CMBS Lending in 2025: Market Momentum, Rising Distress, and Where Built Fits In

The CMBS market is entering one of its most complex periods in a decade. Issuance is accelerating sharply, credit pressure is building, delinquency rates are rising, and a major wave of maturities is fast approaching.

For lenders deeply familiar with securitized CRE finance, the operational demands of CMBS-disciplined underwriting, data accuracy, exposure monitoring, and servicer transitions are intensifying.

Below is a comprehensive look at where the market stands, the structural forces shaping lender behavior, and how modern data workflows can materially strengthen CMBS execution from origination through surveillance.

CMBS in 2025: A Market Reopening Under Pressure

The CMBS market has surged back to life in 2025. Private-label issuance in the first half of the year reached $59.55 billion, roughly 35 percent above 2024 and the strongest start in over fifteen years. Conduit channels are active, multi-borrower deals are resurfacing, and senior tranches are attracting consistent investor appetite. Liquidity is deep, pricing is competitive, and investors remain comfortable with high-quality collateral.

However, the recovery is uneven (as supported by CBRE analysis) . Appetite for AAA and AA tranches has not fully extended down the capital structure. BBB– and subordinate bonds continue to price wider, reflecting investor hesitation around credit risk, property fundamentals, and valuation uncertainty. The market’s credit stress has not yet stabilized.

Credit pressure is building beneath the surface

Delinquency trends confirm the underlying strain. Overall private-label delinquency rates have exceeded 7 percent, and office delinquency rates have climbed into the low-teens in several indices. Loss severities on recently resolved loans, often between 65 and 80 percent, reveal how sharply valuations have reset across challenged sectors. Hybrid work, leasing friction, and higher debt costs continue to push office assets toward distress at a pace the broader market has yet to fully absorb.

These pressures intensify as the industry approaches one of the largest maturity waves in the past decade. Approximately $150.9 billion in private-label CMBS is scheduled to mature in 2025, including more than $63 billion requiring payoff or refinancing. Nearly a quarter of that volume is tied to office assets, many of which cannot support their existing capital structures due to cash flow or valuation issues.

To navigate this maturity wall, borrowers are increasingly negotiating extensions, modifications, or equity infusions. The ability to manage this cycle depends heavily on early visibility into tenant rollovers, property-level cash flow changes, and market-specific performance-long before the loans hit the refinancing runway.

Velocity and risk are colliding

The combination of rapid issuance, widening distress, and a concentrated maturity wall makes 2025 a uniquely dual-track year. The market is open, but conditions are fragile. Lenders must balance transaction speed with heightened scrutiny, stronger stress-testing, and deeper exposure analysis.

Execution now demands ensuring that each asset’s fundamentals can hold up in an environment where refinance certainty is no longer assumed.

How Today’s Market Conditions Are Changing CMBS Execution

The resurgence of issuance is tightening credit standards. Committees and arrangers are pushing toward more conservative DSCR thresholds, higher debt yields, and deeper stress scenarios, especially for office-heavy collateral. Rating agencies are requiring clearer rationale behind assumptions previously taken for granted.

Underwriters feel this most in the level of supporting evidence needed to defend a deal. Inputs that once passed internal checks now require substantiated tenant operating performance, more granular lease-level sensitivity, and reconciliation across multiple valuation scenarios. Every input is questioned earlier and more frequently.

Data discipline becomes the competitive advantage

With conduit and multi-borrower pipelines active, data inconsistency is a major constraint. Tape gaps, rent roll discrepancies, and unaligned assumptions can push a deal out of sequence.

The lenders moving fastest are treating data completeness as a strategic capability. They clear credit more efficiently, sync with arrangers more easily, and avoid the late-stage clean-up that stalls execution. In a high-volume environment, clean data is speed.

Surveillance is continuous, not periodic

Rising delinquencies and valuation pressure have shortened the distance between an early-warning indicator and a potential servicing transfer. Asset managers now need in-cycle visibility into DSCR drift, variance from underwritten NOI, tenant rollover/concentration, and covenant proximity. Performance monitoring is an always-on discipline.

In a year where timelines are compressing, tape quality is an unofficial scorecard. Clean, consistent, CREFC-aligned tapes signal reliability and reduce noise for arrangers juggling multiple contributors. Conversely, messy tapes slow modeling, introduce questions, and can cause a loan to miss a compressed pricing window.

The Structural Realities That Magnify CMBS Pressures

CMBS lending demands operational precision because a single loan moves through many hands: originator, contributor, arranger, rating agencies, trustees, and servicers. Each handoff depends on the same core data being accurate, consistent, and defensible.

In calm markets, small inconsistencies are absorbed. In 2025, they are exposed. Higher delinquency rates and contested refinancings mean that underwritten assumptions are scrutinized again when assets stumble. The chain of custody is long, and poor documentation anywhere becomes a liability everywhere.

Excel creates fragility

Every CMBS lender relies on Excel for its flexibility, but this dependence comes with consequences. As models pass from underwriter to credit officer to capital markets, inputs change subtly, assumptions drift, and supporting data gets trapped in tabs that never make it into the tape.

These are symptoms of a workflow built on tools not designed for multi-party consistency. In a year with valuation resets and heavy rating-agency scrutiny, the cracks become visible.

Long-term accountability

Once securitized, loans are monitored for years. As more loans face refinancing pressure, special servicers intervene earlier. They first examine whether a loan’s performance aligns with the assumptions embedded in the securitization.

If the underwritten rent roll doesn’t match servicing files, or if the logic behind assumptions isn’t clear, lenders lose credibility and leverage in negotiations-especially when extensions and modifications are increasingly common.

Where Built Creates Advantage in Today’s CMBS Environment

The lenders navigating 2025 most effectively are reinforcing their credit discipline with systems that reduce friction, improve data continuity, and create visibility across underwriting, asset management, and capital markets teams.

Built’s role is straightforward: eliminate the operational friction that slows CMBS execution and strengthen the connective tissue between the people doing the work.

- Underwriting that holds up across the loan lifecycle: Built helps lenders capture the full context of a loan’s story-sponsor strength, market assumptions, modeled scenarios-so those inputs travel cleanly across every team. By preserving Excel workflows while making the underlying data reliable, the platform ensures consistency from origination through surveillance.

- Loan tapes that don’t delay execution: Built minimizes the gap between internal data and external requirements by generating CREFC-aligned data tapes directly from the system. This reduces manual cleanup, reconciles discrepancies, and ensures teams are working from unified information, preserving credibility when capital markets teams need it most.

- Continuous performance visibility: Performance drift is happening faster this year. Built provides lenders with real-time insight into how loans are tracking relative to base underwriting, allowing issues to surface before they escalate into servicing conversations. This live view of tenant health, rollover timing, and NOI trajectory provides a clearer picture of risk and leverage for extension negotiations.

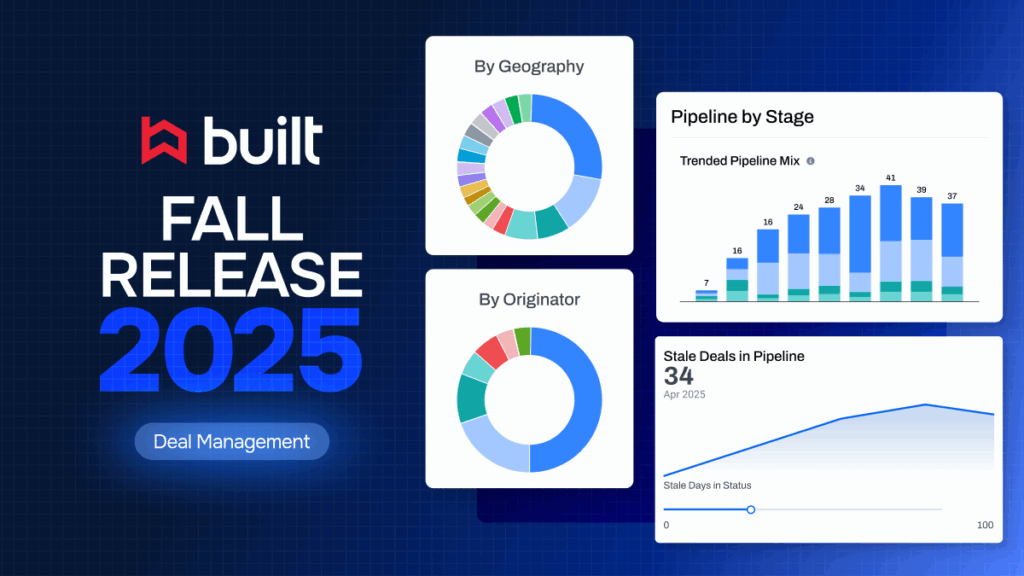

- Asset-level analysis that surfaces critical signals: CMBS pools depend on understanding exposure across dozens or hundreds of assets. Built’s dashboards are designed to quickly identify concentration risk-by tenant, market, property type, or sponsor. This ability to see patterns across a portfolio, like clusters of upcoming expirations or properties diverging from underwriting, is critical when timelines are compressed.

A Foundation for What Comes Next

The lenders who invest in the data foundation now will be best positioned to navigate the 2025 paradox: an open market with rising credit pressure, a moment that rewards speed but punishes sloppiness.

The firms that emerge strongest from this period will be defined by how well they manage the operational details-the integrity of a loan tape, the coherence of an underwriting model, the clarity of a tenant roster, the ability to see performance drift before it becomes distress. These are the quiet advantages that compound over time.

Technology doesn’t replace judgment; it amplifies it. It gives lenders the infrastructure to move quickly without losing control, to scale without sacrificing precision, and to navigate a market where opportunities and risks arrive at the same pace. In 2025, combining discipline with agility is no longer a differentiator-it’s the baseline.

Ally combines a deep understanding of commercial real estate with a passion for solving complex client challenges with technology. At Built, she partners with lenders and developers to design tailored workflows and technical solutions that streamline operations, unlock insights, and deliver lasting value.