Construction Loan Risk Assessment: 3 Blind Spots to Fix

For construction lenders, loan risk assessment has always been the most precise area of commercial real estate (CRE) lending. With market volatility, rising material costs, and fierce competition squeezing every deal, lenders can’t afford to make decisions using incomplete information. And with portfolio concentration under close regulatory scrutiny, the cost of moving slow is simply too high.

Effective assessment starts with understanding where risk originates, such as cost overruns, project delays, contractor defaults, and market swings, all of which can quickly erode loan performance and lender security.

The bigger challenge, however, lies in the gap between today’s risk demands and yesterday’s operations. Many institutions still rely on legacy processes, disconnected spreadsheets, and paper-based workflows. This disjointed approach creates blind spots that expose lenders to unnecessary capital risk, compliance failures, and operational drag.

This article highlights three critical fail points traditional systems can’t fix, and how lenders can move from reactive document management to proactive, real-time oversight that restores continuous visibility across every loan.

Blind Spot 1: The Costly Lag of Stale Data in Construction Lending

Construction loan monitoring is fundamentally reactive. It depends on legacy processes like periodic data entry, isolated spreadsheets, and batch reporting, often on quarterly or monthly cycles. This makes data instantly stale, forces manual reconciliation, and increases risk.

Automating data flows with real-time systems replaces that lag with continuous visibility and control.

The true cost of human error

Manual input is directly responsible for increased operational risk across all construction projects.

- Error rate: According to Radman et al. (2025), manual data entry and fragmented systems are directly responsible for increased operational risk across construction projects. Inefficiencies in data acquisition and manual input delay real-time analysis, hinder early delay detection, and increase the likelihood of financial and scheduling discrepancies. These small errors compound over time, reducing visibility and preventing early warning signs from being spotted.

- Error propagation: Each initial mistake risks compounding across siloed systems, negatively impacting loan balances, draw schedules, and compliance tracking. This inevitably causes delayed decision-making further down the line.

The financial impact: The 1-10-100 rule

The 1-10-100 Rule illustrates the compounding cost of fixing data errors:

- ~$1 to fix immediately at the point of entry.

- ~$10 to fix later during monthly reconciliation.

- ~$100 to address after it causes downstream impacts (like funding mistakes triggers, or foreclosure).

In construction lending, a small error during draw request initiation, such as entering the wrong general contractor payment amount, can quickly snowball into misallocated funds or loan balance discrepancies that compromise portfolio stability.

Example: The compounded cost of over-disbursement

A regional commercial bank approved a $5 million construction loan. During the third draw, a loan administrator mis-entered the “Retainage Held” figure in the reconciliation spreadsheet, causing a $35,000 over-disbursement to the contractor. Because the bank relied on monthly batch reporting, the error went unnoticed for ten days.

By the time it surfaced, the cost of correction had multiplied, triggering internal investigations, legal review, and reconciliation across Accounting, Loan Management, and Credit. Left unresolved, it could lead to borrower disputes, refinancing complications, and compliance penalties for inaccurate records.

This illustrates how a single data entry error, combined with delayed reporting, can quickly become a capital and compliance crisis.

Blind Spot 2: Disconnecting Progress from the Budget

The two most critical data sources, construction progress inspections (physical progress) and draw requests (financial disbursements), are often managed in separate systems like PDFs, emails, or spreadsheets.

This disconnect creates data silos that obscure real-time visibility and make accurate risk assessment nearly impossible. When budgets and progress data don’t align, lenders face unexpected costs, project delays, and heightened default risk.

The failures of continuous due diligence

Traditional due diligence often stops at underwriting. Once the loan closes, ongoing monitoring (the backbone of construction lending) tends to break down. This lapse leaves lenders exposed to risks that emerge throughout the build, not just at origination, and it is a key factor behind many failures in construction and CRE lending.

The erosion of collateral safety

When draw requests and inspection findings are disconnected, lenders lose the ability to automatically verify that the funds requested match the work completed.

This breakdown creates over-disbursement risk, which releases capital against unverified progress and weakens the collateral that secures the loan. Appraisal reports play a vital role in maintaining accurate valuations and oversight throughout the project.

Without integrated systems, lenders must manually cross-check budgets and inspection data before wiring funds. Continuous monitoring of project milestones and completion dates is essential to keep disbursements aligned with progress and contractual deadlines.

The risk of compliance failure

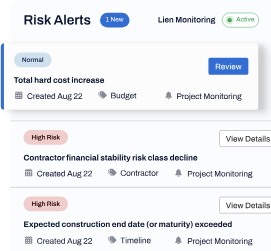

Beyond financial exposure, the disconnected draw process is a major source of loan compliance failure (a major source of credit risk).

- Missing waivers: Lien waivers and other critical compliance documentation (like insurance coverage updates) are often collected via email and stored in a shared drive, completely separate from the draw approval system.

- Compromised position: When the system cannot automatically block a disbursement due to a missing lien waiver, the lender’s lien position is compromised, opening the door to costly mechanics’ liens or legal disputes.

Relying on these manual workflows forces teams to operate through endless cross-referencing, leaving the collateral exposed.

Blind Spot 3: Unseen Risk in Portfolio Concentration

Traditional loan management focuses on individual loan performance, not portfolio exposure. Without real-time aggregation, lenders can’t see concentration trends or identify systemic risk as it develops. To address this, many banks have created specialized construction lending units to better monitor and manage portfolio exposure.

Failure to see systemic exposure

When loan management is disconnected from portfolio risk aggregation, construction lenders struggle to answer fundamental questions about their systemic exposure:

- What is our total exposure to a single, at-risk general contractor?

- Are we nearing our internal concentration limits in a specific geographic market (e.g., Dallas-Fort Worth)?

- How would a localized downturn impact our total committed capital across multifamily assets?

The regulatory threshold challenge

The lack of real-time visibility into aggregation jeopardizes loan compliance with regulatory guidance, particularly concerning CRE concentration thresholds for financial institutions.

- CRE Loans Threshold: Regulators may flag a bank or credit union for significant CRE concentration risk if total CRE loans exceed 300% of total risk-based capital.

- Construction Loans Threshold: A more stringent flag is raised if construction loans alone exceed 100% of total risk-based capital.

Without real-time roll-ups, breaches surface in quarterly reports too late to steer exposure.

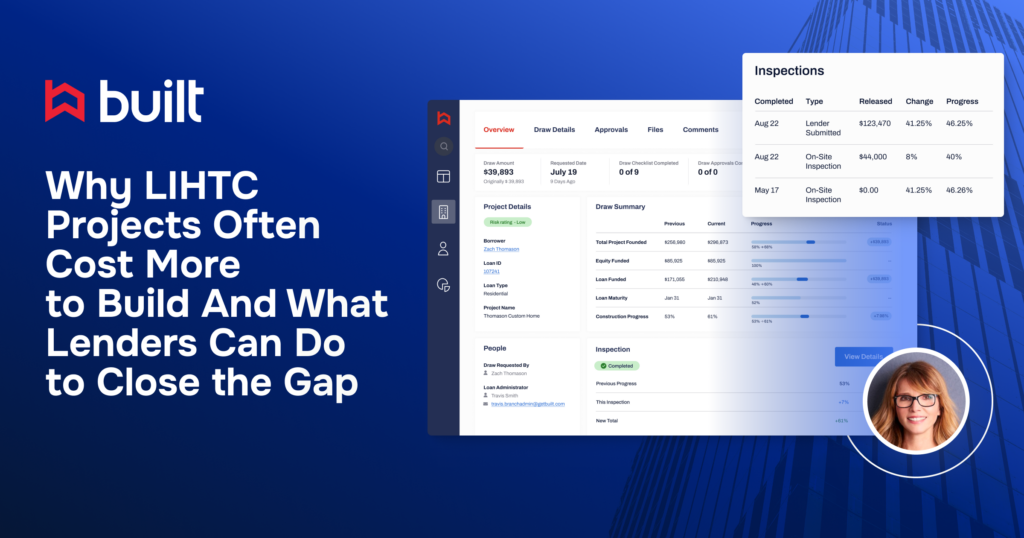

From Blind Spots to Proactive Control

Static spreadsheets and hindsight reporting increase capital at risk. A single, auditable data flow enables draw- and loan-level risk scoring, live threshold monitoring, and faster decisions. Real-time monitoring also helps ensure project completion by verifying construction progress before releasing funds. This strategic shift allows lenders to shorten cycle times, lower capital at risk, and establish proactive risk scoring at draw and loan levels.

Ready to see how risk management dashboards eliminate these blind spots and deliver the real-time insights you need to grow confidently? Book a demo with our team today for a deep dive into managing your potential risks.

Construction Loan Risk Management FAQs

How can lenders ensure their first lien rights are protected during every draw process?

Protecting the lender’s lien position requires active management of documentation during every funds disbursement. Lenders must ensure lien waivers are collected, validated, and tied to each draw request to avoid subordinate liens overtaking the first lien. The best practice is to move away from error-prone lien forms stored in email to a centralized system that automatically blocks funds release if the required documentation is missing, helping to avoid liens.

What is the distinction between a periodic inspection and continuous risk monitoring?

A traditional construction progress inspection is a snapshot in time. It verifies the work completed for the current draw request. Continuous risk monitoring, however, uses real-time insights to track compliance status, project budget adherence, and portfolio concentration between inspections. This provides a constant stream of real-time insights that enable lenders to proactively mitigate risks, unlike reactive, manual progress reporting.

How should lenders monitor contingency budgets once the loan is closed?

The contingency budget is the loan’s cushion against unforeseen costs that may arise during the construction process. To mitigate risks from cost overruns, lenders must continuously monitor the consumption rate of the contingency budget against the construction project’s remaining timeline. Monitoring tools allow lenders to track potential shortfall warnings in real-time and intervene before the project runs out of funds and the loan is exposed to higher credit risk.

How do pre-close due diligence factors, such as contractor vetting, fit into continuous risk monitoring?

Due diligence is crucial for underwriting a secure loan, but the risk doesn’t end when the loan closes. Lenders should treat initial vetting data for builders and general contractors (such as qualifications and experience) as part of ongoing monitoring. Continuous risk management systems track the contractor’s current performance across the entire portfolio, flagging concerns that arise after the close. This helps lenders connect initial due diligence with real-time performance, strengthening their ability to reduce risks on all active construction projects.