The Real Estate Project Lifecycle (2025) – 6 Stages of Capital and Construction Control

Real estate development is broken by disconnected systems, leading to financial risk and low-confidence decisions at scale. This guide outlines the 6 stages of the real estate project lifecycle and explains how unifying capital control and project data prevents delay, protects IRR, and guarantees portfolio-level visibility.

Real estate development doesn’t break down because one tool fails. It breaks down when the information that drives project execution fails to move cleanly from one phase to the next, specifically impacting financial control and risk management.

Owner-developer teams depend on continuity to keep construction projects moving. That consistency should carry through every handoff, from land acquisition to financing, project planning, construction management, and turnover.

In practice, the connections often fall apart. Project budgets are managed in spreadsheets. Draw requests and inspections are handled in separate tools. As critical construction data moves between disconnected systems, context fades, along with the visibility necessary for informed decision-making and risk management. This is a structural issue in construction project management, and it directly affects your ability to execute with confidence at scale, meet project timelines, and protect the project’s financial outcomes.

What are the 6 Stages of the Real Estate Project Lifecycle?

The real estate project lifecycle consists of six standardized phases—Concept, Pre-Development, Financing, Procurement, Execution, and Closeout—that together define how capital moves from idea to completed asset. It demands a system that preserves the logic of your budget and the rationale of your decisions across the following six integrated stages.

| Stage | Primary Goal | Key Output |

|---|---|---|

| 1 – Concept | Validate feasibility | Pro forma, market study |

| 2 – Pre-Development | Secure site, entitlements | Approved plans |

| 3 – Financing | Structure capital stack | Loan agreements |

| 4 – Procurement | Finalize scope & budget | Signed contracts |

| 5 – Execution | Build & monitor | Progress reports |

| 6 – Closeout | Transition & report | CO, final IRR |

What happens during stage 1 – Concept and feasibility?

This stage determines whether a proposed real estate project is financially and technically viable before capital is committed. The focus is on idea validation, market studies, and preliminary financial modeling to ensure project feasibility, scope alignment, and financial viability.

Who handles budget forecasting and building lifecycle planning for new real estate assets?

At this early stage, the developer’s financial team and third-party consultants (like cost estimators) lead the charge. They are responsible for establishing the project’s foundational financial logic:

| Responsible Party | Key Action / Deliverable | Strategic Goal |

|---|---|---|

| Developer’s Financial Team | Develops the Pro Forma (Initial Financial Model) | Determine the project’s financial viability and projected returns. |

| Cost Consultants / Finance Team | Captures Initial Budget Logic and forecasts the full building lifecycle (construction, OpEx, reserves, income). | Ensure the foundational budget logic is immutable, captured, and passed forward for enforcement in subsequent stages. |

What risks emerge in Stage 2 – Pre-development and due diligence?

Once a project receives initial approval, Stage 2 centers on site acquisition, entitlements, zoning, and detailed design and engineering. It’s the first phase where financial oversight and governance determine how efficiently capital moves through the lifecycle.

Financial governance and approvals

At this stage, major capital commitments take shape—land purchases, architectural contracts, zoning applications—and the risk of disconnected systems becomes immediately visible.

Portfolio-level reporting for project approvals

Every approval should flow into a unified reporting framework that consolidates project-level data into portfolio-level insights for executives, investors, and capital partners. When those approvals live in separate systems, teams are forced to reconcile spreadsheets and manual updates—introducing friction and blurring capital visibility.

In 2024, more than 70% of multifamily construction providers reported significant project delays, often beginning with permitting and design approvals. According to Swiftlane’s report, 79% of builders surveyed by NMHC cited ongoing delays driven by permitting, design standards, and other regulatory hurdles. Strengthening Stage 2 governance through connected systems is essential to protect schedules and maintain confidence at the capital-planning level.

How do lenders influence Stage 3 – Financing and capital structuring?

The focus here is securing the complete capital stack (senior debt, equity, mezzanine). The health of your documentation directly impacts financing speed and cost.

How banks support the real estate project lifecycle

Investors and lenders expect clear, timely reporting on project progress and capital pacing. Lender and investor expectations put tight scrutiny on documentation, and loan officers routinely flag lagging or incomplete information, causing financing to be delayed or constrained.

The bank’s role extends beyond merely providing a construction loan; they act as a critical control point throughout the entire execution phase:

- Scrutinizing the plan: Banks meticulously review the finalized budget, schedule, and contracts established in Stage 2.

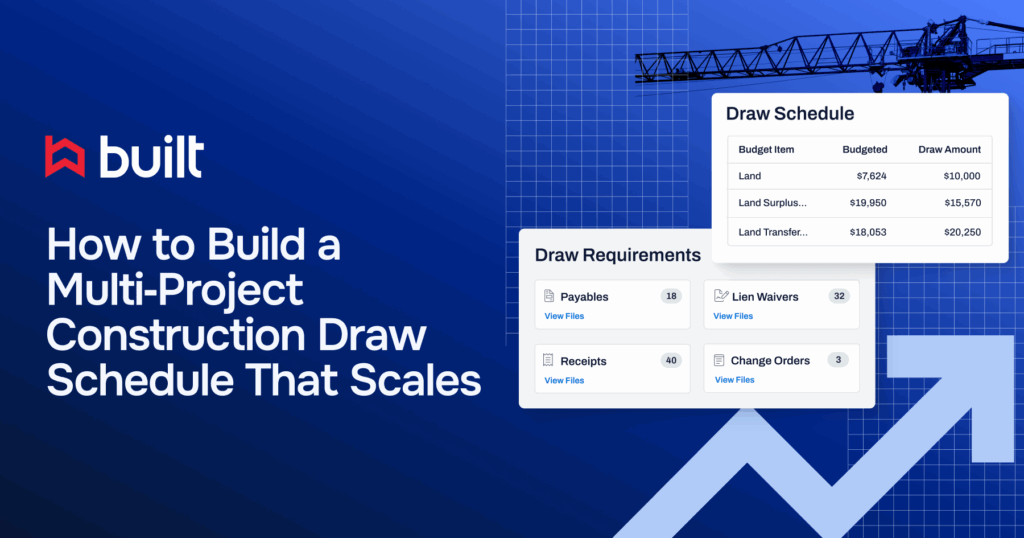

- Construction loan draw process: They control cash flow via the draw process. Lenders and investors expect clear documentation of the resources required for each project milestone to ensure proper allocation and risk management. Without integrated workflows, lenders often delay draw approvals.

- Tracking loan interest and fees: Tracking loan interest and fees throughout a construction project’s life is essential. This data is not just for accounting; it informs the project’s Internal Rate of Return (IRR) depending on precise timing.

IRR drift from delayed approvals: When financial approvals stall, construction slows, lease-up timelines slip, and carrying costs begin to rise. Capital may sit idle while interim financing bridges the gap, driving up expenses and eroding projected returns.

As Matterport’s analysis highlights, delays in multi-family construction strain financing terms, disrupt lease-up schedules, and compound rework costs across phases. Disconnected financial workflows and fragmented visibility represent a capital execution risk that directly undermines IRR performance.

Why Stage 4 – Procurement defines budget accuracy

This stage involves bidding, contract awards, and finalizing the project baseline (scope, budget, schedule).

The peril of the spreadsheet trap

The final, approved, line-item budget that will govern the Execution phase is often built here, but using the wrong tools. Spreadsheets are ubiquitous in real estate project management, but as complexity increases, they become a liability:

- Manual data entry introduces compounding errors that undermine risk management.

- Version control becomes difficult when files are shared across email or cloud drives.

- Context disappears between budgeting and procurement. Scope, schedule, and cost data often live in spreadsheets with no audit trail, making it difficult to validate or trace back changes.

The key activity is generating the immutable, approved budget that preserves its logic and intent, something a unified system can do, but spreadsheets cannot.

How real-time visibility transforms Stage 5 – Execution

This is where the conceptual designs and plans are transformed into physical structures. It requires building the physical asset and rigorous, real-time project monitoring.

What owner-developers actually need: Real-time monitoring

When systems stay siloed, project managers and construction managers lose visibility across the construction project life cycle. Teams often adopt point solutions (One Task, One Tool, No Connection) to supplement spreadsheets for draw processing, inspections, waivers, or collaboration.

To counter this, you need systems that enable confident, real-time decision-making:

- Real-time progress tracking: Field teams rely on tools like Procore or email to make real-time decisions but require visibility into upstream budget intent or risk thresholds. Without centralized reporting, it’s hard to surface performance metrics like pacing, overfunding, or draw cycle lag in time to act.

- Change order management: Every approval and revision must be time-stamped, attributed, and auditable. Configurable workflows adapt to internal structures so approvals and alerts follow organizational logic without creating new bottlenecks.

- Feeding portfolio-level reports: Performance data must flow directly back into the financial system to ensure timely bank draw requests. When context stays intact, teams spend less time reconciling and more time executing. Draws move faster when the history is already there.

Risk mitigation

Delayed insights mean the first warning of cost overrun or pace drift often comes after it’s too late to intervene. Decisions made on stale data can misalign capital and priorities, putting portfolios at risk. Failing to monitor important aspects of project execution can lead to missed opportunities for intervention and increased risk.

According to Oracle’s “2025’s Top ConTech Predictions” by Burcin Kaplanoglu, the industry is moving into a new era of predictive construction management—one defined by AI, automation, and centralized data environments that replace reactive reporting with real-time, proactive risk mitigation.

What does Stage 6 – Closeout and handover involve?

This closure phase includes final inspections, securing the Certificate of Occupancy (CO), loan conversion, and transition to asset/property management.

Critical handoff: Preserving context

Deliverables are finalized without a full view of what shifted during execution, leading to delays, disputes, and misaligned handoffs to asset managers or lenders. This is the stage where:

- The final reconciliation report is generated, comparing planned costs to actual spend. Key closeout KPIs include tracking the final Loan-to-Value (LTV) ratio and calculating the final Internal Rate of Return (IRR).

- All construction and financial documentation must be transferred to the operations team.

Missed context in project handoffs is a major issue in fragmented systems. Budget assumptions and feasibility insights are captured early but rarely passed forward in a structured way. This leads to:

- Downstream teams losing clarity on scope or assumptions.

- Subsequent estimates and forecasts relying on guesswork.

- Ultimately, the missing visibility undermines accuracy and confidence in projections.

What Owner-Developers Actually Need from Lifecycle Tracking Software Systems

Execution at scale depends on continuity of information, assumptions, and decisions. To operate with control, owner-developers need systems that preserve the logic behind the budget, track changes as they happen, and surface the right context at the right time.

- Preserve budget logic across phases: Budget assumptions remain visible through development, construction, and closeout. Scope changes retain totals and rationale, and forecasts reflect costs and intent.

- Align the full team around a shared source of truth: Teams need access to the right data, with clear visibility into what changed and why. Role-based views ensure each function sees what matters.

- Support governance without sacrificing agility: Approvals and alerts follow organizational logic, ensuring teams stay aligned without heavy IT involvement.

The Problem Isn’t a Lack of Tools

Owner-developers are not short on tools. They are short on connection. Systems that collect data without preserving project context or supporting collaboration across the project team often create more friction than they solve.

Execution at scale across the construction project lifecycle requires more than spreadsheets and siloed platforms. It takes a unified system that maintains continuity from the planning phase through construction execution and project completion. Teams need clear visibility to manage resources, reduce project risks, and track progress in real time.

Built delivers that continuity. If you’re ready to stop stitching together disconnected systems and start managing construction with confidence and clarity, see how Built gives owner-developer teams control from project initiation through closeout. Book a demo with our team today.

FAQs: Solving Visibility Gaps Across the Construction Project Lifecycle

Why is visibility across the construction project lifecycle so difficult for owner-developers to maintain?

Most owner-developer tech stacks are built around disconnected tools: Excel for budgeting, standalone platforms for draw requests or inspections, and siloed communication threads. As information passes between these systems, the context behind key decisions gets lost. Without a centralized, connected system, teams operate without a clear line of sight into project timelines, budget changes, or capital pacing, making it difficult to manage risk or execute confidently at scale.

How do fragmented systems impact capital execution and IRR performance?

When tools don’t talk to each other, draw approvals stall, documentation lags, and payment cycles get delayed. This leads to idle capital, increased carrying costs, and misaligned schedules, all of which erode internal rate of return (IRR). Visibility gaps and outdated data also prevent proactive interventions, making it harder to optimize spend and deliver on portfolio-level outcomes.

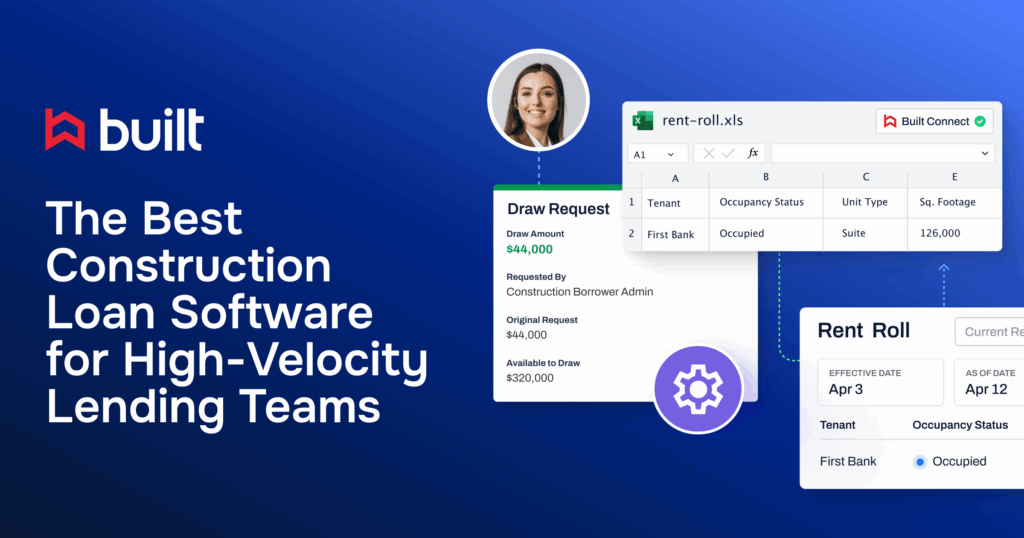

What does a connected project lifecycle platform actually do for owner-developer teams?

A unified platform preserves project context from planning through construction and closeout. It centralizes budgets, schedules, inspections, and draw workflows so all the equipment, resources, and approvals live in one place. This allows for real-time decision making, clearer accountability, faster funding, and better collaboration across the full construction phase, without introducing new bottlenecks.

What should owner-developers look for in construction management software?

Look for software that supports the entire construction project lifecycle, not just one phase. The right platform should maintain continuity of data and decision-making logic, provide audit-ready transparency, enable real-time performance tracking, and adapt to your organization’s workflows. It should also help reduce risk and speed up execution by eliminating blind spots between project planning, execution, and completion.

Mark Murphy leads OGC Sales at Built, where he is responsible for accelerating adoption of payments and standalone solutions purpose-built for real estate owners, developers, and general contractors. He brings deep experience across sales, general management, and operations in technology-driven businesses.

Prior to joining Built, Mark served as General Manager at Apex Service Partners and Operating Executive at Alpine Investors. He also spent over six years at Flexport, where he held multiple leadership roles including General Manager for the South and Northeast regions, and Director & Acting General Manager for San Francisco and Northern California. Earlier in his career, Mark was Chief Operating Officer at Oolong, an INC 500-recognized international trading business.

Mark holds a degree in Mechanical Engineering from Stanford University, where he captained the Varsity Men’s Rowing team.