Collateral Intake: How Lenders Structure and Manage Units in Home Builder Finance

Home Builder Finance (HBF) operations revolve around the Guidance Line of Credit (GLOC), which is the primary form of financing issued to builders for constructing single-family residences. While lenders may use different naming conventions for this product, collateral intake is the foundation of every HBF credit facility.

Before a unit can be activated or funded, lenders must validate the borrower’s request, confirm the documentation, and ensure the collateral fits the rules of the agreement. These steps determine how the unit will be committed, tracked, funded, inspected, and eventually paid off.

This guide breaks down how lenders structure, validate, and manage collateral throughout the entire lifecycle, from setting up the agreement and creating subdivisions to managing plans, intake, sublimits, and payoffs. Each step reflects how underlying structures like borrowing bases and master guidance lines function in real-world HBF operations.

Platforms like Built centralize these workflows and apply the agreement logic automatically, but lenders remain responsible for ensuring every unit is structured accurately from day one.

Key Home Builder Finance Concepts

To understand the lifecycle of collateral management, it is helpful to first define the two primary credit facilities used in Home Builder Finance (HBF): the Borrowing Base and the Master Guidance Line. Since collateral is typically not booked into a lender’s Core accounting system, platforms like Built often serve as the system of record for collateral management.

- Borrowing base: A type of credit facility specifically designed for asset-based lending. Draws are managed at the line of credit level, not the individual collateral unit level.

- Master guidance line (MGL): A credit facility used to manage collateral and their corresponding balances. This structure allows one draw to be spread across multiple collateral units, enabling unit-level balance tracking for payoff purposes.

Collateral Intake and Lifecycle Overview

Built’s collateral workflow is designed to keep agreements, units, and lifecycle activity consistent with lender policy from setup through payoff. The steps below outline the essential components—agreement configuration, subdivision setup, plans and appraisals, collateral intake, lifecycle tracking, sublimit controls, ongoing maintenance, and close-out—providing a streamlined foundation for managing BB and MGL structures at scale.

Step 1: Setting Up the Agreement

Before lenders can add collateral, the agreement must be set up based on its structure, either a borrowing base (BB) or master guidance line (MGL). These two structures determine how availability, advance rates, and draw activity will function.

- Agreement details: Lenders begin by establishing core attributes such as borrower, branch, and the overall structure of the credit facility.

- Revolver type: The revolver classification (gross, over-collateralized, or net) determines how the system calculates availability throughout the life of the line.

- Advance rates: Advance rates are set based on collateral type such as spec homes, pre-sold homes, model homes, finished lots, or vertical units. These rates drive all LTC, LTV, or contract-price calculations once collateral is added.

- Sublimits and constraints: Sublimits and constraints: Sublimits are configured to reflect the specific parameters of the credit agreement, such as maximum spec-home count, dollar caps, or percentage-based restrictions. These rules ensure that new collateral cannot be added if doing so would exceed the borrower’s allowable limits.

In Built, these agreement settings become the foundation for all validation and availability logic.

Once configured, the platform uses them automatically when lenders add collateral, run advance-rate checks, or evaluate new-start requests, helping keep the entire credit facility compliant and consistent from the start. Furthermore, the system can forecast these limitations connected to new start requests while they are in a pipeline state, proactively validating that the constraints will not be exceeded.

Step 2: Creating Subdivisions

Before lenders can add individual units, the subdivision must be configured so each piece of collateral can be tied to the correct legal description. This setup ensures every lot is associated with the right development, phase, and location on the plat map.

- Subdivision details: Lenders establish the subdivision name and baseline information so future collateral can be grouped correctly and linked back to the development.

- Legal mapping: The subdivision structure includes lot, block, section, and phase information, mirroring the plat map. This prevents confusion between similarly numbered lots that exist across multiple blocks or sections.

- Plat map alignment: Because legal descriptions determine where the collateral sits on the actual map, accuracy here is critical. Incorrect lot/block/section data can cause issues with title work, inspections, payoff quotes, or lien releases later in the lifecycle.

- Consistency across BB and MGL: Subdivision setup functions the same way in both borrowing bases and master guidance lines, ensuring each unit is anchored to the correct development before budgets, appraisals, or advance rates are applied.

In Built, subdivision-level data flows directly into collateral intake. When a lender selects a subdivision, the platform automatically displays the correct lot/block/section framework and pre-fills shared details, reducing manual entry and ensuring every unit is mapped correctly from the start.

Step 3: Plans and Master Plan Appraisals

A plan represents the specifications of a unit—its elevation, square footage, features, and construction scope. Each plan is tied to a master plan appraisal, which lenders use to determine the allowable commitment amount when collateral is added. Lenders rely on this master plan appraisal if a site-specific appraisal is not available.

- Appraisal reuse: If the same plan is used multiple times within a subdivision, lenders can reuse the appraisal as long as it remains within its valid reuse period. This reduces the need for repeat appraisals and speeds up the new-start process.

- Expiration management: Once an appraisal expires, lenders must request a new one before the collateral can be activated. This timing affects when units can move from pipeline to active status. Additionally, lenders can set a review timeframe for upcoming appraisal expirations, allowing them and the borrower to proactively determine if a re-appraisal is necessary.

- Appraisal and budget alignment: The appraisal value must align with the construction budget and the lender’s advance-rate rules. For example, if the loan is driven by LTC, the budget determines the cost basis; if driven by LTV, the appraisal becomes the controlling factor.

- Lot value vs. construction value: Lenders differentiate between the underlying lot value and the cost of vertical construction. Each affects availability differently, lot value typically contributes a fixed amount up front, while construction value is released through progress or inspection updates.

In Built, plans and their corresponding appraisals are linked directly to collateral setup. When a plan is selected, the platform automatically applies the correct appraisal, checks reuse validity, and runs the corresponding LTC/LTV logic, reducing manual review and ensuring consistency across all units using the same plan.

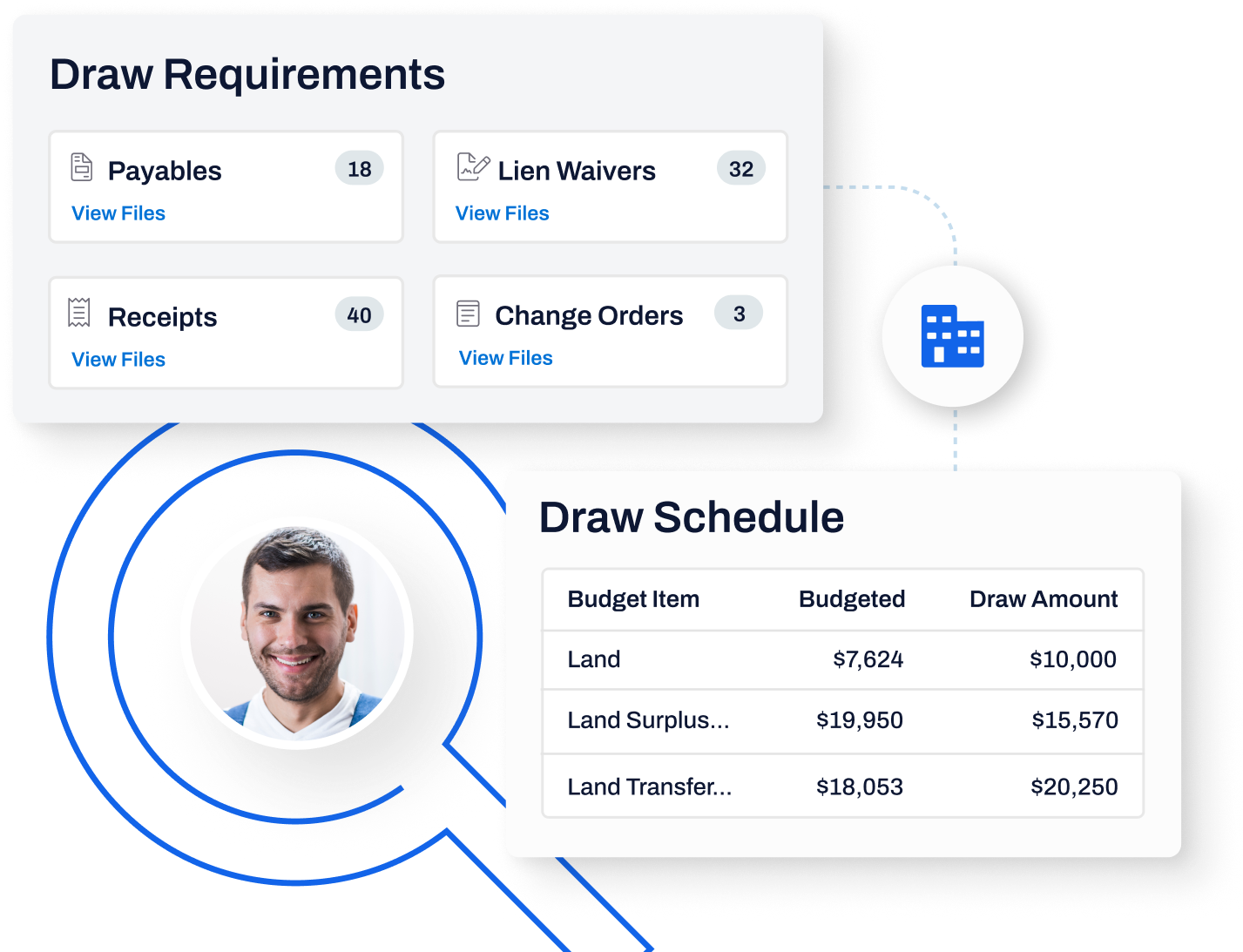

Step 4: Adding Collateral

Once the agreement and subdivision are set, lenders can begin adding individual units to the line. This step determines how each piece of collateral will be tracked, funded, and monitored throughout its lifecycle.

- Collateral type: Lenders select the appropriate collateral type—vertical construction, finished lot, or bulk additions. Vertical units are ready for construction funding immediately after activation, while finished lots may later be converted to vertical through a separate lot-conversion process.

- Legal descriptions: Each unit is tied to its correct legal description, including subdivision, lot, block, section, and phase. Matching the plat map ensures the collateral can be correctly referenced for title work, inspections, and lien releases.

- Bulk intake: Multiple lots can be added at once using ranges or comma-separated entries. Shared attributes such as block, plan, or status can be applied across all units during setup to reduce repetitive entry.

- Sales status: Units are classified as spec, pre-sold, or model homes, as well as identifying the collateral type such as SFR-Detached, Townhome, Condo, etc.. These statuses influence availability and advance-rate logic, since each carries different expectations around payoff timing and risk.

- Eligibility rules: As collateral is entered, it must pass eligibility checks defined by the agreement—such as spec-home limits, dollar caps, or percentage-based restrictions. If adding a unit would exceed these limits, the lender is alerted before activation; however, this functions as a soft stop or warning that can be overridden if the lender has approval to exceed the limitation for business reasons.

- Advance-rate calculations: After the details are entered, LTC, LTV, or contract-price calculations determine the allowable commitment for the unit. Lot value and vertical construction cost contribute differently depending on the structure of the line.

In Built, all collateral inputs (type, legal description, status, and plan) feed directly into Built’s automated eligibility and advance-rate calculations, ensuring each unit is set up consistently and compliant with the agreement from the start.

Step 5: Collateral Lifecycle and Statuses

Once collateral is added, it moves through a defined lifecycle that reflects its progress from initial intake to final payoff. These statuses help lenders track where each unit stands and determine which actions can be taken at each stage. While it is not a requirement to move from one stage to another, you can create standardized workflows if you so choose.

- Pipeline: Units start in the pipeline stage, progressing through draft, proposed, and approved.

- Draft: Initial submission; documentation may still be missing.

- Proposed: Documentation is complete; ready for internal or secondary review.

- Approved: All due diligence is validated and the unit is ready for closing or activation.

- Active: After closing, a unit becomes active and begins contributing to availability. Active statuses typically reflect:

- Activated: Collateral has been officially added and committed to the line.

- In construction: Funds can be drawn as progress and inspections occur.

- Payoff quoted: When a sale or refinance is pending, lenders move the unit into payoff quoted to prevent further draws or inspections. The payoff amount is calculated based on the structure of the line, commitment amount for borrowing bases or outstanding principal for MGLs.

- Archived: Once funds are received, the unit is archived and moved out of the active portfolio. Archived statuses include:

- Paid off: Proceeds have been received and applied.

- Lien released: The lender’s interest has been formally removed from the property.

In Built, these lifecycle statuses control system behavior, such as enabling or restricting draws, inspections, or payoffs, and provide clear tracking across large portfolios. Each transition ensures the unit’s lifecycle is accurately reflected, consistent with the lender’s workflow and agreement structure.

Step 6: Sublimits and Exception Management

Sublimits define how much exposure a lender is willing to take on specific categories of collateral. These rules work alongside the agreement structure to control how exposure is allocated as new units are added.

- Spec home caps: Lenders may limit the number of speculative homes allowed under a line. If adding a new spec unit would exceed the cap, the system alerts the lender before activation.

- Dollar caps: Dollar-based sublimits restrict the total committed amount for certain collateral types. These limits prevent the borrower from concentrating too much value in a single category or phase.

- Lot allocations: Some agreements define the number of finished lots or vertical units that can be active at once. Exceeding these allocations can delay activation until other units pay off or convert.

- Purpose of sublimits: Sublimits act as guardrails for risk management. They ensure the line remains balanced, prevent overexposure to higher-risk units, and enforce the lender’s credit structure automatically as collateral is added. A single sublimit can also apply to multiple collateral types, depending on how the agreement is structured.

- When limits are exceeded: If intake or activation pushes a sublimit over its threshold, lenders receive a warning before moving forward. Decisions may require internal approvals, shifting sales statuses (e.g., spec → pre-sold), or waiting for existing units to pay off.

In Built, sublimits are monitored automatically. The platform checks each collateral addition against the configured limits and flags exceptions in real time, helping lenders maintain policy compliance and avoid unintentional overexposure.

Step 7: Reconciliation and Ongoing Maintenance

After collateral is activated, loan administrators must maintain accurate data throughout the life of each unit. Ongoing updates ensure eligibility, availability, and exposure remain correct as construction progresses.

- Borrower spreadsheets: Builders often provide their own tracking spreadsheets. Lenders reconcile these against the system of record to ensure lot numbers, budgets, progress, and sales data match. This is a tedious but essential accuracy check.

- Sales status updates: Units transition from spec to pre-sold or sold as contracts are executed. Updating sales status ensures advance-rate logic adjusts appropriately and impacts availability calculations correctly.

- Progress reporting: Progress is updated either through borrower reports or inspection results. These updates determine how much construction value becomes eligible for funding as work is completed.

- Aging rules: Some lenders track aging on active units to monitor how long collateral remains under the line. These aging rules can be staggered over time and are often configured to automatically trigger necessary changes to the collateral unit (e.g., changes to advance rates or status). Furthermore, lenders can utilize portfolio-level reporting to proactively identify units with upcoming aging events and understand their potential impact on the overall credit facility.

- Eligible fund adjustments: As progress changes or sales statuses update, eligible funds shift. Lenders must review these adjustments to ensure draw availability reflects the current state of each unit.

In Built, reconciliation, sales updates, progress entry, and eligibility adjustments all feed into a unified lifecycle view. The platform centralizes these changes so availability, exposure, and compliance stay accurate throughout each unit’s development.

Step 8: Payoffs and Lien Releases

As units reach completion or sale, lenders manage the payoff and close-out process to ensure the line of credit reflects accurate exposure and the lender’s interest is properly released.

- Payoff quoted: When a borrower or title company requests a payoff, the unit is moved into payoff quoted. This freezes further activity—such as draws or inspections—and signals that the unit is preparing to exit the line.

- Payoff calculation: Payoff logic depends on the credit structure:

- Borrowing Base: Payoff amount often aligns with the commitment amount or may be zero if availability is already sufficient.

- Master Guidance Line: Payoff reflects the exact principal funded to that unit, tracked at the unit level.

- Payment posting: Once funds are received, they are applied to the line of credit. This reduces principal, updates availability, and moves the unit out of the active portfolio.

- Archiving: After payoff posting, the unit is archived, preserving its full lifecycle history. Archived collateral no longer contributes to availability or exposure.

- Lien release: Final lien-release tracking ensures the lender’s security interest is removed from the property. This is typically handled through title partners or internal operations teams and must be documented for compliance.

In Built, payoff quoting, payment posting, and archiving are tied directly to the unit’s lifecycle. The platform enforces restrictions on payoff-quoted units, tracks unit-level principal for MGLs, and maintains a complete audit trail through close-out and release.

Why Accurate Collateral Intake Matters

Collateral is the foundation of every Home Builder Finance credit facility. When lenders intake and structure collateral correctly, the entire lifecycle functions smoothly, eligibility is accurate, sublimits remain in control, draws move efficiently, and exposure stays aligned with credit policy.

Every downstream action depends on clean collateral data. Accurate intake supports faster draw management, clearer availability calculations, consistent risk monitoring, compliant payoff processing, and a complete audit trail from activation through final release. In high-volume environments, these workflows determine both lender performance and builder experience.

A connected platform like Built helps lenders manage this complexity by centralizing collateral setup, validation logic, sublimit checks, and lifecycle updates, reducing manual work and supporting more reliable, compliant operations across the entire portfolio.

See how Built helps lenders streamline collateral intake and lifecycle management, book a walkthrough with our team today.

Billy Olson brings extensive industry expertise to Built Technologies, joining the company after more than 18 years with Wells Fargo Bank. During his tenure at Wells Fargo, he managed a diverse lending portfolio and led a nationwide team of Loan Administrators within a specialized Homebuilder Finance (HBF) group. His primary focus centered on large, complex credit facilities—including Borrowing Base and Master Lines—serving both major regional and privately held homebuilders across the country.

Driven by the growing challenges of managing a modern, sophisticated book of business with outdated tools, Billy joined Built in late 2018. Motivated by a clear vision of the industry’s future and the transformative potential of technology, he shifted his career toward product development and offering his expertise to our client base. Since then, he has played a leading role in designing, developing, and delivering a suite of advanced HBF solutions tailored to support complex lending structures and provide lenders with a truly modern platform.