How CRE Lenders Gain an Edge with Risk Management Dashboards

Lenders are generating more loan and portfolio data than ever. Much of this data remains locked in outdated spreadsheets and legacy systems, creating blind spots that slow approvals, weaken compliance, and heighten portfolio risk.

Deloitte’s 2024 CRE Outlook reports that over half of firms still rely on legacy technology that cannot support modern analytics. In a sector where speed and precision make all the difference, those gaps leave lenders vulnerable.

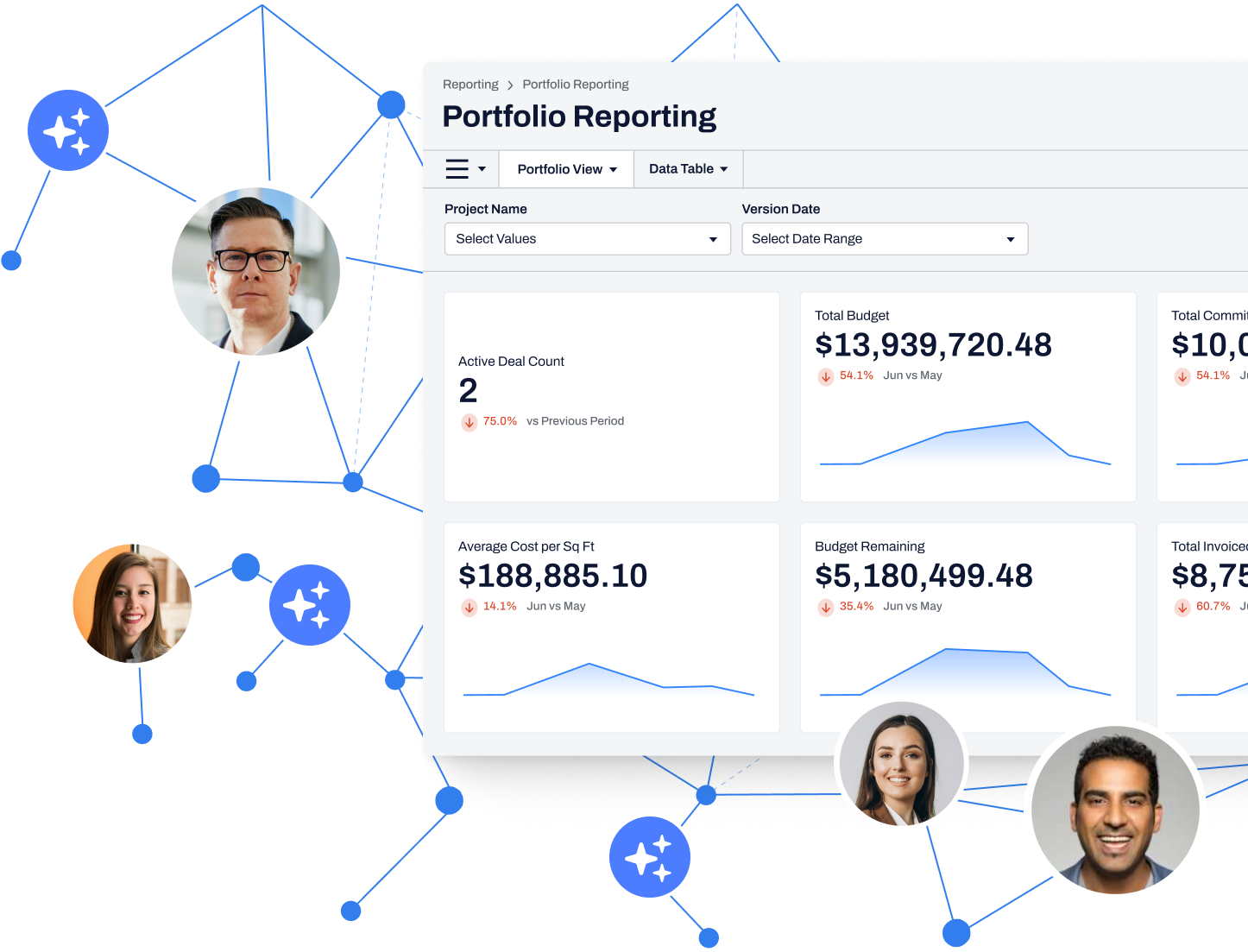

The answer lies in risk management dashboards that centralize loan data, automate reporting, and surface real-time insights, shifting teams from manual searching to strategic action.

In this article, we’ll break down the risks of legacy workflows and show how risk management dashboards give lenders the real-time visibility they need.

Why Portfolio Risk Monitoring Lags Behind

While the industry has invested heavily in origination and underwriting tools, portfolio monitoring has lagged behind. Too often, lenders are left piecing together exposure from disconnected reports, which slows responses and increases risk.

McKinsey research shows that Fortune 500 lenders capture major gains by moving to cloud-enabled systems. However, Deloitte’s 2024 CRE Outlook found that more than half of CRE firms still depend on legacy technology, leaving many firms unable to keep up with modern risk demands.

Modern risk platforms close that gap by transforming loan data into connected, real-time intelligence. With a single source of truth, lenders can do the following:

- Instantly review property- and portfolio-level exposures

- Calculate loan-to-value, draw activity, and risk ratios with live data

- Track investment performance against forecasts in real time

An underwriting model that once lived in a single spreadsheet can now feed into a live view visible to credit, risk, and operations teams. Reports generate instantly, draw activity aligns with budgets, and exceptions are flagged automatically. What once required multiple handoffs is now centralized, auditable, and decision-ready.

Six Benefits of Portfolio Intelligence Tools for CRE Lenders

Once data is connected, the benefits multiply quickly, and risk monitoring tools reshape how lenders operate across the portfolio. Below are six of the most important advantages.

1. Access deeper reporting and analytics

Dashboards turn reporting from static and backward-looking into dynamic and predictive. Lenders can surface origination trends, draw activity, and portfolio-level exposures in seconds.

Historical data flows into forecasting models, which helps teams anticipate delays, catch compliance issues, and act on risks before they escalate.

2. Streamline daily workflows

Data silos slow teams down and create errors. A connected platform replaces them with a single source of truth. Importantly, it doesn’t replace Excel; rather, it integrates with it. Lenders can keep using spreadsheets for ad hoc modeling while the platform consolidates those inputs and shares them instantly across teams.

The result: fewer manual entries, faster approvals, and a cleaner audit trail.

3. Make smarter investment decisions

With centralized, verified data, lenders can price deals more accurately and manage portfolios with greater confidence. Real-time comparisons across loans and properties reduce valuation errors and uncover new opportunities.

From monitoring cash flow to tracking loan-to-value ratios, modern cloud platforms put live risk metrics directly in decision-makers’ hands.

4. Strengthen compliance and audit readiness

Static reports and siloed files make it difficult to prove compliance or provide investors with timely updates. Connected risk tools solve this by time-stamping every update, storing reports in one place, and creating a full audit trail.

Instead of scrambling for quarterly reviews, teams can export audit-ready reports instantly, improving both efficiency and confidence.

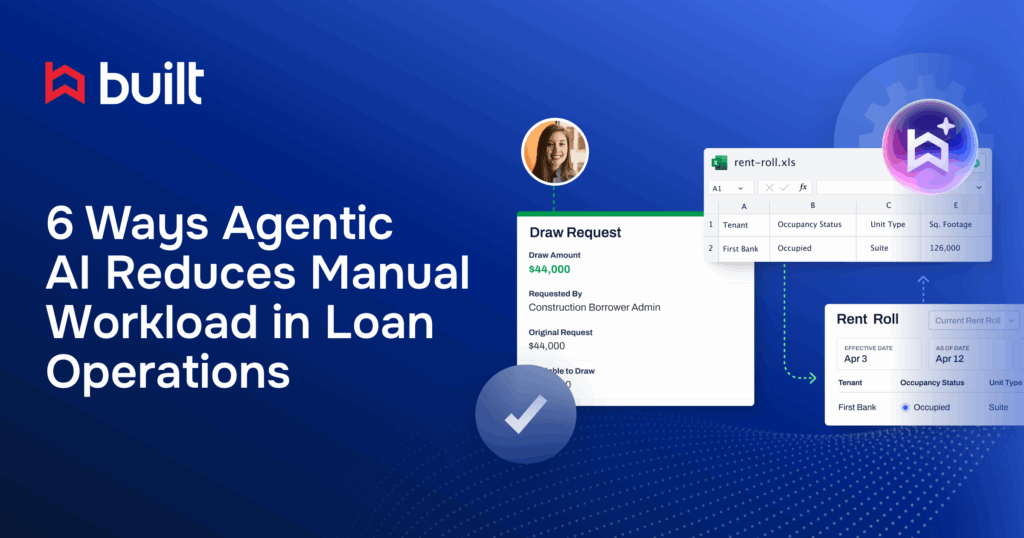

5. Scale without adding headcount

As CRE portfolios expand, risk and operations teams are under pressure to do more with the same resources. A connected platform acts as a force multiplier. That means automating reporting, flagging exceptions, and reducing manual reconciliations. As a result, teams can manage more loans, inspections, and reports without additional staff, which is a critical advantage in today’s tight-margin environment.

6. Build stronger borrower and investor confidence

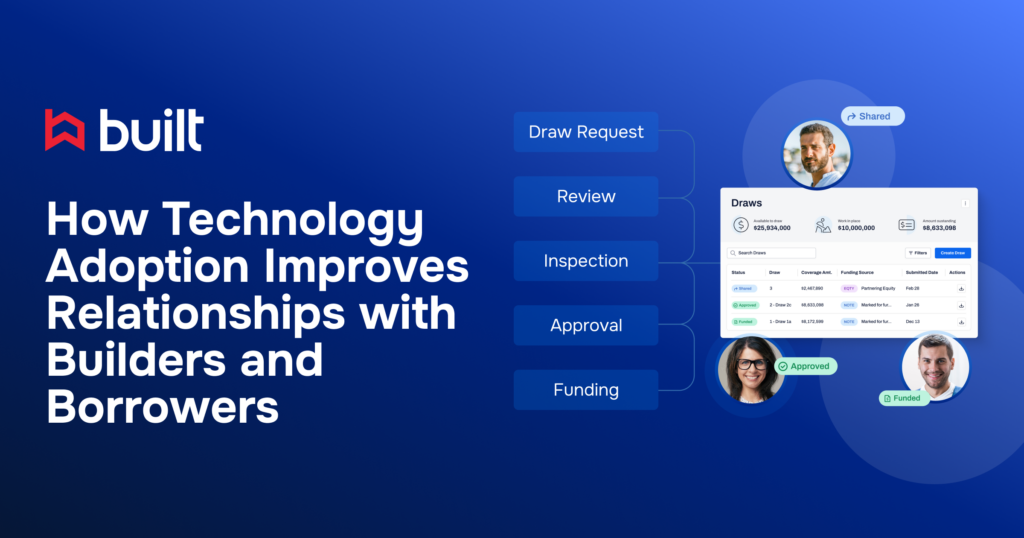

Transparent, accurate reporting strengthens relationships across the capital stack. Borrowers gain faster draw approvals and fewer delays, while investors benefit from consistent, real-time portfolio updates.

By eliminating errors and improving transparency, lenders demonstrate reliability, and that credibility can be a key differentiator in a competitive market.

How Built Delivers Connected Risk Management

Now that we’ve covered the why, let’s talk about how. Built translates these benefits into real-world results, giving lenders a connected platform they can use every day to reduce risk and move faster.

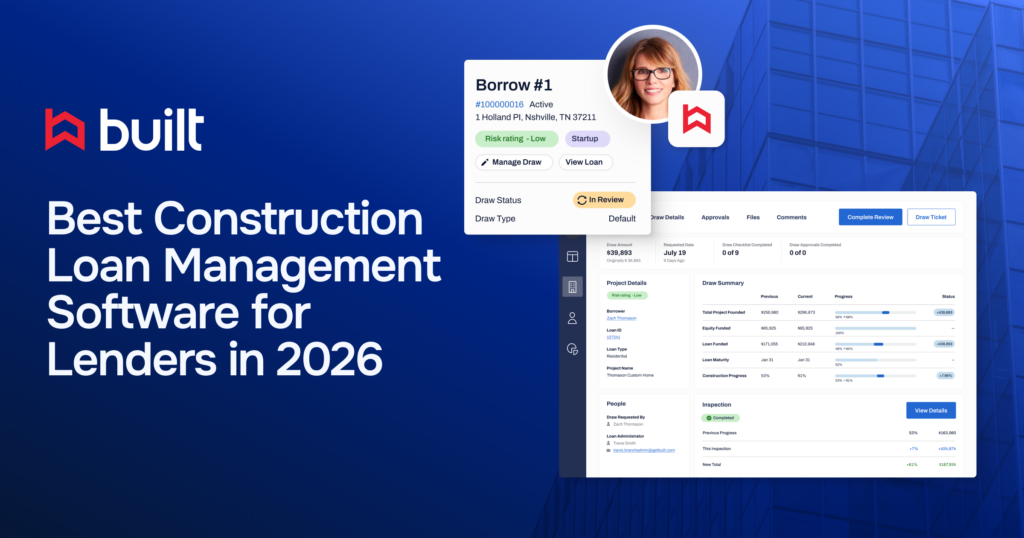

1. Insights: a risk-focused analytics engine

Rather than describing tools in theory, Built delivers them through its Insights module, creating live portfolio views, flagging stale or overfunded loans, and producing audit-ready reports. It turns risk into intelligence, not conjecture.

2. Construction loan administration platform

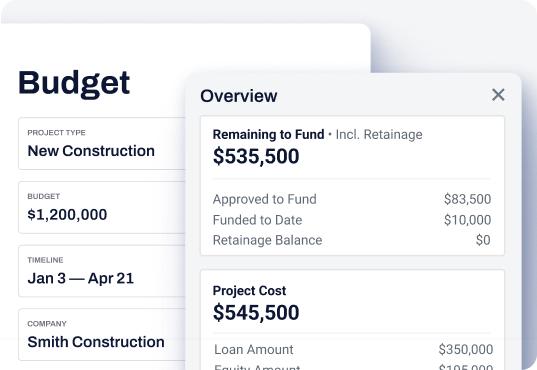

Built powers all stages of construction loan management from draws, budgets, and inspections, all within a single, integrated interface. As a result, lenders gain faster visibility, stronger decision-making, and independence from spreadsheets.

3. Scale smarter, not harder

Using Built, mid-market and community lenders are reportedly doubling capacity without adding staff. Automated workflows and aggregated reporting let teams do more with less, even amid rising deal volumes.

4. Next-level reporting and alerts

Built provides real-time monitoring that surfaces flagged issues, reserve gaps, and maturing loans. Automated report delivery and data-driven alerts keep every stakeholder proactive in managing risk.

5. Deep risk monitoring with project pro

Beyond dashboards, Built Marketplace includes Project Pro, a service layer that delivers live contractor due diligence, lien monitoring, and alerts so risk is monitored, not just reported.

From Blind Spots to Competitive Advantage

Treating portfolio data as scattered files or outdated reports is no longer sustainable. Lenders need a comprehensive view of their portfolios to spot potential risks, track key metrics, and align decisions with broader business objectives.

Risk management dashboards deliver that clarity. By aggregating data from multiple sources, they simplify complex data and provide the detailed insights lenders need for faster, more confident decision-making. This yields better risk mitigation strategies, stronger compliance, and improved operational efficiency.

Built provides this foundation. From monitoring draw requests to helping teams identify risk exposure and maintain data integrity, Built supports a proactive approach to managing risks. Lenders gain the ability to mitigate potential threats, protect funds, and build lasting confidence with borrowers and investors.

See how Built helps risk managers turn hidden risks into opportunities. Book a demo today.

Portfolio Risk Management Dashboards FAQs for Lenders

How do risk management dashboards help lenders stay ahead of portfolio risks?

A risk management dashboard gives lenders a portfolio-wide view of risk exposure, turning scattered reports into a single source of truth. By aggregating data from multiple sources and surfacing key metrics like draw activity, loan-to-value ratios, and compliance checks, they simplify complex data and highlight where attention is needed.

Automated alerts notify risk managers when a threshold is exceeded, prompting immediate action to mitigate potential threats.

What should lenders look for when implementing a risk management dashboard?

When evaluating risk management dashboards, lenders should focus on usability and flexibility. The most effective tools combine an intuitive interface with customization. Lenders can tailor layouts, add specific risk indicators (KRIs), and adjust thresholds to reflect their unique portfolio and business objectives.

They should also expect up-to-date information that supports informed decision-making, plus built-in compliance tracking that simplifies reporting and strengthens audit readiness.

How do risk management dashboards help lenders reduce construction lending risk?

In construction lending, risk management dashboards function as a real-time control system for projects and budgets. They help lenders monitor draw requests, track budgets against forecasts, and flag exceptions that could increase risk exposure.

By tying together project data, compliance checks, and contractor documentation, lenders gain the transparency needed to mitigate risks before they escalate.

How do risk management dashboards improve compliance and investor confidence in CRE lending?

For CRE lenders, risk management dashboards serve as a compliance and reporting backbone. Regulators and investors expect lenders to manage exposure carefully, often through stress testing and ongoing monitoring. Dashboards provide a comprehensive view of portfolio health, time-stamp updates, and generate audit-ready reports on demand.

This transparency helps lenders demonstrate control, meet compliance requirements, and strengthen confidence across the capital stack.