Construction Loan Management for Credit Unions

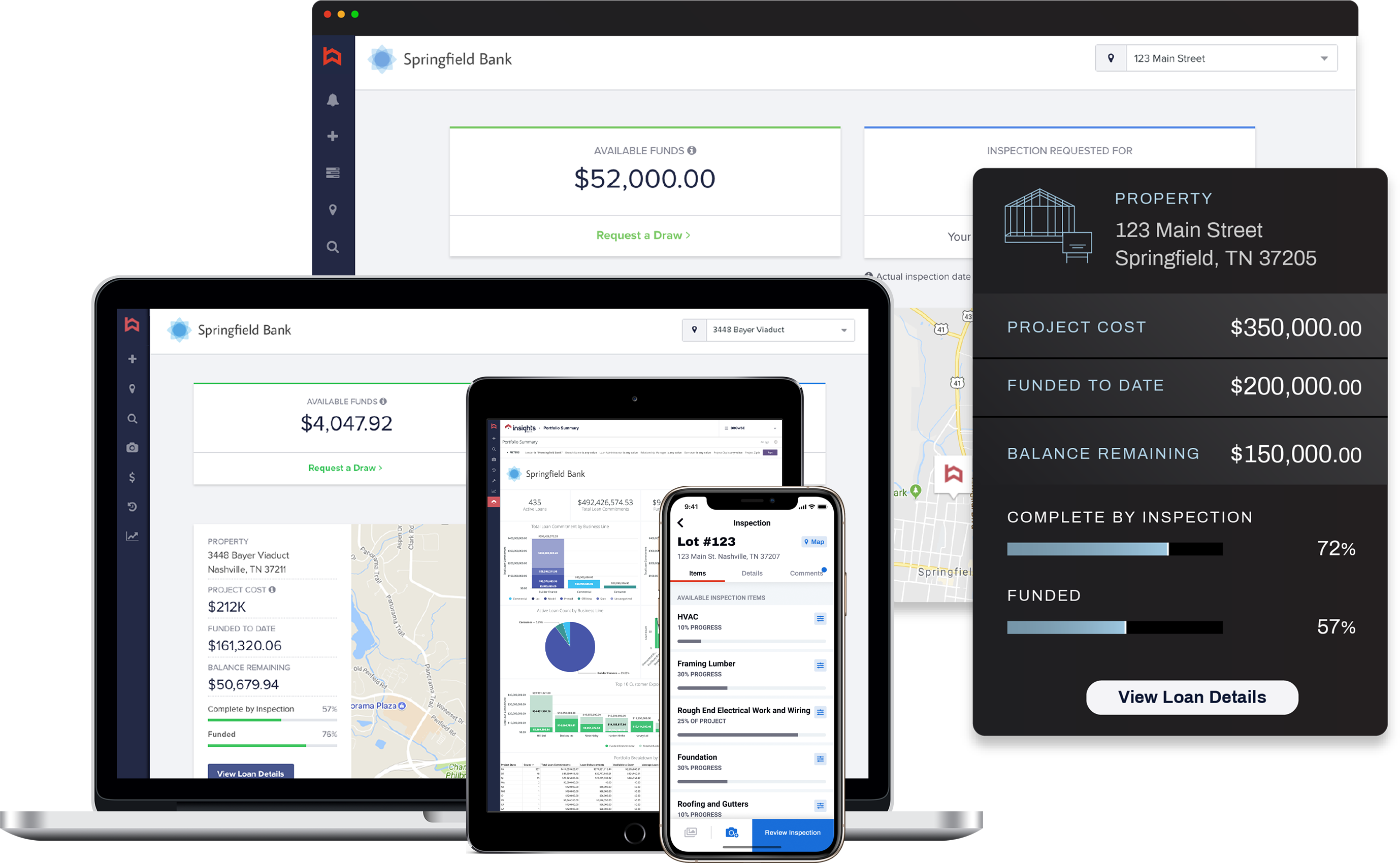

Built was created to simplify residential and commercial construction lending. The collaborative platform was designed to streamline and automate the post-closing loan administration and collateral monitoring process, connecting all key stakeholders, including financial institutions, borrowers, builders and draw inspectors. Specifically designed to complement and work with existing key systems and inspection partners, Built empowers financial institutions to proactively mitigate risk, simplify compliance and increase productivity and profitability.

In light of recent events surrounding Covid-19, and many company initiatives to move employees to a fully remote workforce, Built has developed and implemented a fully remote implementation process for our clients. Our goal is to get your portfolio online as soon as possible and accelerate the ability to report in real time. Expedited Implementations require certain criteria. To see if an expedited implementation is right for you, please contact your Built Account Executive.

By bringing construction loan administration, monitoring and reporting online, Built offers Credit Unions:

In addition to providing a higher level of customer service through technology, Built offers Credit Unions the ability to be competitive in any market.

Built’s platform streamlines construction portfolio management for all business lines, including consumer, home builder, and commercial real estate.

We’re helping 100+ lenders nationwide improve operational efficiency and reduce risk while providing real-time reporting and analytics.

Built also centralizes all workflows and document storage to ensure compliance.

See Built in action.

Want to see how Built can work for you? Schedule a call with our team to learn more.