Same-Day Funding: How Lenders Use Built’s AI Draw Agent to Accelerate Every Review

Across the lending industry, speed continues to be a challenge. Even with modern draw software, reviews still take days, capital sits idle, and loan operations teams continue to battle growing volumes with limited capacity.

That pattern changed when one Built pilot partner introduced the AI Draw Agent into its servicing workflow. Within weeks, average review times dropped by 95%, and disbursements that once required multi-day approval cycles were completed and funded the same day.

This wasn’t a small process tweak. Rather, it was a structural shift.

By using AI to handle document validation, policy checks, and routine approvals in real time, lenders achieved what the industry has long considered unattainable: same-day construction loan funding without compromising compliance.

This article examines how those results were achieved, what enabled such dramatic efficiency gains, and why same-day funding represents more than speed. It’s a preview of how lending operations will function in the next generation of real estate finance.

How Lenders Use Built’s AI Draw Agent to Accelerate Every Review

For most lenders, the difference between a one-day and a three-day funding cycle comes down to manual friction.

Each review still depends on someone collecting documents, reconciling budgets, validating inspection data, and routing the package through multiple signoffs before funding can begin. Even when workflows are “automated,” these handoffs remain sequential and human-dependent, limiting how much speed or scale can actually be gained.

The institutions participating in Built’s pilot proved there’s another way. By embedding intelligence directly into the draw review process, they turned a sequence of disconnected tasks into a continuous, self-validating system. The AI Draw Agent understands context, checks compliance, and executes actions that previously required human review, all in a matter of seconds.

What emerged was a new operational model: one where AI and human oversight work in parallel, accelerating every review without increasing risk. It’s the foundation that made same-day funding not just possible but repeatable across entire portfolios.

How AI Accelerates the Review Cycle

Same-day funding isn’t the result of one shortcut. It’s the result of every step moving at the speed of data instead of the speed of email. The AI Draw Agent re-engineers the entire review sequence, from borrower submission to wire release, to eliminate waiting, rework, and redundant checks.

1. Intake: Complete from the start

Traditionally, a draw review can’t begin until all supporting documentation arrives, such as invoices, lien waivers, inspection reports, and conditional approvals. Missing attachments or inconsistent borrower information can stall a file for hours or days.

The AI Draw Agent pre-screens every submission the moment it’s uploaded. It flags missing data, detects formatting or budget mismatches, and prompts corrections automatically. Reviews start only when the package is already complete, removing the single largest source of delay.

2. Validation: Automated accuracy at scale

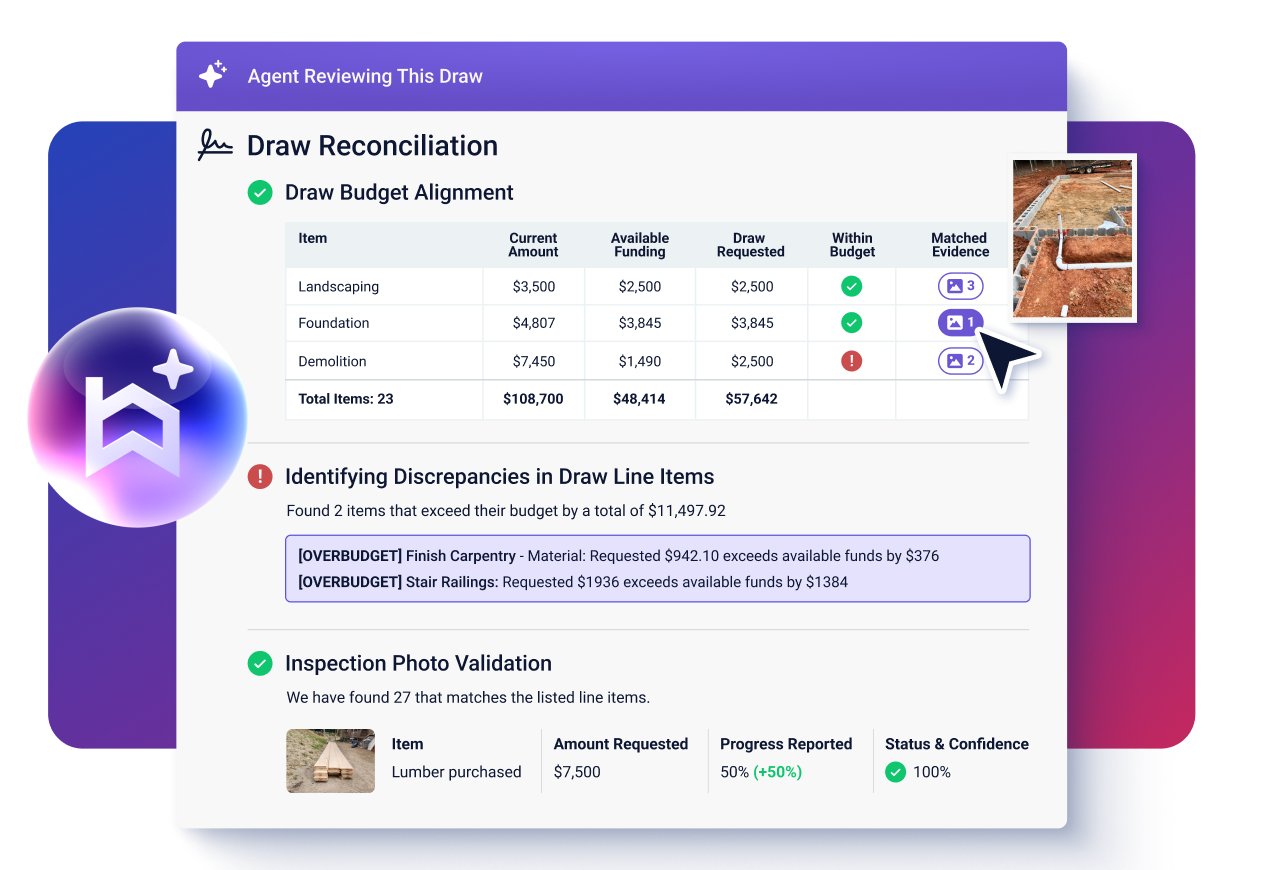

In manual workflows, validation requires hours of line-by-line comparison across spreadsheets, budgets, and inspection records. The AI Draw Agent performs these checks in seconds.

Using machine learning and process intelligence, it validates each draw against lender-defined policy rules and historical spending patterns. It identifies duplicates, outliers, or policy deviations before they reach approval, ensuring every funding decision is grounded in consistent, auditable data.

3. Approval: Instant rule-based decisions

Once validated, the system determines which draws qualify for automated approval. Routine, low-risk disbursements are processed instantly under pre-approved conditions, while exceptions are routed to human reviewers with full context and audit trails.

Instead of waiting in inbox queues or spreadsheets for signoff, approvals happen continuously throughout the day. Reviewers focus only on anomalies, not routine validations.

4. Funding: From cleared to closed in hours

The final step (initiating disbursement) often adds another full day to the timeline as teams confirm ledgers, reconcile amounts, and file audit documentation. Built’s AI Draw Agent connects directly with servicing and accounting systems to trigger funding the moment approvals are logged and verified.

Each transaction is fully traceable, with every data point archived automatically for compliance and audit. What once took days now happens in a single operating cycle.

Proven Outcomes from Pilot Lenders

The most compelling evidence of impact came from the lenders who put Built’s AI Draw Agent into production during early pilots. Each institution began with the same challenge: overloaded operations teams, growing portfolios, and multi-day draw review timelines that slowed funding velocity across their pipeline.

Measured results

Across participating lenders, the AI Draw Agent reduced draw review time by an average of 95%, compressing full approval cycles from multiple days to under an hour.

In several portfolios, same-day funding became the new norm, with more than 80% of draws processed on the same business day they were submitted. Loan administrators who once managed 15–20 reviews per week now handle over 100, all with higher consistency and fewer exceptions.

Operational lift without added headcount

Importantly, none of these results required new hires or parallel systems. The AI operated inside existing workflows, connecting through secure data pipelines and APIs.

Because it automatically pre-validated data and enforced policy logic, review queues cleared faster while risk exposure declined. Operations leaders reported that turnaround predictability improved even during peak volume periods, eliminating the stop-start rhythm that previously constrained portfolio growth.

Real-world validation

One participating loan operations leader summarized the shift succinctly:

“You’re going to have better results with this tool than the actual human that did it.”

Why Funding Speed Redefines Competitive Advantage

In lending, speed is a competitive advantage. The ability to review and release funds faster directly determines how quickly capital moves, how many projects stay on schedule, and how much volume a team can support without expanding headcount.

With the AI Draw Agent, speed no longer requires tradeoffs. Reviews are faster because every step, from intake to validation to approval to funding, moves in parallel, not sequentially. Compliance improves because every action is logged, explainable, and auditable in real time. Borrowers benefit from consistent turnaround, and lenders strengthen relationships by delivering certainty in timelines that used to fluctuate from week to week.

For institutions managing construction or real estate portfolios, this velocity compounds across the organization. More capital deployed. More active loans managed per administrator. More predictability in every funding cycle. What was once a bottleneck becomes a growth lever, and that shift changes everything.

The lenders achieving same-day funding aren’t just improving workflows; they’re setting a new benchmark for what efficiency looks like in modern lending.