From Manual Construction Draw Request Forms to Automated Workflows

Still searching for a construction draw request form that actually works? For lean owner-developer teams, the form might seem like just another document, but when it’s inconsistent, incomplete, or buried in someone’s inbox, it doesn’t just delay a single payment. It slows the entire construction draw process. Funds stall, inspections lag, lien waivers go unsigned, and suddenly, your timeline and your lender’s confidence are at risk.

You’re not managing one draw. You’re managing dozens, across active projects, shifting scopes, evolving budgets, and capital partners who expect speed, accuracy, and transparency. According to PMI, ineffective communication is the primary cause of project failure one-third of the time, and it contributes to negative outcomes more than half the time. Yet many teams still rely on spreadsheets and email to manage draw approvals, using tools that were never designed for accuracy, auditability, or scale.

The real slowdown doesn’t happen downstream. It starts right here with the request process. This article explores the most common breakdowns in construction draw workflows and how high-growth teams are redesigning their approval process to move faster, stay compliant, and scale across portfolios.

Why the Construction Draw Request Form Is a Financial Trigger, Not Just a Formality

In multi-project portfolios, the draw request form is the ignition switch for capital movement.

At its best, it sparks a clean chain reaction: percent complete is validated, supporting documentation is reviewed, approvals move forward, and funds flow to keep work on track. It links budget progress to real dollars, keeping timelines intact, vendors paid, and capital partners aligned.

But when the form shows up as a static PDF, a disconnected spreadsheet, or an email with scattered attachments, the review process begins in confusion, not confidence. Project managers get pulled into back-and-forth exchanges. Draw approvals stall. Inspections are delayed. Lien waivers lag. And trust between borrowers, builders, and lenders begins to erode.

The issue isn’t the draw form itself. It’s the lack of a structured, repeatable construction draw process, especially at scale. And on most teams, that pain hits operations long before finance realizes why funds aren’t flowing on time.

Owner-Developer Draw Tracking Spreadsheet

Track construction draws, budgets, and approvals in a single spreadsheet. Built for owner-developers managing draws manually.

Why Construction Draw Requests Break Down: The High Cost of Manual Forms

On paper, the construction draw request process looks standardized, but in reality, it’s a fragmented mess. Across a growing portfolio, decentralized processes and inconsistent tools turn what should be a repeatable, auditable system into a source of real risk. When project teams rely on scattered PDFs, shared folders, or last month’s Excel tabs, the result is a breakdown.

This manual approach leads to a number of critical failures:

- No consistent format means every request requires manual interpretation.

- Incomplete or delayed documents stall disbursements and slow fieldwork.

- Static PDFs and email threads cause version drift, undermining audit trails and inviting data entry errors.

In fast-moving development environments, project managers become default gatekeepers—chasing lien waivers, shepherding approvals through inboxes, and manually tracking progress. This puts project pacing and capital movement at risk. The problem isn’t the form itself, but the absence of a structured draw process and the purpose-built tools required to support it at scale.

When requests move through outdated workflows, the risks go beyond inefficiency. Inconsistent draw practices erode trust, disrupt capital pacing, and delay closeouts. A single form error can lead to missed inspections, stalled disbursements, and increased JV scrutiny.

The Challenge with Excel Templates

Many teams start with a free construction draw request template in Excel. It feels like a quick win, but hidden costs surface quickly. Excel might work for a single project, but across a portfolio, it’s a version control nightmare. Spreadsheets get scattered across email threads and shared folders, and teams lose track of which version is correct.

Beyond version issues, these static templates are prone to manual data errors. A single misplaced number or overlooked update can stall the entire draw approval chain. Even worse, Excel lacks a clear audit trail.

When a capital partner asks to review a previous draw, there’s no single source of truth, just a fragmented history of emails and files. In the end, the tool meant to simplify the process becomes its biggest bottleneck.

What a Scalable Draw Request Form Needs to Keep Capital Moving

A scalable draw request form must embed structure, logic, and controls that keep the draw approval process moving without back-and-forth delays.

Here’s what that looks like in practice:

- Budget Line-Item Tie-Ins: Every disbursement must map cleanly to a defined line in the schedule of values — no guesswork, no gray areas.

- Structured % Complete Fields: Numeric progress inputs that sync with inspection results or field data make validation fast and audit-ready.

- Required Documentation Uploads: Lien waivers, invoices, photos, and certifications should be required at submission, not tracked down via email later.

- Logic-Based Approval Routing: Approvals move automatically through the right stakeholders based on roles and budget thresholds.

- Live Versioning and Audit Trails: A single source of truth for every draw package, every edit, every sign-off. No more “which PDF is the right one?”

When forms are this structured, project managers manage progress, not paperwork. And capital partners trust what they see.

Why Capital Partners Lose Trust in Your Portfolio

Trust breaks down long before a missed payment or delayed milestone. It often starts when a draw request lacks clarity, consistency, or completeness.

Capital partners aren’t just reviewing numbers. They’re assessing control, discipline, and risk exposure. When draw packages feel improvised or incomplete with missing backups, unclear progress, or unsupported by documentation, it raises red flags. And when that happens across multiple projects, it signals a deeper issue with operational maturity.

In high-growth environments, capital efficiency is everything. Investors need to know that funds are being requested for real work, on real timelines, with real oversight. When that confidence slips, so does your ability to move quickly, secure future capital, or expand relationships.

Digitizing the draw process improves speed and signals credibility. With structured submissions and centralized visibility. You don’t just move faster, you show your partners that every dollar is accounted for, every time.

Draw Inspections: The Critical Checkpoint for Releasing Funds

A draw request is only as reliable as the evidence behind it.

Before funds move, capital partners need clear confirmation that claimed progress aligns with work completed. Inspections provide that validation. They are routine steps that protect budget accuracy and maintain financial trust.

In fast-moving portfolios, inspections often cause delays. Field teams wait longer than they should. Reviewers waste time searching for missing photos. Inspectors face scattered requests and unclear expectations, which slow down everything.

Built removes that friction by embedding inspections directly into the draw workflow. Results are linked to specific budget items and tied to progress inputs, with digital documentation captured in real time. There’s no switching systems or chasing details.

When inspections are integrated, verification happens faster, funding moves sooner, and teams stay focused on execution instead of paperwork.

How Built’s Digitized Workflows Transform the Draw Process

With so many points of friction in manual workflows, teams don’t just need a better form. They need a better system.

In a scaled portfolio, it’s rarely the form itself that breaks the process; it’s everything that happens after submission. When draw requests live in PDFs, shared folders, or inbox threads, small misses become big delays.

Built’s digitized draw workflows eliminate that friction at the source. Here’s how:

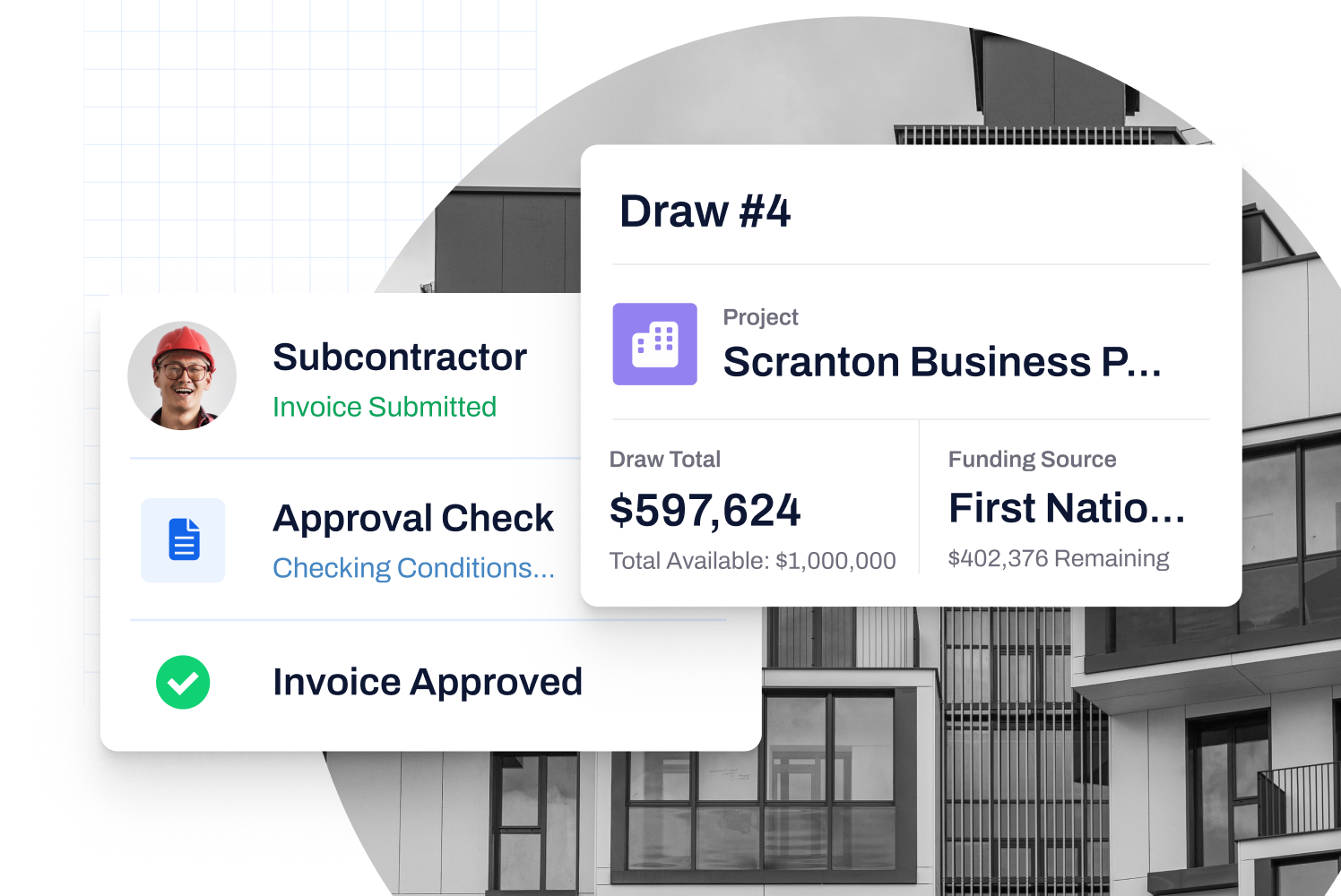

- Smart Forms, Pre-Filled: Built automatically populates draw packages with real-time field data and budget information, saving hours per request and automating “invoice management, draw creation, change order approvals, and budget adjustments”.

- Centralized Source of Truth: Every request, document, and approval is consolidated in one place, so there’s no version drift or conflicting spreadsheets. You can manage all financial operations from a single platform, including “AIA-styled and direct cost invoices,” compliance documents, and lien waivers.

- Built-In Validation: With integrated guardrails, Built flags issues like “missing lien waivers, expired COIs,” or unsupported percent complete before a draw ever leaves the site. This ensures accuracy and allows you to confirm a vendor is compliant before making a payment.

- Accelerated Funding: You can “create and submit draws in minutes” by mapping payables and documents to your draw schedule. This improves collaboration with lenders and helps you get access to funds faster by avoiding never-ending email threads.

- Faster Contractor Payments: Built’s end-to-end workflow keeps subs paid and schedules on track by enabling high-volume payments securely via its “integrated ACH solution”. This streamlines the billing process and boosts vendor productivity.

- Automated Approvals: You can update draw statuses with automated “sequential or parallel approval flows” and ensure every payment has a signed lien waiver on file.

For owner–developer teams managing active builds across multiple geographies, Built is a trust-builder and a competitive edge.

Ready to Ditch Inbox Submissions and Static Forms?

Construction draw requests shouldn’t be a guessing game. They’re financial triggers built to unlock funds, validate work completed, and keep construction projects moving. Built helps you do exactly that.

With a centralized, compliant, and fully digital draw workflow, owner-developer teams don’t just save time, you also accelerate funding, improve project pacing, and give lenders and capital partners the confidence to keep moving at your speed.

Ready to see how it works? Book a demo and see how Built can transform your draw request process from form to funding.

Construction Draw Request Form FAQs For Owner-Developers

What’s the biggest bottleneck in most construction draw request form workflows?

Inconsistent formatting and manual approval routing are the biggest bottlenecks in construction draw request form workflows. In a scaled portfolio, relying on scattered PDFs and email threads leads to a fragmented mess, where every request requires manual interpretation and data entry.

Delays inevitably creep in when teams are forced to chase missing documentation, slowing down the entire draw approval process.

How do we ensure every draw request is complete before it’s submitted?

The most effective way is to use a system that enforces required uploads and validates submissions at the source. This ensures that lien waivers, invoices, photos, and other critical certifications are attached before the request can be submitted.

Built’s workflow validation stops incomplete requests and eliminates the time-consuming back-and-forth communication that frustrates contractors and slows down funding.

Can a single draw request template work across multiple project types?

Yes, but only if it’s a dynamic, purpose-built template. Static forms and spreadsheets are too rigid; they require custom builds for every new deal, which invites errors and inconsistency.

A truly scalable template, like the ones in Built, should flex by budget line items, project scope, and approval logic, allowing owner–developer teams to maintain a standardized process across their full portfolio.

Mark Murphy leads OGC Sales at Built, where he is responsible for accelerating adoption of payments and standalone solutions purpose-built for real estate owners, developers, and general contractors. He brings deep experience across sales, general management, and operations in technology-driven businesses.

Prior to joining Built, Mark served as General Manager at Apex Service Partners and Operating Executive at Alpine Investors. He also spent over six years at Flexport, where he held multiple leadership roles including General Manager for the South and Northeast regions, and Director & Acting General Manager for San Francisco and Northern California. Earlier in his career, Mark was Chief Operating Officer at Oolong, an INC 500-recognized international trading business.

Mark holds a degree in Mechanical Engineering from Stanford University, where he captained the Varsity Men’s Rowing team.

Related Posts

How to Account for Construction Loan Draws: Automating Workflows and Reducing Risk