How to Account for Construction Loan Draws: Automating Workflows and Reducing Risk

Each draw reflects verified project progress and must align with the construction draw schedule, budget line items, and lender-approved documentation. But when these transactions are managed manually via spreadsheets, PDFs, and email threads, things break down fast.

For lean owner-developer teams juggling multiple projects, even minor bottlenecks can quickly snowball into financial and operational risks — documents go missing, percent completes are misreported, and GL entries drift from actuals.

This chaos turns close week into a frantic scramble to reconcile outdated exports and rebuild what happened. It’s a hidden cost that drains your finance team’s time, threatens capital trust, and, as outlined by Janover in its analysis of construction draw delays, multifamily projects can incur over $150,000 per month in additional interest, insurance, and overhead when draws stall.

This guide focuses on the accounting controls and reconciliation required to keep construction loan draws audit-ready, close-friendly, and financially accurate for owner-developer teams.

Key Takeaways

- Construction loan draws are accounting control events, not just funding requests

- Each draw impacts cash, loan balances, and the general ledger

- Draw schedules and SOVs are the source of truth for accurate accounting

- Manual workflows increase close risk, audit exposure, and funding delays

- Automation aligns budgets, approvals, and GL entries in real time

If you’re evaluating how modern teams operationalize these controls at scale, construction draw software connects accounting, compliance, and funding workflows without sacrificing financial control.

How Construction Loan Draws are Accounted For

Before automation or tooling comes into play, accounting teams must understand the financial control points embedded in every construction loan draw. Regardless of project size, each draw creates accounting dependencies that directly affect cash flow accuracy, budget integrity, and month-end close.

What is a construction loan draw (From an accounting perspective)

A construction draw is a controlled release of loan funds that must be supported by verified project progress and reconciled against approved budgets. From an accounting standpoint, each draw represents a financial transaction that impacts cash position, loan balances, and general ledger activity.

Unlike traditional AP disbursements, construction draws cannot be recognized solely on invoice receipt. They must align with lender-approved milestones, validated percent complete, and supporting documentation to ensure amounts funded accurately reflect work in place.

What is a construction draw schedule in accounting?

The draw schedule is the primary accounting control for construction financing. It governs when funds can be released and caps how much can be drawn against each budget line item.

Typically derived from the Schedule of Values (SOV), the draw schedule ties each cost category to an approved dollar amount and tracks funding based on verified percent complete. For accounting teams, the draw schedule serves as the source of truth that links project progress, remaining budget, funded-to-date balances, and general ledger entries. When the draw schedule is outdated or misaligned, reconciliation becomes unavoidable.

As portfolios grow, draw schedules must scale beyond single-project tracking. For portfolio-level accounting and capital pacing, multi-project draw structures become essential.

The construction loan draw process (At a glance for accounting teams)

While the draw lifecycle appears operational on the surface, each step introduces an accounting dependency that must be controlled to avoid downstream risk:

- Draw request submitted: A funding request is initiated, creating a pending financial obligation.

- Supporting documentation collected: Invoices, lien waivers, and updated SOVs establish whether the request is eligible for recognition and payment.

- Inspection verifies percent complete: Physical progress validation determines the maximum allowable draw amount.

- Lender reviews and approves: Compliance and budget checks confirm funds can be released without violating loan terms.

- Funds disbursed: Cash is released and must be accurately reflected in loan balances and the general ledger.

- Schedule updated and cycle repeats: Funded-to-date amounts and remaining budgets are recalculated for future draws.

Where most teams struggle is not with the steps themselves, but with managing these accounting touchpoints across disconnected systems. When documentation, inspections, schedules, and GL entries live in silos, reconciliation becomes manual, close slows down, and financial risk compounds.

Draw documentation checklist for an audit-ready accounting trail

The steps above define when accounting controls are triggered. The checklist below defines what evidence must exist to support those controls at audit and close.

- Draw request form / itemized funding request

- Schedule of Values / budget line mapping

- Invoices / pay apps tied to line items

- Lien waivers (conditional/unconditional, partial/final)

- Inspection report and photos (if required)

- Certificates of insurance (if required)

- Approval log (who approved, when, notes)

- Funding confirmation + disbursement record

- Any change orders tied to funded items

For portfolio-scale draw pacing and early delay signals, multi-project draw schedules surface funding friction before it impacts close.

How draw approvals affect accounting and month-end close

From an accounting perspective, draw approvals define when construction costs can be recognized — not when invoices are received or documentation is submitted.

For owner-developers, the draw approval is the control point that converts project activity into a legitimate financial transaction. Until a draw is approved, costs remain pending. Once approved, they become fundable, reconcilable, and eligible for recognition in the general ledger.

This distinction is critical at month-end.

Accounting teams do not close based on invoices alone. They close based on approved and funded draw activity that aligns with verified progress and loan terms.

At close, teams typically reconcile:

- Approved draw amount ↔ funds disbursed

- Funds disbursed ↔ budget line items / Schedule of Values (SOV)

- Supporting documentation ↔ audit trail (invoices, lien waivers, inspection reports)

- Exceptions ↔ discrepancy log (missing documents, mismatched percent complete, unresolved conditions)

When draw approvals are delayed, undocumented, or processed outside the accounting system, close becomes a manual exercise in reconstruction. Teams are forced to chase approvals, re-verify progress, and reconcile against outdated schedules — increasing audit exposure and slowing financial reporting.

This is why modern owner-developers treat the draw workflow as an accounting control, not just an operational step in getting funds released.

How change orders impact draw accounting

Change orders update the Schedule of Values (SOV), which directly determines how much can be drawn and how costs should be recognized.

When a change order is approved, the budget structure needs to reflect that update before the next draw is reviewed. If draw approvals are routed against an outdated SOV, funded amounts no longer align with current budgets, forcing accounting teams to reconcile discrepancies after the fact.

For owner-developers, maintaining alignment requires updating SOV and budget line items first, then approving draws against the revised structure. This sequencing keeps funded-to-date balances, remaining budget, and general ledger entries consistent throughout the draw cycle.

Why Manual Construction Draw Accounting Creates Risk

A construction draw schedule should serve as a real-time source of financial truth, linking progress to disbursements, forecasts, and general ledger activity. It’s a planning document and a critical control mechanism.

However, when these workflows break down, it’s finance that feels the pain. What starts as a project team update often turns into hours of accounting rework due to missing documentation, inconsistent formats, or unverified progress.

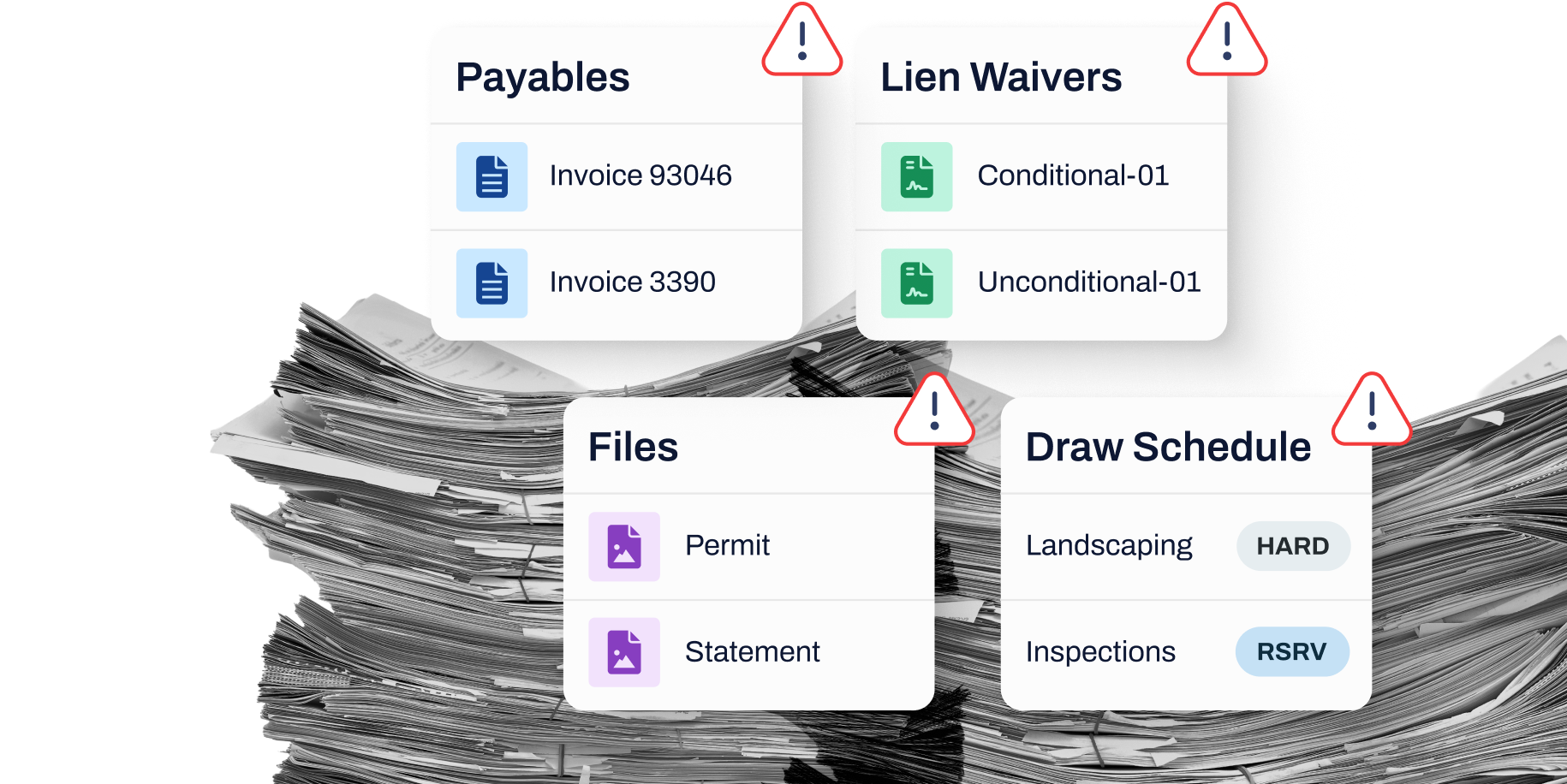

For many firms, the draw schedule remains fragmented across spreadsheets, inboxes, and disconnected trackers. This disjointed communication can lead to significant issues, as a single missed lien waiver or unapproved change order can stall payments and compromise compliance. Without a single system of record, forecast accuracy suffers and close becomes a manual grind.

For owner-developers, manual draw tracking breaks down because approvals, documentation, and funded-to-date reconciliation live in different places—only a draw system of record resolves that fragmentation.

Ultimately, this inefficiency becomes a systemic financial risk. Fragmented records and email chains leave finance teams exposed, especially when audit season hits. For lean owner-developer teams, manual draw tracking drains resources, delays funding, and threatens capital trust across the stack.

Spreadsheet-based draw tracking breaks down for owner-developers managing multiple projects because approvals, documentation, and funded-to-date reconciliation live in separate systems.

Who’s involved in the construction draw process?

The draw process requires tight coordination between multiple parties, but the finance team holds the key to risk management:

- Owners / Developers: Responsible for managing cash flow, ensuring work is verified, and securing timely loan disbursements.

- Contractors: Responsible for completing work on time and submitting accurate draw requests for payment.

- Lenders: Responsible for managing risk, ensuring compliance with loan agreements, and verifying the asset’s value through inspections.

- Inspectors: Third parties who verify the physical percent complete of the work before funds are released.

The goal of automated draw management is to streamline communication and financial control for all stakeholders.

Construction Draw Schedules: Where Finance Control Starts

The Schedule of Values (SOV) is the backbone of the construction draw. It breaks down the total contract price into specific work items.

- SOV vs. Draw: The percent complete of each SOV line item directly drives the amount of the draw request. If the SOV isn’t accurate or up-to-date, the draw request is inherently flawed.

- Why schedule changes (COs) break accounting: When a Change Order (CO) is approved, it modifies the SOV. If this change isn’t instantly reflected in the financial tracker, the GL entries, draw request, and remaining budget all desync, causing significant audit risk and manual reconciliation.

- Why spreadsheets fail here: Spreadsheets cannot enforce version control, automatically link COs to budget lines, or ensure real-time synchronization with the general ledger. They create data drift instantly.

Managing Change Orders Without Breaking the Draw Process

Change Orders (COs) are inevitable in construction, but managing them retroactively is a major source of financial risk and delay.

- Desynchronization risk: An approved CO immediately impacts the project’s budget, the total loan amount available, and the SOV. If this isn’t captured and validated immediately, the next draw request will be based on outdated financials.

- Financial risk: Retroactive fixes to align the GL with COs and draw history create financial inconsistencies that can delay month-end close and increase the cost of compliance.

- The automated solution: An integrated system validates COs against the remaining budget before they can be added to the draw, ensuring budget-schedule-GL alignment in real time.

How to Automate Construction Loan Draws

High-performing owner-developer teams operationalize discipline by centralizing draw approvals into a single system and building in audit-proof documentation processes. They avoid reactive scrambling and proactively resolve issues before they become bottlenecks.

This is what a finance-first, automated workflow looks like:

Step 1: Centralize documentation

- Best practice: High-performing teams ensure submissions arrive complete and are validated against the loan agreement from the start.

- Solution: Provide borrowers and contractors with a secure portal to submit draw requests and upload all backup documentation online. This single digital hub eliminates scattered emails, paper files, and spreadsheets, ensuring every record is instantly accessible and audit-ready.

- Real-world proof from Built: “We were spending days each month chasing lien waivers and fixing draw package errors. With Built, it’s all tracked automatically.” —John Kraemer & Sons

Step 2: Automate compliance and validation

- Best practice: Top teams use technology to stay ahead of regulatory risk by automating compliance checks.

- Solution: Built-in rules automatically flag missing documents, overdrawn budgets, or expired insurance policies. The system automates retainage triggers, tying payments to specific project milestones and minimizing costly errors.

Step 3: Streamline review and approvals

- Best practice: Proactively resolve discrepancies by leveraging collaborative workflows that escalate exceptions before they become bottlenecks.

- Solution: Route draw packages through automated workflows so the right stakeholders, from loan admins to risk teams, are notified instantly. This ensures every required signature is captured and creates an audit trail that makes your process transparent and accountable.

Step 4: Integrate with core and accounting systems

- Best practice: Leading teams ensure systems are perfectly aligned to maintain forecast accuracy and keep close cycles from becoming a manual grind.

- Solution: Push approved disbursement instructions directly into your servicing or accounting system, reducing duplicate data entry. This synchronization keeps payment schedules and GL entries perfectly aligned.

Step 5: Fund faster and keep everyone informed

- Best practice: Timely submissions, rigorous documentation, and airtight compliance protocols protect both timelines and capital trust across the stack.

- Solution: Issue payments to GCs, subs, and suppliers quickly with digital disbursements. Giving all parties real-time visibility into funding status and project progress reduces back-and-forth communication, building trust and strengthening relationships across the capital stack.

- Real-world proof from a Built customer: “Before Built, our loan admins were managing 20 projects on average. Now we’re able to manage over 50.” —Bremer Bank

Step 6: Leverage Reporting and Analytics

- Best practice: The most disciplined teams bring capital confidence to every project by using a single source of truth for their data.

- Solution: Monitor portfolio health with real-time dashboards for draw turnaround times, inspection performance, and compliance risks. Use these insights to improve decision-making and scale efficiently, transforming reactive reconciliation into proactive financial control.

Automation often starts at the draw request, where manual forms create bottlenecks by fragmenting approvals, documentation, and validation.

Generating real-time reports for construction loans

Real-time reporting means having instant visibility into the status of your construction loans, budgets, and draw activity without waiting for manual updates. Stakeholders can access live data at any point in the project lifecycle.

Why real-time reports matter:

- Faster decision-making – Lenders and developers can quickly assess funding needs, approve draws, and keep projects moving.

- Better forecasting – Accurate, up-to-the-minute insights help teams anticipate cash flow needs and avoid budget overruns.

- Reduced risk – Early visibility into potential issues, such as overdrawn budgets or compliance gaps, allows proactive intervention.

- Stronger transparency – Builders, contractors, and borrowers gain clarity into project status and funding progress, minimizing delays and disputes.

By shifting from static reporting to real-time insights, construction finance teams can improve efficiency, strengthen relationships, and ensure projects stay on track.

Built for Accounting Accuracy: How Built Streamlines Loan Draws

Built is purpose-built to replace chaotic draw tracking with a centralized, finance-ready system that connects progress, compliance documentation, and real-time accounting. It’s how today’s most disciplined finance teams protect margins, ensure compliance, and bring capital confidence to every project draw.

Built reduces risk by integrating validation, documentation, and draw logic directly into your workflow.

Key capabilities that facilitate this include:

- Auto-populated draw forms: Pull line items, inspection results, and percent completes directly from your schedule of values. There’s no manual entry, no version drift.

- Compliance-built routing: Draw requests can’t move forward unless required documents like lien waivers, invoices, and COIs are attached and approved.

- Audit-ready approval logic: Every submission is time-stamped, locked, and logged. Approvals follow structured thresholds to enforce capital controls across your portfolio.

- Collaborative visibility: Project managers, fund admins, and accounting teams work from a shared schedule, so everyone sees the same status, in real time.

- Direct accounting sync: Built integrates with systems like Sage Intacct and QuickBooks, keeping payment schedules, GL entries, and disbursements perfectly aligned.

With Built, you move from reactive reconciliation to proactive financial control. Funding aligns with verified progress. Close moves faster. And audit trails are built in rather than built after the fact.

For a full breakdown of how owner-developers evaluate draw platforms through an accounting and control lens, see this construction draw software guide.

Draw Confidence Starts with Accounting Control

The construction draw process is a financial engine. Each payment request drives disbursements, impacts cash flow, and directly affects your working relationship with a third-party lender. But when these workflows are manual, fragmented, or spreadsheet-bound, even small gaps can lead to cost overruns and big financial consequences.

For the project owner, chasing lien waivers, verifying work completed, and rebuilding audit trails shouldn’t be the norm. It slows construction financing, distorts forecasts, and puts lender relationships at risk.

Built changes that. By replacing manual inputs with automated validation, centralized documentation, and real-time accounting sync, you transform draw requests into capital-ready transactions—on time, in compliance, and backed by a full audit trail. This ensures your draw schedule supports timely payments and a smooth review process for the entire project.

It’s time to move beyond manual construction work for construction loan draws and start building with confidence.

Book a demo today to see how Built can help you streamline your draw process and protect every dollar you deploy.

Accounting for Construction Loan Draws FAQs

How do you align construction budgets with loan draw schedules?

A draw schedule should map project timeline and milestones to disbursement triggers. A modern system digitizes this process, tying budget line items and real-time project progress directly to your loan amount, eliminating manual alignment via spreadsheets.

How does the draw process affect financial close and audit readiness?

Manual workflows in the construction industry often delay financial close and create audit vulnerabilities due to fragmented documentation, version conflicts, and GL misalignment. An automated system with built-in audit trails and real-time approvals eliminates these issues, ensuring your financials are always audit-ready.

What documentation is required to support a construction loan draw request?

A standard draw package includes a completed draw request form, a schedule of values, percent completes, lien waivers, vendor invoices, certificates of insurance (COIs), and recent site inspection reports. A finance-first platform automates the collection and validation of these documents to ensure all requirements are met before a draw can proceed.

How do you reconcile construction payments automatically?

Manual reconciliation is a hidden construction cost that leads to missed early pay discounts and overworked teams. A modern platform integrates directly with your accounting and ERP systems, automatically syncing approved disbursement instructions and GL entries to ensure perfect alignment and reduce duplicate data entry for entire project financials.

Mark Murphy leads OGC Sales at Built, where he is responsible for accelerating adoption of payments and standalone solutions purpose-built for real estate owners, developers, and general contractors. He brings deep experience across sales, general management, and operations in technology-driven businesses.

Prior to joining Built, Mark served as General Manager at Apex Service Partners and Operating Executive at Alpine Investors. He also spent over six years at Flexport, where he held multiple leadership roles including General Manager for the South and Northeast regions, and Director & Acting General Manager for San Francisco and Northern California. Earlier in his career, Mark was Chief Operating Officer at Oolong, an INC 500-recognized international trading business.

Mark holds a degree in Mechanical Engineering from Stanford University, where he captained the Varsity Men’s Rowing team.

Related Posts

Lenders: Stop Draw Delays and Automate Construction Loan Draw Requests