Doubling Lending Capacity With Construction Loan Management Software

Construction lending has always been resource-intensive: multiple stakeholders, complex draw cycles, compliance-heavy risk checks, and high-touch borrower relationships.

Within the broader world of construction finance, community and mid-market lenders face tighter capital environments and shrinking margins, making it harder to grow without growing teams. That’s where modern construction loan management software is changing the game, helping lenders expand capacity without sacrificing oversight or borrower experience.

At the same time, deal volumes are rebounding. The Mortgage Bankers Association projects total mortgage originations will increase 28% in 2025, reaching $2.3 trillion after two years of contraction. That means competition is rising for lenders who can move quickly while keeping risk in check. The question is no longer whether to scale, but how to scale without adding headcount.

That’s exactly what Built explored in our recent webinar, How Lenders Are Doubling Capacity with the Teams They Already Have. Hosted by Andy Wallace, Senior Solutions Engineer, the session outlined five strategies lenders are already using to increase efficiency, reduce risk, and deliver a modern borrower experience without hiring more staff.

In this article, we’ll recap those strategies and add industry context to show how visibility, efficiency, risk management, and collaboration come together to create sustainable growth in construction lending.

Visibility in Construction Loan Management Software: A Single Source of Truth

Construction lending programs can only grow as fast as their teams can keep track of the data. For many community and mid-market lenders, this means endless Excel files passed around via email with outdated versions, hidden errors, and no clear portfolio-level visibility.

That siloed approach creates three major issues:

- Uneven transparency: Leadership only sees snapshots of performance rather than live data.

- Operational drag: Frontline teams waste time searching for the latest version instead of serving borrowers.

- Delayed risk detection: Critical issues like maturity extensions or stale projects with no draws or inspections, surface too late to act.

According to a recent survey by AutoRek, 90% of financial institutions still rely heavily on spreadsheets for core operations. In construction lending, where volumes are rising and compliance demands are high, that reliance creates bottlenecks that stall growth.

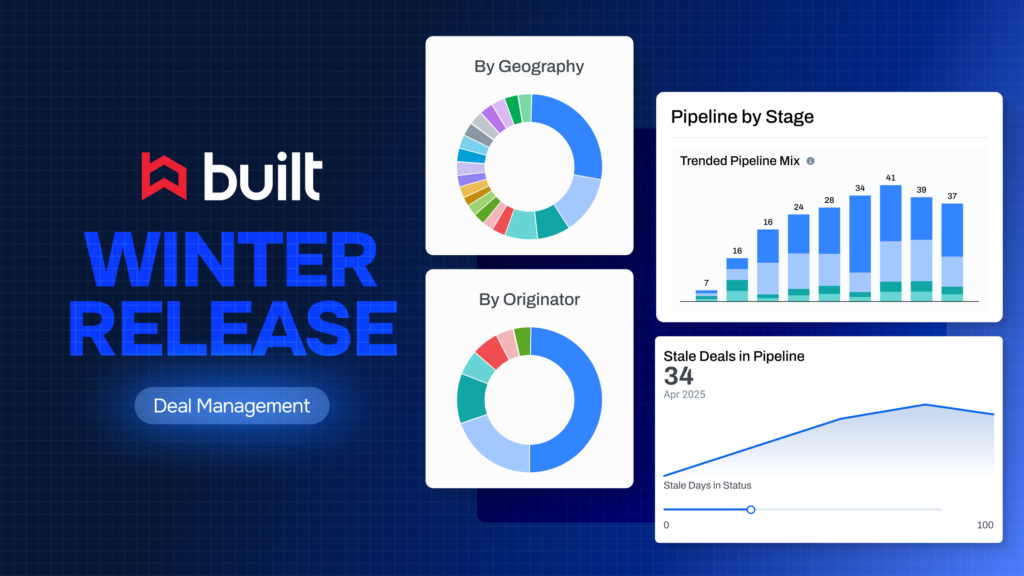

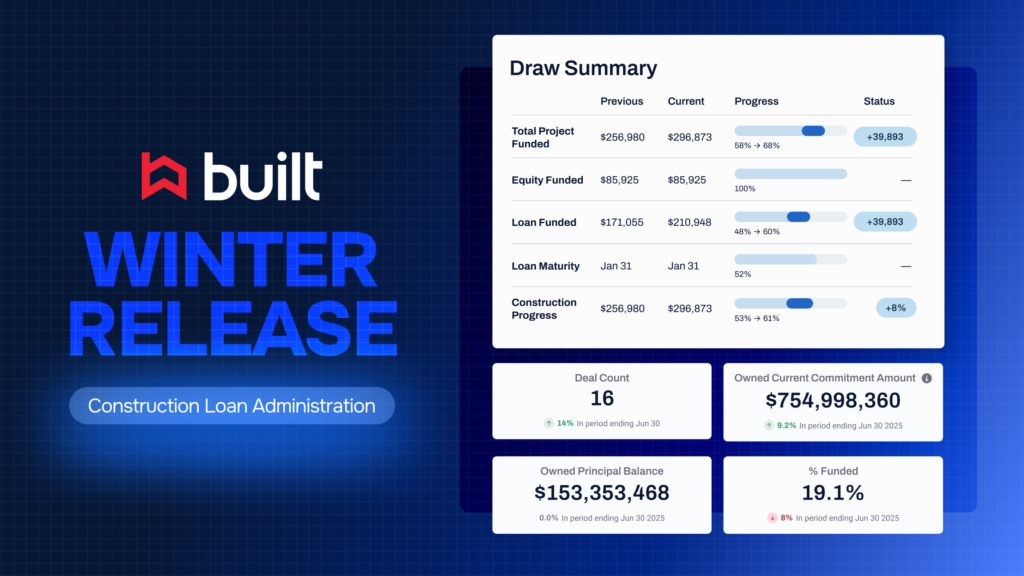

How Built Creates Real-Time Portfolio Views

In the webinar, Andy demonstrated how Built replaces static trackers with a single, configurable portfolio dashboard. Instead of passing spreadsheets back and forth, teams see live data in one place, filtered by originator, geography, or book of business. Dashboards can be exported or scheduled to arrive before team meetings, so everyone stays aligned without extra effort.

The impact goes beyond convenience. With a single source of truth, lenders can scale without hiring additional resources: originators see deal status instantly, credit teams catch exposures earlier, and executives gain confidence in forward-looking portfolio insights. Visibility stops being a bottleneck and starts fueling smarter growth.

The Takeaway

Visibility scales when lenders move beyond static spreadsheets. A single source of truth creates portfolio clarity, reduces hidden risks, and gives teams the confidence to grow without expanding staff.

Streamlining the Draw Process with Construction Draw Software

Construction draw management has always been one of the most resource-intensive parts of construction lending. Each request passes through multiple hands: borrower, inspector, lender, back-office. And when those workflows run on email chains and spreadsheets, the draw process quickly becomes a bottleneck:

- Draws get lost or delayed in inboxes.

- Approvals pile up if one person is out of office.

- Communication gaps force teams to chase documents or resend requests.

The result is inefficiency that limits capacity. Instead of servicing more loans, teams spend their time reconciling paperwork and checking status updates.

How Built Centralizes Draw Operations

In the webinar, Andy walked through how Built’s DrawDesk replaces scattered workflows with a single queue for all pending requests. Every draw appears in one place, sortable and filterable by branch, originator, or project.

Teams can do the following:

- Take bulk actions on multiple requests at once.

- Reassign tasks instantly if someone is out.

- Trigger inspections or borrower approvals directly in the system.

Because everyone sees the same live status, the model works whether draws are handled centrally or across decentralized markets. Borrowers, builders, inspectors, and lenders all collaborate in one platform, eliminating back-and-forth emails and giving administrators real-time clarity on bottlenecks.

The Takeaway

Efficiency grows when draws move from inboxes into a structured workflow. Centralizing requests reduces delays, minimizes risk of errors, and frees teams to handle more loans.

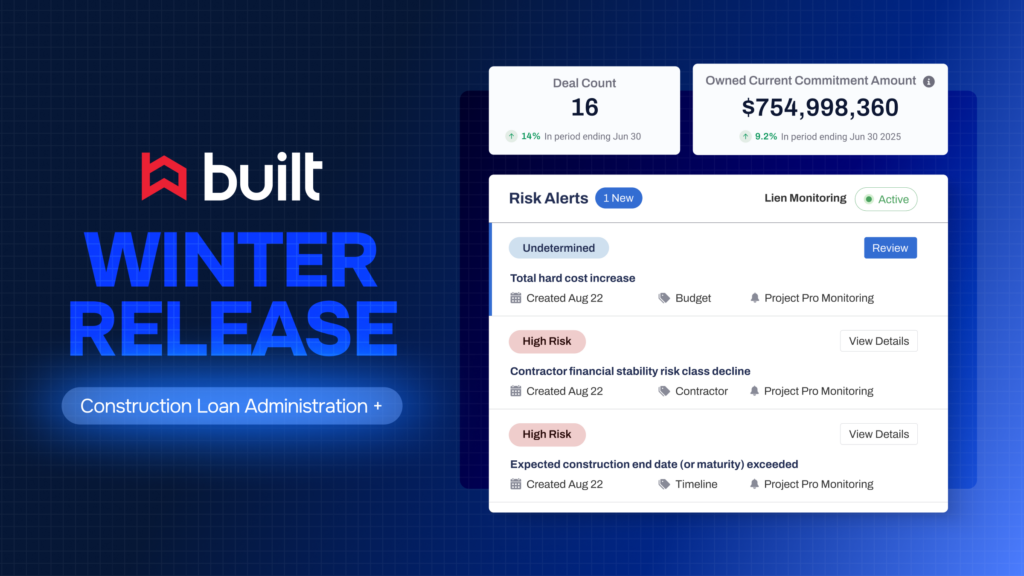

Construction Loan Risk Management with Real-Time Monitoring

Even well-run construction portfolios can drift off course without continuous, structured monitoring. The day-to-day reality for many teams is periodic, manual checks across emails, spreadsheets, and servicing portals, so early warning signs arrive late or not at all.

Common failure points include the following:

- Mechanics’ liens or contractor credit issues surfacing after funds go out

- Stale projects (no draws/inspections) masking schedule slippage

- Covenant risks (e.g., DSCR, budget variance) caught only at quarter-end

- Expiring insurance or other critical docs discovered during a draw

Bank supervisors continue to flag operational risk from manual processes and data quality, especially where siloed systems impede timely monitoring and reporting. That push to digitize is intensifying alongside CRE stress and rising special-servicing transfers in segments like office real estate, which makes proactive surveillance more valuable.

And with disaster events hitting records in recent years, lenders benefit from geo-aware alerts that connect portfolio exposure to real-world events.

How Built Operationalizes Proactive Oversight

In the webinar, Andy showed how teams move from periodic checks to always-on monitoring:

- Pre-close diligence in one flow: Digitize contractor/builder acceptance (e.g., information requests and business credit checks) so you’re confident in counterparties before first disbursement.

- Automated lien and contractor signals: Built surfaces property lien activity and contractor credit changes as risk tiles, so potential red flags are visible before the next draw request.

- Timeline and budget trackers: A project tracker visualizes pacing vs. plan; budget alerts flag variances as they occur (not weeks later).

- Expiry ticklers: Automatic reminders for soon-to-expire items (e.g., insurance) reduce scramble during funding.

- Inspection workflow and network: Trigger inspections automatically or on demand; third-party inspectors submit on-site photos and line-item confirmations via mobile, feeding decisions and audit trails.

The result is a single view where risk indicators, documents, and approvals live together, so issues are escalated to the right person, at the right time, with the right context.

The Takeaway

integrated, always-on monitoring turns risk management from reactive clean-up into early intervention, reducing surprises at draw time and keeping projects on schedule.

Seamless Collaboration via Construction Lending

Construction lending depends on constant communication: builders submitting draw requests, inspectors completing reports, borrowers signing off, and lenders keeping everything moving. In most programs, that collaboration still happens through email threads, phone calls, and scattered attachments. The result is predictable: missing documents, delayed approvals, and frustrated partners.

Despite new tools and digital workflows, productivity in construction has barely budged. McKinsey’s 2024 research found that global construction productivity grew only 0.4% annually between 2000 and 2022, compared to 2% for the overall economy and 3% for manufacturing. That long-standing gap underscores why lenders relying on fragmented processes can’t afford inefficiency in how they collaborate across teams and stakeholders.

How Built Enables Seamless Collaboration

In the webinar, Andy showed how Built brings all collaborators, including internal teams, builders, inspectors, and borrowers, into a single system. Instead of back-and-forth emails, draw requests, inspection results, and borrower approvals flow through one portal.

- Builders log in to submit itemized draw requests and upload invoices directly to the line items they cover.

- Inspectors complete site reports from a mobile app, attaching photos that feed directly into the loan file.

- Borrowers review and e-sign approvals without waiting on paper forms or email chains.

Everything is time-stamped and auditable, so lenders gain confidence that each step was completed, while partners gain transparency into the process.

The Takeaway

Collaboration doesn’t have to mean constant chasing. By replacing email back-and-forth with a shared platform, lenders speed up approvals, reduce errors, and give every stakeholder a smoother experience.

Scaling with Partnerships and Portfolio Management

In construction lending, originators, credit teams, asset managers, servicers, and borrowers all need to stay aligned. But too often, each group works in its own silo. That fragmentation leads to the following:

- Duplicated effort: the same borrower data keyed into multiple systems.

- Delays: covenant breaches or draw requests surface late because information gets stuck at handoff points.

- Weakened relationships: borrowers experience the process as disjointed and slow, undermining satisfaction.

The urgency to modernize is growing. McKinsey’s 2024 research showed global construction productivity actually declined by 8% between 2020 and 2022, despite record demand. Projects that rely on fractured, one-off collaborations can’t keep pace, and lenders who depend on the same disjointed workflows risk falling further behind.

How Built Enables Partnership at Scale

In the webinar, Andy emphasized that the difference isn’t just software, but partnership. Built provides a connected system of record where borrowers, inspectors, and servicers can contribute data directly into the platform, while lenders maintain control and visibility. That means fewer handoff delays, stronger borrower relationships, and a real foundation for scale.

But the value extends beyond the platform itself. Built’s subject matter experts support clients through implementation, workflow testing, and best-practice consulting. A dedicated Data-in-Motion team helps integrate APIs and SFTP connections so portfolio data flows seamlessly into existing tech stacks. And as lenders weigh emerging technologies like AI, Built remains focused on responsible adoption, ensuring tools are both practical and safe for regulated environments.

The result is more than a vendor relationship: it’s a future-focused partnership that helps lenders adapt to market volatility, manage complexity, and embrace innovation without straining their teams.

The Takeaway

Future-focused lending partnerships rely on connected ecosystems and expert support. When lenders, borrowers, and third parties collaborate through one platform, backed by a partner invested in their long-term success, they reduce duplication, strengthen relationships, and gain the capacity to grow without expanding teams.

Scaling Smarter, Not Harder

Scaling your construction lending operations doesn’t have to mean endlessly expanding your team.

As we’ve explored, the key lies in leveraging better visibility, streamlining workflows, implementing proactive risk oversight, and fostering stronger partnerships. Modern tools now make construction loan administration far more efficient, helping lenders manage complexity while keeping programs profitable.

Lenders who embrace this modernized approach are already demonstrating that sustainable growth is achievable while effectively managing both risk and resources.

To see these strategies in action and discover how Built can specifically help your organization double its operational capacity, we invite you to watch the full webinar, How Lenders Are Doubling Capacity with the Teams They Already Have, or request a personalized demo.