Inside the AI Draw Agent: How It Actually Speeds up Every Review Step

Everyone’s talking about AI in construction lending, but few explain how it works. When a lender achieves same-day funding or cuts draw review time by 95%, the obvious question is What’s happening behind the scenes to deliver that result?

Built’s AI Draw Agent is not a black box. It’s a purpose-built, enterprise-grade system designed to operate transparently within your existing draw management workflow. It was created to break the cycle of manual review, where loan admins sift through emails, reconcile spreadsheets, and route documents sequentially, a process that caps portfolio growth and increases audit risk.

The system follows a simple, three-part framework Audit- Assist- Automate, designed to remove manual friction without removing oversight. This article pulls back the curtain to show how the AI processes every draw package, turning policy enforcement into a real-time function.

1. Audit: The Policy Brain

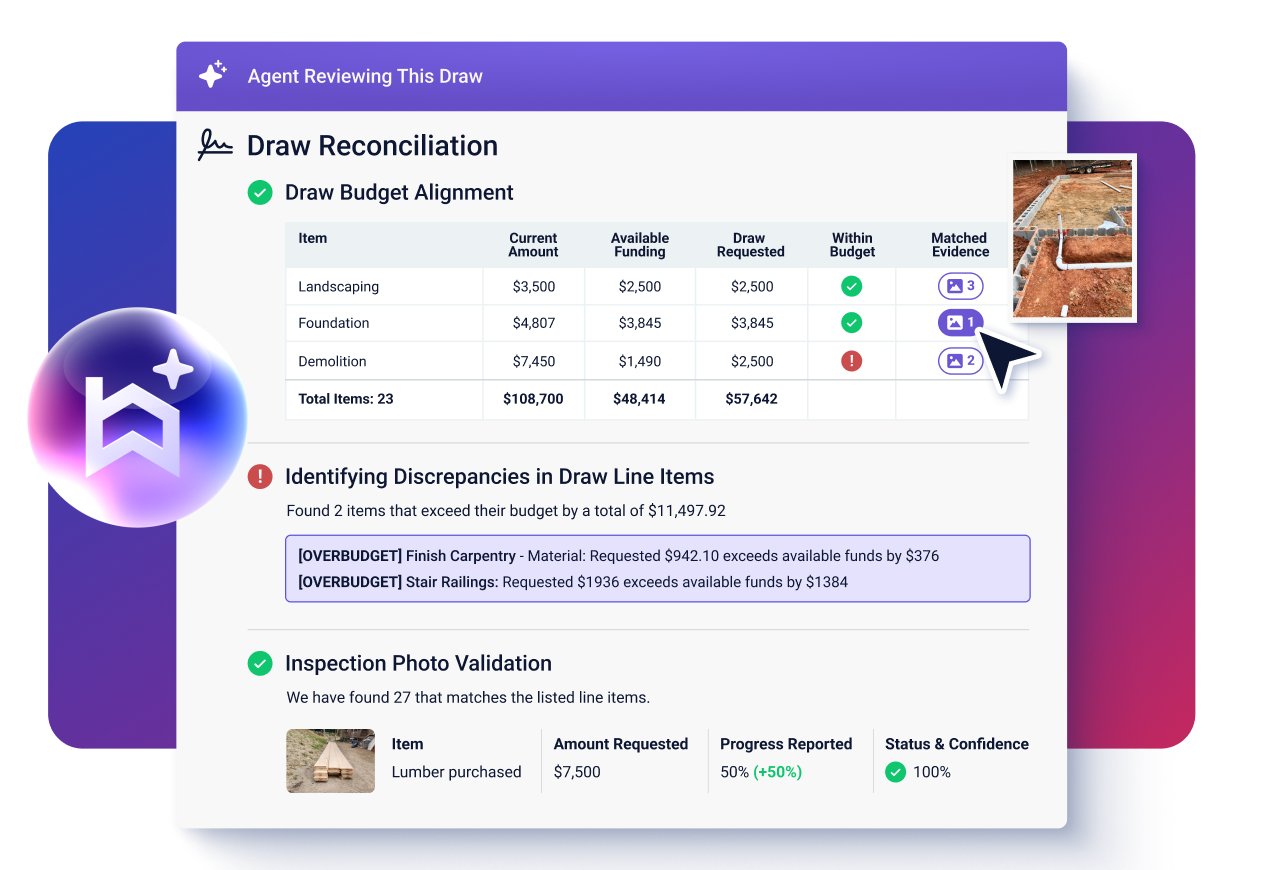

The moment a draw package is uploaded, the Audit stage begins. This is where precision replaces manual checking, and the AI Draw Agent cross-references every document, line item, and inspection record against your lender-defined rules and historical benchmarks.

The Audit intelligence performs the detailed validation work that typically consumes the most time in a human review, strengthening both accuracy and confidence.

How the policy engine works:

- Line item verification: The AI verifies each line item request against the original loan budget, corresponding invoices, and progress reported in inspection data.

- Discrepancy detection: It actively searches for patterns that signal potential errors or risks, detecting duplicates, inconsistencies, or outliers (e.g., a sudden, unusually high percentage of completion for a specific line item).

- Compliance rule enforcement: It confirms that all regulatory and internal compliance requirements are fully satisfied (e.g., ensuring funds are requested from the correct budget categories).

Every check is explainable and traceable, with a complete log recording the data inputs, the policy rule logic, and the resulting decision. This transparency ensures there’s no black box, just repeatable, compliance-grade auditing at scale.

2. Assist: Smart, Guided Actions After the Audit

Most draw delays start when reviewers are forced to resolve inconsistencies one by one — missing documents, mismatched totals, or unclear line items. These slowdowns usually appear after the initial submission, creating avoidable back-and-forth and stalled reviews.

The Assist stage eliminates this friction by surfacing smart, evidence-backed actions immediately after the audit completes. Instead of requiring loan administrators to hunt for issues, the AI presents clear, recommended next steps based on what the audit uncovered.

Here’s what’s actually happening:

- Evidence-backed recommendations: Assist suggests actions based on audit findings, attaching the relevant document excerpts or data points.

- Pre-populated corrections: When totals or line items don’t align, Assist proposes corrected values with a clear rationale.

- Guided follow-up: If information is missing, Assist prepares pre-drafted requests and routes them to the right party, reducing back-and-forth.

3. Automate: Real-Time Execution

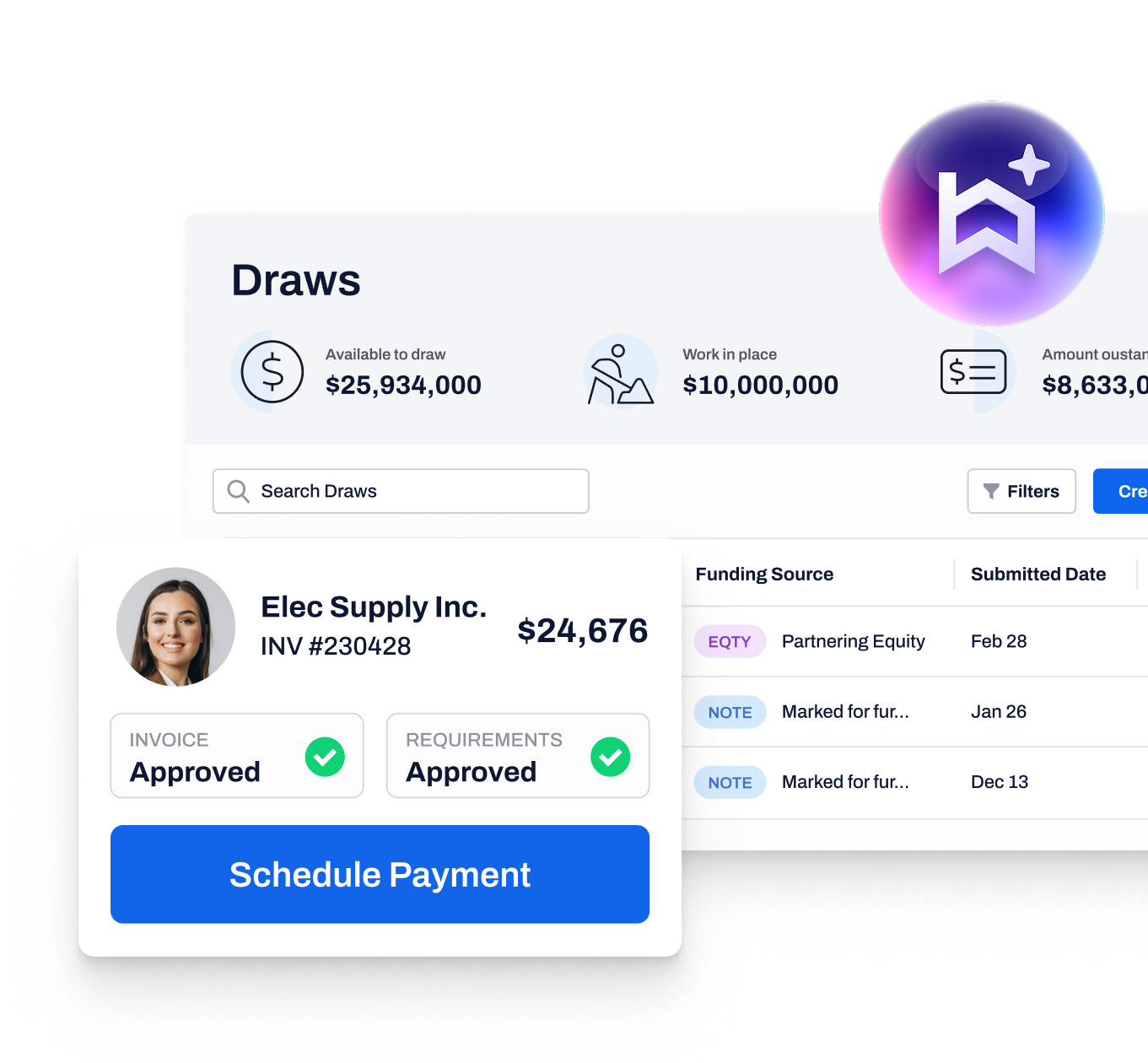

With the audit verified and assist actions accepted, the Automate stage transforms the review from a sequential, manual process into a continuous, data-driven sequence.

- Auto-approval: Low-risk draws that are 100% compliant with lender-defined policy rules are instantly auto-approved, freeing up loan teams from repetitive validation.

- Exception routing: Any draw package with exceptions that fall outside established policy parameters (e.g., a discrepancy requiring human judgment) is immediately routed directly to the right reviewer. This ensures human attention is reserved only for the cases that truly require expertise, with full context provided.

- Auto-disbursement: The AI Draw Agent connects through secure data pipelines to servicing and accounting systems. Once the approval is verified (either automatically or by a human reviewer), funding is auto-triggered without duplicate entry or manual confirmation.

This transformation means what once required multiple signoffs, emails, and status checks now happens as a single, continuous sequence, moving disbursements at the speed of data instead of the speed of email.

The Workflow in Motion: From Submission to Funding

The AI Draw Agent is built to enhance human judgment, not replace it. Lenders retain full control over policy creation and rule configuration. The AI simply removes the repetition, allowing teams to focus on strategy and true exceptions.

| Stage | Manual Review Process | AI Draw Agent Workflow |

| Intake | Missing documents, manual follow-ups, delayed start. | Audit: AI immediately reviews the full package for policy alignment, completeness, and data consistency. |

| Validation | Line-by-line manual cross-checks across spreadsheets and budgets. | Assist: AI surfaces smart, evidence-backed actions based on audit findings, guiding reviewers to resolve discrepancies quickly. |

| Approval | Sequential signoffs and email-based coordination. | Automate: Low-risk draws are auto-approved; exceptions are routed immediately with full context. |

| Funding | Manual ledger updates and confirmation steps. | Automate: Auto-triggered disbursement and audit logging within existing systems. |

Every step that once waited on an inbox now happens at the speed of data.

From Workflow to Real-World Impact

What makes the AI Draw Agent different is this step-by-step precision. The Audit – Assist- Automate framework runs quietly in the background, completing the checks that once stalled progress. Every action is traceable, every rule is lender-defined, and every result is explainable. All of which is the foundation of a system built for compliance-grade performance.

For lenders, that means faster decisions, stronger oversight, and a level of operational consistency manual reviews could never achieve. It’s how Built’s partners move from multi-day reviews to same-day funding, without sacrificing control.