Mastering Construction Loan Activity Tracking in Built: A Guide for Modern Lenders

In construction and commercial real estate lending, precision is the foundation of profitability and compliance. However, many lenders still rely on manual, error-prone processes, with a single misplaced decimal having the power to derail a project. Research shows manual data entry carries an error rate of up to 4%, a margin that multiplies across complex loan portfolios.

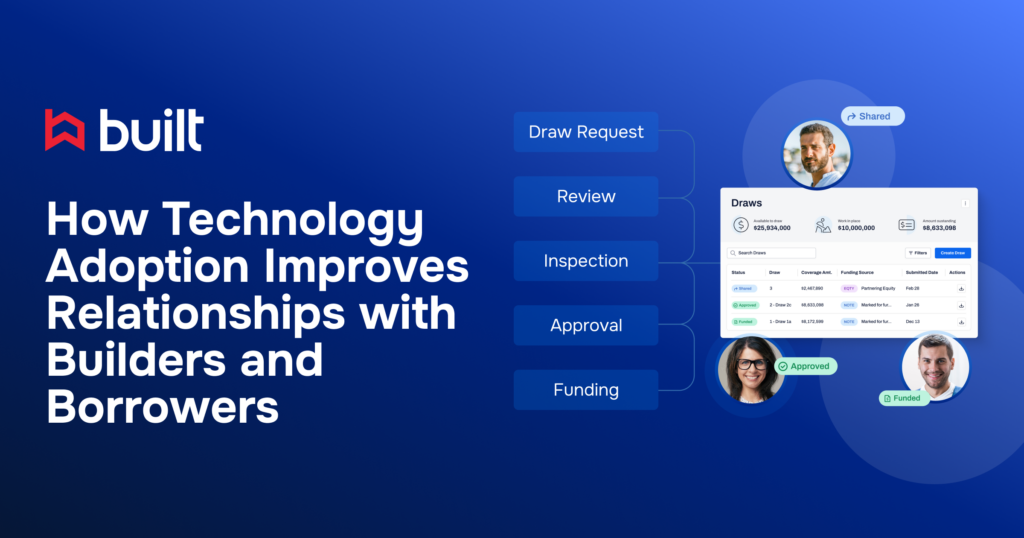

That’s why more lenders are moving beyond outdated workflows to eliminate bottlenecks. By digitizing construction loan activity tracking and origination, they’re reducing errors, speeding up execution, and freeing their resources and teams to focus on strategy instead of data entry.

This article, based on a recent Built webinar, will highlight the core functionalities that help lenders and financial institutions modernize, from managing disbursements and payments to reporting and draw corrections, so your team can operate with confidence in a fast-moving market.

Disbursement Methods: The Foundation of Accurate Tracking

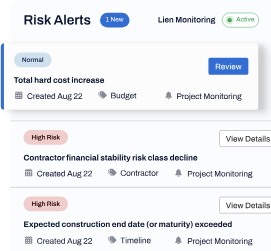

The value of accurate tracking extends far beyond the draw ticket; it’s a strategic advantage in a challenging market. In today’s U.S. lending climate, where commercial real estate delinquency rates have climbed significantly in 2025, a lack of visibility into your entire portfolio can create serious risk.

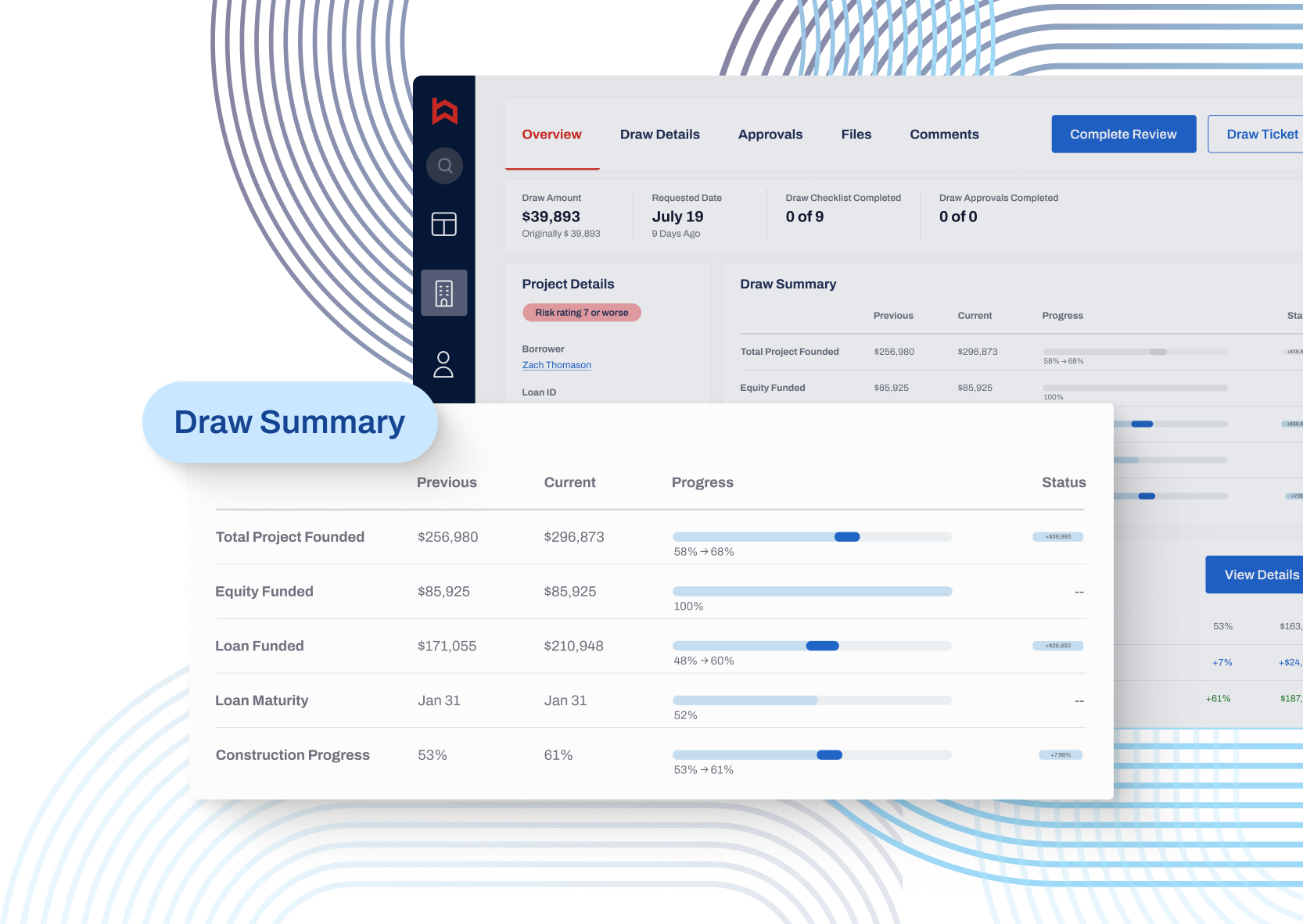

Built’s payment tracking functionality addresses this directly by empowering you to consistently log all financial activity, providing a true and up-to-the-minute picture of your portfolio’s health.

For lenders seeking to proactively manage and reduce risk, Built’s Transaction Report is a powerful tool. It provides an all-in-one view of all fund movement on a loan or across your portfolio, giving you the real-time data necessary to manage portfolio risk, reducing exposure to project risk and costly change order delays.

Meticulous tracking also safeguards against significant compliance risks and financial penalties. With IRS penalties for misfiled 1099 forms ranging from $60 to $330 per form (and reaching up to $660 for intentional disregard), a platform that simplifies reporting is an important risk-management tool.

The Built 1099 Report is specifically designed to address this by capturing all disbursements tied to a builder company, helping you maintain a clear audit trail and simplifying a high-stakes process.

Data Connections and Draw Corrections: Unifying Your Systems

While a single platform is a powerful tool, its true potential is unlocked when it connects to the rest of your ecosystem.

In the U.S. lending sector, data silos and disconnected systems create costly errors and operational friction. Fragmented systems are notorious for producing duplicate entries and inconsistent data, translating into costly reconciliation work and higher audit risk. It’s why a “single source of truth” is no longer a nice-to-have but, rather, a market-wide driver for technology adoption.

Built directly addresses this by offering robust data connections that sync information from your core systems. This helps to mitigate the significant financial losses that companies with fragmented workflows face.

A key outcome of this live data connection is Built’s Discrepancy Report, which identifies mismatches in funded balances or maturity dates. This proactive approach is a necessity for reducing fraud exposure and ensuring accurate financial records.

Mistakes happen in any workflow, but a unified system makes corrections transparent and accountable. Built’s dedicated correction draw feature ensures a clear audit trail. This helps lenders maintain the hierarchy of control and documentation necessary for proactive risk portfolio management in today’s demanding market.

The Future of Lending Is Built on Digital Foundations

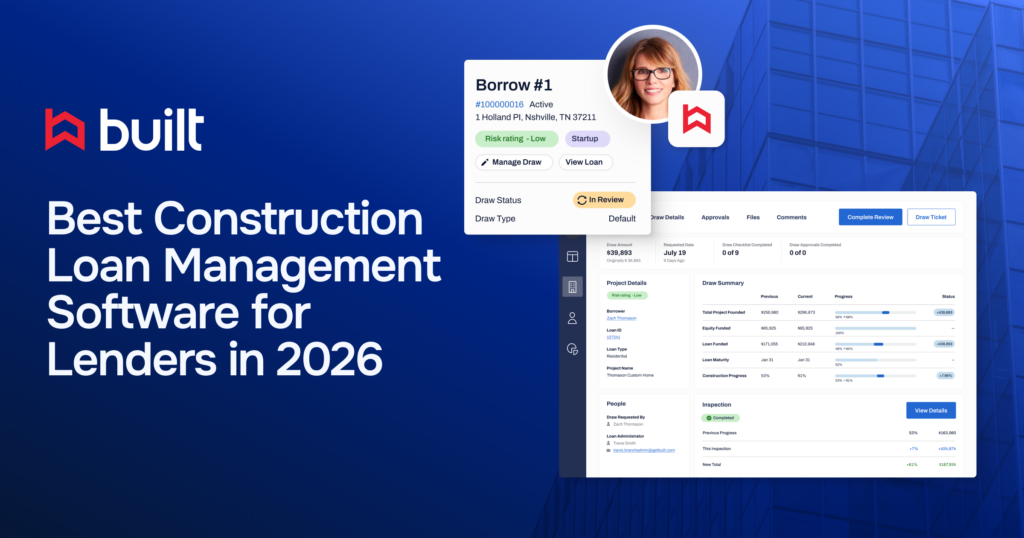

The takeaways from this guide are clear: in a complex lending environment, a digital foundation is no longer a luxury. It’s the key to protecting your portfolio and scaling your business.

By mastering the core functionalities of a platform like Built, you are fundamentally modernizing your entire operation. Loan officers, credit analysts, and bankers alike benefit from real-time access to loan data, borrower records, and construction progress, eliminating the manual processes and exceptions that slow down underwriting and compliance.

Other lenders are already leveraging these capabilities to analyze investments, streamline tax return handling, and enhance customer information management. The ROI is undeniable: financial teams adopting real-time technology reclaim 70% to 80% of their time, redirecting hours once lost to reconciliation into strategic growth and portfolio performance.

The need for a “single platform and source of truth” is now a market-wide priority. By unifying systems, lenders can improve efficiency, strengthen customer relationships, and ensure their teams can act with confidence in a rapidly changing industry.

Ready to Modernize Your Lending Workflows?

To learn more about how Built’s platform can help you mitigate risk, improve compliance, and streamline your operations, request a demo today.

Construction Loan Monitoring FAQs

How does the auto-balance feature affect disbursements on a draw?

The auto-balance feature automatically creates transactions for you, which affects disbursements on a draw. If a default disbursement method is set, the system will automatically apply that method to the transaction. If no default is set, you can manually select the fund’s destination after the transaction is created.

What are the data limitations for the real-time draw integration?

The webinar addressed data limitations for the real-time draw integration by referring to a slide that listed the specific fields supported. For any additional fields, users should contact their account manager to discuss their specific needs.

Where can lenders track interest reserve sufficiency?

Interest reserve sufficiency can be tracked in the compliance risk dashboard. This metric provides a clear view of what percentage of a project is trending toward lower sufficiency in the interest reserve line item.

Does Built’s monitoring apply to commercial and complex homebuilder projects?

While the webinar’s main focus was on the residential experience, the hosts noted that much of the information holds true for commercial projects as well. Those with questions on complex home builder experiences, such as a Master Guidance Line, should reach out to the team for a separate conversation.