Operational Efficiency in Lending: How Agentic AI Expands Capacity Without Expanding Headcount

Across real estate finance, lenders are under pressure to accelerate draw reviews without compromising compliance. Traditional automation helped digitize workflows, but it never solved the core problem: manual dependency, limiting scalability as portfolios grow.

Agentic AI represents the next operating paradigm in real estate finance. Systems don’t just follow instructions. They plan, reason, and act autonomously within governance rules. This shift moves lenders beyond static, task-based automation toward truly scalable, self-optimizing operations designed to address the entire loan lifecycle. This framework is already delivering a documented 300–500% ROI in its first applications.

The goal is scalable growth: expanding operational capacity to handle 3-5 times more loans with the same team.

Agentic Framework Across the Real Estate Loan Lifecycle

| Lifecycle Stage | Traditional Process | With Agentic AI | Operational Impact |

| Origination | Loan officers and analysts manually verify borrower, project, and credit data before underwriting. | Agents pre-screen borrower and project files for completeness and policy alignment, flagging inconsistencies automatically. | Fewer incomplete files reach underwriting, faster time-to-yes and reduced administrative prep. |

| Underwriting and Credit Review | Teams manually compile documents, analyze credit risk, and reconcile supporting data across systems. | Agents organize and summarize loan files, apply risk logic, and draft memos or checklists for final review. | Underwriters focus on analysis, not document prep, cutting cycle times substantially. |

| Draw and Servicing | Loan administrators validate documentation, reconcile budgets, and route approvals manually. | Agents autonomously validate draw packages, apply policy logic, and trigger next actions under governance controls. | Up to 95% faster reviews, 3-5 times throughput per admin, and same-day funding capability. |

| Compliance and Audit | Policy checks and reports are performed retroactively and manually compiled. | Agents enforce policy in real time, logging every decision with full reasoning and audit trails. | Continuous compliance with no separate review cycle, complete audit transparency. |

| Portfolio Oversight | Executives rely on static reports and periodic summaries to assess exposure and performance. | Connected agents reconcile live data, monitor risk indicators, and surface exceptions in real time. | Real-time visibility into portfolio health, risk exposure, and capital velocity. |

The Operational Leverage: Scaling Loan Volume Without Adding Headcount

The underlying constraint in legacy lending operations is the linear dependence on human coordination at every checkpoint. Every new project adds hundreds of documents and compliance checks, forcing operational growth to rise linearly with headcount.

The Agentic Framework (perceive, reason, and act under policy) changes this equation. It embeds reasoning and decision execution directly into the workflow, creating an operational network that operates autonomously from origination to portfolio oversight. This is the foundation for a self-optimizing lending model built for scalable efficiency.

This framework is designed to transform the entire real estate loan lifecycle:

- Origination: Future agents will autonomously pre-screen borrower and project data for completeness and alignment with credit rules, shortening Time-to-Yes and freeing underwriters for complex analysis.

- Servicing and monitoring: Agents will continuously reconcile transactions, monitor covenants, and flag emerging risks in real time, eliminating human-dependent reporting cycles.

- Portfolio oversight: Connected agents will aggregate live data across the portfolio to surface exposures and exceptions, providing executives with real-time, aggregated transparency.

By removing human checkpoints and dependencies across all core functions, lenders can build a self-optimizing system that maximizes capital velocity and team capacity.

Proof of Concept: Capacity Expansion in Draw Review

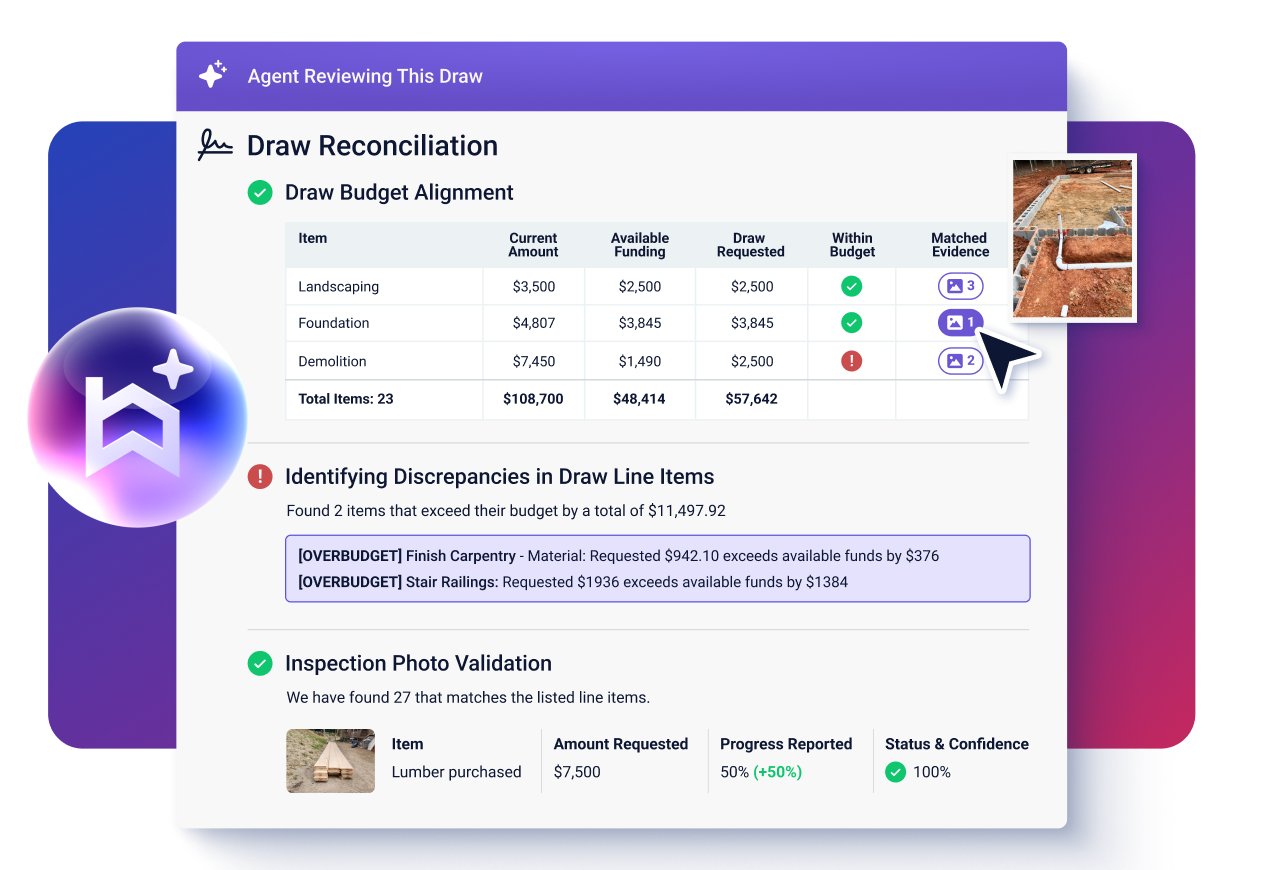

The first major application of the Agentic Framework is in draw management, the most labor-intensive step in construction lending. Built’s AI Draw Agent is a working example of this transformation, proving the framework’s ability to deliver capacity expansion immediately.

By autonomously validating documentation, applying policy logic, and routing exceptions, the Draw Agent has demonstrated clear results across live lender portfolios:

- 95% faster review times, reducing multi-day approval cycles to minutes.

- Three to five times more loans processed per administrator, with no increase in staff.

- Four-fold improvement in risk detection, as the system automatically flags missing or outdated documentation.

- Same-day funding, achieved through autonomous document validation and policy checks.

These outcomes show how the Agentic Framework strengthens lending operations at the level of the individual task. For executives, this means immediate throughput protection, improved audit readiness, and measurable operational capacity expansion without additional headcount.

The Executive ROI Story: Aligning Growth and Control

Agentic automation delivers measurable financial and operational returns by creating deep operational leverage across the entire organization:

- Capacity expansion: Teams process up to five times more loans per administrator, providing the operational leverage necessary for scalable growth without proportional hiring.

- Capital velocity: Faster draw approvals accelerate capital redeployment and improve project timelines across the full portfolio.

- Risk governance: Automated policy enforcement reduces human error and strengthens audit readiness system-wide.

- Portfolio visibility: Executives gain real-time transparency across funding velocity and compliance status, driven by continuously operating agents.

- Return on investment: Early adopters report 300–500% ROI, even across portfolios under 500 loans, proving the financial viability of this scalable model.

For leaders overseeing construction and real estate portfolios, this model finally aligns growth capacity and risk control, transforming operational efficiency into a lasting competitive advantage.

The Path Toward Fully Agentic Portfolios

The future of real estate lending depends on operational models that break the linear link between volume growth and headcount. Agentic AI is the technology that delivers this leverage.

By establishing autonomous, policy-driven systems across the entire loan lifecycle, validated by early success in draw review that guarantees massive ROI and capacity expansion, lenders are no longer forced to trade speed for control.

The Agentic Framework is the foundation for a truly scalable, self-optimizing portfolio, offering executives a clear path to aggressive, risk-managed growth in the years ahead.