AI in CRE Finance: 5 Lessons From the Industry’s Early Movers

Commercial real estate lenders are facing a challenging trifecta: tightening spreads, intensifying competition, and elevated credit and capital pressures. As more private credit platforms enter the space and banks narrow their appetite, lenders are competing in narrower pricing bands. Traditional differentiators (like relationship strength or bespoke structuring) are rapidly losing their impact.

Against this backdrop, operational execution is emerging as one of the few defensible ways for lenders to stand out. Across the industry, lenders are prioritizing efficiency, not product innovation, as a primary strategic focus. Faster, more consistent processes are now directly tied to winning mandates, improving the borrower experience, and protecting margins in an environment where “plug-and-play” term sheets are becoming the norm.

What follows are the key patterns shaping how lenders are approaching AI today: where they see value, what’s driving early adoption, and how they’re navigating the practical challenges of implementation.

Lesson 1: Operational Execution is the New Differentiator

As price and structure converge across the market, execution quality is becoming the primary differentiator. Firms are prioritizing how quickly they can move a deal from intake to funding, how reliably they apply internal standards, and how efficiently they can scale without adding headcount. AI is emerging as the most practical lever to achieve these gains.

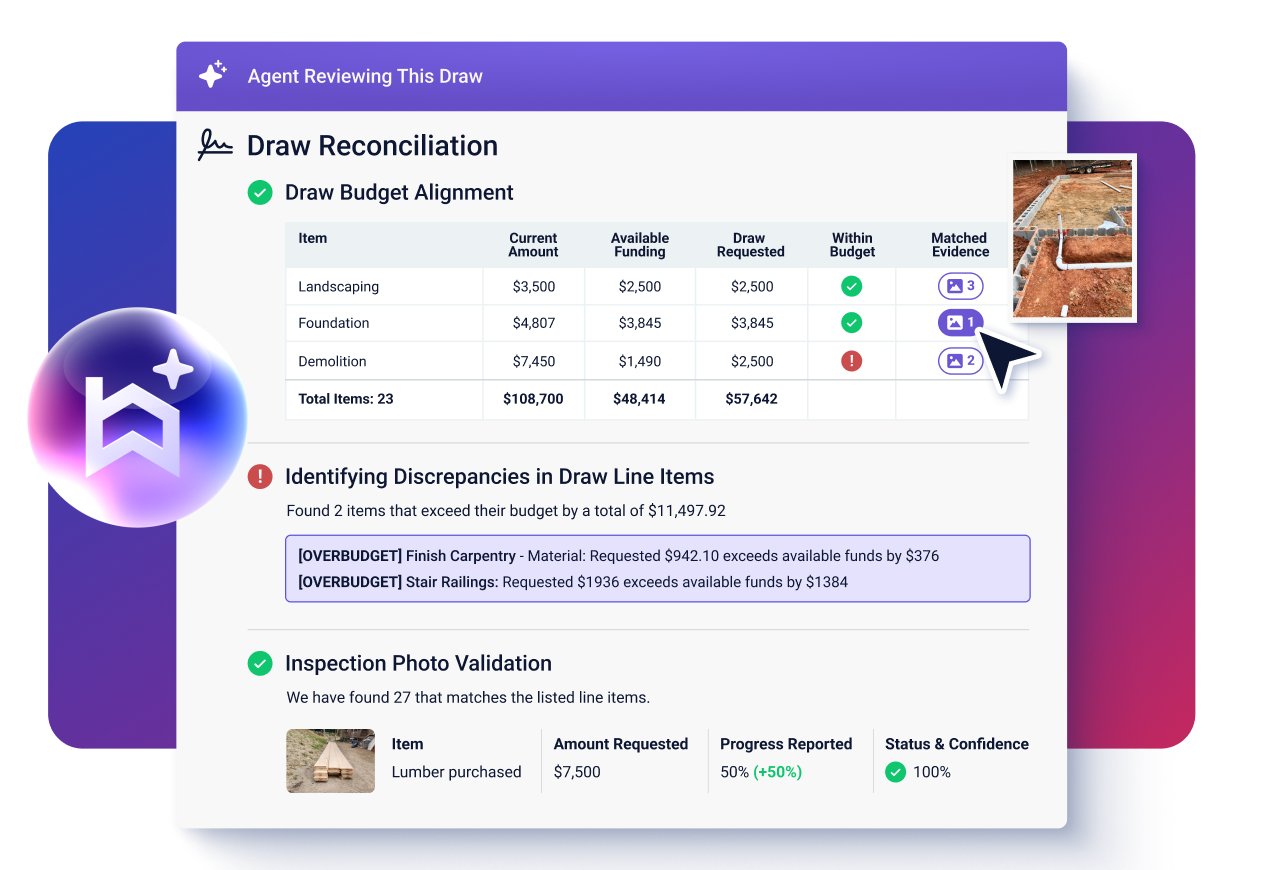

Early adopters are primarily using AI to reduce the manual burden in loan administration and asset management, focusing on tasks like document review, data reconciliation, and routine eligibility checks. The impact directly affects throughput and borrower experience. For example, pilots using Built’s AI Agent have cut initial draw reviews to under three minutes, shrinking cycle times substantially. Lenders deploying these workflows report handling 2–5x more loans per administrator, a meaningful capacity shift when hiring is difficult or costly.

These efficiency gains translate into measurable speed improvements for customers. Draw turn times that once averaged 6–8 days are being reduced to one day or less, with some lenders reaching same-day processing benchmarks. For lenders competing in an increasingly commoditized market, these improvements are now core to how firms win and retain business.

Lesson 2: AI Procurement Is Driven by Business Users (The Bottom-Up Approach)

In many CRE lending organizations, the people pushing AI forward are the operators who feel workflow bottlenecks every day. Credit administrators, portfolio managers, closing teams, and asset managers are increasingly exploring AI tools because they see immediate opportunities to remove friction from their processes.

This bottom-up pattern mirrors what is common across financial services, where “shadow AI procurement” has become a reality. Teams test solutions informally, validate whether a tool can meaningfully reduce manual work, and only afterward pull in IT or risk teams to formalize adoption. While this dynamic accelerates experimentation, it can also lead to fragmented efforts if different groups evaluate different tools without a shared framework or governance model.

Traditional procurement cycles, designed for core systems or large vendor contracts, often move too slowly for AI, where value can be demonstrated in days rather than months. Consequently, lenders are beginning to rethink how they evaluate emerging technologies, building lighter-weight processes that allow business units to explore safely while still maintaining oversight. This shift is shaping how AI enters CRE organizations: not through sweeping, top-down initiatives, but through practical, use-case-driven adoption led by the teams closest to the work.

Lesson 3: Build vs. Buy — Lenders Are Choosing Buy

When weighing whether to build AI capabilities in-house or adopt existing solutions, most CRE lenders are concluding that buying is the faster and more reliable path, especially for early use cases. Workflows ripe for automation (like document validation, data extraction, and basic reconciliations) are largely repeatable across institutions and do not require proprietary models to deliver strong results.

Attempts to build internally often run into familiar hurdles: fragmented data sources make it difficult to assemble clean training sets, and machine learning expertise is scarce within most credit and operations teams. Furthermore, internal development cycles, constrained by long budgeting and approval processes, rarely keep pace with the rapid evolution of AI tools. Consequently, in-house efforts often stall before achieving production-level performance.

Purpose-built platforms address these challenges by delivering out-of-the-box functionality that can be tailored rather than engineered from scratch. For instance, in Built’s early access pilots, the AI Agent completed over 50,000 tasks with 99.9% accuracy, demonstrating that high-quality automation is achievable without the lender developing core models. Teams can then refine the system by applying their own policies, thresholds, and exception rules, adding customization where it matters while avoiding the overhead of maintaining AI infrastructure. This approach allows lenders to adopt AI incrementally, focusing on proven use cases first and layering sophistication over time, rather than committing to large internal builds with uncertain timelines and outcomes.

Lesson 4: Practical AI Use Cases Deployed by Lenders Today

The first wave of AI adoption in CRE lending centers on practical, high-frequency workflows (areas where incremental improvements in speed and accuracy compound into meaningful operational benefits). Across institutions, several categories of use cases are emerging as early wins:

A. Embedded intelligence in existing tools

The introduction to AI often comes via existing productivity platforms (like Microsoft Copilot or Google Gemini). Embedding AI within familiar interfaces lowers the training barrier and reduces the friction of experimentation.

Because these features sit alongside standard workflows (email, spreadsheets, and document drafting) they help staff build confidence in AI support, paving the way for broader, domain-specific adoption later.

B. Asset management and portfolio oversight

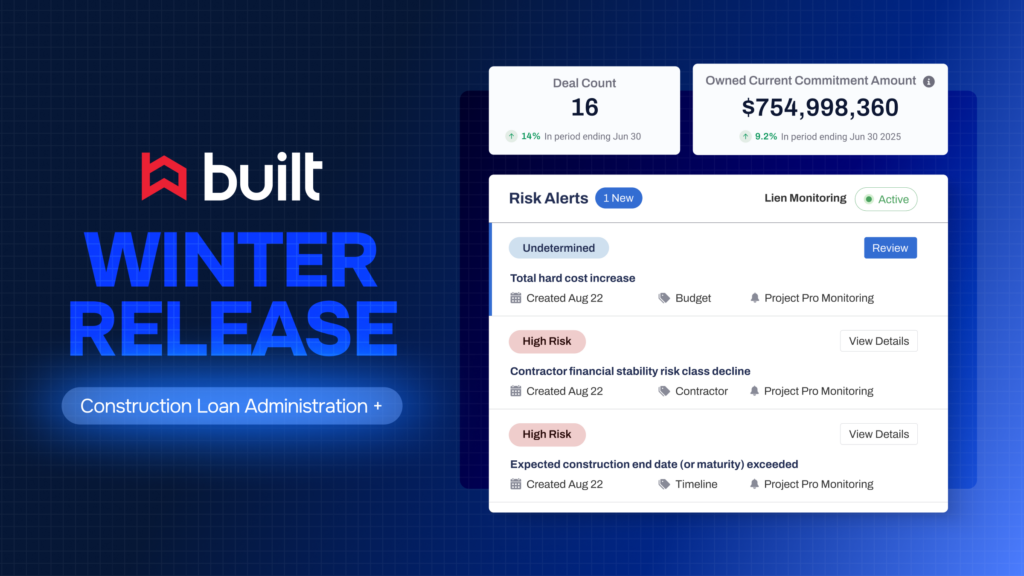

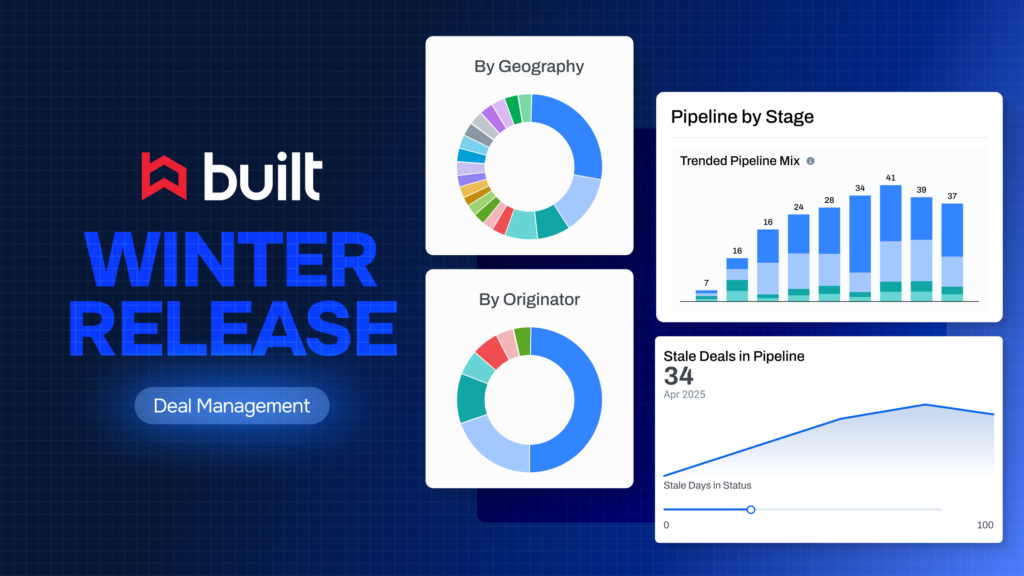

AI is becoming a practical tool for proactive portfolio oversight. Lenders use automation to generate recurring reports (e.g., loan summaries, covenant snapshots), freeing asset managers from hours of manual compilation.

Some firms are implementing standardized triage frameworks where AI assigns assets a High/Medium/Low risk status based on performance indicators. This helps teams focus attention on emerging risks rather than spending cycles on routine review, leading to a more proactive portfolio-level view of health.

C. Document intelligence and data entry

The steady flow of documents that must be read, verified, and tied back to budgets or underwriting assumptions is one of CRE lending’s most resource-intensive tasks. AI is now used to extract key values from invoices, validate inspection data against prior progress, and perform reconciliation steps that typically consume hours per file.

Built’s experience mirrors this trend: the AI Agent has consistently handled complex document types (including HUD statements, lien waivers, and inspection photos) and cross-checked them against budgets and policies with high reliability. These capabilities help lenders reduce errors, maintain consistent standards, and mitigate staffing limitations.

D. High-volume automation: Draw processing

Draw administration remains one of the strongest early fits for AI due to its blend of structured data, repeatable logic, and high documentation volume. Lenders are seeing significant impact:

- Capacity: Backlogs that once stretched weeks have been reduced by up to 67%.

- Staffing impact: For one rural lender, the lift was equivalent to “getting the work of 10 extra people,” demonstrating how transformational automation can be in environments with staffing constraints.

Lesson 5: Implementation Challenges Still Exist — But Are Surmountable

Even with clear momentum, lenders face practical hurdles introducing AI into day-to-day workflows, many rooted in the complexity of CRE itself.

The primary challenge is data fragmentation and variability. Data often lives in multiple systems and formats that differ significantly by product type (e.g., construction, stabilized CRE, SFR). This inherent variability makes standardizing inputs difficult and raises concerns about whether AI can correctly interpret information across all scenarios.

Accuracy and caution are common worries. Teams seek efficiency but remain cautious about relying too heavily on automated outputs. Ensuring that AI supports decisions (rather than replacing them) is a crucial part of change management, especially for staff accustomed to rigorous manual verification.

Despite these barriers, lenders are making steady progress by narrowing the scope of early deployments:

- Many start with lower-risk, high-volume tasks where automation reduces friction but leaves final judgment with analysts.

- Others build momentum by adopting AI within platforms they already trust, leveraging familiar guardrails.

- Leadership sponsorship is also key, setting clear expectations that AI is a strategic priority and providing cover for teams to rethink established processes.

Built’s approach helps ease adoption by embedding “policy as code,” ensuring the AI Agent executes steps aligned with each lender’s standard operating procedures rather than generating its own rules. This structure, combined with full audit trails and exception routing, gives teams visibility into decisions and reduces risk, making it easier to scale automation with confidence.

The First Movers Will Capture the Advantage

AI adoption in CRE lending is no longer limited to early experiments—many institutions are already moving into the “early majority” phase, where practical use cases, proven performance, and clearer governance models are accelerating adoption. In this environment, the lenders who begin integrating AI now gain advantages that compound over time: faster workflows, more consistent execution, stronger borrower experiences, and the ability to expand capacity without expanding headcount.

These operational gains matter in a market where spreads are tight and products increasingly resemble one another. Efficiency becomes a form of defensible differentiation, and the organizations that build AI-enhanced processes early will widen that gap as volumes grow and expectations shift.

Built’s position in the market, combining a decade of lending-specific infrastructure with AI agents that operate within lenders’ existing policies, gives institutions a way to adopt this technology safely, incrementally, and at scale. With embedded controls, auditability, and the ability to tailor automation to each lender’s SOPs, the platform enables teams to realize the benefits of AI while maintaining the standards their businesses depend on.

For lenders evaluating where to begin, the message from early adopters is clear: starting now offers a meaningful and lasting advantage.

Ally combines a deep understanding of commercial real estate with a passion for solving complex client challenges with technology. At Built, she partners with lenders and developers to design tailored workflows and technical solutions that streamline operations, unlock insights, and deliver lasting value.