How Remote Project Monitoring Transforms Construction Loan Oversight

For lenders and loan administrators, ensuring project progress is on track is critical to mitigating risk management and keeping funding on schedule.

While on-site inspections have long been the standard, remote project monitoring is emerging as a powerful way to streamline and improve the construction lending process, especially for draw requests.

This guide explains how remote construction monitoring works. It explores its key benefits, and it demonstrates how it can complement, not replace, traditional on-site inspections.

What Is Remote Project Monitoring?

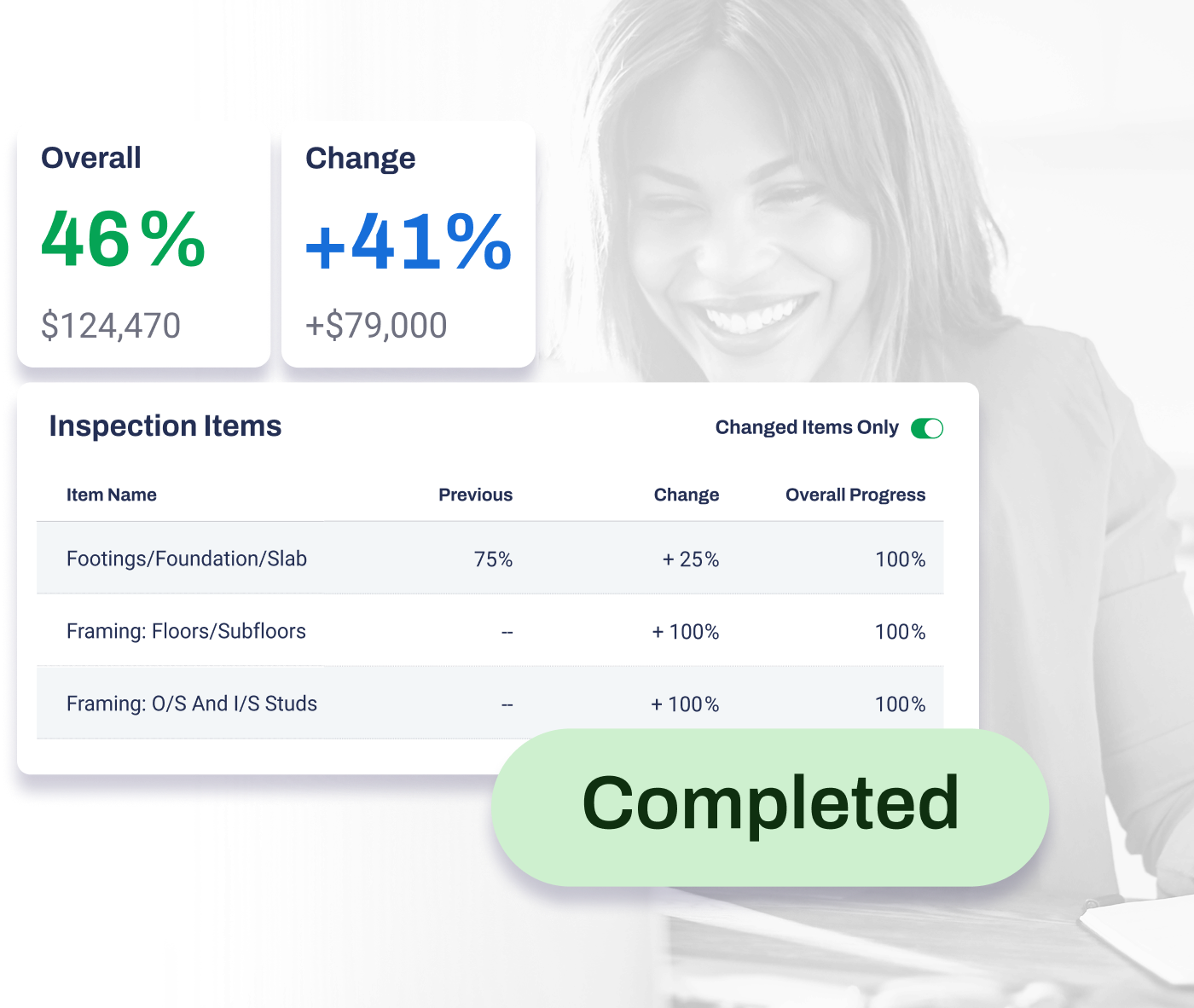

Remote construction monitoring gives lenders insight into a project’s progress without requiring an inspector to visit the job site. This method leverages a team of trusted on-site stakeholders, such as the builder or a project manager, who can capture and upload time-stamped, geolocated photo evidence to a shared system.

This technology addresses a key historical challenge in the construction industry: verifying the authenticity of a photo to avoid human error.

- Before: Verifying a photo’s authenticity was difficult, creating a risk of fraud.

- Now: Advanced geolocation technology ensures every image is automatically tagged with the precise location, date, and time it was taken, providing auditable proof of progress.

This makes remote site inspection a reliable tool for verifying work completed and expediting fund disbursement.

The Strategic Advantages of Remote Project Monitoring

Remote monitoring offers several strategic advantages, enabling lenders to be more responsive and efficient. By eliminating unnecessary travel and reducing administrative work, lenders can achieve a more rapid and secure way to verify progress. This is especially useful for urgent needs that arise between scheduled on-site visits, ensuring builders get the funds they need without unnecessary hold-ups.

Furthermore, remote progress monitoring is invaluable for accessing rural or challenging properties and for easily addressing minor, missed line items without a costly return trip. It also creates a comprehensive, verifiable visual log of a project’s lifecycle, which is useful for resolving potential disputes and answering questions about the completion of specific project stages.

Remote monitoring provides valuable insights into the construction process for lenders and is a more cost-effective way to conduct progress monitoring.

A Smarter Way to Manage Loans: The Role of Digital Technology

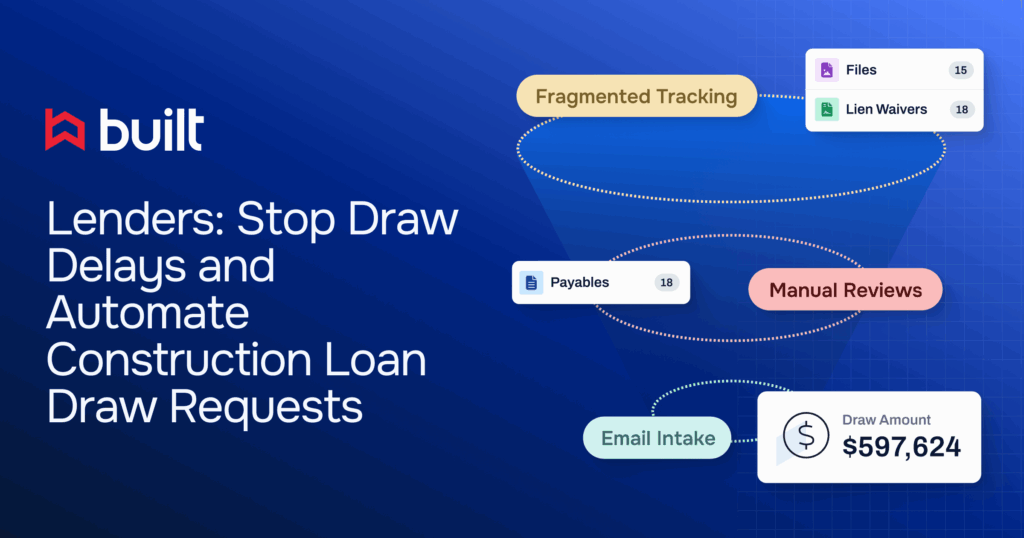

Modern technology has fundamentally changed how lenders oversee construction projects, moving from a paper-based, manual task to a streamlined, data-driven workflow.

Construction loan monitoring software and remote site inspection software provide a single source of truth for all project data, empowering lenders with real-time insight and automated controls.

Here’s how these technologies transform the process:

- Centralized and auditable records: Instead of scattered emails and physical files, all project documents, from loan agreements and budgets to invoices and inspection reports, are stored securely in a centralized, cloud-based platform. Every action is automatically logged, creating a complete and immutable audit trail that simplifies compliance and audit preparation.

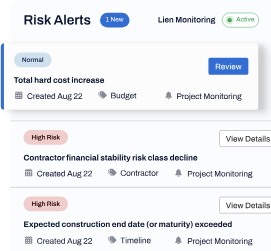

- Analytics for proactive risk mitigation: These platforms go beyond basic reporting. They analyze data points like budget consumption rates, timeline adherence, and change orders to generate predictive insights. This allows lenders to proactively identify and mitigate potential risks before they become major issues, which strengthens the overall audit trail.

- Digital draw management: Software centralizes and automates the draw request process, providing a digital portal where borrowers, builders, and lenders can submit, review, and manage all required documentation and approvals. Features like document auto-tagging, instant notifications, and auditable approval chains keep projects moving while maintaining strict compliance.

How to Implement a Hybrid Inspection Model

The most effective strategy for construction loan oversight is to combine remote and on-site inspections into a single, seamless hybrid model. This approach maximizes efficiency while maintaining a high level of oversight.

- Establish a baseline: Start with a traditional, in-person, on-site inspection to establish a baseline for the project, allowing the inspector to meet with key personnel and perform an in-depth initial review.

- Schedule regular on-site audits: Schedule periodic on-site inspections, typically every 30 to 45 days. These serve as a regular check-in, ensuring the project is physically on track and providing an opportunity for hands-on review.

- Use remote monitoring for “in-between” needs: In between scheduled visits, leverage remote inspections for more frequent, ad-hoc needs. This could be for a specific loan disbursement, to verify a completed line item, or to check on progress for a time-sensitive stage.

- Integrate data: Ensure all data, whether from a remote or on-site inspection, is funneled into a single, centralized software platform. This creates a unified view of the project, allowing lenders to compare on-site reports with remote photo evidence and analytics data to get a complete picture.

Built: The Solution for Modern Construction Finance

To put this hybrid model into practice, lenders need a platform that connects inspections, draw requests, and portfolio oversight in one system. Built eliminates these manual bottlenecks by automating the entire draw process, cutting approval time from days to hours.

Fund projects faster with digital draw management

Built’s automated workflows streamline the entire draw management process, enabling faster funding and eliminating redundant steps that can cause delays.

Stay ahead with real-time portfolio oversight

Go beyond a single project. Built’s dashboard gives you a complete, real-time view of your entire portfolio, tracking budgets and risk signals across all loans in one place.

Always audit-ready with secure record-keeping

With Built, every piece of data is automatically timestamped and securely stored, creating an immutable audit trail that simplifies compliance and ensures you are always prepared.

Ready to eliminate inspection bottlenecks and gain real-time visibility into every loan? Book a demo with Built to accelerate your draw approvals.

Building a Better Future for Construction Lending

By adopting remote project monitoring and integrating it with modern loan management platforms, financial institutions can move beyond traditional, time-consuming manual processes. This hybrid approach allows for more efficient draw requests, enhanced risk mitigation, and seamless auditing, all while providing the transparency and accountability necessary to responsibly manage a project.

The result is a more streamlined and responsive lending process that benefits everyone involved, from lenders to the builders who are bringing their vision to life.

Remote Construction Loan Monitoring FAQs for Lenders

How can construction loan monitoring enhance risk management?

Construction loan monitoring helps to mitigate risks by providing proactive risk signals that alert lenders when milestones go unmet or budgets are exceeded. It also ensures all subcontractors and suppliers are paid, which protects the lender’s legal claim on the property.

What is the role of technology in construction loan monitoring?

Technology plays a crucial role in modern construction loan monitoring by providing independent, third-party verification of project progress. Software integrates inspections with loan lifecycle management, ensuring project budgets and schedules align to create a reliable audit trail.

How does a clear disbursement schedule help with a construction loan?

A clear, milestone-based disbursement schedule ensures borrowers receive funds when they are necessary, enabling a more efficient and predictable loan process for all stakeholders.