Eliminate Manual Methods for Construction Loan Management: Q&A with Mike Segreto

One of the riskiest elements of a lenders’ portfolio is relying on manual methods to manage construction loans. The fact that lenders have not committed to digitizing one of the riskiest parts of a portfolio is cause for concern—but there is a solution. Built VP of Enterprise Sales, Mike Segreto, knows how crucial it is to manage these projects with ease so that you can focus on what matters most: providing a better borrower experience, reducing risk, and ultimately, improving your bottom line.

- What options are available to construction lenders to manage their portfolios?

Right now, three options come to mind: manual tools like Excel, a custom but labor-intensive back of house system, or a truly collaborative tool that can bring all necessary people and information into one place. The number of lenders who are still using a manual tool like Excel to manage the riskiest part of their portfolio is, in my opinion, concerning. This process is riddled with opportunities for risk. But, for lenders who decide to go with a tool like ours, not only are they actively mitigating risk opportunities but they’re also able to collaborate with all of the individuals involved in a construction project. Improved collaboration on the system leads to faster draw times and happier borrowers.

- What are some of the challenges with the first two options you discussed?

If you think about a bank’s portfolio, the riskiest piece of it is typically construction. You are counting on somebody who is counting on somebody else to do something on time and on budget—and there’s really no control around it. With Excel, the data is static, forcing you to be reactive. When any project updates occur, they are passed manually and updated manually—this is time-consuming, prone to error, and a negative user experience. With a back-of-house system, whether purchased or developed, there is no true collaboration. These systems can provide workflow options but lack the centralized information that borrowers and lenders alike can benefit from. Without the visibility or communication on a system, draw turnaround time is still slow and inefficient.

- What are some of the most successful construction lenders focusing on right now?

There are three areas that the most successful construction lenders are focused on for happy and returning clients: user experience, visibility, and collaboration. A bank’s customers, whether builders, owners, or developers, are asking questions like: How is my experience? How are you helping ensure that my project can be completed on time? How are you keeping me informed? Lenders who are competitive in the construction space have clear answers to those questions—and a digital tool that can connect all parties involved in the process.

- How can loan administrators and lending teams maintain a competitive advantage?

If you can provide faster draw times, you’re going to get repeat business. Builders who have used Built have seen the power of our platform and are demanding it. They can track and communicate their project with you the way that they would for any other facet of their lives in this digital era. From inspections to draw disbursements, everything is captured in one place with Built. It’s our aim to provide a great product to our clients who can, in turn, provide the best possible experience to their customers—and that’s a huge competitive advantage.

- What are the main areas you see as a reason to adopt a digital tool?

The world has moved to a digitized, collaborative platform for so many other things—it’s time for lenders to catch up. Built has 16 of the top 25 construction banks and over 140 financial institutions total. These lenders are able to provide efficiency gains, a better customer experience, remain compliant and improve their bottom line. If a lender doesn’t want those things, they should really be asking themselves why…or why not?

- What steps can a lending team take toward improving processes before or after adopting a digital solution?

Take a look at your portfolio as it exists today. Then, evaluate your processes! One of the first questions that our team typically asks is if a lending team has their standard operating procedures (SOPs) written out. We’re often surprised at what we learn—even if banks have them, they’re often not documented or accessible. When considering a digital tool, it’s also a good idea to consider the way you’re currently doing the work and if there’s room for improvement. Start paying attention to how long your draw time is compared to best-in-class lenders. Where is there room for improvement?

- What’s the value of a digital solution when it comes to mergers and acquisitions?

When two banks merge, there is an abundance of information that has to come together as one new set. In the case of construction lending, there are two different data sets and two different teams with different processes for how they manage their portfolios. If both teams are already on Built, the data is set up in a standardized fashion and the process is already set up—so the merging becomes more painless than it would be without it. Built can do the heavy lifting by providing the digital centralization and standardization that teams require.

- Why do you think some lenders have taken longer than others to go digital?

When I talk to lenders, most have already invested in technology, but it’s usually for the bank’s larger core or in their loan origination system. Or both. Construction lending often does not get the time and attention it is due because of the number of involved parties and complicated processes. It has been done the same way for decades—even as other areas of the bank are fully digitized. The only real reason why it’s stayed the same is just that, “We’ve always done it this way.” There’s a better solution.

We take a consultative approach to incoming prospects and our partnerships with existing clients. Everyone knows that construction is booming right now—and on top of that, banks have to consider mergers and acquisitions as a factor in their day-to-day processes and workflow development. The number of banks of all sizes who are entering this market is increasing. Built can help by providing the framework for getting up to speed quickly so those banks are prepared to continue building to meet the increasing need for housing and more. If you provide construction loans of any type at your bank, why have you not at least explored what Built has to offer?

Related Posts

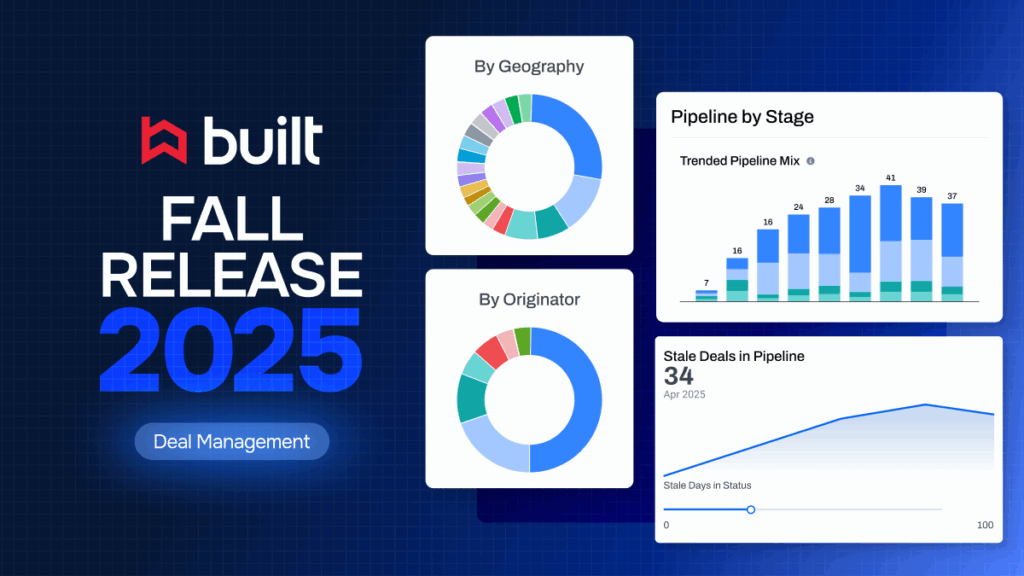

Fall Release Recap: What’s New in Deal Management