In Their Own Words

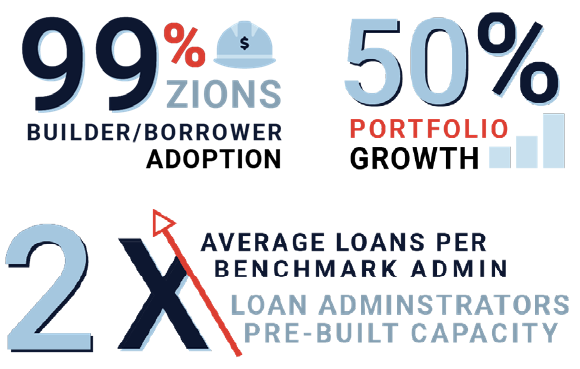

At a Glance

Zions Bancorporation and its Enterprise Mortgage Lending group implemented Built to digitize and transform their residential construction portfolio. Since adopting Built, Zions has been able to significantly reduce the amount of time that it takes to get draw disbursements out the door, all while streamlining their interactions with key project stakeholders because of the increased transparency that Built provides.

By utilizing key Built tech-powered services such as inspections and lien monitoring, they’re able to manage projects proactively while reducing risk. Built has also enabled growth at scale for Zions—their portfolio has grown by nearly 50% without the need to increase the team size.

The transparency for the borrower and the builder, the efficiency that your team is able to gain, and the reporting capabilities that are all real-time are the three main areas that we really see value with Built.

The Challenge

Zions Bancorporation takes a methodical approach to decision-making—and knew that they needed to find a way to differentiate their mortgage business. In other areas of the business, digitization became a key differentiator. It was important to modernize the aspects of their product offerings that were not digital, like budgeting on construction projects and creating a modern digital relationship with borrowers, builders, and inspectors. Having to scan a budget, print it, and send it to the borrower is just one example of the ways that slow processes were impacting their customers and their team.

With an average draw turnaround time of 6-8 days, Zions knew that there had to be a better way to manage and scale their construction portfolio all while improving relationships with their builders and borrowers. So, they took their methodical approach to evaluate software solutions and selected Built.

The Solution

Adopting Built has empowered Zions Bancorporation to move faster with draw disbursements for a number of reasons. Zions leverages Built’s Lien Monitoring and Inspection Technology and services capabilities to improve turnaround times and security. With lien monitoring through Built, Zions was able to turn their reactive lien waiver process into a proactive one, allowing them to catch liens on any project prior to funds being disbursed.

Additionally, they’ve seen a drastic decrease in inspection turnaround times, and the digital solution and speed of service have improved interactions with existing inspectors as well as enabling them to work with more inspectors. Zions sees a less than 36-hour average inspection turnaround time since their adoption of Built’s Inspection Technology and Services.

By enabling faster and more secure processes, Zions is actively mitigating risk while growing at scale. Brian Mica, Sr. Vice President of Residential Construction Lending at Zions, shared that Built has “certainly lived up to our expectations” and that “builders really see the benefits of providing digital transparency to the borrowers” on all projects. Built gave Zions the peace of mind needed to grow their business, even while enduring one of the toughest macroeconomic climates of the past 15 years.

We view Built as a strategic ally in our construction mortgage lending.

The Results

Digital processes have helped Zions reduce its average draw turnaround time from 6-8 days to 2-4 days. The speed of getting money in the hands of their builders/borrowers has enhanced relationships. And, this also means that their builders reap the benefits of providing transparency to the borrowers, all from a single platform.

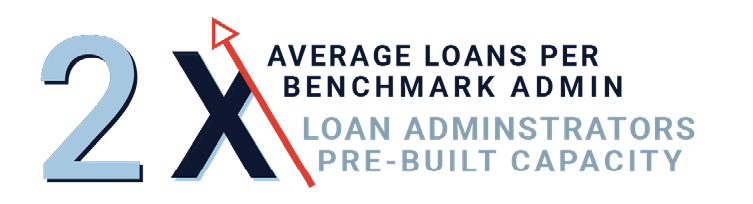

The cutting-edge digital experience that Zions strives to provide their borrowers is possible with Built. All of these benefits have provided Zions the opportunity to grow its construction business without the need for additional headcount. Before Built, Zions averaged around 60 loans per loan administrator, and now their top performers average between 130-190 loans each.