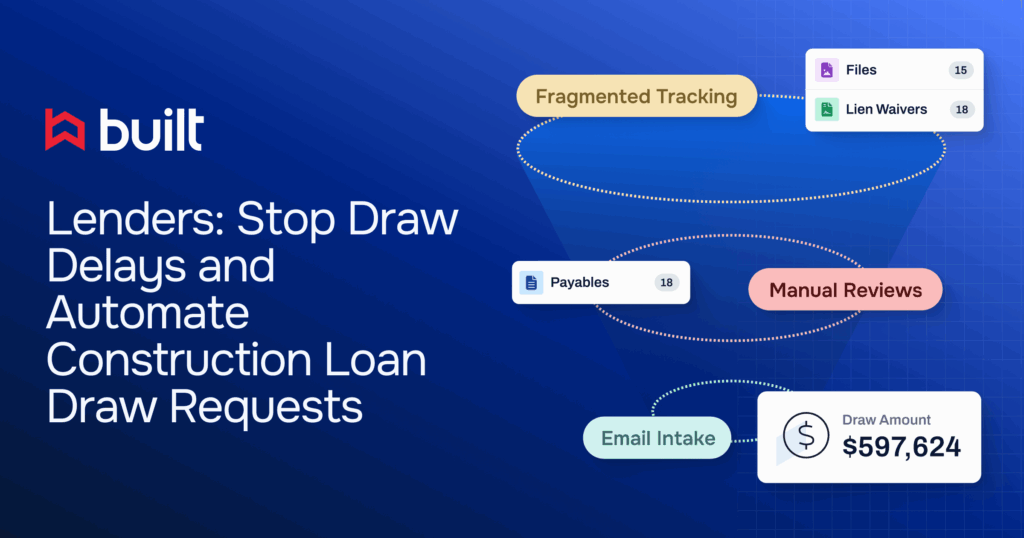

The risk of distributed responsibility

The underlying issue is that responsibility is distributed rather than centralized. No single person sees the full lifecycle of a draw in real time. Decisions are frequently made with partial information because the remaining data exists elsewhere, held by different people on different schedules.

This fragmentation creates a pattern of “minor” exceptions that eventually become standard operating procedure:

- Inspections report asynchronously, leading to draws moving forward despite progress variances.

- Lien waivers arrive late with the expectation that they will “catch up” eventually.

- Budgets and contingencies are tracked in spreadsheets outside the approval system.

As long as projects move forward and borrowers stay satisfied, the risk never feels acute.

What Examiners Actually Reconstruct

A regulatory exam is not a spot check. Rather, it is a reconstruction of decisions. Examiners walk a single construction loan forward draw by draw.

At each point where funds move, they ask one core question: was this decision authorized, documented, and supported by complete information at the moment of disbursement?

Examiners assume no prior institutional knowledge and rely solely on what the file proves in sequence.

The five tests of a draw

To evaluate the integrity of a loan, examiners test five elements simultaneously:

- Sequence: Did the inspection, title update, lien waivers, and approvals happen in the correct order?

- Timing: Was all documentation in the file before funds moved, or was it backfilled?

- Authority: Did the borrower, contractor, inspector, and loan officer each provide documented authorization within their specific limits?

- Consistency: Was the same process applied across every draw, or did controls loosen as the project progressed?

- Evidence: Can the lender prove each decision without relying on memory or email threads?

Where fragmentation collapses

In the daily flow, it is easy to overlook an inspection arriving a day late or a title update sitting with a closer instead of a loan officer.

Teams coordinate informally and trust fills in the blanks. An exam removes those assumptions. It forces every draw into a single timeline and asks the lender to prove that each decision was made with full visibility at the moment funds moved.

Specific Gaps Exposed by Reconstruction

When examiners reconstruct loans, the same small process breakdowns tend to surface. While they may seem minor in isolation, they compound into visible control failures.

Lien waiver gaps

In daily operations, funds are often released with the expectation that subcontractor waivers will arrive shortly after. Under an exam, this assumption fails. Examiners look for proof that waivers were obtained and validated before disbursement, using the correct form and state-specific language.

What felt like routine paperwork timing becomes a recorded control failure.

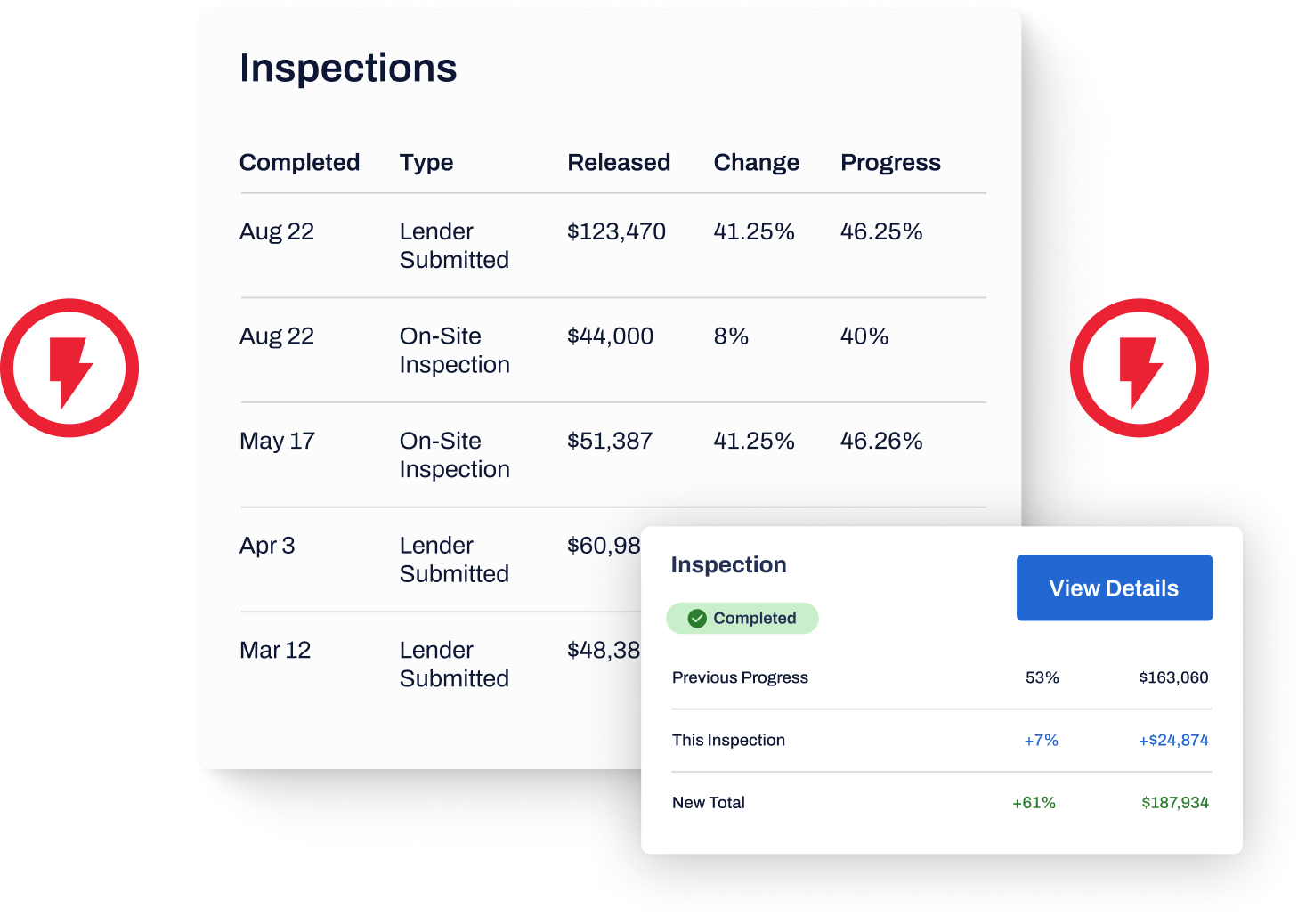

Inspection timing and variance drift

Draws are intended to match verified progress, but inspection timing often lags behind decision-making. If disbursements consistently run ahead of inspection-backed progress, the discrepancy becomes clear during a timeline reconstruction. The exam expects each draw to be fully supported at the exact time funds moved.

Title update timing failures

Title updates are frequently reviewed separately from the draw decision. If an update arrives after funding or is reconciled after the fact, the lender can’t prove that funds were released with confirmed lien priority.

What felt before like a day-to-day formality becomes evidence of weak draw controls.

Documentation inconsistency

Documentation often starts strong and becomes lighter as projects progress and teams become familiar with the borrower. Examiners, however, look for consistency. Missing change order approvals or incomplete late-stage draw packages signal that controls weakened over time.

Even if the project performed well, uneven documentation reads as a breakdown in discipline.

Contingency and budget blind spots

Day-to-day decisions often focus on the current request rather than the remaining budget. When contingency usage and remaining availability are not independently reconciled as part of every disbursement decision, over-advances surface.

What was a future problem before becomes a current finding once all draws are aggregated.

Why Gaps Persist at Well-Run Banks

These gaps exist not because of a lack of understanding, but because of competing priorities.

- Speed vs. control: Short-term incentives favor keeping projects moving and borrowers satisfied, even if some documentation is expected to “catch up” later.

- Delayed feedback: A late lien waiver or inspection variance rarely causes an immediate project failure. Without a triggering event, these gaps don’t register as risks.

- Organizational silos: No single team owns the entire lifecycle. Improving draw discipline requires changes across loan operations, accounting, compliance, and vendors, making system-level change difficult to prioritize.

- Scrutiny is episodic: Construction lending is continuous, but exams are periodic. This allows small exceptions to become entrenched habits long before they are viewed as a cohesive timeline.

Defining “Audit-Ready” Administration

Audit-ready construction lending doesn’t rely on after-the-fact assembly or memory. It’s built into the daily administration of the loan.

In an audit-ready environment, loans are managed through a single system of record:

- Draws can’t proceed until inspections, waivers, and title updates are verified.

- Sequence is enforced automatically.

- Documentation is captured at the moment of the decision.

- Every approval is tied to authority and evidence in one place.

Platforms like Built are designed for this operating model. Rather than layering compliance checks on top of fragmented workflows, Built embeds draw sequencing, documentation requirements, approvals, and audit trails directly into the construction loan process itself. The result is fewer surprises when exams happen.

This shifts the nature of the exam. Instead of preparing for scrutiny, the bank is simply demonstrating how the process already works. Examiners see consistency and transparency rather than fragments and explanations.

When Compliance Is Embedded, Exams Stop Being Disruptive

When compliance is embedded into the execution of the loan, regulatory exams stop being a process of reconstruction and start being a process of confirmation.

The takeaway for lenders is that audit readiness doesn’t come through preparation alone. Instead, it’s a byproduct of how construction loans are administered every day.

The real question is whether your current process would hold up if an examiner walked in tomorrow.

See how audit-ready construction lending works in practice.

Built is designed to embed draw sequencing, documentation, approvals, and audit trails directly into construction loan administration. If you want to see what that looks like day to day, talk with a member of our team.