Transparent & Efficient

Consumer Loan Management

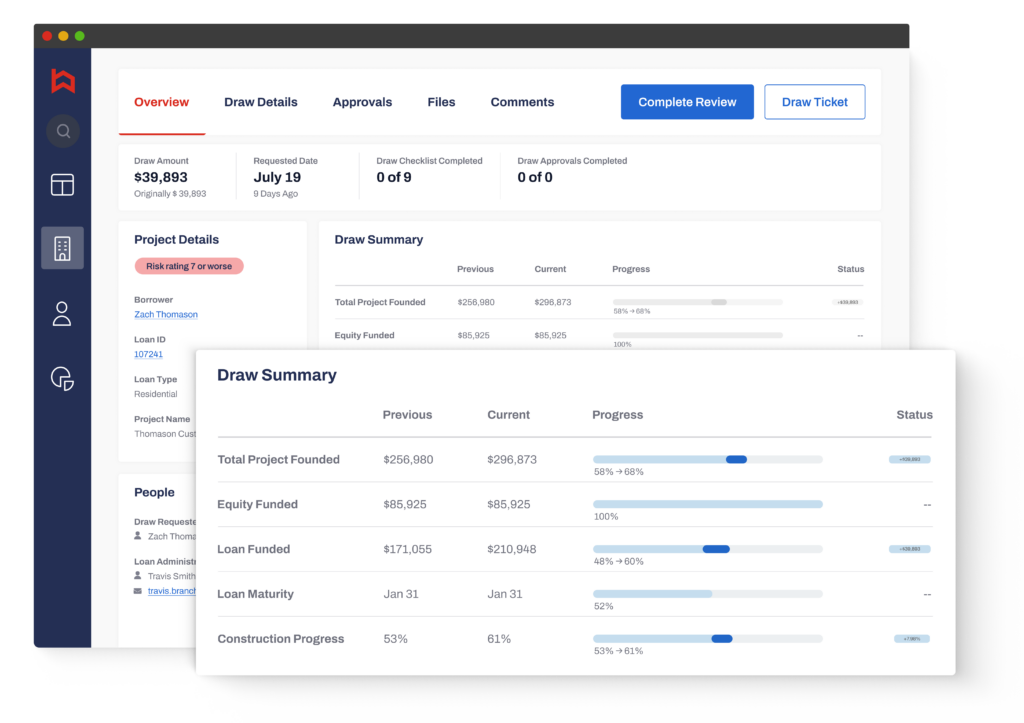

Excessive handoffs and manual processes make construction loan administration complex and inefficient—Built transforms the way loans are administered to eliminate complexities and increase efficiencies.

Our platform provides you with the ability to collaborate more efficiently while also streamlining your operations.

Single Family Residential Loans

Built expedites draw turnaround time, yielding increased interest income and happier customers. The digital, cloud-based platform improves project visibility and collaboration, providing information sharing between all key project stakeholders in one place. Built provides the online banking experience consumers expect for their construction loans, too.

Renovation Loans

Renovation projects often cause lenders, borrowers, and contractors unnecessary stress when managed manually. With legacy processes and systems, contractors have limited visibility, and lenders lack aggregated risk reporting. By bringing the process online, Built brings efficiency and transparency to a once risky and cumbersome process.

Eliminate Complexities & Increase Efficiencies

Provide an intuitive portal experience for key construction/renovation stakeholders including lenders, borrowers, contractors, and inspectors.

Set up clear draw administration workflows that result in increased administrative capacity and automate communication with key stakeholders at each stage of the loan process.

Enable collateral completion status through every stage of the process and ensure that projects are staying on track.

Provide proactive risk mitigation through real-time portfolio management and data insights with alerts to quickly identify at-risk projects and monitor data for portfolio trends to improve performance.

Automate and standardize draw and loan management processes maintains compliance with internal, regulatory, and agency requirements.