6 Ways Agentic AI Reduces Manual Workload in Loan Operations

Across the lending industry, operations teams face a common challenge: too much manual work and too little time. Every loan requires document intake, data validation, and compliance review: tasks that remain largely human-driven even inside modern platforms. This burden results in slower turn times, rising servicing costs, and teams stretched thin as portfolios grow.

Agentic AI is changing that. Rather than automating isolated steps, it coordinates entire workflows, validating information, applying policy logic, and routing decisions without constant human oversight. This shift from automation to autonomy fundamentally reduces the manual workload that limits scalability.

Here are six practical ways Agentic AI helps lenders streamline every stage of the real estate lending lifecycle, from origination to portfolio oversight, reducing administrative effort and enabling teams to scale without adding headcount.

Where Agentic AI Delivers Workload Reduction

Here’s a quick look at how agentic AI reduces manual effort and accelerates efficiency across the entire lending lifecycle.

| Operational Area | Traditional Process | With Agentic AI | Impact on Manual Workload |

| Origination Pre-Screening | Teams manually verify borrower data and risk indicators before approval. | AI pre-screens for completeness, cross-checks data against policy, and flags inconsistencies automatically. | Prevents incomplete files from entering underwriting and reduces prep time per loan. |

| Document Intake | Manual data entry and verification of all borrower and project documents. | AI validates completeness, extracts key data, and flags missing or inconsistent details automatically. | Cuts hours of administrative review per loan. |

| Field Data and Inspections | Inspection results are uploaded manually and reconciled later in the draw process. | AI interprets field data instantly, aligns results to draw schedules, and triggers next-step reviews automatically. | Eliminates manual document matching and reduces inspection-to-approval lag. |

| Routine Reviews and Approvals | Staff manually review all low-risk draw and servicing requests. | AI applies embedded policy logic to autonomously evaluate and approve compliant requests. | Removes 70–90% of repetitive review work. |

| System Coordination | Teams manually re-enter data across LOS, servicing, and accounting tools. | AI connects systems, syncing data and triggering next steps automatically. | Eliminates redundant data entry and context switching. |

| Compliance and Oversight | Retroactive checks and manual portfolio risk reporting. | AI enforces policy in real time, logs every action for audit, and continuously monitors portfolio exposure. | Turns compliance into a built-in function and replaces manual risk monitoring. |

1. Automates Pre-Screening at Origination and Underwriting

Loan delays begin before a file is even fully approved. Teams often spend unnecessary time verifying borrower data, identifying preliminary risk factors, and reconciling inconsistencies between application forms and supporting documents.

Agentic AI systems pre-screen every potential loan file for completeness and policy adherence. These agents verify documentation, cross-check key financial data against credit rules, and surface critical risk signals before the file moves to a human underwriter. This prevents incomplete or high-risk files from entering the pipeline, ensuring underwriters focus only on qualified loans.

2. Automates Data Validation at Intake

Once a loan is in progress, document intake becomes the next bottleneck. When submissions arrive incomplete, such as missing lien waivers or supporting invoices, administrators waste hours tracking them down. Manual intake also increases the risk of oversight as information is re-entered across multiple systems.

Agentic AI acts as the central intake hub. It scans every incoming package, verifies document completeness, and cross-checks data against loan-level policies and budget structures. If a field is missing or conflicts with policy, the system flags it instantly and requests clarification. This eliminates early-stage bottlenecks, ensuring loan files reach human reviewers fully prepared.

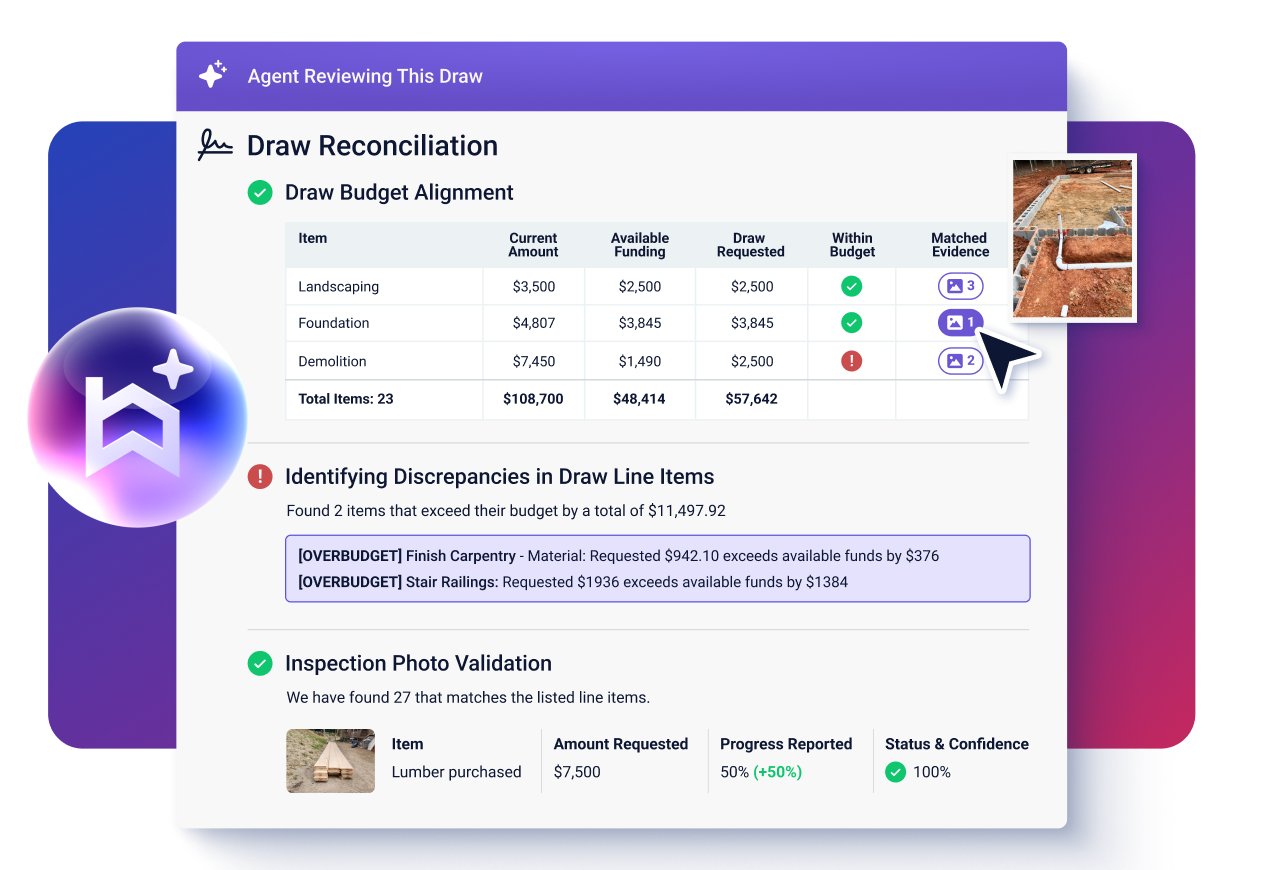

3. Validates Field Data and Inspections in Real Time

For construction and specialized loans, delays frequently occur waiting for manual reconciliation of field data and inspection reports. Staff must manually align photos, status updates, and documentation with the planned draw schedule.

Agentic AI interprets field data the moment it is submitted. It verifies the results of inspections, compares progress against the project budget, and confirms alignment with the draw schedule in real time. This eliminates manual document matching and triggers the next step, either approval or review, automatically, drastically reducing the inspection-to-approval lag.

4. Streamlines Routine Reviews and Approvals

Routine draw and servicing requests consume a disproportionate amount of staff time. Teams manually verify amounts, match invoices, and confirm compliance, tasks that rarely require judgment but still demand full attention. This creates a backlog that slows overall throughput.

Agentic AI applies embedded policy logic to automatically evaluate and approve compliant requests. It validates documentation and confirms alignment with budgets in real time. Only true exceptions are instantly routed to staff for oversight. This shifts routine approvals from hours to minutes, freeing staff from repetitive cycles while ensuring every action remains fully traceable.

5. Flags Exceptions for Human Review

In traditional workflows, every file receives the same scrutiny, draining capacity by forcing teams to recheck compliant loans just to find the handful that truly need attention.

Agentic AI continuously monitors each transaction, applying risk-based logic to identify true exceptions. When data falls outside of policy thresholds or documentation looks inconsistent, the system flags it and pauses automation for expert review.

Routine, low-risk items continue moving forward automatically. Staff can now focus their expertise on problem-solving, as routine reviews disappear from the queue and critical files surface instantly.

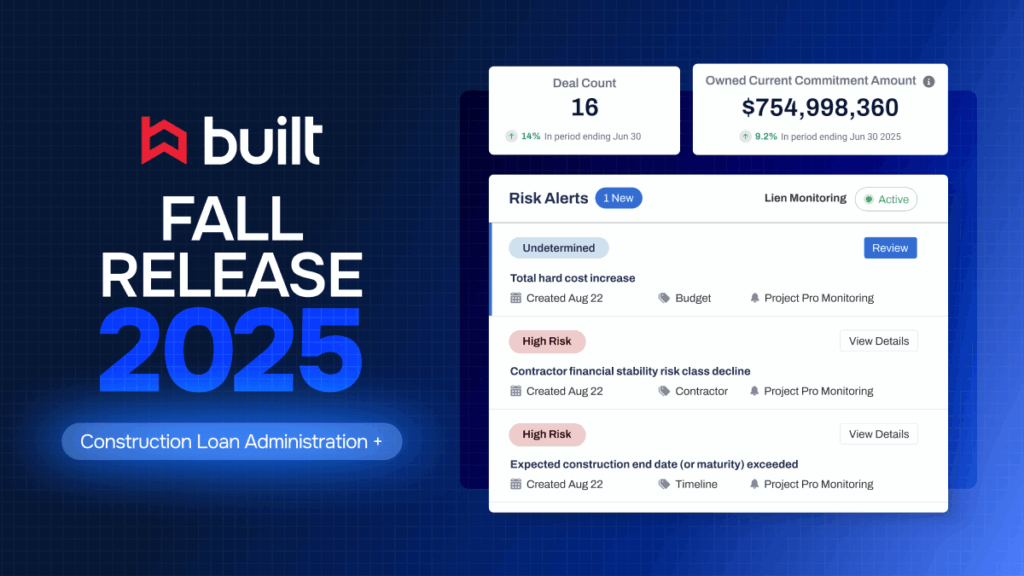

6. Maintains Continuous Compliance and Portfolio Oversight

Compliance and risk monitoring often happen after the fact. Teams compile reports manually and verify policy adherence retrospectively, leaving limited visibility between review cycles and failing to catch problems as they emerge.

Agentic AI integrates compliance and oversight directly into the workflow. Each action is automatically checked against policy and regulatory criteria in real time. Critically, every decision is logged with a timestamp and reasoning trail, creating a living, audit-ready record.

Furthermore, the agents continuously monitor the live portfolio, flagging risk exposure or policy deviations instantly. Compliance becomes a continuous function, and portfolio risk management shifts from periodic reporting to real-time visibility, eliminating manual effort.

From Manual Oversight to Intelligent Operations

Across the lending lifecycle, the impact of Agentic AI is unmistakable: fewer manual steps, faster turnaround times, and stronger compliance, all achieved without expanding headcount. By embedding intelligence directly into every stage from origination and underwriting to servicing and portfolio oversight, lenders replace fragmented, manual coordination with autonomous execution that scales naturally with portfolio growth.

Workflows that once required constant human intervention now operate as connected, self-governing systems. Reviews progress in real time, inspections trigger next actions automatically, and compliance runs continuously in the background. The result is a lending operation that moves faster, operates with greater accuracy, and maintains complete transparency.

Agentic AI has become the foundation of operational resilience. As lenders extend autonomy across intake, underwriting, servicing, and risk oversight, they gain the capacity to manage more loans, deploy capital faster, and maintain governance without expanding teams.

Built’s AI Draw Agent is proving what this evolution looks like in practice, delivering measurable gains in speed, accuracy, and portfolio control. It represents the first step toward a connected, intelligent future for real estate finance, where every process operates with clarity, efficiency, and trust.

Related Posts

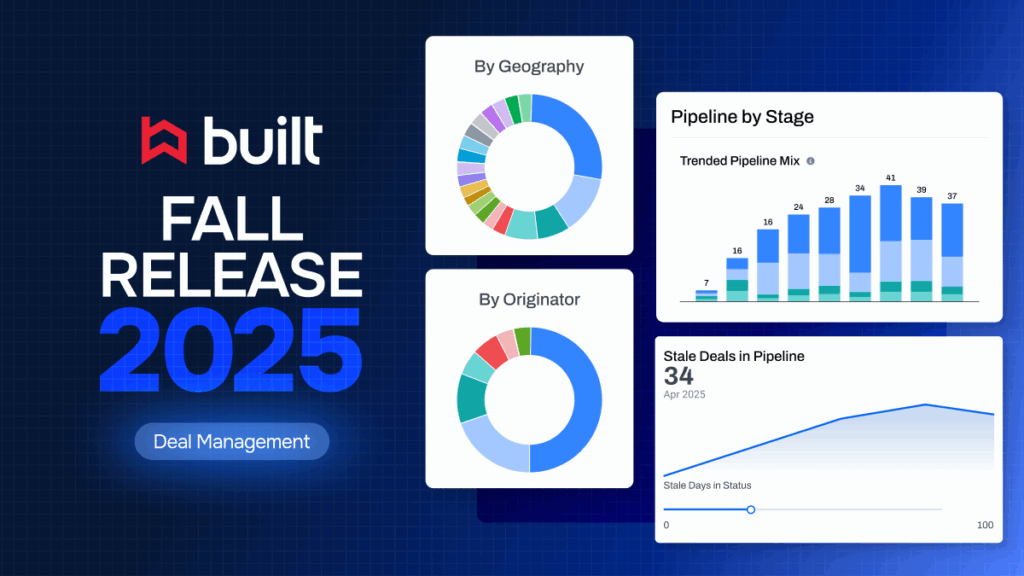

Fall Release Recap: What’s New in Deal Management