Build a better experience for your customers.

Stay ahead of the competition with digital tools that help you strengthen customer relationships, secure additional business, and work more efficiently than ever before.

Streamline Processes. Enhance Transparency. Fuel Business Growth.

With Built, loan officers can transform the construction loan experience for their customers.

Borrowers and builders can access key information about their construction projects on Built in real-time–creating informed decisions and streamlining communication for a better experience.

Streamline your administrative work and free up your schedule for what really matters. With Built, you’ll be able to close loans faster than ever before, all while providing top-notch service to your clients.

Built connects everyone involved in the management of a construction loan–creating a more transparent, collaborative, and efficient online experience.

Built has revolutionized my experience as a construction-focused loan officer. Truly a game-changer. The platform has not only made me and my operations colleagues work more efficiently but has also given my builder clients and customers a level of transparency they’ve never seen (or expected)! Thanks to Built, I’ve increased my closings and reduced my post-closing involvement, all while offering clients the transparency they deserve. It’s an essential tool for anyone originating (or servicing) construction loans.

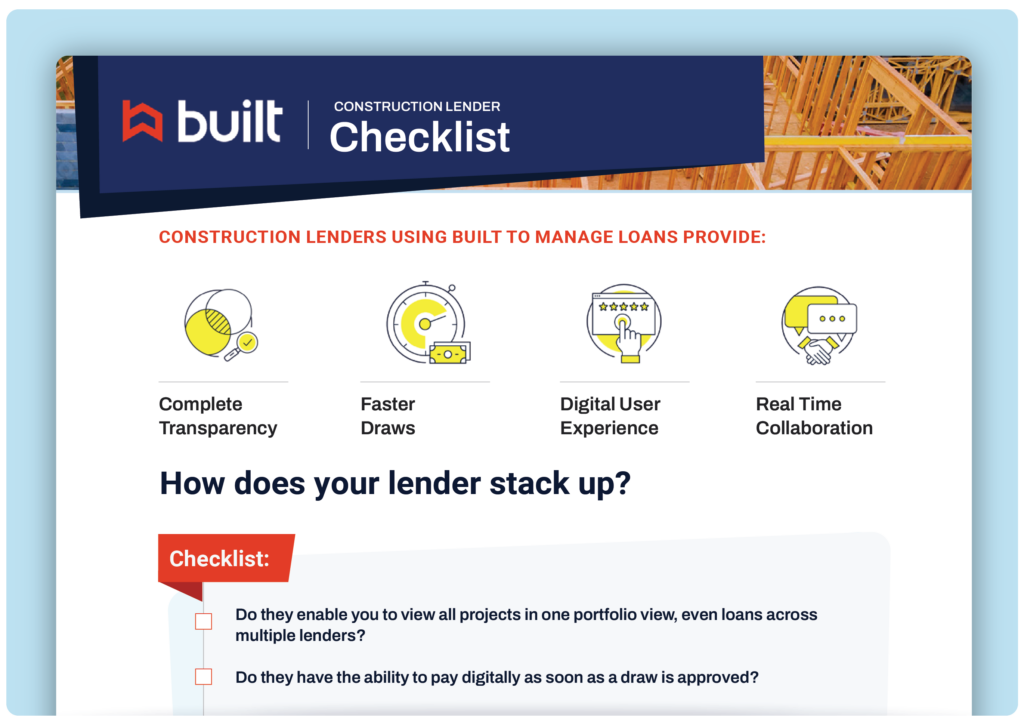

Construction Lender Evaluation Guide

Is Your Lender Up to the Task? Equip Your Builders and Borrowers with This Essential Checklist for Choosing the Right Lending Partner.