IRR at the Commercial Real Estate Fund Level: A Guide

Commercial real estate (CRE) investors and lenders use a range of metrics to assess factors like risk and potential profit. Arguably one of the most crucial of those metrics is the internal rate of return (IRR).

At the CRE fund level, IRR serves user-specific key purposes and fits within a larger strategy—ideally enhanced by real estate investment management software that tracks meaningful data.

What makes IRR at the CRE fund level distinct? And how can you best systematize your data tracking using commercial real estate deal management software? We’ll answer these questions and more in this guide.

Why and how to use IRR in the commercial real estate pipeline

Let’s start from the beginning so we can gather a complete picture of fund-level IRR for CRE lenders.

Internal rate of return (IRR) is a comparative metric that real estate investors often use to evaluate the future value of an investment in today’s dollar value.

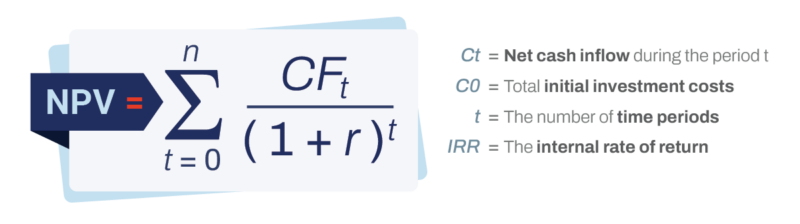

IRR is a complex equation that considers time value of money (which is particularly crucial in an inflationary market). This differentiates it from a simple return on investment (ROI) calculation.

IRR is a percentage-based metric in which a higher percentage suggests higher annualized profit. It comes in two forms:

- Unlevered/unleveraged IRR: Cash flow rate of return without financing

- Levered/Leveraged IRR: Cash flow rate of return with financing

The equation has numerous variables, but here’s what a key iteration looks like:

This 30-second video shows you how to calculate IRR in Excel.

In the CRE pipeline, IRR proves helpful because it allows you to:

- Decide which investment(s) are more likely to be fruitful for your bottom line over time

- Make more accurate profit and risk assessments in a time of prolonged inflation

- Provide a baseline of underlying assumptions you can give to investors, which can be toggled as needed

Many people in the CRE space are working at the fund level, meaning it’s important to differentiate how best to use metrics that may otherwise be reserved for individual properties. Let’s dig into what this looks like below.

Looking at IRR from fund-level CRE: Distinctions and caveats

When we talk about fund IRR for commercial real estate, we refer to the internal rate of return for an entire portfolio. This allows us to differentiate IRR for sole projects and instead utilize the metric as a way to assert an entire fund’s poised profitability.

When used in tandem with other key metrics, it can serve as a factor in determining the shifting risk of a CRE portfolio. This is thanks in part to IRR’s consideration of time value of money.

Of course, this metric does have its own limitations.

Some IRR as a percentage metrics don’t give you a real-world dollar value of projected return (this isn’t the case with Built’s platform, which does give you a dollar value return projection, but it’s good to keep this in mind). CRE funds may benefit from incorporating actual financial projections to showcase value. When it comes to quarterly earnings and other key reports, the ability to visualize dollars is significant.

Plus, IRR doesn’t function in a vacuum. The metric is most meaningful when accompanying other measurements of return, particularly those that offer dollar-value results.

But all of this doesn’t make IRR useless. In fact, it’s just the opposite—with IRR as an essential ingredient in a CRE fund’s toolkit.

Understanding the differentiators and limitations of IRR for commercial real estate is important, but what about implementing it as a tool for assessing funds over time? That’s where key deal management software comes into play.

What to know about systematizing fund IRR with CRE software

The whole goal of tracking data like fund-level IRR is to leverage what you learn. It’s not the numbers themselves, but the informed lending decisions you make with the data in mind, and the reduced risk you take on as a result.

Fact: Asset managers, lenders, and other related players in the CRE market play a big role in the industry.

Another fact: Those same professionals have a lot of skills to put to use, which tedious, risk-prone data entry tasks eat into.

If one of your goals is to boost fund IRR, systematizing the analytical process with CRE software is a necessary step.

With Built, a real estate software for investors, the process of using automated systems to track fund IRR also happens to involve creating more efficiencies throughout the process (like we said, IRR doesn’t function in a vacuum, and neither does the software that tracks it).

For example: Excel can become messy and time-consuming. Built’s IRR module eliminates the need for manual tracking by providing a live, real-time updated data feed from the client’s servicer. In addition to saving time, this reduces the risk of human error and ensures accurate, up-to-date performance tracking. Plus, dialing in profitability using the IRR module is likely to increase margins across a financial institution’s lending portfolio.

As you gain a bird’s eye view of your portfolio, you induce operational transparency. This informs your predictive analytics and helps you gain the upper hand in a competitive and ever-changing capital environment.

If you were to throw deal management, IRR, and CRE software on a Venn diagram, where would they overlap? The Reuleaux triangle—aka the place where all three overlap—would be “assessing profit and risk.”

Looking at fund IRR for commercial real estate from this perspective, it’s easy to see that integrating the right software is an indispensable part of the pipeline. After all, the software has the same intentions as the metrics you may have been using on Excel this whole time and the deal management process your empire is built on.

The indispensable nature of using software to track data and inform expert decisions is especially true in the current economic climate. In a time when next year’s inflation rate may look wildly different from this year’s (and both of which look wildly different from historical averages), making efficient use of metrics like fund IRR, which takes time value of money into account, just makes sense.

Commercial real estate tech like Built, for example, provides CRE lenders the right tools to manage participations and syndications, low-income housing tax credit requirements, and other complex capital stacks.

Additionally, asset managers get the upper hand by utilizing a digital platform for construction loan administration that allows them to track pertinent metrics like IRR, which often serve as a deciding factor for investments.

At the end of the day, fund IRR for commercial real estate plays a pivotal role in a portfolio, and its functions at the fund level are perhaps even more memorable. As decision-makers seek ways to stay ahead, deal management software and fund IRR work alongside one another to provide the foundation for accurate projections.

Related Posts

Built Names Chris DeVito as Vice President of Product