From Automation to Autonomy. How Agentic AI Is Rewriting the Efficiency Playbook for Lenders

Traditional automation made lenders faster but not more efficient, as systems that execute rigid rules still require human oversight that limits scale. Agentic AI introduces true autonomy by allowing systems to intelligently plan and execute end-to-end tasks, transforming efficiency from a cost-saving measure into a growth driver with demonstrable results, such as 95% faster review times.

Lenders have invested heavily in digitization, automation, and streamlining their entire workflow, from origination and underwriting to draw management, servicing, and compliance. These systems were meant to dramatically save time and reduce costs.

Yet, the opposite has happened. The cost to originate and service a loan keeps climbing. Turn times remain bottlenecks that limit growth, policy checks are missed when volume spikes, and hiring more staff is often the only way to truly keep up.

The critical insight is that automation made lenders faster, but it did not make them more efficient.

Current technology merely executes rigid, single-step rules, demanding constant human oversight and coordination across disparate systems. True efficiency requires autonomy, such as systems that can not only execute but also plan, act, and complete end-to-end tasks without constant intervention.

This is the distinction where Agentic AI begins to change the equation, offering lenders the ability to finally move beyond simple automation to achieve scalable, autonomous efficiency.

The Automation Ceiling

Automation brought the first real wave of efficiency to the lending industry. By digitizing repetitive tasks and introducing workflow triggers, it replaced manual checklists with systems that could process data faster and reduce basic errors. Document collection, OCR, and routing rules helped teams handle more volume without losing control.

But the returns are diminishing. Each process still depends on people to interpret results, make decisions, and push work forward. Even the most automated draw review still waits for a human to decide what happens next.

Automation improved productivity, but not throughput. It reduced effort at the task level, not the system level. True operational efficiency requires decisions to move at the same speed as the data that powers them, which is something traditional automation can’t achieve.

Enter Agentic AI: from Scripts to Systems That Think

The next evolution of efficiency is about smarter systems. Agentic AI represents this shift. It can perceive data, reason through context, and act within defined compliance boundaries, turning static workflows into intelligent, adaptive processes.

Where automation executes instructions, Agentic AI plans and decides actions. It understands the intent behind a process and determines how to complete it safely and efficiently.

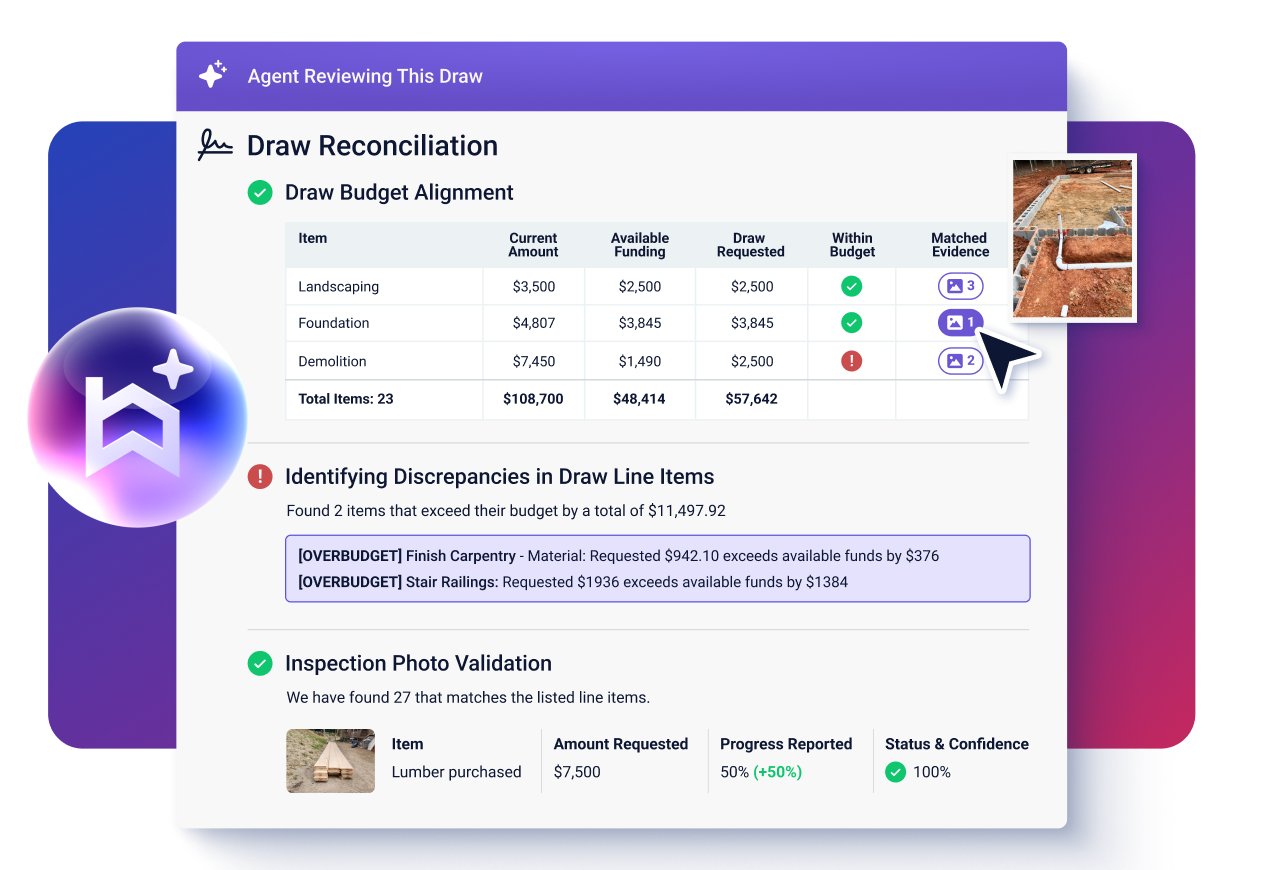

Built’s model, Assist – Audit – Automate, shows what controlled autonomy looks like in lending operations. The AI assists by pre-screening data, audits for compliance and accuracy, and automates low-risk actions while routing exceptions for human review.

This framework does not remove human oversight. It removes unnecessary dependency. Reviewers remain in control, but the system handles the repetitive execution that once required constant attention.

Efficiency used to mean doing the same work faster. Agentic AI redefines it as achieving the same outcomes with less work altogether.

The Executive Case for Autonomy

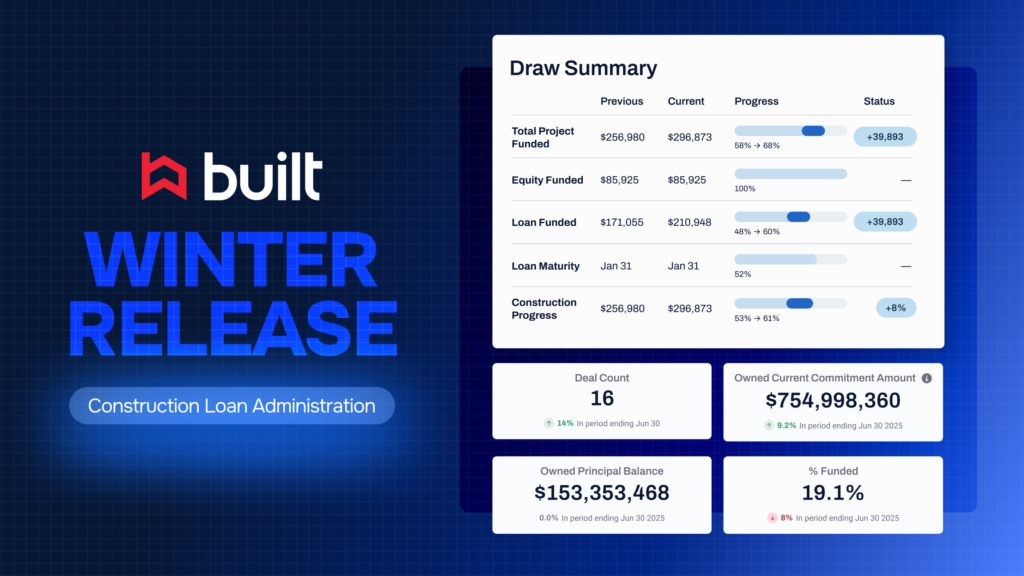

For financial institutions, efficiency is measured in margins, throughput, and risk control. Agentic AI delivers measurable gains across all three.

In pilot programs, lenders processed two to five times more loans per administrator and cut review times by up to 95 percent, all without adding staff or sacrificing compliance. Every action the system takes is logged, ensuring full transparency and auditability. That means no tradeoff between automation and control.

For executives, the impact is direct:

- Margin Protection: Autonomy protects margins as labor costs rise.

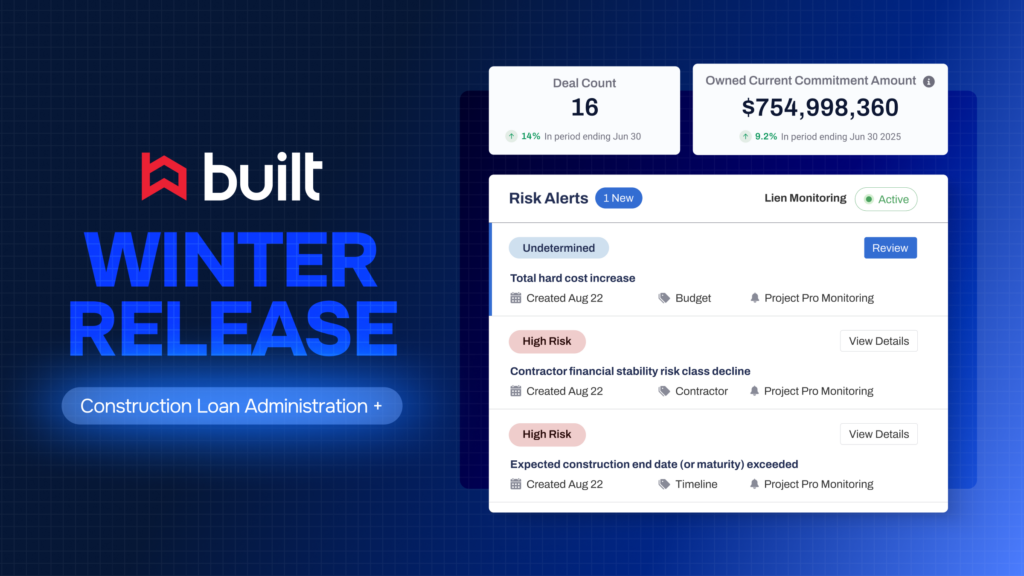

- Risk Reduction: It reduces exposure to human error and ensures that compliance monitoring happens continuously, not periodically.

- Scalable Capacity: It allows teams to expand capacity without expanding headcount, transforming efficiency from a cost-saving measure into a growth driver.

Autonomy is no longer a technical advantage. It is an operational imperative.

From Operational Efficiency to Strategic Leverage

When autonomous systems handle execution, human talent shifts from managing volume to managing value.

Loan administrators, credit officers, and compliance teams can focus on exceptions, insights, and strategy rather than repetitive review cycles.

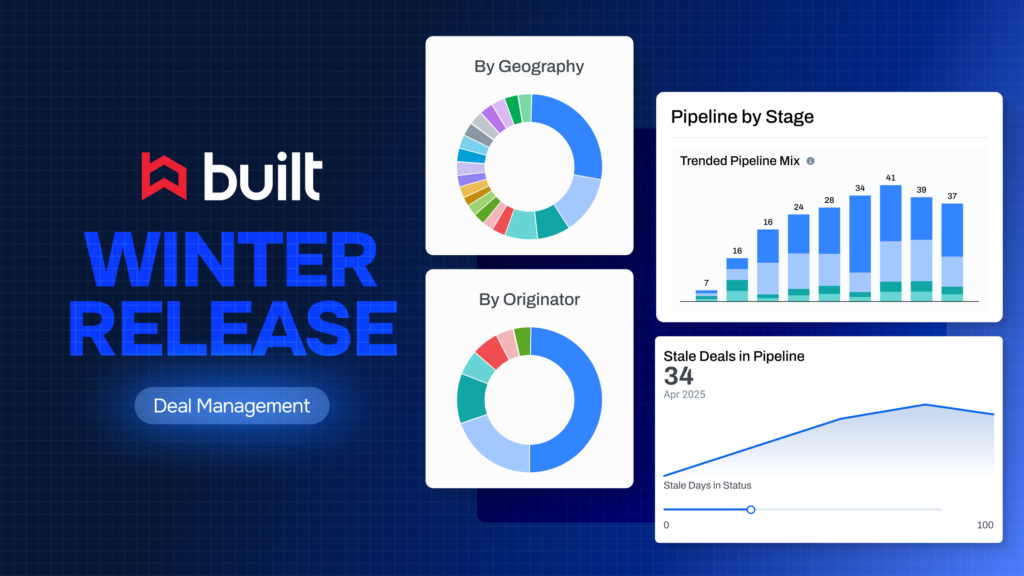

For portfolio and credit leaders, this creates real-time transparency across every loan and project. They gain predictive visibility into bottlenecks, funding velocity, and exposure before issues escalate, transforming oversight from reactive to proactive decision-making.

Autonomous systems also lay the foundation for scalable lending models. Institutions can onboard new partners, manage multiple entities, and expand into new markets without rebuilding processes or adding proportional headcount.

For lenders managing complex construction and real estate portfolios, this adaptability is the difference between keeping up and leading the market.

The Future Efficiency Model Is Autonomous

The next frontier of efficiency in lending will not come from faster automation. Rather, it will come from systems that can operate intelligently and independently within clear governance boundaries.

Autonomy enables scale that software alone cannot, such as systems that plan, act, and adapt in real time while keeping every action compliant and auditable.

The lenders that move beyond automation will define the next decade of financial operations. They will deploy capital faster, manage risk with greater precision, and build organizations that scale without the friction of manual review.

Built’s AI Draw Agent is a powerful first step in this journey, demonstrating how agentic autonomy scales safely within lending operations, reducing review times by up to 95 percent while maintaining complete auditability. The future efficiency model is built on this foundation of controlled autonomy.

Learn how autonomous systems can unlock your next wave of efficiency.