Where Construction Draw Reviews Lose Time and How AI Fixes Each Stage

Construction lending is complex. Reviews are labor-intensive, documentation-heavy, and costly to manage. Loan admins spend 60-80% of their time sorting through draw packages that can include hundreds of files, many of them incomplete, inconsistent, or covered in handwritten notes. At the same time, borrowers expect faster turnaround times than ever.

Because policies vary by lender, program, and region, every draw becomes a unique review cycle. Teams end up spending more time processing paperwork than supporting customers.

This article breaks down where time is lost in the construction draw workflow from intake and documentation review to validation, approvals, and funding, and it shows how AI automation removes the delays at each stage. The goal is a clear, grounded, before-and-after view of how lenders are moving from reviews that take days to reviews that take minutes.

Key takeaways

- Manual draw reviews lose time at every step, including intake, documentation, reconciliation, SOPs, and approvals.

- Built’s AI Draw Agent removes these bottlenecks by reviewing every document and applying policies automatically.

- Lenders see up to 95% faster reviews, same-day funding, and 2-5× more loans managed per admin.

Where Time is Lost in a Construction Draw Review

Even with strong processes in place, most lenders lose time in the same predictable parts of the workflow. The delays don’t come from one step. Rather, they compound across the entire draw cycle.

Here’s where teams get stuck.

1: Intake: Incomplete or inconsistent borrower submissions

The first slowdown happens before the review even starts. Borrowers submit files through email, spreadsheets, shared drives, and ad-hoc uploads. Critical pieces are often missing, mislabeled, or unclear, such as an invoice without a description, a lien waiver without signatures, or a receipt that doesn’t match the requested amount.

At this stage, the team’s job isn’t reviewing the draw: it’s assembling it. Administrators track down missing items, request clarifications, and rebuild the package into something reviewable. Until the missing pieces arrive, the draw simply can’t move forward.

This is pure administrative drag, and every incomplete submission extends the timeline.

2. Documentation review: Massive volume and unstructured data

Once the package is finally complete, an entirely different challenge emerges: volume. Draw packages routinely span hundreds of pages across invoices, inspections, permits, lien waivers, and supporting notes. Many arrive in inconsistent formats or with handwritten annotations that are difficult to interpret.

This isn’t about missing documents. It’s about too many documents.

No reviewer can realistically read every page on every draw while managing a growing portfolio. As volume increases, important details get missed, variances are overlooked, and compliance risks accumulate. The combination of fatigue and unstructured data is one of the biggest sources of exposure for lenders.

3. Budget reconciliation: Manual cross-checks across systems

Once documentation is reviewed, teams move into budget reconciliation, which is one of the most time-consuming parts of the process. Reviewers manually compare invoices, inspection photos, budget tables, and historical draw data to confirm that requested amounts align with completed work.

This means verifying that each invoice ties to the correct line item, checking that inspection evidence supports the request, and ensuring that prior draw activity was recorded accurately. It’s repetitive work that requires constant context switching across documents and systems, making it slow and prone to human error under tight timelines.

4. SOP and policy checks: Highly nuanced, lender-specific rules

Every lender applies its own set of policies to each draw review, such as permit requirements, insurance thresholds, overage allowances, inspection triggers, and other risk controls. These rules can also vary by region, program, and construction type, which adds another layer of complexity.

In many organizations, SOPs are partially documented or live mostly in the knowledge of veteran staff. That makes training difficult and leads to inconsistent application of rules. Two reviewers may interpret the same scenario differently, creating uneven risk mitigation across the portfolio.

5. Draw Checklist: Manual steps and little automation

Checklists should create clarity, but in most shops they create more manual steps. Requirements differ for first draws, final draws, rehab projects, CTP programs, and more.

Admins mark items complete or deferred by hand and often need to re-check what has changed since the last draw. Without automation, every checklist becomes another round of manual verification, and another opportunity for delay.

6. Approval and Funding: Cross-team handoffs slow everything down

Even after the review appears complete, approvals introduce a new set of bottlenecks. Credit, compliance, risk, and operations teams all need to weigh in. Draws sit in inboxes waiting for signoff, questions get routed back to admins, and funding gets pushed another day.

If anything in the package is missing or unclear, the cycle restarts: clarification, documentation gathering, re-review.

7. Audit and traceability: The final bottleneck

Even after a draw is approved, teams must document how the decision was made. That often requires pulling together emails, locating files across shared drives, and rebuilding the reasoning behind each step.

Creating a complete audit trail is slow, repetitive work, and any missing detail creates a non-compliance risk.

When these steps stack up, it becomes clear why draw reviews take days and why teams feel stretched as portfolios grow. Each stage adds friction, and every delay compounds the next. As loan volumes increase, the workflow slows even more, creating pressure on both turnaround times and risk controls.

This is the operational problem lenders are trying to solve, and AI is now positioned to be the solution.

How Built’s AI Draw Agent Replaces Each Manual Bottleneck

Built’s AI Draw Agent is designed to step into the exact points where the manual workflow slows down. It completes the same work loan administrators do today but with full context, consistency, and the ability to evaluate every document on every draw.

Below is how the agent maps to each stage of the construction draw process.

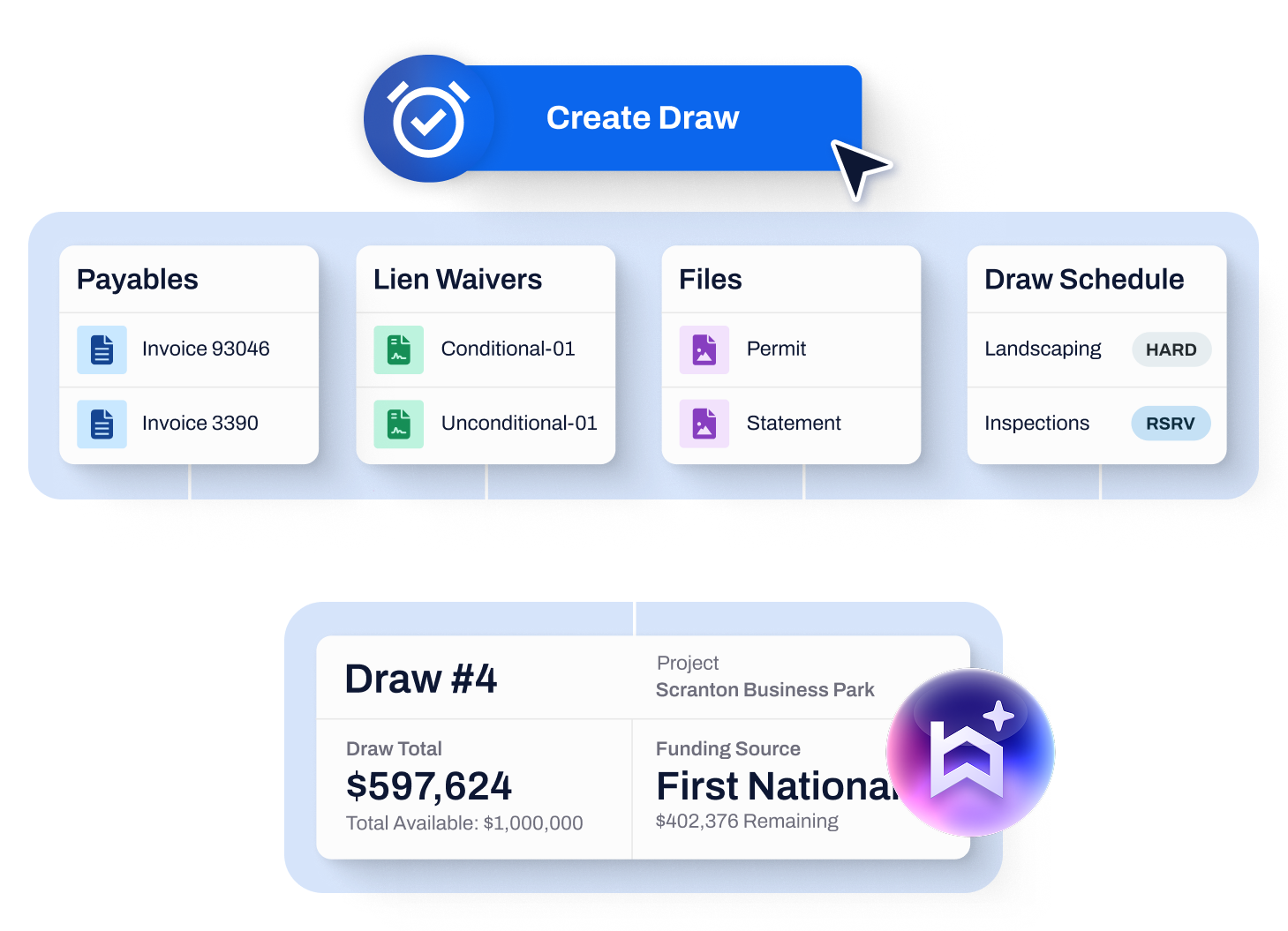

1. Intake: Complete, clean packages from the start

The agent reviews all incoming files as soon as they are uploaded. It checks for missing items, identifies inconsistencies, and flags unclear documentation before the review begins. By ensuring the package is complete upfront, it removes the early delays that typically hold up the process.

2. Documentation review: Reads every document, every time

Once the package is assembled, the agent processes every file associated with the loan: invoices, inspection reports, permits, lien waivers, prior draw information, and project files. It extracts key details and stores them as context so it can evaluate the draw holistically.

Reviewers can also search within documents or ask the agent for specific information without digging through the files themselves.

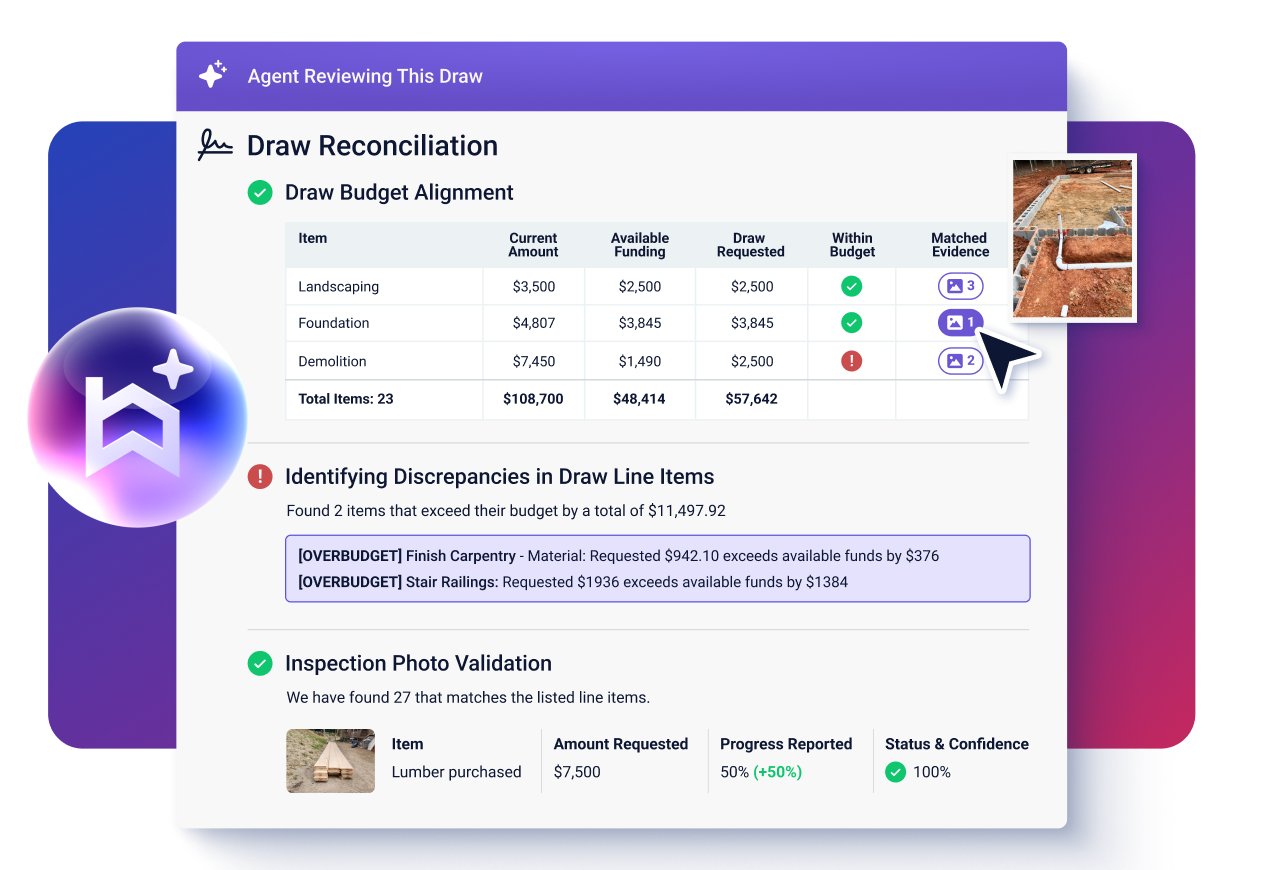

3. Budget reconciliation: Automatic cross-correlation

During reconciliation, the agent matches invoices to the correct budget line items and aligns inspection photos with the work being requested. It cross-checks all documentation tied to the budget and highlights any discrepancies immediately.

This eliminates the need for reviewers to move back and forth between systems, spreadsheets, and images to confirm amounts.

4. SOP execution: Your policies as code

Every lender operates with unique rules, thresholds, and risk controls. The agent applies those policies automatically, including regional variations or program-specific requirements. Built works with each lender to translate these policies into structured logic during a two-to-four-week onboarding period.

Every decision the agent makes is tied back to the exact evidence it used, creating consistency across all reviews.

5. Checklist automation: Loan- and draw-specific verification

The agent also completes lender-defined checklists for each draw or loan type. It evaluates all items using the data and documents already on the platform. Based on the lender’s rules, it can complete, defer, or waive checklist items and display its evaluation directly next to the checklist itself, giving reviewers a clear, unified view.

6. Approval pathing: Three modes that keep you in control

The agent adapts to the level of automation each lender is comfortable with.

- Audit mode: The agent reviews the draw and presents its findings for human decision-making.

- Assist mode: the agent performs actions and prepares decisions, but approvals remain with the reviewer.

- Automate mode: for draws that meet all policy requirements, the agent can complete the review and move it forward without human intervention.

These modes allow lenders to adopt automation at their own pace.

7. Funding: Fast processing when everything is clear

When a draw meets all policy requirements and the borrower approves, the agent can move the draw through final processing. In production environments today, this has enabled full reviews and approvals in minutes, including a documented seven-minute end-to-end draw.

8. Audit trail: Full transparency for compliance

For every draw, the agent produces a complete record of its actions. This includes the checks it performed, the evidence it used, and the decisions it made. Lenders can export a compliance-ready file at any time, providing clear traceability without the need to reconstruct the process from emails or shared drives.

Proven Performance from Live Lender Pilots

Across early adopters, the AI Draw Agent delivered measurable improvements in speed, capacity, and consistency. These results reflect real production environments and represent the impact lenders achieved within the first weeks of deployment.

Faster reviews and funding

Pilot lenders reduced draw review times by as much as 95%, moving from multi-day cycles to same-day turnaround. In production, the agent has completed full end-to-end reviews in as few as seven minutes, including borrower approval.

Greater capacity without adding headcount

Lenders saw a 2× to 5× increase in the number of active loans managed per administrator. One institution reached 496 loans per admin, and several doubled their capacity as automation scaled.

Higher accuracy and stronger controls

Across more than 50,000 automated tasks, the agent achieved 99.9% accuracy. Because it reads every document on every draw, lenders also identified twice as many risks compared to manual review, improving oversight without slowing down operations.

Consistent policy execution

The agent applied lender-specific SOPs with 100% adherence, ensuring that permits, insurance requirements, budget thresholds, and regional variations were enforced the same way every time. This consistency removed the variability that often appears when policies rely on manual interpretation.

What lenders are saying

Pilot participants emphasized both the speed and the quality of the reviews:

- “You’re going to have better results with this tool than the actual human that did it.” —Vice President, Post-Close Loan Operations

- “The ability for this to automate and give our team the equivalent of 10 extra people . . . was amazing.” —Senior Vice President, Director of Business Solutions

These results illustrate the operational lift lenders can expect when manual steps are replaced by continuous, evidence-based automation.

Why This Change Redefines Modern Construction Lending

The impact of the AI Draw Agent reaches beyond faster reviews. By removing the manual friction in the draw workflow, lenders gain a model that scales without adding headcount, applies policies the same way every time, and strengthens oversight across the portfolio.

Each draw is evaluated with full context, and every decision is backed by evidence, improving both precision and consistency.

This shift also changes the borrower experience. Faster, more predictable turnaround times keep projects moving and reduce the delays that frustrate builders and loan officers. It’s a more reliable process for everyone involved, one that reflects how modern construction lending should operate.

A New Standard for How Draw Reviews Should Work

The draw process has traditionally been defined by manual effort, fragmented steps, and long turnaround times. By automating the heaviest parts of the workflow, reviewing documents, reconciling budgets, applying policies, completing checklists, and preparing audit trails, the AI Draw Agent replaces that friction with a faster, more consistent model for construction lending.

The result is a process that scales without adding headcount, applies policies the same way every time, and gives teams clearer visibility into every decision. Borrowers and builders benefit from predictable turnaround times. Reviewers gain a system that handles the repetitive work so they can focus on true exceptions. And lenders get a workflow built for speed, accuracy, and control.

If you want to see how this looks in practice, you can watch the recorded demo from our recent webinar, where we walk through how the agent evaluates documents, flags discrepancies, applies SOPs, and generates a complete audit trail.