One place to manage construction billing

Introducing Payment Management: Built’s collaborative platform for invoicing, lien waivers, compliance documents, and payments.

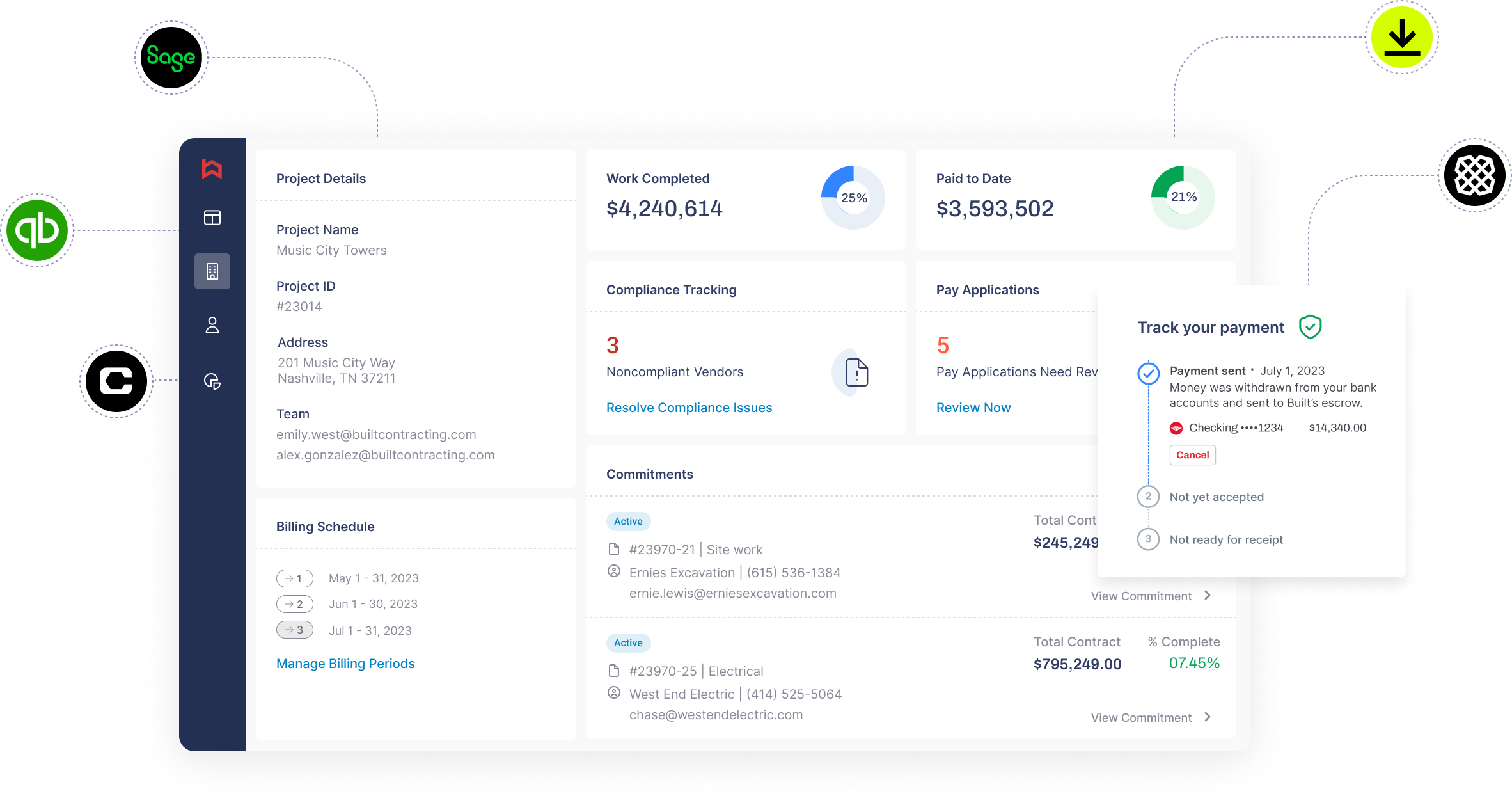

Streamline construction accounts payable

Elevate your accounting and project management teams with time-saving tools they will genuinely appreciate.

Collect G702/G703-styled progress bills or one-time invoices from subcontractors and suppliers.

Streamline issuing, collection, and tracking of primary and lower-tier lien waivers.

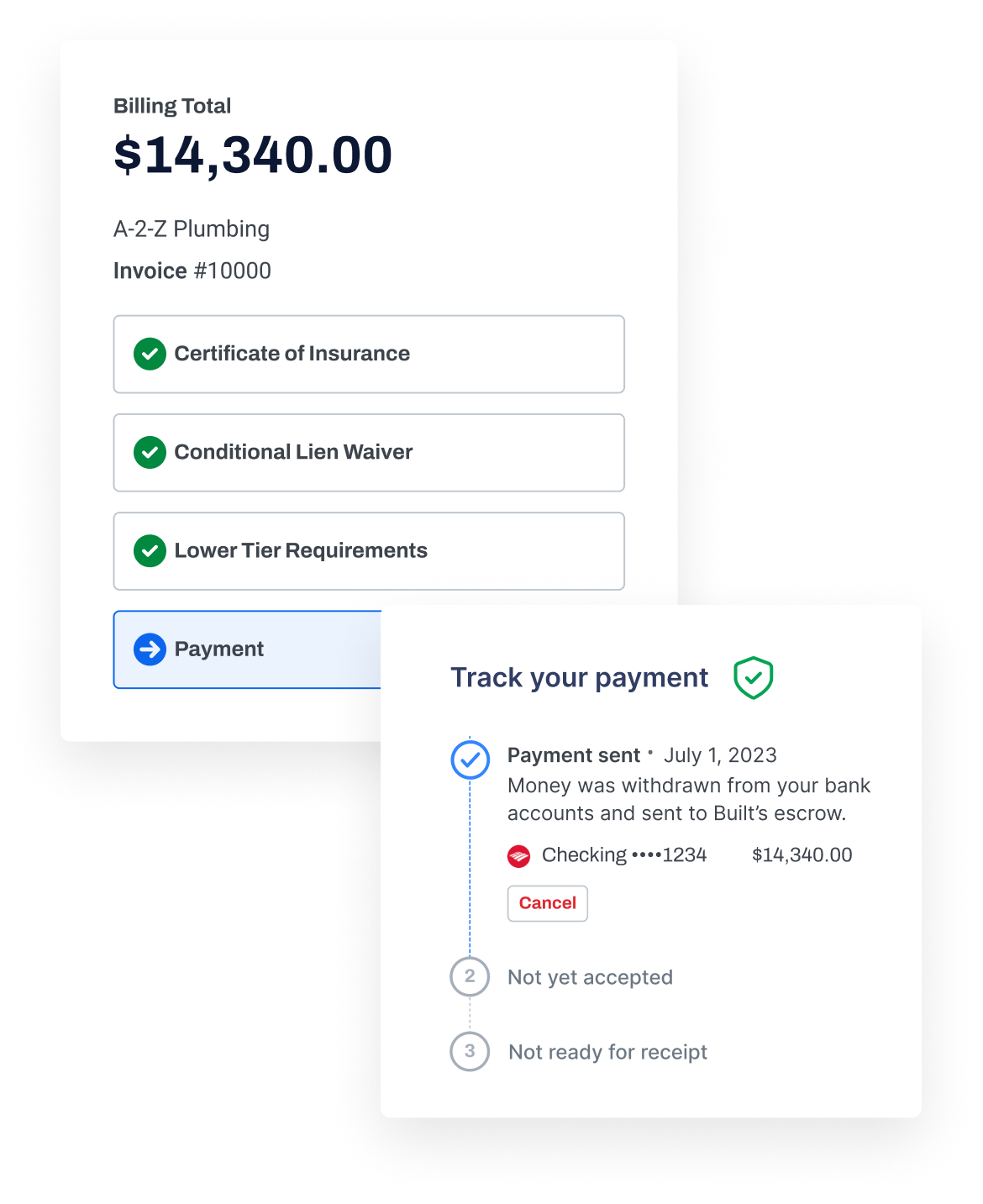

Manage subcontractor COIs, safety reports, and more. Automatic alerts to subcontractors prevent gaps in compliance.

Quickly and securely transfer funds via ACH. Send a single payment, bulk payments, partial payments, or leverage the lien waiver / payment exchange.

Streamline construction accounts payable

Elevate your accounting and project management teams with time-saving tools they will genuinely appreciate.

Collect G702/G703-styled progress bills or one-time invoices from subcontractors and suppliers.

Streamline issuing, collection, and tracking of primary and lower-tier lien waivers.

Manage subcontractor COIs, safety reports, and more. Automatic alerts to subcontractors prevent gaps in compliance.

Quickly and securely transfer funds via ACH. Send a single payment, bulk payments, partial payments, or leverage the lien waiver / payment exchange.

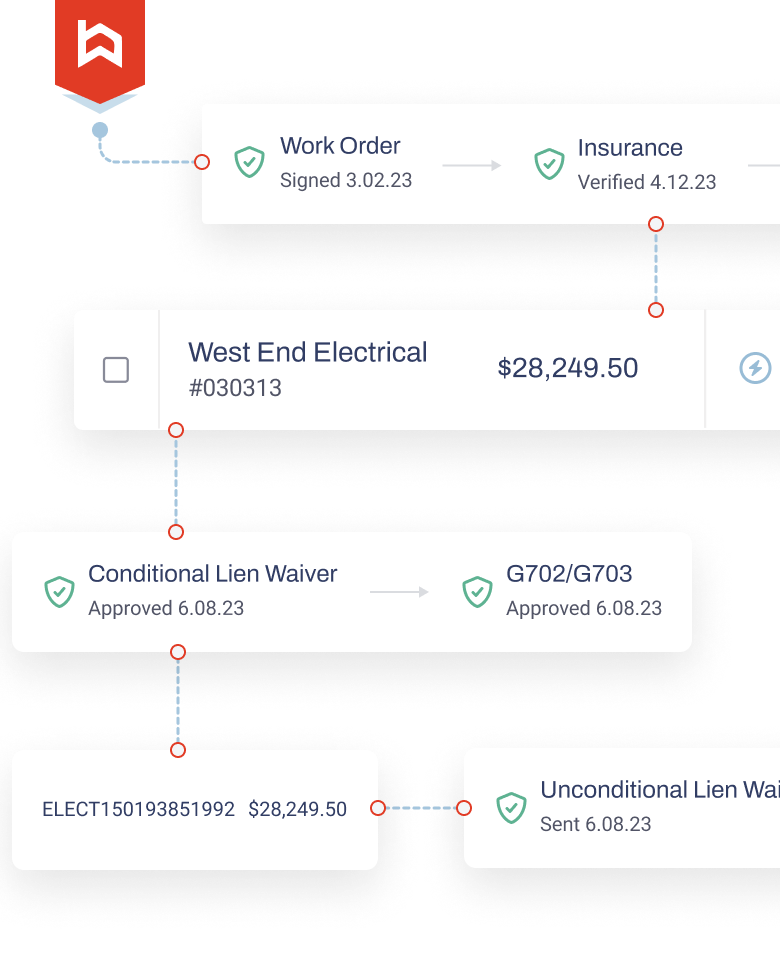

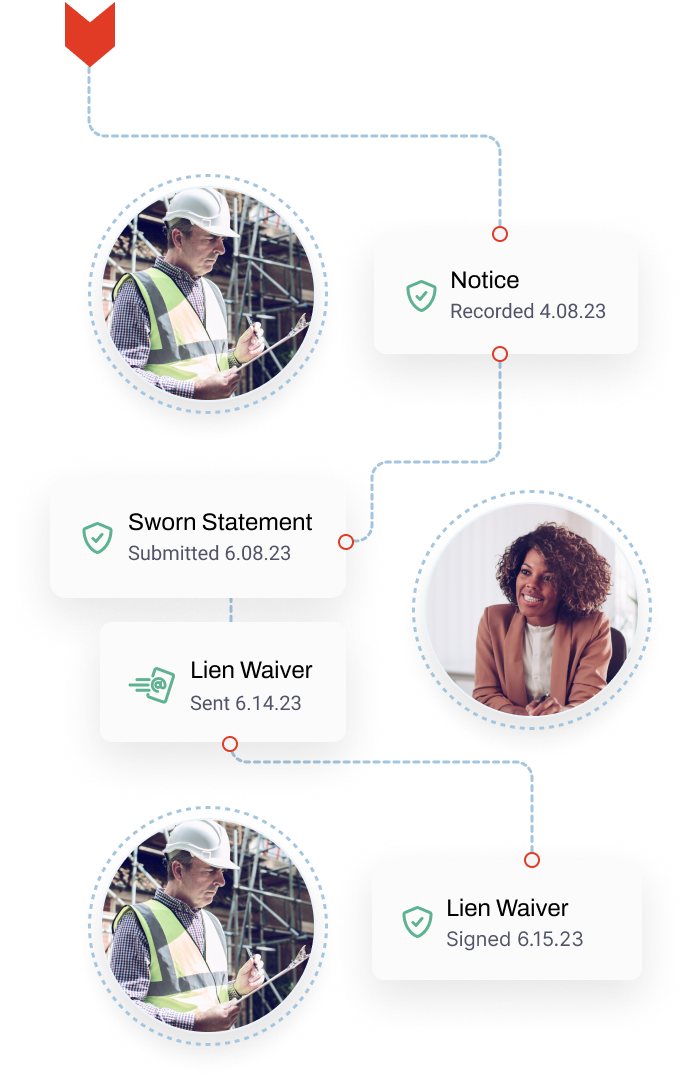

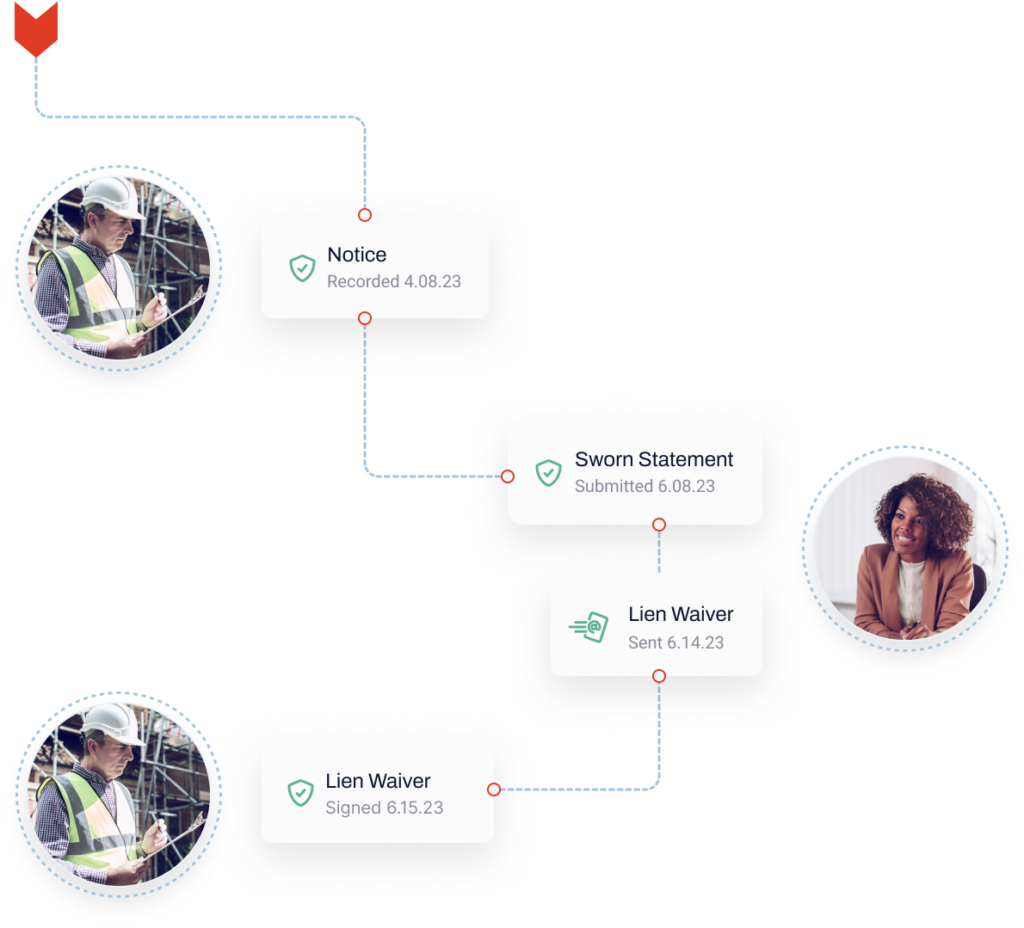

Visibility down the entire project chain

Effortlessly track billing information and documents from lower tier subcontractors and suppliers.

Track billing information and lien waivers from lower tiers.

Collect and track sworn statements from subcontractors each pay period.

Track preliminary notices all the way down the project chain.

Visibility down the entire project chain

Effortlessly track billing information and documents from lower tier subcontractors and suppliers.

Track billing information and lien waivers from lower tiers.

Collect and track sworn statements from subcontractors each pay period.

Track preliminary notices all the way down the project chain.

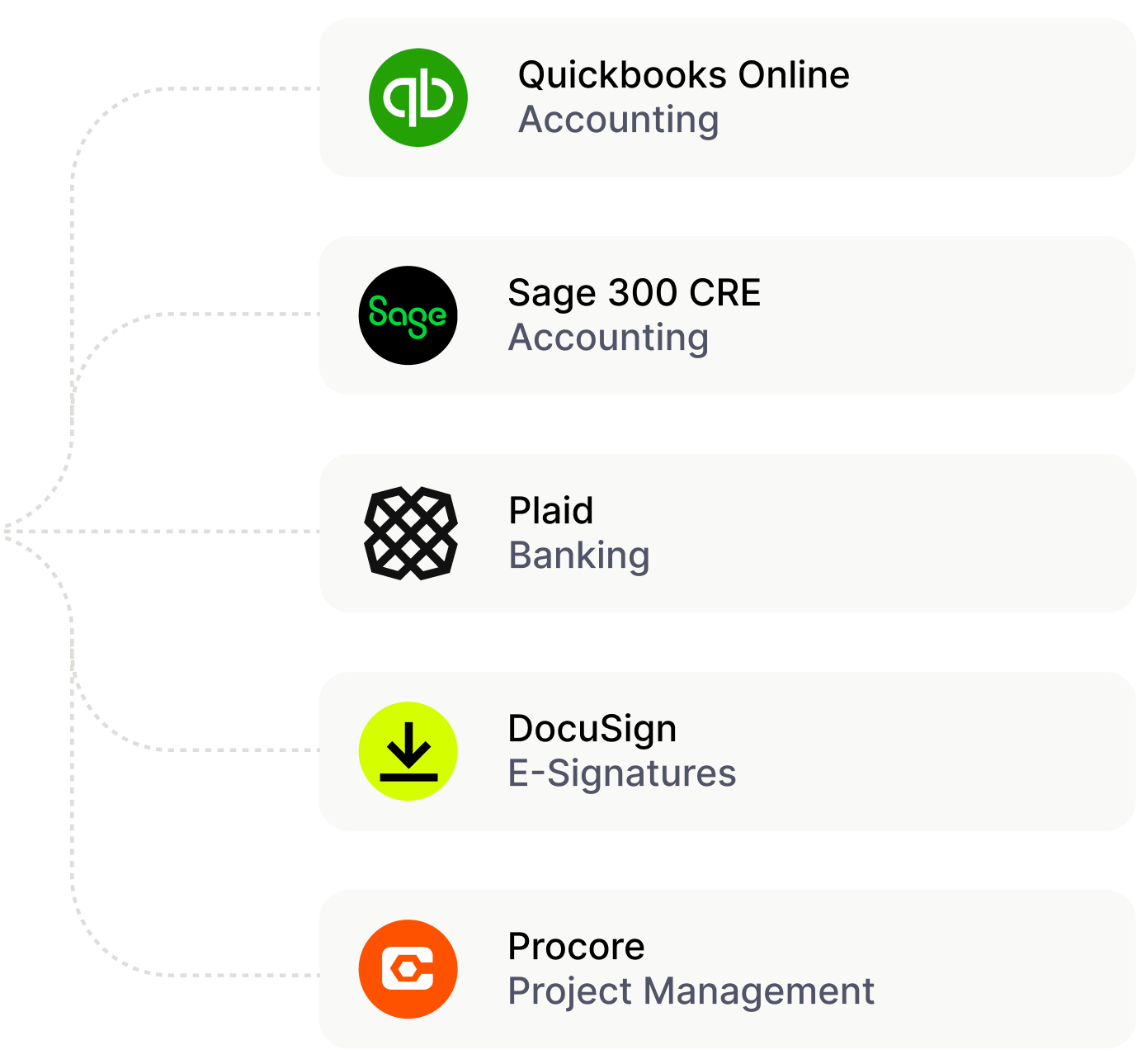

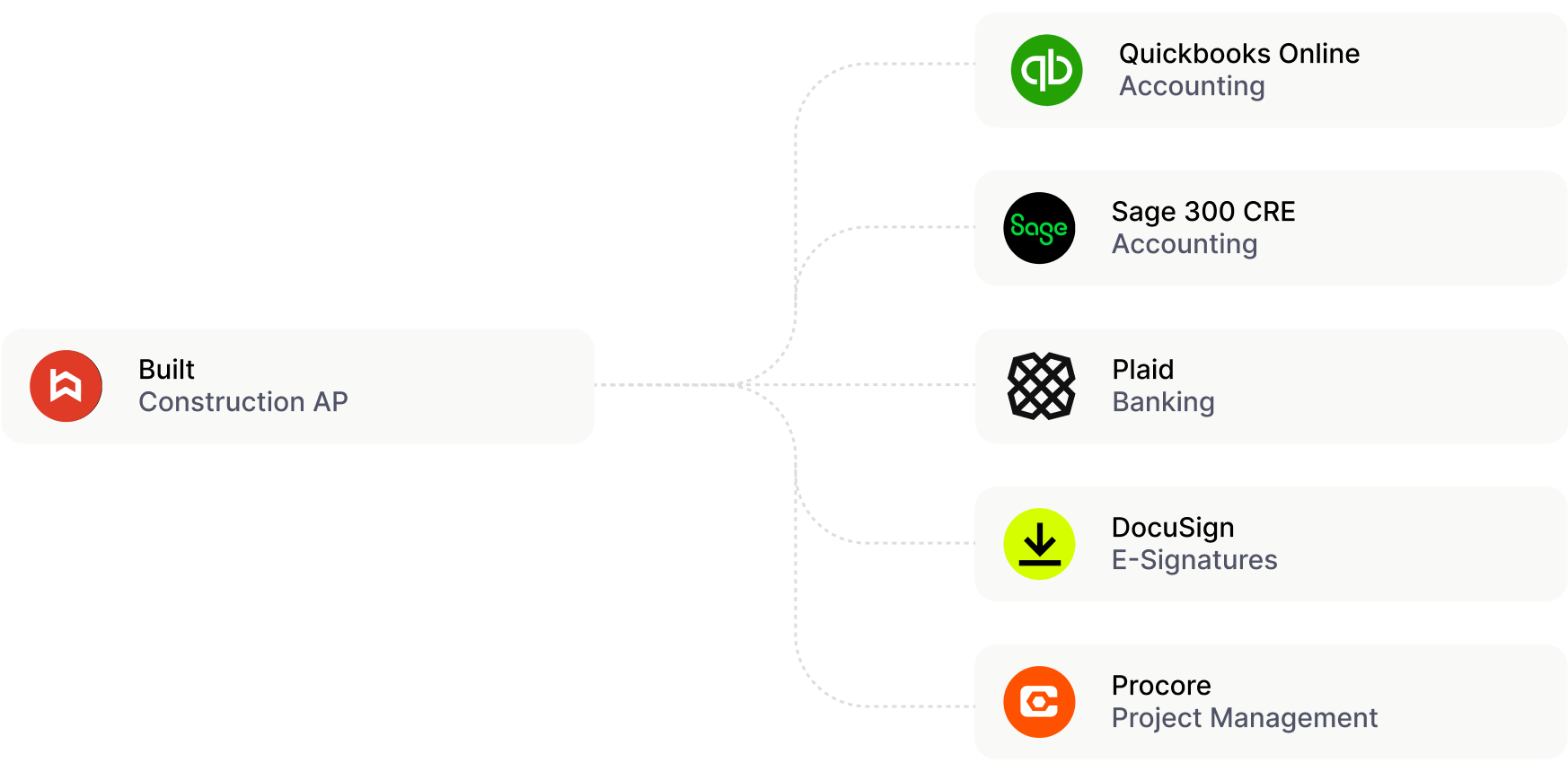

Integrate critical workflows

Data flows seamlessly with Built’s ready-to-use integrations for popular accounting, project management, and banking platforms.

Where else do you want to connect?

Becoming your trusted partner for payment management

Since 2016, we’ve helped 500+ customers manage more than two million lien waivers. Now, we are ready to serve the construction industry with so much more.

Frequently asked questions

What if my subcontractors have trouble adopting the software?

95% of subcontractors say Built is “very easy to use.” We also have training materials and live support available.

What type of training do you provide?

We provide virtual training to all new organizations. If you prefer to learn on your own time, we also have self-guided training materials.

How long does it take to onboard my company to Built?

We can get your organization onboarded and trained in as little as 48 hours.

Is Built secure?

Built maintains both SOC 1 and SOC 2 Type II compliance. Each year Built undergoes AICPA/SOC audits by an independent third-party audit firm.

Can I use and manage custom project billing documents?

Yes, add a custom template to a project in minutes or select from our default templates.

What type of support do you provide?

Our U.S. support team is available Monday through Friday from 7am to 7pm CT.

Powerful financial tools for construction

Make project billing hassle-free for you and your project partners.