Redefining the construction loan process: Why builders turn to Built

The traditional construction lending process is often inefficient, with many builders and lenders relying on manual processes, paper files, and Excel spreadsheets to complete draws. These administrative tasks take away from time spent building customer relationships and growing the business.

But there’s an opportunity to do things differently. Today, leading builders are using technology to redefine the construction lending process, and as a result, they’re increasing efficiency, completing more on-time projects, and getting capital requests funded faster.

We surveyed over 50 builders who collectively completed 1,600 draws in the past 6 months to learn how using construction lending technology impacts their business. Keep reading to learn more.

Builders help borrowers select lenders

Builders are trusted partners to their clients. We found that nearly 90% of new clients seek lender referrals from their builders.

When deciding who to recommend, builders look for lenders that use technology to streamline operations and create a better experience for all parties involved in the construction loan process. And, builders trust lenders who use Built. Half of the builders surveyed reported that a lender’s use of Built influences their decision to recommend that lender to clients.

Builders choose Built

Leading builders rely on Built to drive transparent operations and expedite the draw process. In fact, 89% of builders say the draw administration experience is better when lenders use Built. Charlotte-based builder Paul Kowalski prefers to partner with lenders who use Built because of the increased visibility and efficient draw process.

Built drives increased transparency

Built enables visibility for all parties by consolidating all documents and draw information in a single platform. And, with Built’s commenting functionality, builders, borrowers, and lenders can communicate to remediate issues and get answers quickly.

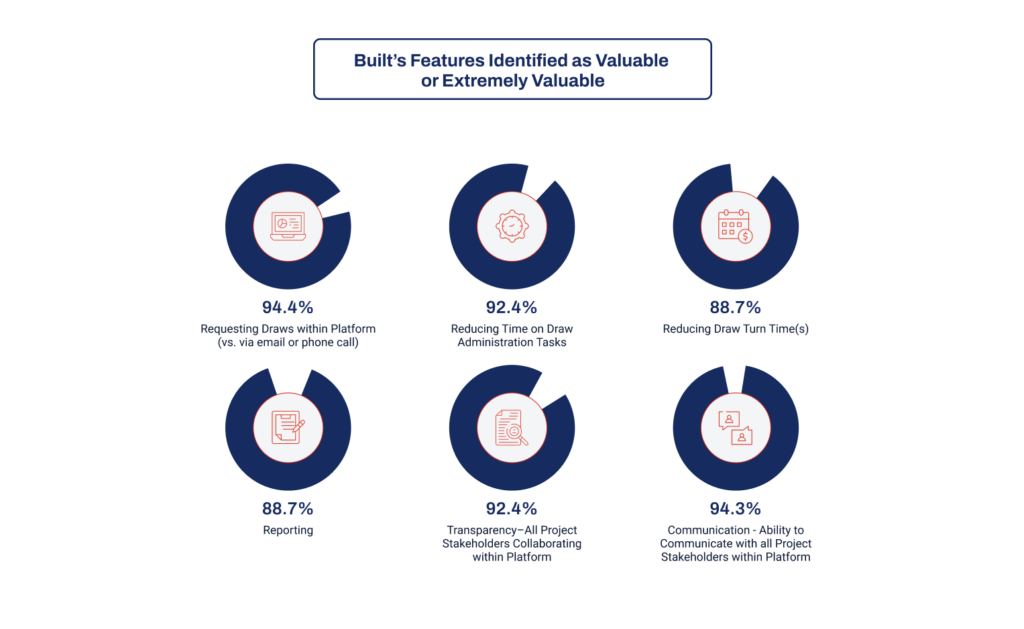

Transparency and communication are top-rated features of Built. 92% of builders reported transparency as extremely valuable or valuable, and 94% of builders reported communication with all stakeholders as extremely valuable or valuable. More transparent operations result in a faster and easier draw process.

Built improves draw turnaround times

With Built, builders can digitally request draws in just a few clicks. 94% of builders find it extremely valuable or valuable that they can request draws within the platform. Once the draw has been requested, it’s easy for inspectors to get started on their work and report back with photos. With a more streamlined process, builders can get their money faster.

Improved efficiencies also lead to shorter draw turnaround times. On average, Built customers complete draws in 1.4 days. And 89% of builders reported reduced draw time as an extremely valuable or valuable Built feature.

With more visibility and easier access to money, builders who partner with lenders using Built gain a competitive advantage.

Builders rely on Built

By adopting construction lending platforms, like Built, builders can deepen their client relationships and grow their business. Built transforms manual and error-prone processes into more efficient workflows and enables builders to complete more projects and get paid faster.

Want to learn more? Get a demo today.

Related Posts

Built Names Chris DeVito as Vice President of Product