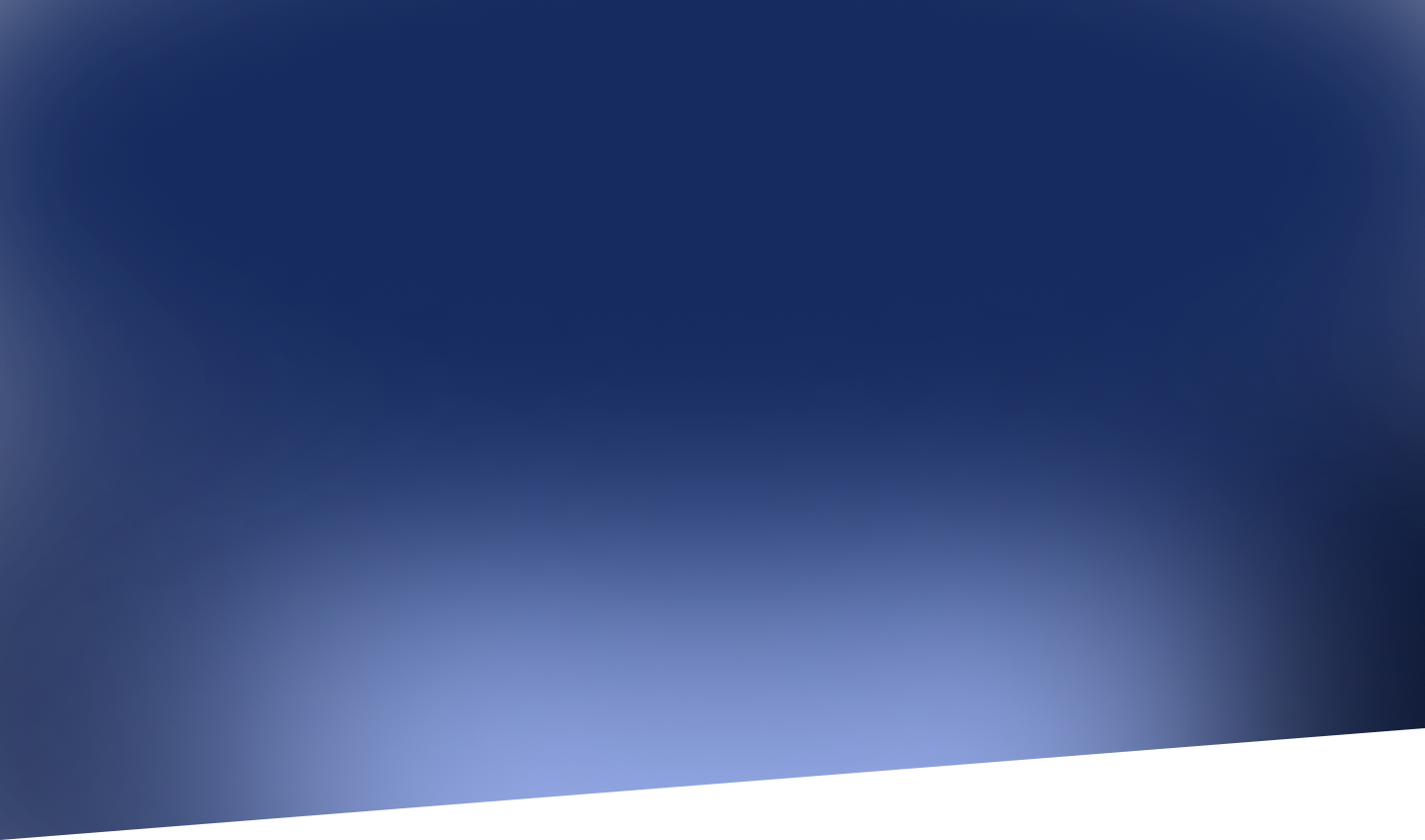

100% portfolio visibility with one click.

Work seamlessly from spreadsheet to synthesis for all of your commercial real estate deals with Built.

Manage your commercial real estate portfolio with ease.

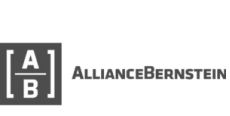

Centralize pipeline.

Pinpoint which projects in your pipeline are worth pursuing by leveraging our proprietary, two-way Excel integration.

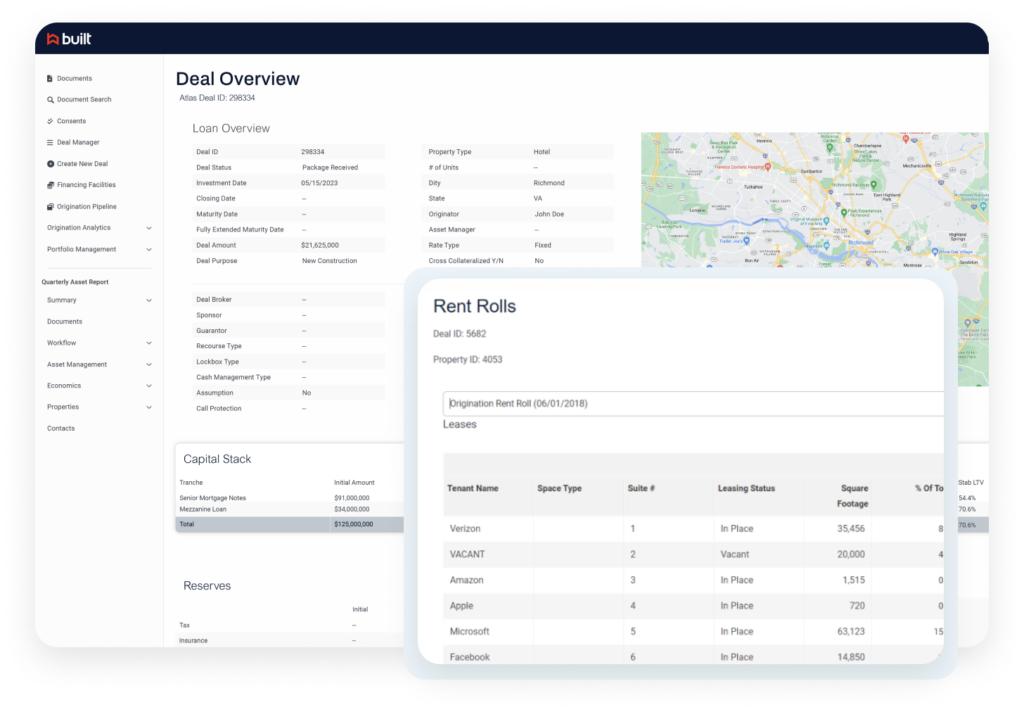

Digitize underwriting.

Centralize the information you need to evaluate the integrity, creditworthiness, and risk of a prospective client or project.

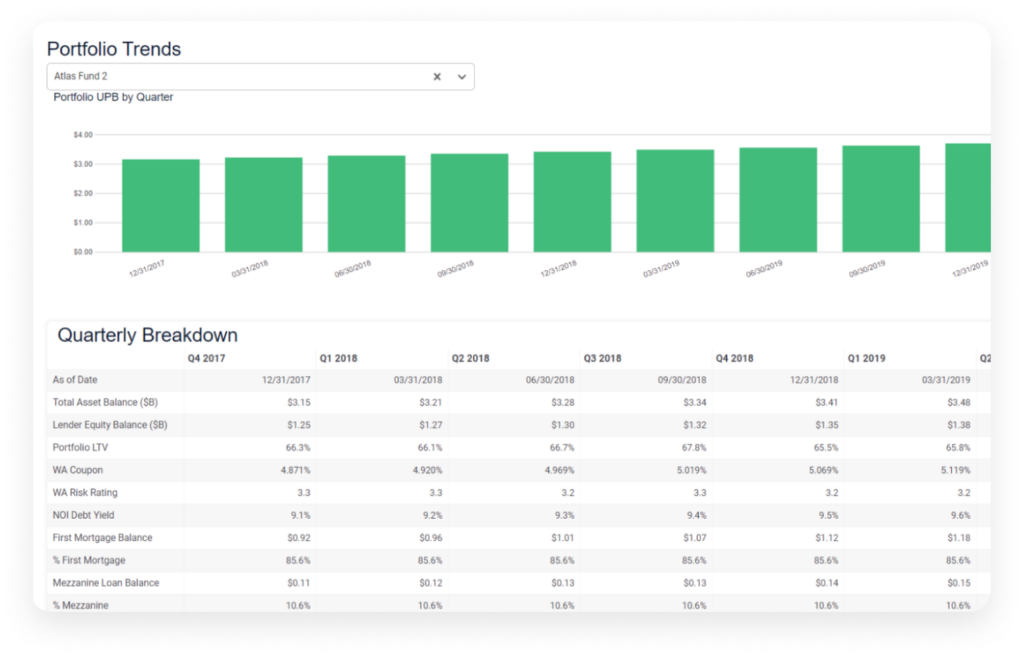

Simplify portfolio & asset management.

Harness your Excel data and centralize all of your asset level performance metrics in the cloud.

Trust & Security

Built’s priority is your security and data privacy, ensuring utmost confidentiality, so you can focus on your business with peace of mind.

- Secure Platform

Built Technologies prioritizes security, with a dedicated team implementing best practices, monitoring the environment, and continuously improving security measures.

- SOC Compliance

We maintain SOC 1 and SOC 2 Type II compliance, undergoing annual audits to validate our security controls and meet high industry standards.

- Robust Infrastructure

Our highly secured data centers in the US meet demanding security requirements, ensuring the confidentiality and integrity of your data.

- Comprehensive Security Program

We employ encryption, access management, vulnerability scanning, and secure software development practices to protect your information.