Product Deep Dive: Built Reports

Manual spreadsheets are a trusty tool, but they just don’t cut it for modern-day construction loan monitoring. From increased regulatory scrutiny to the state of the commercial real estate market, there are myriad reasons to not just closely manage your portfolios, but also to take action on the data you uncover. Built reports give you actionable data, not just accessible data.

In this article, we’ll dive into three categories of Built reports:

- Operational

- Management

- Risk Mitigation

We’ll show you what different reports in each of these categories can do to optimize the construction loan monitoring process from A to Z.

Operational Reports:

Holding Your Day-to-Day Accountable

Operational reports serve as the home base for daily users of the Built platform. This includes larger loan administrators, people who are pulling and funding draws, and those otherwise working with builders and borrowers on a daily basis.

Here are a few operational reports you can access with Built:

| Report name | Recommended Frequency* | Purpose |

| Draw and Inspection Turn Times | Weekly | Monitor activation volume, plan work capacity |

| Upcoming Milestones | Daily | Identify milestones that are uncompleted, approaching due dates, or overdue |

| Construction Progress | Weekly | Segment portfolio by construction progress percentage and take action |

*All Built reports are updated in real-time, but we recommend that you review them at least on the recommended cadence. Users can always access live data as needed.

Digging Deeper:

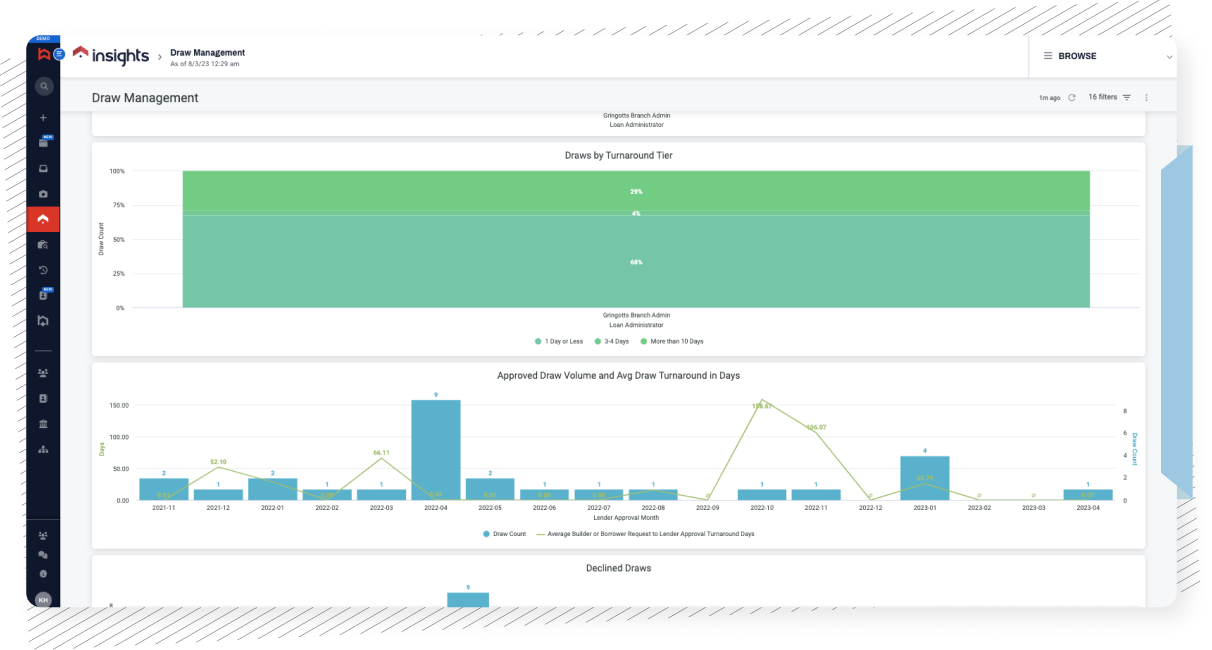

Draw & Inspection Turn Times

One essential operational report is Draw and Inspection Turn Times. This draw management report is useful for loan administrators and construction team leads who manage multiple admins under them. In a user-friendly display, you can visualize pending draw approvals, with each loan administrator having a different column. Quickly see how many pending or approved draws each admin has, and who is behind or caught up.

Monitor your team’s bandwidth at large and comprehend the state of your portfolio so you can take action on the fly.

Built has a goal of sending money out the door—from when a draw is requested to when it’s funded—in two days or less. On average, Built lenders have reduced draw times by more than 50%.

You might have this information if you have a workflow outside of Built. However, Built’s live visibility allows you to be proactive, not reactive. If you’re not reaching a particular goal, you can pinpoint the exact cause of that shortcoming and resolve it.

Management Reports to Keep Team Leads & Executives in the Loop

Management reporting is the place to go for construction team leads who manage a range of loan admins, giving them the information they need to report up to leadership. Alternatively, it’s helpful for executives (like CLOs) who want to garner data quickly for quarterly business reviews or board meetings. In the current market, loan officers are heavily scrutinizing portfolios, making this category even more important. Built Value Realization Principal Katie Wilson said in a recent webinar, “Banks are expecting increased focus and scrutiny from regulators, particularly in their higher risk construction in CRE books.”

Here are a few management reports you can access with Built:

| Report name | Recommended Frequency | Purpose |

| Portfolio Trends Summary | Quarterly | Monitor portfolio performance, identify trends impacting the construction portfolio’s health and reliability |

| Projected Draw Summary | Monthly | Identify projected upcoming draws for balance sheet management |

| Portfolio Breakdown by Builder | As Needed | Identify total number of projects and total exposure associated with each builder |

Digging Deeper:

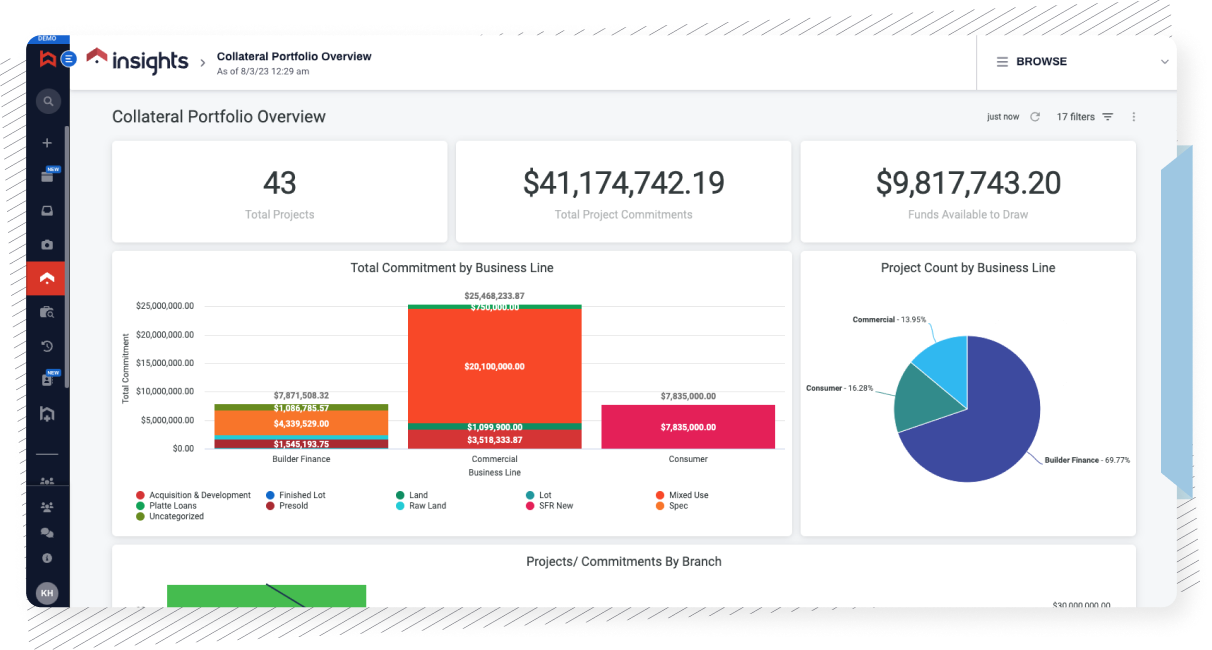

Portfolio Trends Summary

A crucial management report is the Portfolio Trends Summary. Reporting is a capability that can take teams days without a platform like Built. To be able to click on a collateral portfolio overview and see what you need all in one place is revolutionarily time-saving. For example, CLOs can click a button and instantly find what they’re looking for, then enter a meeting fully prepared.

Find out what you’re leveraging as a bank with total project commitments. See how much funds you have available to draw right now and the number of total projects you’re committed to.

Risk Mitigation Reporting Tools Offer Deep Granularity

Daily users and executives alike can use Built’s risk mitigation reporting capabilities to see where risk lies in a portfolio and proactively mitigate it. From granular to high-level risk mitigation, the ability to take charge of your portfolio (rather than get buried by unfavorable outcomes) is essential.

Here are a few risk mitigation reports you can access with Built:

| Report name | Recommended Frequency | Purpose |

| Risk Alerts | Weekly | Early warning indicators |

| FEMA Dashboard | Monthly | Understand exposure to open FEMA disaster declaration reported within the last 3 months |

| Pacing Report | Monthly | Identify upcoming maturities and loans considered off-pace |

Digging Deeper:

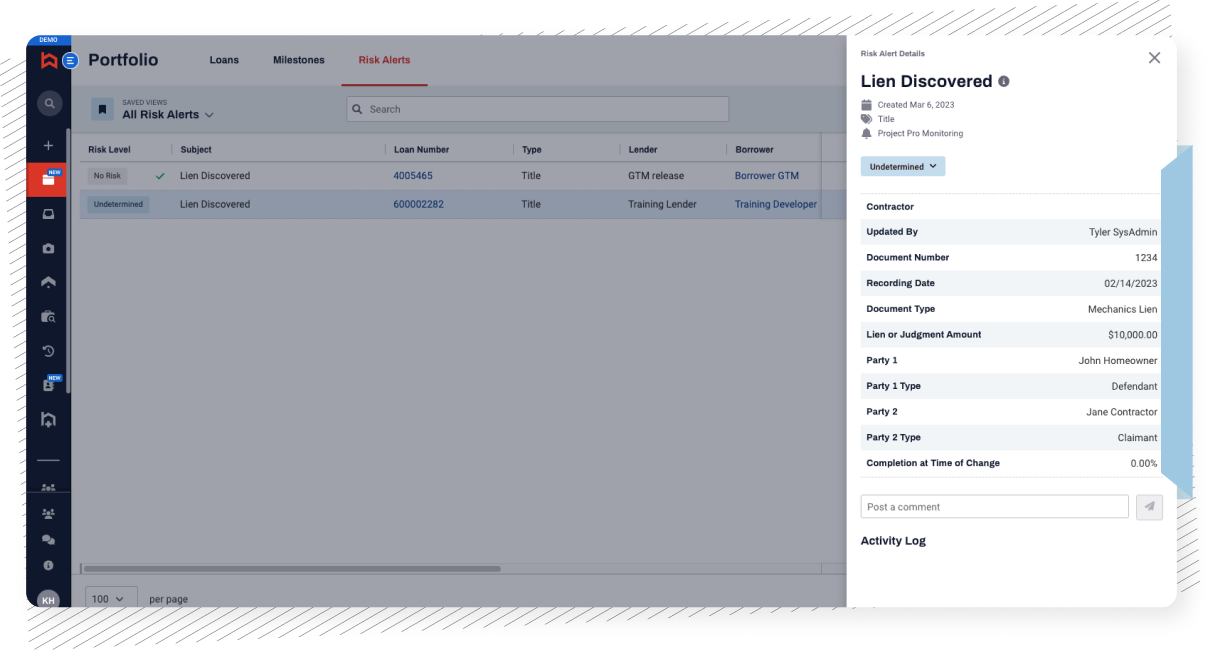

Risk Alerts

The Risk Alerts report makes risk mitigation a breeze. These alerts allow you to see a range of risks, including:

- Business credit risk score decline

- Business reported as inactive

- Contractor financial stability risk class decline

- Expected construction end date exceeded or extended

- Lien discovered

- Materials delay

- Maturity date exceeded or extended

- Owner-builder dispute

- Permit delay

- Project stale for 60 or 90 days

- And more!

Your risk assessments can get even more granular: Search by risk level, active vs. resolved risks, loan administrator name, builder name, and more. For example, if you discover a bunch of liens come from one particular contractor, you may not want to give them a loan moving forward.

Gain Access, Take Action

Built reports don’t just provide access to essential data for the construction loan process. They also give loan administrators, chief loan officers, and others involved in the process a path toward action. This ultimately streamlines the process and invigorates the lending ecosystem.

Take your next step: Download the full list of reporting capabilities available with Built.

Related Posts

Built Names Chris DeVito as Vice President of Product