The Best Construction Loan Software for High-Velocity Lending Teams

Construction lending is scaling faster than operations can keep up. As new projects surge and competition intensifies, lenders must process more draws with fewer people. Legacy back-office workflows (manual reviews, spreadsheets, and email approvals) weren’t built for this pace, and they create friction that slows disbursements and limits capacity.

High-velocity lending demands systems designed for construction finance, delivering speed, accuracy, and control. This is why average draw cycles still stretch seven to ten days, while purpose-built platforms like Built routinely fund in as few as two to three days, a capacity advantage we will detail in this article.

What High-Velocity Lending Teams Actually Need

For lenders evaluating construction loan software, the focus is finding systems capable of accelerating throughput while maintaining strict control. The best solutions share five defining traits:

1. Centralized draw management

High-velocity lenders eliminate the chaos of email and spreadsheets with centralized, configurable queues that route every request through a single system of record. These systems streamline intake, assignment, and approval, maintaining a clean audit trail for every draw.

2. Automated compliance guardrails

Compliance is often the biggest bottleneck. Modern software removes this burden with automated document validation, which instantly flags expired or missing lien waivers, insurance certificates, and inspections before approval. This turns reactive checks into proactive oversight.

3. Real-time portfolio visibility

Static spreadsheets can’t keep up. High-velocity lenders depend on real-time dashboards that surface live indicators (budget variance, stale inspections, delayed draws) so risk teams and executives see the same information at the same time.

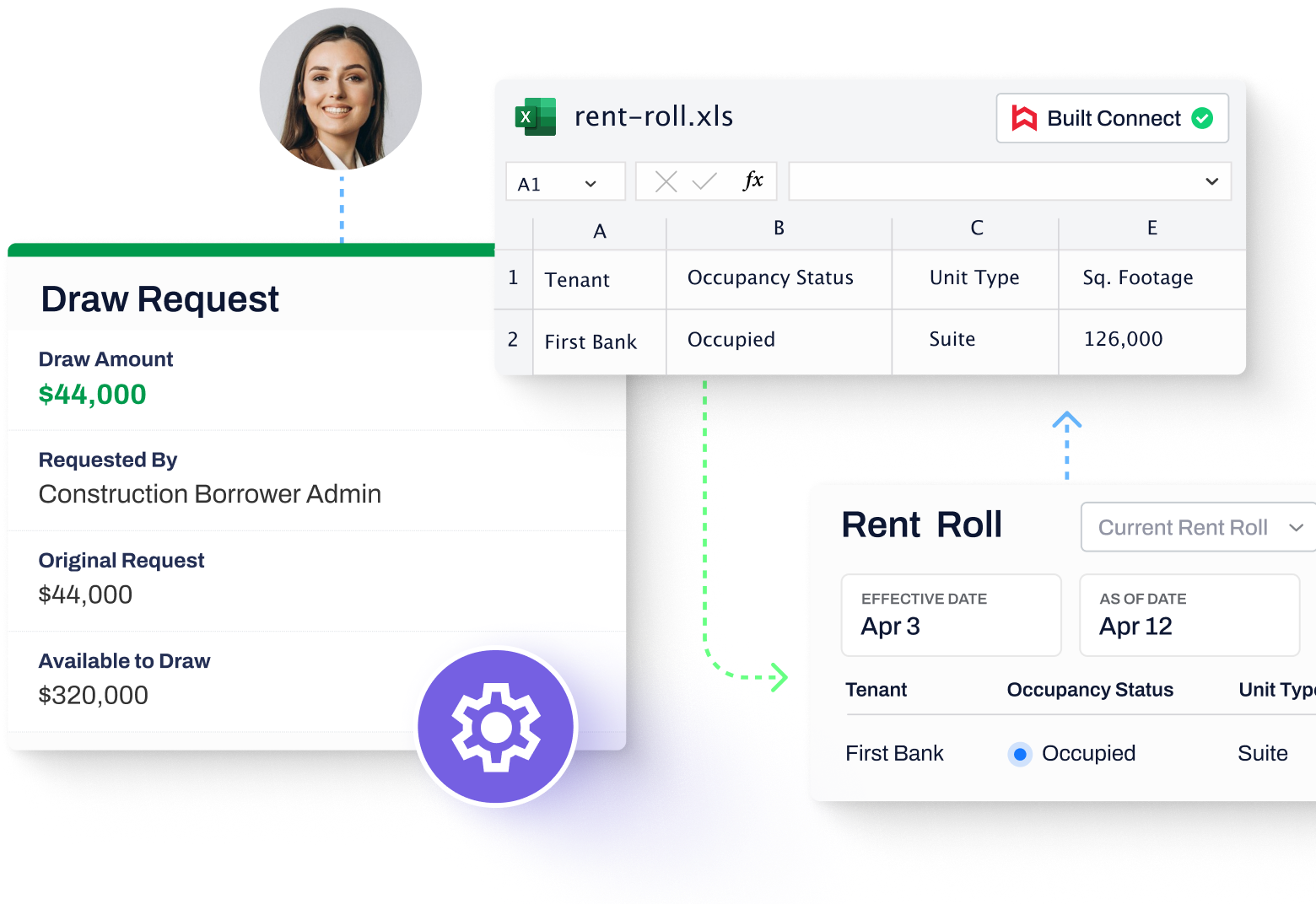

4. Integration with core systems

Effective platforms integrate directly with loan origination, servicing, and accounting systems through secure APIs. This eliminates duplicate data entry and ensures consistent, accurate reporting across the institution’s entire tech stack.

5. Scalability without headcount growth

The ultimate test is capacity. Lending teams measure success by how much volume each administrator can handle. Purpose-built automation must unlock capacity that generic systems simply can’t match.

The Construction Loan Software Landscape (2025)

Construction lending carries unique operational risk, making precision essential. The following comparison outlines the leading software categories lenders evaluate today, highlighting each platform’s core focus and where they fall short for draw-intensive lending.

| Software | Type | Key Focus | Limitations for Construction Lending |

| Built | Purpose-built CLM platform | End-to-end construction loan lifecycle management, draw automation, and compliance tracking | Designed specifically for construction and CRE portfolios. |

| nCino | General LOS | Loan origination and digital banking workflows | Post-close functions are manual, lacks integrated draw automation or lien waiver tracking. |

| Wolters Kluwer | Compliance-focused | Regulatory documentation, disclosures, and audit trails | Does not manage inspections, budgets, or construction-specific disbursement processes. |

| BankLabs | Niche CLM | Construction lending and participation management | Limited scalability and integration depth for large, enterprise portfolios. |

| Abrigo | Credit and risk platform | Loan review, CECL, and credit administration | No built-in draw management or lien tracking features. |

Built is the only platform in this group designed exclusively for the end-to-end construction lending lifecycle.

The Broader Shift Toward Automation in Construction

The construction industry is undergoing a major digital inflection point, driven by chronic labor shortages and mounting productivity pressures. Automation and AI are moving from pilot projects to everyday operations.

This shift is reflected in overwhelming industry investment intentions: according to the 2025 State of Workforce Planning Report by Bridgit and Construction Dive, 98% of construction leaders plan to increase technology investments, while BDC Network’s August 2025 analysis found that sentiment toward automation jumped from 74% in 2024 to over 95% in 2025. Together, these trends highlight the urgency of replacing manual workflows still used by 71% of firms with connected, data-driven systems.

As construction teams digitize workflows and embed intelligence across their processes, lenders must also evolve. Purpose-built lending platforms represent the financial side of that same transformation, bringing automation, visibility, and speed to the capital workflows that fund modern construction.

Why Generic Systems Can’t Compete and What Built Does Differently

Generic loan management systems were never built to handle the complexities of construction draw management. They handle origination well enough but slow down disbursements and obscure risk once projects begin.

| Generic System Limitation | The Built Advantage |

| Fragmented Workflows reliant on email and manual data entry across disconnected tools. | Workflow Automation: Built’s centralized platform eliminates manual handoffs, allowing lenders to process two to three times more loans per administrator. |

| Delayed Disbursements with funding timelines that stretch to seven to ten days, causing project delays. | Faster Funding: Built routinely cuts draw cycles to two to three days, keeping projects on track and maximizing capital flow. |

| Limited Auditability where lien waivers, insurance, and inspections are siloed in folders or emails. | Lower Risk Exposure: Automated compliance checks flag missing items instantly, supporting a defensible compliance posture as FDIC and investor scrutiny intensifies. |

| No Real-Time Risk View assessed only retroactively via spreadsheets and quarterly summaries. | Proactive Oversight: Live dashboards surface issues like stale inspections or budget overruns instantly, enabling proactive management instead of reactive cleanup. |

The ROI of Purpose-Built Construction Loan Software

Modernizing construction loan management delivers measurable operational gains:

- Faster draws: Lenders using Built have reduced average draw processing times by nearly 50%, shrinking multi-day turnaround cycles to just two to four days. This accelerates capital flow and keeps projects moving on schedule.

- Higher team capacity: With centralized workflows and automation, administrators can manage significantly more active loans without expanding headcount. Zions Bancorporation, for example, increased portfolio volume by 50% after adopting Built.

- Streamlined reporting: Automated dashboards and export-ready reports eliminate manual spreadsheet work and speed up audits and investor updates—saving teams hours each quarter and reducing last-minute “fire drill” reporting.

- Reduced risk exposure: Built’s compliance checks and audit trails flag missing lien waivers, expired insurance, or outdated inspections in real time, helping lenders maintain oversight and minimize potential losses.

Rural 1st® also saw significant ROI gains after shifting to Built’s digital inspection and draw workflows. Loan officers eliminated hours of on-site travel by reviewing progress remotely through borrower-submitted photos, speeding up verification while reducing administrative load. This operational efficiency strengthened both borrower and builder relationships, even generating repeat business driven by the improved experience Built enabled.

Building the Future of High-Velocity Lending

High-velocity lending isn’t achieved by working harder: it’s achieved by working smarter. Lenders must automate manual processes, gain real-time visibility, and establish tighter control over every draw.

Generic loan systems slow down disbursements, obscure risk, and make scaling expensive. Purpose-built construction loan management software changes that equation entirely.

Built gives lenders the infrastructure to grow faster, safer, and smarter, turning operational bottlenecks into a competitive advantage.

See Built in action: request a personalized demo today.

Loan Management Software for Lenders FAQs

How can lenders speed up the construction draw process without adding staff?

Manual draw reviews, email-based approvals, and fragmented documentation slow everything down. By automating draw requests, approvals, and funding through a centralized system, lenders eliminate back-and-forth and reduce turnaround times (often processing draws 50% faster with the same team capacity).

What causes capacity bottlenecks in draw administration?

Most capacity issues stem from disconnected systems, inconsistent workflows, and repetitive manual reviews. When each administrator handles documentation, inspections, and funding approvals independently, productivity flatlines. Standardizing workflows through draw management software brings everything into one view, allowing teams to manage more loans without sacrificing control.

How does automation improve draw tracking and communication between lenders and builders?

Automated draw tracking keeps every stakeholder in sync. Builders can submit draw requests and upload documents digitally, while lenders see updates in real time. Automatic notifications replace follow-up emails, and missing document alerts prevent funding delays, creating transparency for both sides and freeing up lender capacity.