A Day in the Life of an HBF Loan Administrator: How Builders Get Funded

Home Builder Finance (HBF) Loan Administrators are the operational engine for construction portfolios. They manage the entire unit lifecycle: controlling the flow of documentation, collateral, and funding from a new start request through final payoff and lien release. In high-volume environments, this central role demands acute accuracy, consistency, and coordination.

The function is central to lender risk and builder cash flow. Tasks range from validating new collateral, coordinating due diligence (title, appraisals), and processing draws, to updating project progress and reconciling data for unit close-out. Even with dedicated platforms like Built as the system of record, they maintain the daily responsibility for compliance, accuracy, and lifecycle management.

Below is a clear, practical look at what the job actually requires day to day.

A Unique Intersection of Skills

The HBF Loan Administrator operates at the nexus of documentation, data integrity, and constant communication. Since every decision affects the next phase of the construction lifecycle, a detailed understanding of loan agreements, collateral structure, sublimits, and timelines is essential.

Key aspects of the role include:

- Precision: Vetting borrower submissions, confirming documentation, validating collateral against loan requirements, and verifying core metrics like LTC/LTV.

- Coordination: Managing interaction with borrowers, title companies, appraisers, inspectors, and internal lending teams.

- Volume and velocity: Handling simultaneous requests arriving from multiple sources, each with different urgencies and dependencies.

- Friction management: Resolving common bottlenecks caused by missing documents, appraisal delays, flood determination timing, data mismatches, and last-minute sales changes.

This complex, constantly shifting environment is often compared to “herding cats.”

The Daily Workflow of an HBF Loan Administrator

While the workflow below is organized into morning, mid-day, and afternoon stages for clarity, these tasks almost always happen simultaneously across multiple builders and units, requiring constant context switching and prioritization.

Morning: Intake, review, and validation

The day starts with incoming borrower requests, including new start packages, existing project updates, or documentation for collateral additions.

- Intake and follow-up: The loan admin reviews each submission to confirm all required information is present and correctly formatted. Incomplete packages require immediate follow-up with borrowers to request missing items.

- Agreement check: Once documentation is complete, they confirm the request aligns with the loan structure, whether a borrowing base or a master guidance line.

- Eligibility: Crucial eligibility checks begin here, including verification of subdivision, plan, appraisal status, budget alignment, and sublimit impact.

Mid-morning: Collateral management

After initial validation, the focus shifts to loading and structuring collateral within the system.

- Data entry: Unit legal descriptions are entered and tied to the correct lot, block, and section details. The admin confirms the selected plan and appraisal match the approved subdivision plan and that the remains within its valid reuse period.

- Advance rate and sublimit review: The role reviews how the addition affects any sublimits (e.g., limits on speculative homes or total dollar caps). Advance rate checks (LTC/LTV/LTC-P) ensure the requested commitment aligns with the agreement parameters.

When these details are managed within a platform like Built, automated checks for eligibility, sublimits, and advance rate logic can significantly reduce manual cycles and prevent avoidable delays.

Noon: Coordination and pre-close activities

As collateral moves toward approval, they coordinate final pre-close requirements.

- Ordering due diligence: This includes ordering necessary third-party due diligence—title work, appraisals, flood determinations, and loan documents—to ensure the lender has complete oversight before construction begins.

- Scheduling and final checks: The admin coordinates closing schedules with internal teams and closing agents. Once all documentation is returned and validated, they confirm the collateral is being added under the correct line and aligns with the agreement structure. These final checks prevent activation delays.

Afternoon: Draw and project management

The afternoon often centers on draw management and maintaining current project status.

- Draw processing: Draw processing depends on the structure: borrowing base draws are funded at the line level, while master guidance lines require unit-specific principal tracking. The admin reviews requests, confirms fund availability, and moves the draw through the lender’s approval and funding steps.

- Progress updates: Project progress is updated using borrower reports or by incorporating inspection results captured outside the system. These updates directly feed eligibility calculations, determining available funding value for each unit.

Centralizing draw requests, availability calculations, and inspection updates in a platform like Built provides a single place to manage funding activity across the entire portfolio.

End of Day: Clean-up and reconciliation

The end of the day is dedicated to ensuring system data integrity.

- Reconciliation: They spend time reconciling system data against external sources, often comparing borrower spreadsheets to the system of record. This tedious but essential task maintains accuracy.

- Status updates: Sales statuses are updated (e.g., Spec to Pre-Sold), ensuring advance rates and eligibility values adjust correctly.

- Close-outs: Paid-off units are archived once funds are received, completing their lifecycle. The admin then follows up on lien releases to confirm the lender’s interest is properly removed from the property.

Why This Workflow Is So Complex

The HBF workflow is complex because it relies on the accurate movement of information across multiple people and systems. The admin must constantly coordinate with borrowers, third-party partners, and internal teams, often consolidating data scattered across emails, spreadsheets, and portals. Any incorrect or missing item quickly compounds into a slowdown.

Accuracy is paramount: legal descriptions must match, sales status impacts funding, and sublimits determine collateral eligibility. Furthermore, much of the process involves manual steps—reconciling external spreadsheets, preparing payoff quotes, and ordering due diligence through separate systems—which creates friction and makes it difficult to maintain a clean, central record.

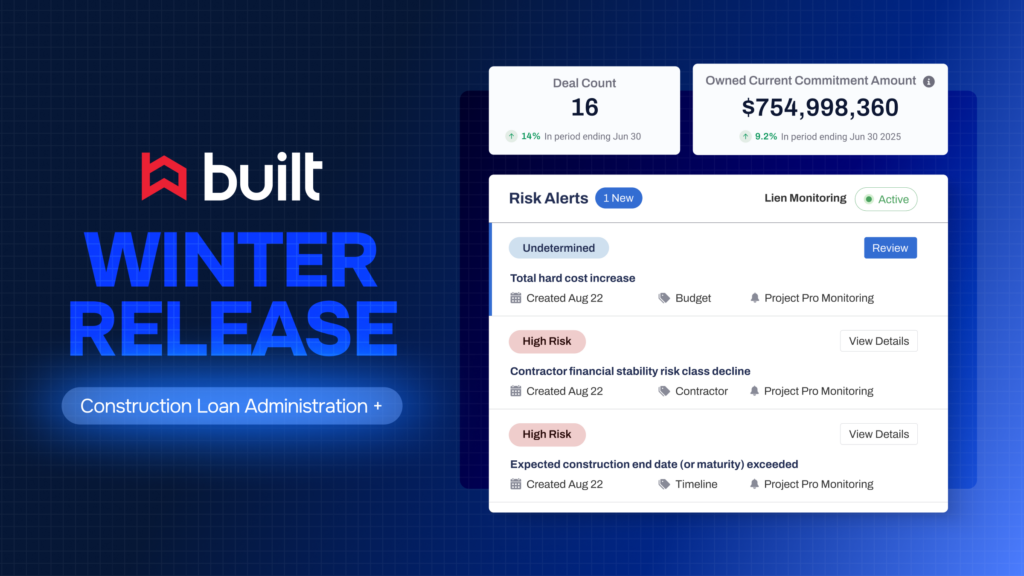

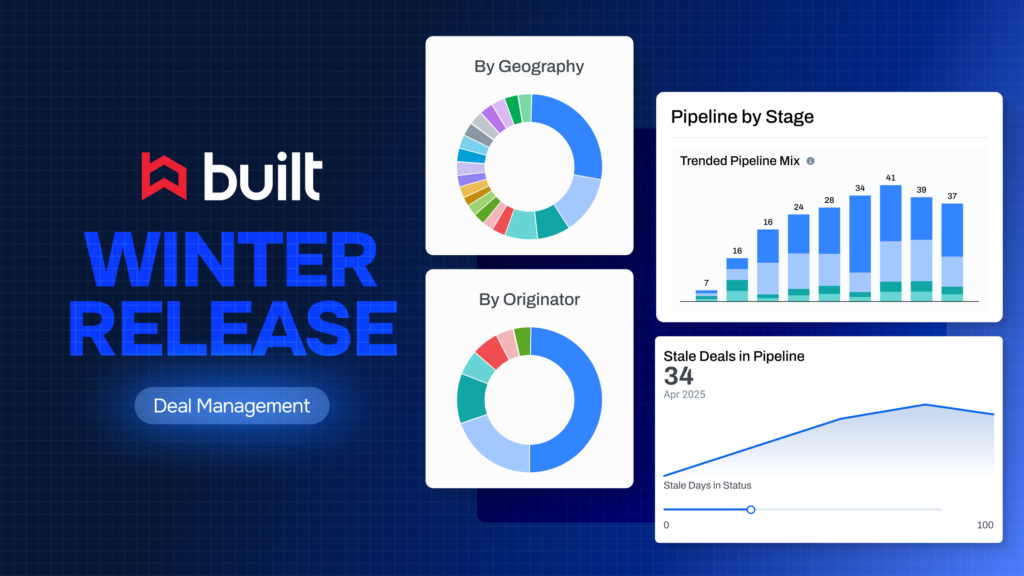

A connected platform like Built helps manage this complexity by centralizing collateral data, validations, inspections, and draw activity. By reducing manual rework and providing clear visibility into the unit lifecycle, the platform makes an inherently complex workflow significantly more manageable.

The Impact of Strong Loan Administration

HBF Loan Administrators bear the operational load of keeping every moving piece aligned: collateral accuracy, documentation, inspections, draw activity, payoffs, and compliance, from the first new-start request to the final lien release.

Their work is vital. It provides lenders with the necessary data to manage exposure, validate loan performance, and ensure structural integrity, while guaranteeing builders receive timely approvals and funding to keep projects on schedule. Clear processes and accurate information ultimately reduce risk for lenders, improve speed for builders, and create a smoother experience for everyone involved.

See How Built Helps Lenders Simplify HBF Workflows

Loan administrators carry a massive operational load. If your team is looking for a more efficient way to manage collateral, inspections, draw activity, and portfolio-level visibility, Built supports these daily workflows in one connected platform. Book a demo with our team today.

Billy Olson brings extensive industry expertise to Built Technologies, joining the company after more than 18 years with Wells Fargo Bank. During his tenure at Wells Fargo, he managed a diverse lending portfolio and led a nationwide team of Loan Administrators within a specialized Homebuilder Finance (HBF) group. His primary focus centered on large, complex credit facilities—including Borrowing Base and Master Lines—serving both major regional and privately held homebuilders across the country.

Driven by the growing challenges of managing a modern, sophisticated book of business with outdated tools, Billy joined Built in late 2018. Motivated by a clear vision of the industry’s future and the transformative potential of technology, he shifted his career toward product development and offering his expertise to our client base. Since then, he has played a leading role in designing, developing, and delivering a suite of advanced HBF solutions tailored to support complex lending structures and provide lenders with a truly modern platform.