Real-Time Risk Management for Construction Loan Portfolios: Closing the Blind Spots

Construction loans remain one of the riskiest segments in commercial real estate finance. The latest delinquency data from Cred-IQ underscores this reality: FDIC-insured CRE loans hit a 1.70% delinquency rate in Q1 2025, with more than $31 billion in balances past due, with the majority already 90+ days delinquent.

The sector’s inherent volatility, fueled by budget complexity, volatile material costs, and complex lien issues, is compounded by traditional, reactive oversight. The greater challenge is how to manage the risks.

Quarterly reporting, reliance on spreadsheets, and siloed data create dangerous blind spots, making it impossible to catch issues before they escalate into losses. This traditional, reactive cycle transforms minor inefficiencies into costly delays that deplete reserves and erode confidence.

Real-time risk management replaces this hindsight with foresight, offering continuous control. To truly understand the power of continuous control, we must first examine the inherent and persistent failures of the legacy systems in place today.

The Flawed Status Quo: Why Traditional Oversight Fails

Lag and inaccuracy define traditional risk management for construction lending. Even today, the majority of credit teams rely on entrenched, manual processes that are fundamentally unsuited for the speed of modern construction.

1. The lag of manual processes

According to Enable, nearly 88% of accounting spreadsheets contain errors, which should be a stark warning for lenders who depend on manual reporting. Every formula error or missing entry not only compromises accuracy but also delays oversight by weeks, forcing credit teams to spend their time gathering data instead of managing risk.

- Scalability limits: In manual workflows, loan administrators typically max out at a few dozen active loans before bandwidth breaks.

- Reactive oversight: The result is a cycle of quarterly fire drills where teams drop everything to reconcile figures across multiple, often out-of-date spreadsheets. By the time reports are ready, the risks have already shifted.

2. The inaccuracy of inspection data

Inspection delays compound risk. Traditional visual progress reports often fail to reflect the true state of work, leaving lenders exposed when funds are released against incomplete or outdated data. In fact, a survey from Procore and IDC of more than 500 North American project owners found that 75% of projects went over budget and 77% finished late, with average delays of about 70 days and cost overruns of roughly 15%.

Broader global benchmarks echo the same trend: the majority of construction projects miss both cost and schedule targets, making reliance on manual or subjective inspections a direct driver of portfolio losses.

3. Compliance and portfolio blind spots

Missing lien waivers or gaps in insurance coverage frequently expose lenders to mechanics’ liens and uninsured losses, an issue specifically flagged by regulators like the OCC and Federal Reserve.

Furthermore, lenders often lack real-time insight into concentration or covenant risk until performance issues emerge or quarter-end reporting finally surfaces a breach.

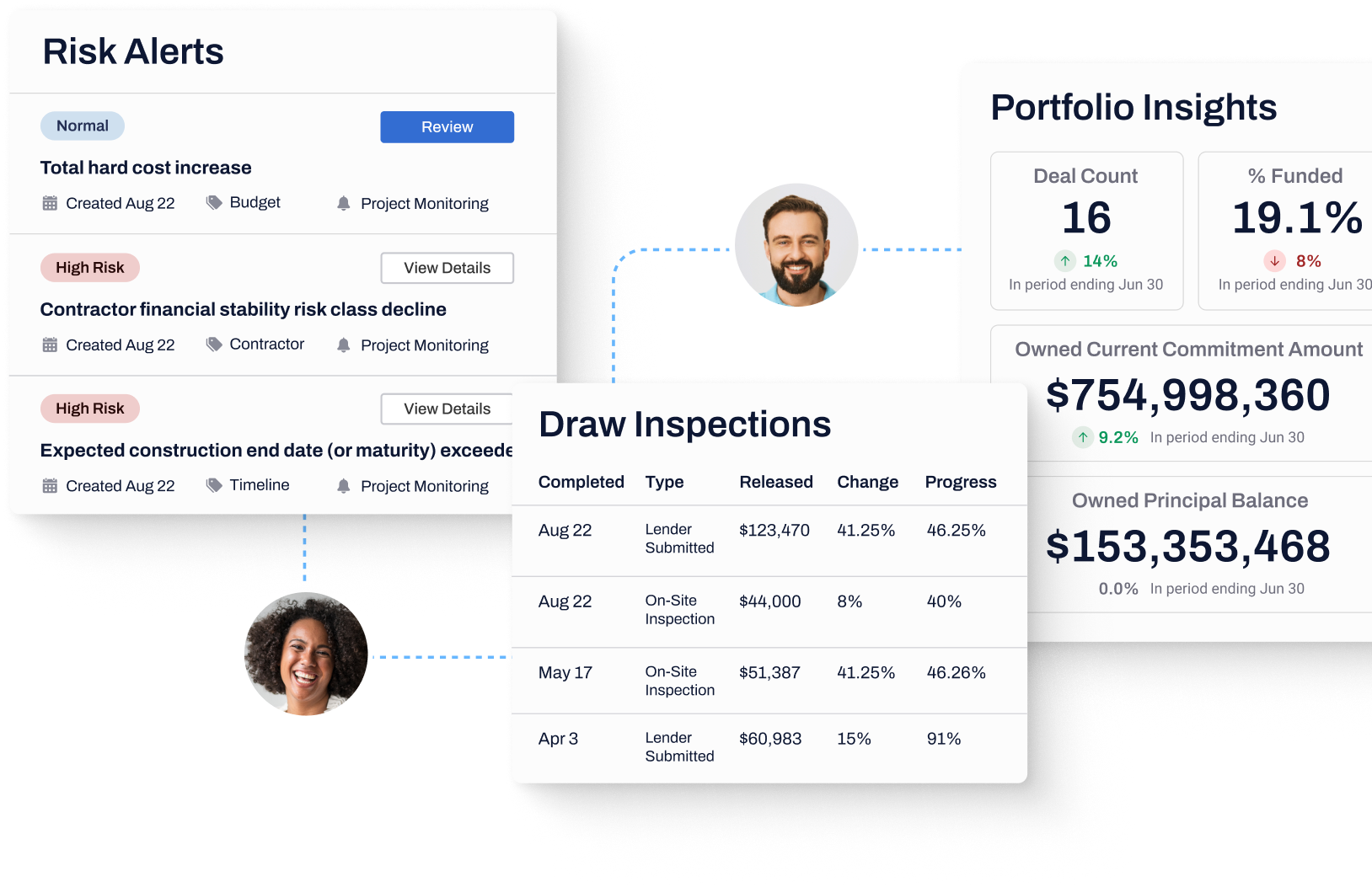

Moving from Hindsight to Continuous Control with Built

Real-time monitoring catches risks at the source, enabling proactive intervention. Instead of discovering an overfunded draw or a missing waiver weeks later, credit teams see it immediately and act before damage is done.

Tangible impact and case studies

By digitizing draw control, lien tracking, and reserve monitoring, Built helps lenders shift visibility from 60–90 days behind to within 24–48 hours.

- Risk prevention: Built flags draw requests that exceed approved budgets, allowing lenders to pause funding before misallocations occur.

- Compliance enforcement: Built automatically blocks draw requests when lien waivers or required documentation are missing, eliminating lien exposure that might otherwise linger in email threads.

- Default foresight: Built alerts lenders when interest reserves cross risk thresholds, providing lead time to intervene and restructure before defaults occur.

Key operational ROI

Zions Bancorporation offers a clear example of the scale impact: before digitization, their loan administrators averaged ~60 loans each. After adopting Built, top performers now manage between 130–190 loans, a 2–3× capacity gain without adding headcount.

Across the broader Built client base, the returns are equally measurable:

- 30–40% faster draw processing times.

- 50–70% time savings on quarterly reporting and fire drills.

- 10–20% improvement in default prevention through early alerts.

- Up to 3x more loans managed per administrator.

Best Practices for System-Enforced Risk Mitigation

The most effective lenders are shifting from checklist-driven, manual processes to system-enforced, real-time oversight across the entire loan lifecycle.

| Function | Traditional Approach | Real-Time Best Practice |

|---|---|---|

| Origination | Fragmented spreadsheets, version risk | Centralized pipeline, digitized documents, single system-of-record sync |

| Draws and Compliance | Dependent on analyst memory, delayed verification | System-enforced checkpoints: draw tied to budget, block funding without inspection and lien waivers |

Redefining roles and responsibilities

Digitization redefines roles:

- Loan administrators shift capacity from chasing paperwork to supporting borrowers, managing 50+ loans instead of 20–30.

- Risk officers move from reactive firefighting to strategy, monitoring reserves and budgets daily to intervene before problems snowball.

- Executives gain confidence to take on complex deals, achieving reporting cycles in clicks instead of weeks, which strengthens investor credibility and unlocks growth.

From Blind Spots to Continuous Control

Construction lending will always be high-risk, but manual oversight is no longer a viable way to manage that risk. By adopting real-time technology, lenders can eliminate the costly blind spots created by out-of-date data, delayed inspections, and siloed processes. This shift transforms risk management from reactive clean-up into proactive protection, allowing portfolios to scale with stability and control.

Built Technologies delivers this capability, enabling lenders to act early, protect capital, meet regulatory standards, and unlock scalable growth.

Ready to see how real-time risk management can eliminate blind spots in your portfolio? Book a demo with Built and see how our platform helps lenders protect capital, meet regulatory expectations, and unlock scalable growth.

Construction Loan Risk Management FAQs

What are the most common risks in construction lending that banks and credit unions need to manage?

Common construction lending risks include incomplete project budgets, delayed inspection reports, missing lien waivers, and gaps in insurance coverage. For financial institutions, these blind spots can trigger credit risk by funding incomplete work, extending too much on undisbursed funds, or exposing the lender’s lien position. Regulators such as the OCC highlight these risks as essential to monitor in real time.

How can lenders use real-time progress reporting to mitigate risks?

Traditional progress reporting often lags weeks behind the actual state of work completed, creating risk when funds are disbursed against outdated data. Real-time construction progress reporting allows lenders to verify that each draw request matches the project budget and that funds only go out for work completed. This reduces potential risks like overfunded draws, delays in the construction process, and capital tied up in stalled projects.

Why is due diligence on construction contracts and contingency budgets crucial for lenders?

Before a loan closes, lenders should conduct a deep dive into the construction contract and ensure a sufficient contingency budget is built in. Without this diligence, lenders risk exposure to cost overruns, disputes with general contractors, and delays that push back the project completion date. Standardizing contract reviews and monitoring contingency use in real time helps protect interest income and ensures a more seamless operation across the portfolio.